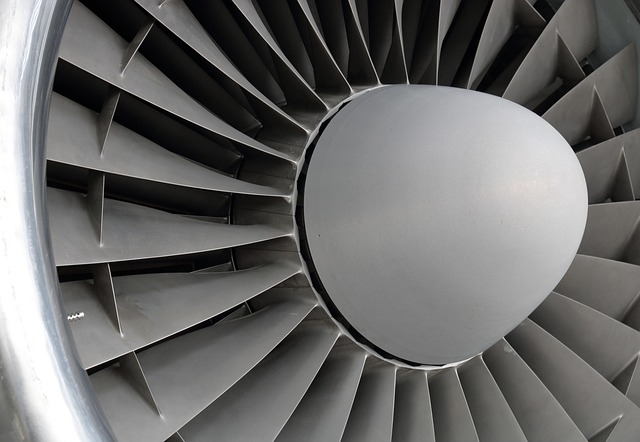

Merchants Trust (MRCH) regrets not holding Rolls-Royce (RR), the engineering group making a remarkable comeback under chief executive Tufan Erginbilgic. Shares in the aerospace engineer and small nuclear reactor manufacturer soared 78% in the six months to 31 July, a major contributor to the £938m UK equity income trust underperforming in its half-year results released today.

On Friday Rolls-Royce hit a £100bn valuation for the first time since it was formed 121 years ago in what Mail Online reported as “one of the most remarkable turnarounds in British industrial history”. The shares have doubled this year on increased defence spending and excitement over demand for its small modular reactors. They have soared 13-fold since Erginbilgic took charge in early 2023.

Merchants’ underlying half-year investment returns of 5.4% trailed the 7.5% total return of the FTSE All-Share, with 1.5% of the index gain coming from Rolls Royce alone.

Merchants also paid the price for not holding BAE Systems (BA), another beneficiary of defence spending. Combined, the impact of not holding Rolls and BAE accounted for all of Merchants’ underperformance against the index.

In its defence, the trust said: “Rolls only recommenced paying dividends this year after a five-year pause, so it is not a natural holding for Merchants’ high yield strategy.”

Actual shareholder returns were lower at 1.5% as the shares derated with their discount to net asset value widening to the current 8.4%.

Dividends from the portfolio run by value fund manager Simon Gergel, Richard Knight and Andrew Koch at Allianz Global Investors edged 0.7% higher to 14.6p per share from 14.5p a year ago, putting the shares on a 5.4% yield. The payout was covered by earnings per share which rose 3.5% to 17.7 from 17.1p.

The company is an AIC “Dividend Hero” having increased its payout consistently for 43 years.

Chair Colin Clark said in light of the underperformance in the “recent low-growth environment”, the board had reviewed the manager’s disciplined, value-focused approach and holdings in “attractively valued domestic cyclical” stocks, adding “we remain convinced that it provides the best foundation for long-term returns.”