Emerging technologies are poised to reduce the steel industry’s environmental impact, creating compelling investment opportunities in the sector.

Executive summary

- Steel remains a vital component of many products solving environmental challenges and improving resource efficiency, from wind turbines to waste collection.

- This makes lowering the carbon intensity of its production and aligning the industry with net zero both a priority and potential long-term investment opportunity.

- Today, low-carbon technologies, industry commitments and supportive government policies are steadily transforming the production of primary steel.

- Steel producers are already employing electric arc furnaces (EAF) to great effect, but emerging technologies such as direct reduced iron (DRI) need to be scaled up to become cost competitive.

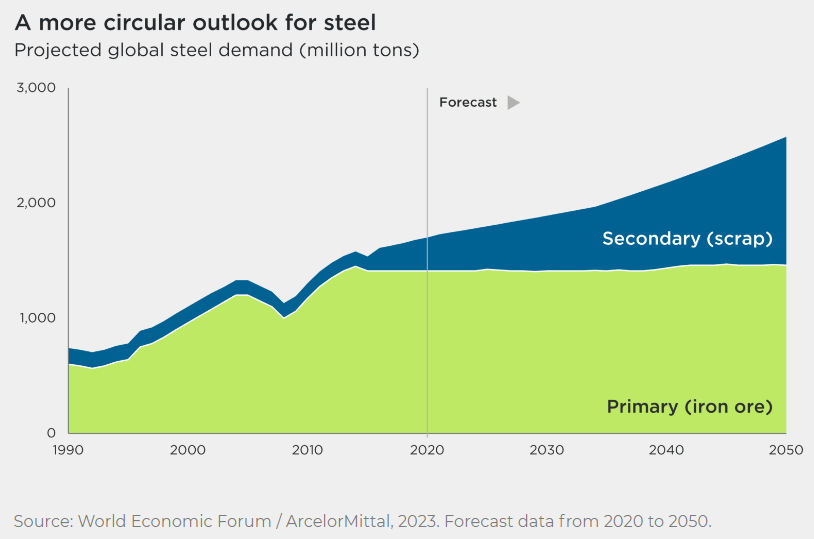

Steel forms the backbone of our built environment, from buildings to vehicles. Global demand for the alloy has roughly trebled since 1970 and is forecast to rise by 50% again by 2050.

Today, the production of steel accounts for an estimated 6% of global greenhouse gas (GHG) emissions and 8% of CO2 emissions. The intense heat required to forge new steel in traditional blast furnaces (and associated fossil fuel combustion) makes it one of the more difficult industries to decarbonise. So, while the steel sector will continue to play a central role in the economy, its emissions must be dramatically reduced to achieve national and global net-zero goals.

Each ton of crude steel produced worldwide emits roughly two tons of CO2. The industry’s overall carbon intensity is driven by the dominance of blast furnaces, which account for roughly 70% of steel production. The process requires temperatures in the range of 1,100°C to 1,600°C, usually achieved by burning coal. In China – which produces a little over half of the world’s steel – blast furnace processes accounted for an estimated 89% of production in 2021.

Under a business-as-usual scenario, sustained demand growth would drive global steel emissions up by more than one-third by 2050, according to estimates by The Mission Possible Partnership (MPP), an initiative designed to catalyse the decarbonisation of the world’s highest-emitting industries. Steel will be core to the infrastructure needed for the clean energy transition, such as power transmission lines and wind turbines; each megawatt of offshore wind capacity demands 250 tons of steel.

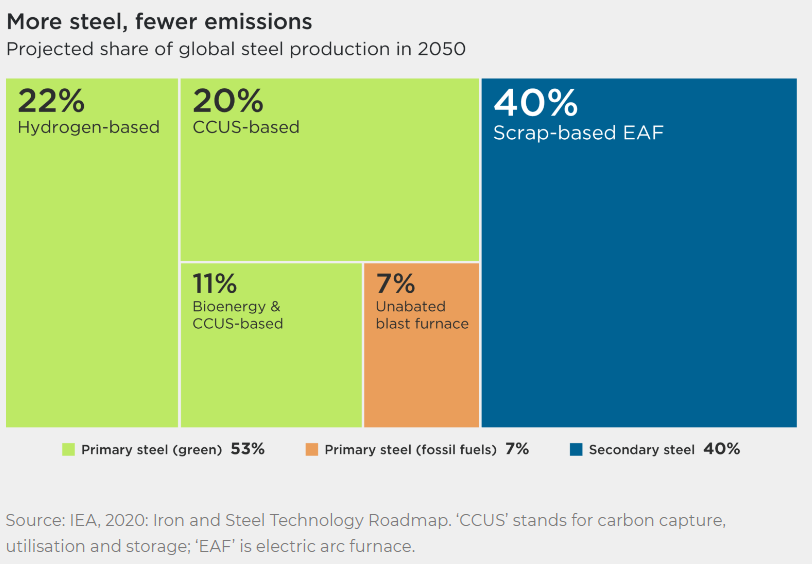

The adoption of new technologies – and the expansion of existing ones – is essential in the industry’s pathway to net zero. In its long-term projections for the sector, the International Energy Agency (IEA) estimates that just over half of 2050 steel production will come from primary production using emerging hydrogen-based processes or carbon capture (see chart below), while scrap-based secondary production will account for 40%.

Decarbonising primary steel production

The majority of global steel demand will continue to be met by the production of primary steel from iron ore.

A process called direct reduction could hold the key to making primary steel more sustainable. Using a blend of hydrogen and carbon monoxide gas (syngas), iron ore can be reduced without melting it – thereby saving energy. The solid byproduct of this process, direct reduced iron (DRI), is then used as a feedstock into an electric arc furnace (EAF) to roll steel. Today, around 5% of the world’s steel is produced via DRI, but using natural gas instead of syngas. That’s an improvement on current methods, but still emits 1.2 tons of CO2 per ton of primary steel.

Substituting natural gas with hydrogen derived using renewable electricity could reduce the sector’s 2050 emissions by more than one-third. Hydrogen-based DRI, with its potential for 95% GHG reduction, is nearing commercialisation with projects underway from the likes of ArcelorMittal, the world’s second-largest steel producer. Additionally, direct reduction with biomass, such as that developed by the Finnish cleantech BMH Technology, offer a 60% reduction and can be integrated into existing plants

Other innovative green steel technologies are emerging. Boston Metal’s Molten Oxide Electrolysis (MOE) process – which uses renewable electricity to convert iron ore to high-quality liquid metal – targets cost-competitiveness at electricity prices of US$15 to US$35 per MWh. Additional promising pathways include Voestalpine’s SuSteel pilot project, which is exploring the use of hydrogen plasma in a carbon-neutral steelmaking process, and flash ironmaking research by the University of Utah.

There could also be an important role for carbon capture, utilisation and storage (CCUS) technologies as part of the industry’s decarbonisation. Under the MPP’s net-zero scenario, up to one-fifth of the industry’s prospective 2050 emissions could be avoided through CCUS. There are currently 30 commercial CCUS projects worldwide.

Making more use of scrap metal

Alongside the greening of primary steel production over the coming decades, an expanding role for secondary or scrap steel will help reduce the sector’s emissions intensity in the medium term.

It is forecast that electric arc furnace (EAF) technology, which already supplies one-quarter of global steel demand, will produce roughly 40% by 2050. EAF uses electricity to melt down and re-use scrap steel. Emissions from EAF are highly dependent on how electricity is generated locally, but average 0.5 tons of CO2 per ton of steel produced – and less where only renewable electricity is used. Increased scrap use could reduce the industry’s prospective 2050 emissions by up to one-fifth under the MPP net-zero scenario.

The US currently leads in secondary steelmaking, with EAF-based processes accounting for 70% of domestic output in 2019. Other major steel producers are also looking to make more use of scrap steel: China is aiming for between 15% and 20% EAF-based production by 2025, while India is already at 54%. However, it’s important to note that feedstocks in developing economies can sometimes include carbon-intensive pig iron (not only scrap) and electricity is in many cases generated largely by coal. A transition to scrap feedstocks and the use of renewable energy will be needed to enable deeper emissions cuts from EAF.

Improving credit among secondary steelmakers

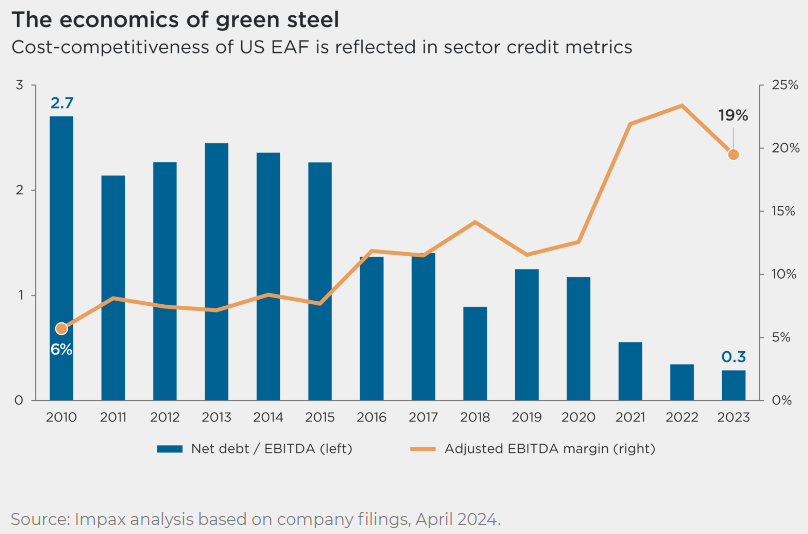

We believe the investment opportunities that will be created by technological and market drivers in the transition to a greener steel industry are well illustrated by the market response to EAF.

The financial health of EAF steel producers in the US has improved over the past decade or so. Using a peer group comprised of EAF producers Nucor, Steel Dynamics and Commercial Metals, we compared ‘pureplay’ companies against steelmakers reliant on blast furnace production

The improving financial health of US EAF producers is reflected in key metrics. We observe in the chart below that average net leverage – as measured by net debt to EBITDA – has decreased significantly for EAF producers since 2015. Over the same time, profit margins have increased to an average of 19%. This compares with average margins of 11% among their traditional steelmaking peers.

Reduced debt and improved profitability are driving higher credit ratings. From 2015 to 2023, credit quality for the EAF peer group improved from an average senior unsecured credit rating of ‘Ba1’ to ‘Baa3’, according to Moody’s, thereby moving to investment grade.

Commitments and policies are galvanising the transition

The development of low-carbon technologies for steel production isn’t the only force driving the industry’s transition: corporate commitments and supportive government policy are also accelerating changes.

Steelmakers are increasingly setting ambitious emissions targets. In line with guidance from the Science-Based Targets initiative (SBTi), more than 20 steel companies have validated near-term science-based targets, with 19 committing to net-zero emissions. Initiatives from non-governmental organisations like MPP are further accelerating the industry’s transition towards net-zero goals.

In parallel, policy support is emerging in the form of incentives, regulations and tariffs to align steelmaking with national climate targets. As an example of the former, Germany’s current €23bn ‘net zero’ budget includes ‘climate protection contracts’ that subsidise companies adopting cleaner steelmaking technologies. Tightening caps on GHG emissions under the EU Emissions Trading System will meanwhile improve the competitiveness of less polluting technologies by raising the relative long-term cost of blast furnace steel. To help ensure a level playing field with steel produced elsewhere, the EU’s Carbon Border Adjustment Mechanism puts a price on carbon-intensive imports.

Forging new markets

The rate of change will also be informed by end-user appetite for less emissions-intensive steel. Encouragingly, strong market demand for sustainably produced primary steel has recently been evidenced by the premium pricing commanded by H2 Green Steel, an early-stage Swedish maker of primary steel using a green hydrogen-fuelled DRI process.

Under the First Movers Coalition, some of the world’s largest companies are using their purchasing power to create early markets for innovative technologies in hard-to-abate sectors, including steel. Ørsted, the world’s largest offshore wind developer, has partnered with turbine manufacturer Vestas to procure turbine towers made from scrap using renewable electricity, reducing carbon emissions by up to 70%.

We see the convergence of promising technologies, ambitious industry goals and supportive policy creating fertile ground for long-term investment in companies enabling the transition to a greener steel sector.