NextEnergy Solar Fund (NESF) has published its annual results for the year ended 31 March 2024. In what is her first annual report as NESF’s chairwoman, Helen Mahy says that the continued macroeconomic backdrop has presented challenges to the sector, but she is encouraged that NESF has continued to show resilience having achieved multiple key milestones throughout the year. She adds that NESF has made solid progress with its capital recycling programme, which started with the sale of Hatherden, a 60MW ready-to-build solar project in November 2023 and, since the financial year end, NESF has delivered on the second phase of this programme realising attractive value from the sale of Whitecross, a 35.22MW operating solar asset.

Mahy also comments that NESF has maintained strict discipline across its capital structure and continues to look at active ways to narrow the discount to NAV, including implementing a £20m share buyback programme. However, NESF’s NAV per share fell by 8.4% during the period. This was driven by a range of factors which we explore below.

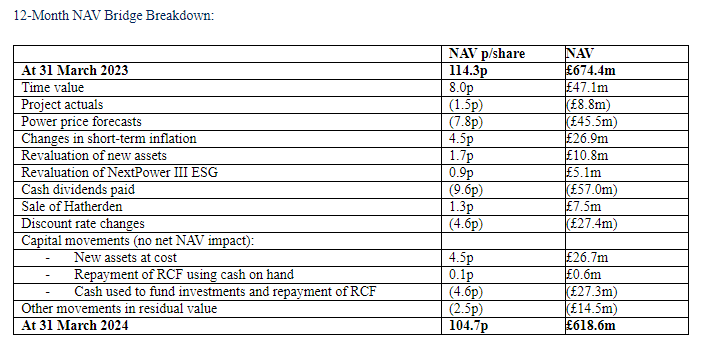

The NAV bridge

The movement in the NAV over the period was driven primarily by the following factors:

- Increase due to time value, reflecting the change in the valuation as a result of changing the valuation date, prior to adjusting for any outflows of the company. The increase in value is attributable to the unwinding of the discount applied to cash flows for the period when calculating the DCF.

- A decrease in short-term (2024-2029) UK power price forecasts provided by consultants, mainly as a result of lower commodity prices (particularly gas, which is down c.30-40%), influenced by above-average gas storage levels, milder weather across winter 2023/24 and sustained reductions in demand.

- The valuation incorporates revisions to short-term inflation forecasts from external third parties.

- The revaluation of new assets accounts for assets as they become operational and moved from holding them at cost to fair value. This includes the standalone energy storage asset, the two international solar co-investments and Whitecross.

- The revaluation of NextPower III ESG.

- The dividends declared and operating costs incurred during the year, this includes both ordinary and preference share dividend payments.

- Other movements in residual value include changes in FX rates, fund operating expenses, and other non-material movements.

Key highlights from the results

Financial

- NAV per ordinary share of 104.7p (31 March 2023: 114.3p).

- Ordinary shareholders’ NAV of £618.6m (31 March 2023: £674.4m).

- Income generated of c.£80m (31 March 2023: c.£79m)

- Financial debt gearing (excluding preference shares) of 29.3% (31 March 2023: 28.4%).

- Total gearing (including preference shares) of 46.4% (31 March 2023: 44.6%).

- Weighted average cost of capital of 6.4% (31 March 2023: 5.7%).

- Weighted average cost of debt of 4.5% including preference shares (31 March 2023: 3.9%).

- Weighted average discount rate across the portfolio of 8.1% (31 March 2023: 7.3%).

Dividend:

- 11% increase in total dividends paid of 8.35p per ordinary share for the twelve months ended 31 March 2024 (31 March 2023: 7.52p).

- Dividend cover for the twelve months ended 31 March 2024 was 1.3x (31 March 2023: 1.4x).

- Increased target dividend to 8.43p per ordinary share for the year ending 31 March 2025.

- Attractive high dividend yield of c.11%, as at closing share price on 17 June 2024.

- Forecasted target dividend cover of 1.1x – 1.3x for the year ending 31 March 2025.

- Total ordinary dividends paid since IPO of £345m or 67.8p per share.

Portfolio

- Reached 1GW installed capacity milestone with 1,015MW of total installed capacity (31 March 2023: 889MW).

- Increased portfolio size to 103 operating assets (31 March 2023: 99).

- Maiden 50MW standalone energy storage asset (Camilla) achieved commercial operation.

- Energised two international solar co-investments totalling 260MW alongside NextPower III ESG (Santarém and Agenor).

- Energised Whitecross, a 35.22MW solar asset in the UK.

- Remaining weighted asset life of 26.6 years (31 March 2023: 26.3 years).

ESG & sustainability

- Maintained Article 9 Fund classification under the EU Sustainable Finance Disclosure Regulation and EU Taxonomy Regulation.

- Generated 852GWh of clean electricity during the period, contributing to the avoidance of 279.3KtCO2 emissions (31 March 2023: 899GWh, 363KtCO2 emissions).

- Released third standalone sustainability report, focused on three principal sustainability topics: climate, nature and social-related issues.

- Powered an equivalent 301,000 homes for one year (31 March 2023: 242,000).

- Adopted the Taskforce on Nature-related Financial Disclosures (TNFD) to go above and beyond the Company’s sustainability reporting requirements, alongside commitment to disclose under the new TNFD framework.

- Adopted the International Sustainability Standards Board (ISSB) standards S1 and S2, which covers and expands on the Taskforce for Climate-related Financial Disclosures guidance, through a dedicated ISSB aligned Sustainability and ESG Report.

Capital structure

- Refinanced all revolving credit facilities at attractive margins demonstrating the appetite of the company’s banking partners to provide debt to the company at attractive terms.

- The company’s financial debt (excluding preference shares) is currently £338m which represents a gearing of 29.3% of gross asset value (“GAV”) (31 December 2023: 28.8%). The company also includes non-amortising preference shares as part of the debt structure and therefore values the total gearing of the company at 46.4% of GAV (31 December 2023: 45.7%).

- Of the company’s total debt 4, 68% remains at a fixed rate of interest (including the preference shares) and 32% is a floating rate at attractive margins (SONIA + 1.20% to 1.50%).

Capital recycling programme

- Completed the first phase of the Capital Recycling Programme with the sale of Hatherden, a 60MW ready-to-build solar project, for £15.2m, representing a 100% premium to its holding value (2.0x multiple on invested capital) and an attractive 57% IRR.

- Post period end, the company completed the second phase of the capital recycling programme with the sale of Whitecross a 35.22MW operating solar asset for £27m (the “Transaction”) to a third-party, Downing LLP.

- The transaction represents a 1.3x multiple on invested capital, an attractive 14% unlevered IRR, and a 14% premium to the holding value as at 31 March 2024.

- The transaction is Net Asset Value (“NAV”) accretive to shareholders and will generate an estimated uplift of 0.57p which will be reflected in the company’s NAV per share as at 30 June 2024.

- The Investment Manager (“NEC”) secured potential for further consideration of £1m payable in the event the project benefits from planned changes to network charging before 31 December 2028, bringing the total transaction value to £28m.

- The total transaction value including this further consideration represents a 1.3x multiple on invested capital, an attractive 15% unlevered IRR, and a 18% premium to the holding value as at 31 March 2024. It would also generate an estimated uplift of 0.70p if reflected in the company’s NAV per share as at 30 June 2024.

- Proceeds from both phases of the capital recycling programme were used to repay the company’s short-term debt facilities.

- Subsequent phases are progressing positively through exclusive negotiations with selected third-party bidders. The company will provide further updates in due course.

Share Buyback Programme

- Post period end, the board announced it approved an initial share buyback programme of up to £20 million.

[QD view: as we commented on the first of the three NESF stories this morning, the next phase of the capital recycling programme will hopefully prove decisive in tackling the discount. The company’s impressive 10-year track record, the important part that it and other UK-listed renewables funds are playing in the energy transition, and the incoming Labour government’s commitment to a significant increase in renewable generation all stand in its favour.]