Baillie Gifford UK Growth Trust (BGUK) has announced its annual results for the year ended 30 April 2024 during which BGUK provided NAV and share price total returns of 0.6% and 0.5% respectively, which it says compares to 7.5% for its benchmark FTSE All-Share Index total return.

BGUK’s chair, Carolan Dobson, says that when the board took the decision to appoint Baillie Gifford to manage the trust’s assets in 2018, it was in the expectation that a growth-focused UK equity mandate would deliver positive absolute and relative returns over the long term. She adds that, since then, whilst there have been periods of good performance, the longer-term results have not been as expected. Over five years to 30 April 2024, the company’s NAV total return was only 3.0% at a time when the FTSE All-Share Index total return was 30.1%.

In February, BGUK’s board conducted a rigorous review of the services Baillie Gifford provides to BGUK to inform the board as to what it should recommend to shareholders for the continuation vote due at this year’s Annual General Meeting (AGM). Having concluded its review of Baillie Gifford’s ability to deliver on the company’s investment objective, Dobson says that the board continues to believe firmly in BGUK’s mandate and has confidence that over the longer term the portfolio managers, through application of Baillie Gifford’s investment process, have the capacity to outperform. Accordingly, the board is recommending that shareholders vote in favour of continuation at the AGM.

Key highlights from the results:

- The largest detractors to relative performance were: St James’s Place, a UK wealth manager; Burberry, a luxury goods retailer; and Genus, a leading animal genetics company. Not holding HSBC was also a notable detractor. Abcam, an online platform selling antibodies to life science researchers, and 4imprint, the direct marketer of promotional merchandise, were the notable positive contributors to relative performance.

- One new position was initiated in the period: online greetings card and gifting platform, Moonpig. Four positions were exited: Abcam, which was taken over in the year; Boohoo.com, an online fashion retailer; Farfetch, an online luxury fashion retailer; and Naked Wines, an online wine retailer.

- The net revenue return for the year was 5.68p per share (2023: 4.05p). A final dividend of 5.60p per share is being recommended (2023: 3.60p). The dividend is paid by way of a single final payment.

- Over the year a total of 3,841,977 shares were bought back into treasury. Since period end to 12 June 2024, a further 635,000 shares have been bought back into treasury.

- The board and managers believe that the portfolio is populated with exciting growth businesses, with large market opportunities, strong competitive positions, and importantly, the cultural adaptability to succeed in a rapidly changing world. The boards says that, once style headwinds abate, the portfolio should be well placed to benefit.

- At this year’s Annual General Meeting (‘AGM’), the directors are proposing, in accordance with the Company’s Articles, that the life of the company be extended for a further five years.

- Should the life of the company be extended, the board is making the following commitments: 1) The Board will introduce a one-off 5-year performance triggered exit opportunity whereby, in the event the Company’s NAV per share total return over the 5-year period from 30 April 2024 to 30 April 2029 does not equal or exceed the total return on the Company’s benchmark (FTSE All-Share Index), the Company will provide shareholders with the opportunity to realise their investment in full at close to NAV per share; and 2) The Company will put forward a resolution at the Company’s Annual General Meeting to be held in 2027 for the continuation of the Company. This is in addition to the five-yearly continuation votes in the Company’s Articles of Association.

- As highlighted in last year’s Chairman’s Statement, Ms Carolan Dobson will not be standing for re-election at this year’s Annual General Meeting and has decided to stand down from the Board on 14 June 2024. Mr Neil Rogan was appointed to the Board on 1 January 2024 and takes over as Chairman on 14 June 2024.

Board review – vote in favour of continuation

BGUK’s board reviewed the Managers’ provision of company services, third party oversight, internal risk controls, marketing, shareholder support, quality of staff and overall commitment to the Company and the investment trust sector and says that it found these to be of an excellent quality, provided with commitment and integrity.

The Board also reviewed the Managers’ investment philosophy and processes, the portfolio risk analysis, the largest stock contributors to positive and negative performance, the quality of the companies held in the portfolio, turnover levels and style tilts and found these to be in line with the Managers’ committed growth style and that predicted risk of investments was set appropriately for a committed growth-orientated long-term fund. The Board says that it examined the quality of the Managers’ research before stock purchase and thereafter and found it very thorough and informed.

BGUK’s board notes that there has been much press comment about the difficulties the UK stock market is facing, the lack of traditional buyers for UK equities and the pressure that companies feel to move their listings to the US to achieve higher ratings. The Board says that it examined these issues with the support of their corporate brokers and Baillie Gifford and found that whilst these problems were real, they were not overwhelming. It notes that there are several brokers providing research on each of BGUK’s companies, and none of the portfolio companies, that are currently held, have moved their listing. The UK equity market is now generally considered to be inexpensive, it adds, and that view is supported by the number of takeover approaches appearing for UK listed companies both from private equity buyers and international companies.

The board observes that, over this five-year period the macroeconomic backdrop of sluggish economic growth, rising interest rates and a spike in inflation has not been conducive to Baillie Gifford’s growth investment style. In addition, it notes that the UK benchmark index has a significant exposure to resource and financial companies whose profits tend to be cyclical with limited long term sustainable growth and as such are not areas that meet the Managers’ long term growth requirements.

BGUK’s board observes that these broader style and macroeconomic factors explain a significant amount of the investment underperformance but not all. However, it recognises that the balance between successful and unsuccessful individual stock investments over this period has not been in the BGUK’s favour and, as noted above, has confidence that over the longer term the portfolio managers have the capacity to outperform. It is therefore recommending that shareholders vote in favour of continuation at the AGM.

Continuation votes and performance-triggered exit opportunity

BGUK shareholders have the right to vote on the continuation of the trust every five years and the next vote is at this year’s AGM in September. BGUK’s Board believes that the current style headwinds will not last forever and growth will resume its historical outperformance. The Board says that it is reassured that the current portfolio is populated with exciting growth businesses with strong competitive positions and large market opportunities. The fundamentals of the portfolio look strong n its view, with 97% of the portfolio having positive earnings or cashflows and 1-year forward sales growth and earnings better than the index it adds (it cites 6.0% and 7.6% 1-year forward sales and earnings growth compared to 2.7% and 5.6% for the FTSE All-Share Index).

Shareholders patience tested

BGUK’s Board says that it recognises shareholders’ patience will have been tested by the last three years of underperformance and, following consultation with shareholders representing a material proportion of BGUK’s share capital, if the continuation vote is passed at the AGM the Board makes the following commitments, which it believes will provide greater certainty for shareholders in the event that underperformance were to continue and that it also believes are in shareholders best interest as a whole:

- The Board will introduce a one-off 5-year performance triggered exit opportunity whereby, in the event the Company’s NAV per share total return over the 5-year period from 30 April 2024 to 30 April 2029 does not equal or exceed the total return on the Company’s benchmark (FTSE All-Share Index), the Company will provide shareholders with the opportunity to realise their investment in full at close to NAV per share.

- The Company will put forward a resolution at the Annual General Meeting to be held by the Company in 2027 for the continuation of the Company. This is in addition to the five-yearly continuation votes in the Company’s Articles of Association and, as such, a continuation vote is expected to be held in 2029 as well.

Board composition – Neil Rogan to takeover as chairman

BGUK’s chair will not be standing for re-election to the Board at the upcoming AGM as she will have completed ten years of service by then and is standing down from the Board on 14 June 2024. Earlier this year, Andrew Westenberger (chair of the audit committee), led a recruitment process supported by an external recruitment consultant, Trust Associates, to find Dobson’s successor. Mr Neil Rogan was appointed to the Board on 1 January 2024 and will take over as chairman on 14 June 2024. Neil is an experienced Investment Trust Chairman and non-executive director. He also spent 30 years as an investment manager with Touche Remnant, Flemings and most recently Gartmore/Henderson where he was Head of Global Equities.

Share issuance and buy-backs

Since issuing shares in 2021 and 2022, BGUK’s shares have de-rated and moved to trading at a discount to NAV. Over the course of the year to 30 April, the Company has bought back on 67 occasions, buying into treasury 3,841,977 shares, which represents 2.6% of the Company’s issued share capital as at 30 April 2023. Since the financial year end, a further 635,000 shares have been bought back. BGUK currently has 14,873,677 shares held in treasury.

The Board says that it recognises the importance to shareholders that BGUK’s shares should not persistently trade at a significant discount to NAV in absolute terms or relative to the peer group and, while the Board does not believe it is appropriate to publish a specific discount target, the Board would expect to be more active in buying back shares, when appropriate.

Gearing – RCF renewed during the year

During the year, BGUK renewed its one-year £30m revolving credit facility with The Royal Bank of Scotland International Limited. Drawn and invested gearing stood at 6% and 5% of shareholders’ funds as at the Company’s year-end compared to 5% and 3% respectively a year earlier. BGUK’s Board sets internal guidelines for the portfolio managers’ use of gearing which are altered from time to time but are subject to net effective gearing not representing more than 20% of shareholders’ funds.

Earnings and dividends – revenue increase driven by special dividends

The net revenue return per share for the year was 5.68p, versus 4.05p in 2023. The year-on-year increase was largely a consequence of increased dividends received as well as special dividends from Lancashire Holdings and 4imprint. A final dividend of 5.60p per share, payable on 13 September 2024 to shareholders on the register as at 16 August 2024, is being recommended to shareholders. BGUK’s priority is capital growth so shareholders should not rely on receiving a regular or growing level of income from their investment in the trust.

Investment managers’ comments on performance

“We discussed the disappointing short-term performance of the first half of the Company’s financial year in the interim report. In the second half of the year, the Company’s NAV total return broadly matched the index, the FTSE All-share total return, so the result for the year remained unsatisfactory (over the six months to 30 April 2024, the Company’s NAV per share total return was 14.2% compared to 14.2% for the FTSE All-Share total return). There are a number of strands to this: while the absolute performance of the index over the year was respectable, the performance of individual holdings in the portfolio was much more dispersed, reflecting in particular a slant to the downside with the stockmarket displaying displeasure at any unexpected bad news, particularly with growth businesses. For example, a further unexpected charge against profits led to a further lurch down in the share price of wealth manager St James’s Place, while concerns about the health of the Chinese economy notably impacted the shares of pig breeder Genus, life insurer Prudential and to some extent the luxury goods retailer Burberry. While painful in the short term, we believe in all these cases there remains a long term growth investment case in and we are patiently sticking with them. For example with Prudential, the growth case involves its exposure to a wide variety of fast growing Asian life insurance markets where it has strong competitive positions that allows it to weather the shorter term vagaries of the GDP growth in one country. Moreover, an impressive new management team have articulated a clear and simple strategy that they are beginning to execute on. This is not meant to be dismissive of possible China risks for Prudential but as bottom up stock pickers we see this is an example of a business that is growing and getting stronger even if the share price appears disconnected to these fundamentals.

“Although some other businesses that had guided to softer short-term trading fared better, such as the leader in UK kitchens Howden Joinery and IT services business Softcat, a greater number in the portfolio simply marked time as the market appeared to place more emphasis on the cloudy near term economic and geopolitical outlook, rather than the long term opportunities for the businesses. We did see particularly strong operational performance rewarded in the strong share price performance of specialist marketer 4imprint and the foreign exchange payment disruptor Wise. Lastly, Wayve, our sole unquoted investment, which is an autonomous driving technology business, was written up substantially following its latest funding round where a significant sum of new investment was raised at a higher valuation.”

Managers’ comments on the 5-Year Review

“It is five years since the Company’s last Continuation Vote. When we took over the management of the Company from Schroders, we asked shareholders to judge us over five years. The results are not what we, the Board or you as a fellow shareholder would have hoped for, having underperformed by 4.8% per annum. We were therefore asked by the Board to examine the data, offer our perspectives and explain why we feel confident about the portfolio being in good shape from here, despite the disappointing outcome so far.”

Managers’ recap of how they invest

“Our investment philosophy is anchored around a core belief that share prices will follow fundamentals over the long term. We try to identify companies that will deliver superior earnings growth and hold onto them long enough for their unique competitive and cultural strengths to emerge as the dominant influence on share prices. The following chart provides some evidence to support this approach as it shows the striking correlation between superior long-term earnings growth and stock price returns for the FTSE All-Share. However, the path is not always a smooth one and there will be periods when our style of investing will be out of favour.

Manager Q&A – Why hasn’t our investment approach worked recently?

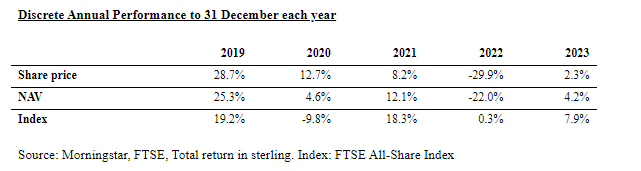

“Since taking over the management of Baillie Gifford UK Growth Trust, we believe that the macroeconomic backdrop has had an unusually dominant influence on investment outcomes. For example, if we consider calendar year NAV performance, as detailed in the table below, we can see that the portfolio delivered robust relative returns during the initial shock of COVID-19 in 2020 as many of the high-margin, capital-light, well-capitalised companies held were better able to weather the pandemic and, in some cases, directly benefited from global lockdowns. However, relative performance started to struggle in 2021 as economies re-opened and supply chains struggled to operate smoothly.

“In 2022, the conflict in Ukraine put still greater upward pressure on prices and interest rates rose sharply. It was at this point in 2022 that our performance was most challenged in both absolute and relative terms. Why? The stock market had to process the imperative to discount future cash flows at a higher rate. Conventional wisdom dictates that the multiples applied to future earnings streams should compress in a more inflationary environment, so the market had to grapple with the right ‘new normal’ multiple to attach to equities. Growth businesses, which are valued on the premise of long-duration earnings streams projected out into the future, underwent a sharp decline in their share prices. To put it simply, the market backdrop over the past few years has given rise to an environment where the share prices of growth companies have been hit indiscriminately, regardless of the fundamental operational progress they are making. We believe that much of the recent underperformance of the portfolio has been down to this – our investment style being out of favour – rather than too many poor investment decisions. To be clear, we have made individual mistakes that have hurt performance, and we have learnt from these experiences, but the magnitude of the underperformance cannot be explained by these.”

Manager Q&A – Could we have mitigated the underperformance?

“We asked the investment risk team at Baillie Gifford to undertake analysis to identify whether we could have done anything different from 2021 when performance turned down. The short answer is that after looking at various scenarios, the only way we could have achieved an outcome aligned with the index would have been to significantly change the portfolio by taking large new positions in some of the largest businesses in the UK, such as Shell, BP and HSBC. Many of these companies in our view do not have obvious long term growth potential but they have been beneficiaries of the macroeconomic turmoil described above because of their near term earnings certainty. Owning many of these large ‘value’ stocks would have mitigated underperformance, however, it would have also undermined our active, bottom up, long-term growth investment style. We consider it imperative to stick to our long-term growth investment philosophy because the alternative is trying to second guess, and trade around, short term swings in “style” in stock markets. Attempting to do so in our view could make things far worse for shareholders.”

Manager Q&A – Why do we believe that performance will improve over the next five years?

“With a high inflationary and interest rate environment, we understand why our style of growth investing has been out of favour with the market. However, we believe that current valuations fail to adequately reflect the value of the progress we are seeing in the businesses we invest in; they underestimate the adaptability of the management teams running these businesses, and they overlook the resilient financial characteristics that the portfolio possesses. Rather than a cause for despondency, this disconnect between share prices and fundamentals is a key reason why we remain confident in the long-term outlook for the performance of the portfolio.

“The three charts below illustrate the superior quality and resiliency characteristics of the portfolio relative to the index. While we would urge caution in relying too heavily on spuriously precise earnings forecasts, it is encouraging that the portfolio is invested in companies with higher growth expectations than the broader market.

“Why does this matter? As we noted earlier, our investment philosophy is anchored around a core belief that share prices will follow fundamentals over the long term. Enduring growth should act as a catalyst for long-term share price appreciation.

“We continue to believe the portfolio is populated with exciting growth businesses, with large market opportunities, strong competitive positions, and importantly, the cultural adaptability to succeed in a rapidly changing world. Having the nerve and patience to continue holding them through turbulent times is key to realising their long-term potential.”

Managers’ comments on the outlook for the portfolio

“We see an abundance of significant and unrecognised potential within the current portfolio. We see it in long-standing holdings like Auto Trader, Experian and Ashtead which have been working successfully to expand their already substantial market opportunities, are embedding themselves ever more deeply into their customers’ businesses and whose competitive advantages are now deeper than they have ever been. We also see it in relatively more recent purchases like IT service providers Kainos and Softcat which enjoy multi-decade growth tailwinds from the adoption of technology by both enterprises and the public sector, and where the market fails to appreciate unique cultural strengths which make both stand out from competitors and be most trusted advisors to customers.

“Despite all the doom and gloom surrounding the state of innovation in the UK, we look to long-standing holdings like Renishaw and Genus whose commitment to research and development spending, we believe, will yield significant results in the coming decade by enabling manufacturers and farmers across the globe to solve some of their most pressing productivity and sustainability challenges.

“Earlier in their lifecycles are companies like AI autonomous driving start-up Wayve, the surgical endoscopy business Creo Medical, and next generation sequencing company Oxford Nanopore. All three are at the vanguard of progress in their respective fields and are true world leaders.

“We invest in companies for decades, so trust in management is of great importance for us. We are fortunate to be invested alongside some of the most accomplished leadership teams such as those at Games Workshop and 4imprint whose long-term mindset and dedication to doing the right thing have been a crucial ingredient in the enormous success both businesses have achieved over time.

“Your portfolio managers work in an investment firm which allocates capital to some of the most promising public and private enterprises across the world. We can both say, with some confidence, that the companies in this portfolio can hold their own across that global investment stage.”