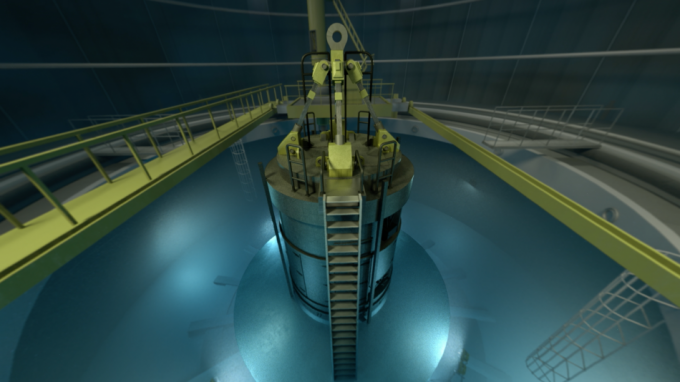

INPP, a £2.3bn London-listed infrastructure fund, promises good risk-adjusted returns for shareholders from its co-investment with the UK government in the nuclear plant construction project in Suffolk.

The ability of London-listed investment companies to back projects of national importance was underlined today when International Public Partnerships (INPP) announced a £250m investment in Sizewell C, a nuclear reactor construction project in Suffolk.

INPP’s fund manager, Amber Infrastructure, will take an initial 7.6% stake in the 3.2GW project alongside the UK government, which will own 44.9%, Canadian pension fund La Caisse with 20%, UK energy supplier Centrica (CNA) on 15% and EDF, the French operator, with 12.5%.

INPP has committed to invest five tranches of £50m over the next five years, which will leave it with around 10% of its current £2.7bn infrastructure portfolio invested in the project by 2030.

The company’s £200m share buyback programme, which has so far returned £82m to shareholders, is unaffected as INPP will largely fund the project through disposals of lower-returning assets.

INPP says the “low-teen” annual return it will make from Sizewell C will exceed that from repurchasing its shares, currently trading 14% below net asset value.

The shares were broadly unchanged at 125.6p as the board reassured investors that the strategic investment would boost the predictable inflation-linked cashflows behind its 6.8% dividend yield.

As an early “first mover”, INPP would earn a cash yield from day one with “significant” yield increase and capital growth forecast once construction milestones were achieved and the plant operational.

It allayed concerns over likely cost overruns saying Amber had negotiated enhanced investor protection “even in severe downside scenarios and remote nuclear-specific risks”.

INPP said it already had experience of the regulated asset base (RAB) model it was using for Sizewell C from its investment in the Tideway sewage tunnel in London which opened last year.

In addition, INPP said it was helping with wider national goals with its participation in the “landmark infrastructure investment”. The project should strengthen UK energy security, contribute to net zero goals through generating emissions-free power equivalent for the needs of six million homes and create 10,000 jobs.

INPP chair Mike Gerrard said: “Sizewell C represents a compelling opportunity for INPP’s investors to benefit from attractive risk-adjusted returns by bacing a regulated utility highly comparable to projects and businesses in which the company is already invested.”

Jamie Hossain, senior investment director at Amber Infrastructure, added: “We have worked extensively with the UK government to structure a regulated investment in Sizewell C that fits INPP’s established investment criteria.”

Our view

James Carthew, QuotedData’s head of research, said: “This is a big-ticket, high-profile investment for INPP, but it looks like it might be a good one. INPP gained experience of these types of big-ticket projects by backing Tideway (the Thames Super Sewer). COVID-19 caused a nine-month delay and a £233m cost overrun on the Tideway project and this contributed to a fall in INPP’s NAV over 2020. This time around INPP appears to have worked to minimise its exposure to the risk of a construction overrun. In fact, I’m struggling to identify where INPP’s risk is in this deal. Although, maybe, a future government might ask the same question and seek to renegotiate it.”