AVI Japan Opportunity

Investment companies | Update | 19 July 2023

Good governance, better returns

The team behind AVI Japan Opportunity (AJOT) continues to champion the tenets of good corporate governance and shareholder alignment. On this front, it recently made some positive progress at NC Holdings AGM. The benefits that it can accrue through improved corporate governance complement an attractive-valued Japanese equity market, which is increasingly attracting the attention of foreign investors. The missing piece of the puzzle is the weakness of the Yen. If that changes, AJOT could really sparkle.

Whilst there has been a handful of new additions to AJOT’s portfolio, there has been an overall reweighting of the portfolio towards higher-quality stocks, reducing exposure to some ‘deeper value, lower quality’ names that have sometimes dragged on performance.

Thanks to its idiosyncratic tailwinds, AJOT has been able to generate enviable outperformance of peers and index benchmarks over the long term, as well as command strong demand for its shares, with the trust’s share price continuing to trade close to its NAV.

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a focused portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors leverages its three decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

Why AVI Japan Opportunity?

Readers might wish to refer to our last annual overview note.

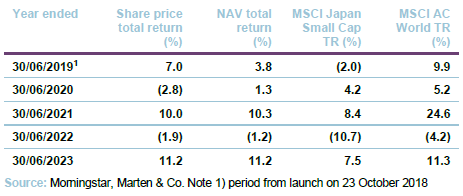

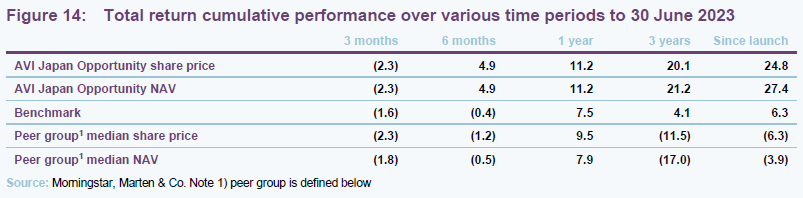

Since its launch in October 2018, AJOT has been building a track record of outperformance of both its performance benchmark (MSCI Japan Small Cap Index) and its peer group, delivering an NAV return of 27.4% from launch to the end of June 2023. Notably, it has done so against a headwind of a weak Japanese yen and a local stock market that has made little progress in four years.

AJOT was founded primarily to capitalise on structural, yet resolvable, issues within Japan’s corporate governance. Such issues include that:

- Japanese companies are hugely overcapitalised, with 40% of the TOPIX having net cash balances worth more than 20% of their equity;

- whilst major inroads have been made, only 15% of Japanese board members are women (about half the level in the US), and the majority of board directors are not independent;

- the Japanese small-cap sector chronically lacks analyst coverage, with 63% of AJOT’s portfolio having no sell-side analysts covering; and

- despite containing numerous high-quality businesses and global market leaders, Japanese small caps remain undervalued versus their developed market peers, especially those with persistent governance issues.

It is by reforming these issues that AJOT is able to enhance its returns, be it improving governance practices, enhancing margins, implementing share buy backs, or improving dividend profiles. Regardless of what path the AVI team takes, they should all (if successful) lead to tangible increases in share prices. As an example of how deeply undervalued the AJOT target market is, the trust traded on an EV/EBIT ratio of 7.9 times, compared to the median 13.0 times of the MSCI Japan Small Cap.

Market backdrop

Foreign investors are returning but remain underweight.

One could be forgiven for labelling Japan as a perennial laggard, given its well-publicised issues around its demographics, inflation, and governance. However, Japan is home to some of the world’s leading industries, and some of the most well-known global manufacturing brands, as well as simply being the world’s third-largest economy, with a GDP of $5trn. Japanese equity markets have seen something of a renaissance over 2023, with foreign investors (including Warren Buffett) flocking back to the region (although they remain underweight).

Japan is earlier in its post-COVID recovery than developed world peers.

Whilst Japan did not experience the post-COVID-19 boom in the same way as the rest of the developed world did (due to a longer lockdown period, slower roll-out of vaccines and its inherent exposure to China, which only removed its lockdown this year), it has begun to catch up over 2023. Nevertheless, Japanese consumer spending is still yet to recover to its pre-COVID levels.

Yet Japan is more than a domestic recovery story. There is hope of a resurgence of demand from China (Japan’s largest export partner) now that its COVID-restrictions have been lifted. However, the pace of recovery in Chinese economy has disappointed and a wider global slowdown is also causing concern.

In the case of AJOT, about 80% of its look-through sales are domestic, meaning that the recovery of the Japanese consumer and economy is of greater import. AJOT offers a ‘purer’ form of Japanese market exposure.

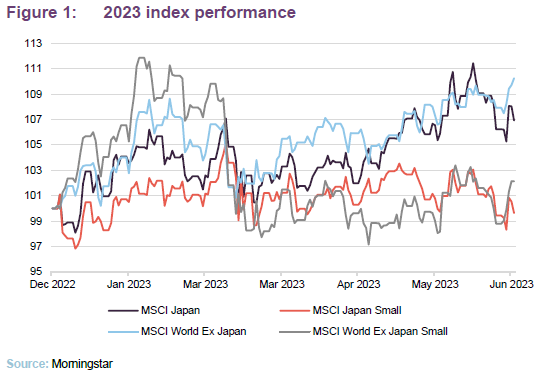

Japanese equities have kept pace with the global peers of 2023.

Japanese large-cap stocks have kept pace with the MSCI World ex Japan Index. Japan’s small caps have kept pace with developed market peers too, but almost everywhere small caps have lagged large caps. Investors may be looking for safer, larger companies during a period of heightened uncertainty.

One thing to note is that Japan’s equity market rally has been more broadly based, compared to that of the US (and thus the wider MSCI World index), which has been dominated by the performance of mega-cap technology stocks.

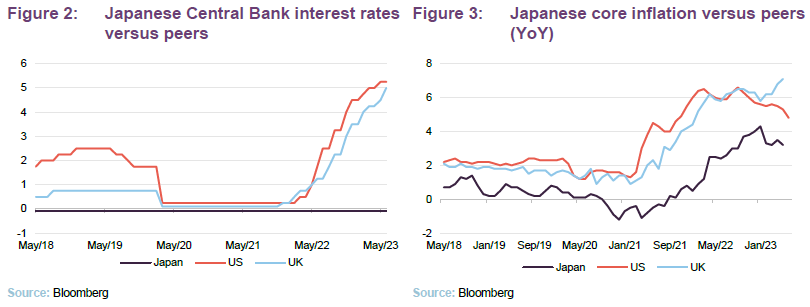

Japanese inflation is rising but lags peers.

A major reason behind the renewed investor interest in Japan is its current macroeconomic outlook. Japan’s inflation rate remains far lower than its developed market peers. While its recent core CPI (less food and energy costs) figure has peaked at 4.2%, it remains below the 4.8% of the US and well below the 7.1% of the UK. Until now, this has allowed its central bank a degree of leeway, permitting it to maintain a much less restrictive monetary policy than peers.

Might we see an end to yield curve controls?

Japan’s central bank has kept its short-term interest rate unchanged at -0.1% since the start of 2016. This is in stark contrast to the decade-high interest rates implemented in the west. Japanese companies have been cushioned from the rising cost of capital, but now it seems likely that the yield curve control policy will be relaxed.

Could the Yen strengthen from here?

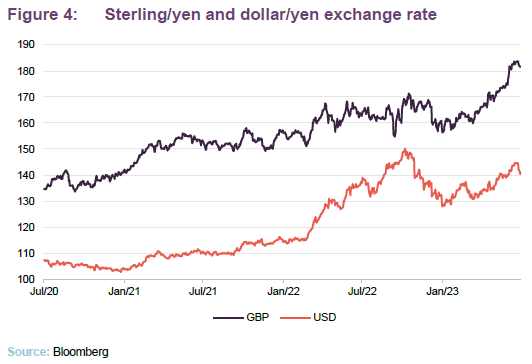

Low interest rates have been a double-edged sword, as they have caused the Yen to depreciate relative to sterling, which has impacted AJOT’s performance, given its unhedged currency exposure. Now, there is a possibility for the Yen to turn the tide in the near term and stem, if not reverse, its currency losses.

Improved corporate governance can make all the difference to returns.

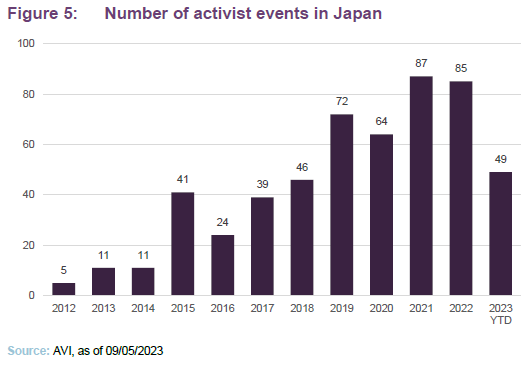

We remind readers that the outlook for AJOT hinges on far more than the outlook for the Japanese economy. Given its activist mandate, the opportunities for constructive engagement can be as important as the wider market sentiment, if not more so. Thankfully, 2023 is looking like another positive year for Japanese governance reforms. As can be seen in Figure 5, the number of activist events in 2023 may be on track to surpass 2022 and 2021, given that the data shown is only for the first five months of the year. 2022 also saw a 39% increase in buybacks, seeing an all-time high to the TOPIX.

AJOT’s current campaigns

As would be expected from an activist fund such as AJOT, the team has multiple engagement campaigns concurrently ongoing. However, given the sensitive nature of these activities, few if any are ever made public, with AVI typically disclosing its campaigns once they have been successful. Ideally, any identified reforms can be accomplished in private; however, there are a handful of occasions where AVI’s behind-closed-doors activities are not successful and in such cases it may utilise the option of going public to increase the pressure on management.

AJOT has recently had great success in influencing the governance policies of NH Holdings.

In our recent conversations, the AVI team has highlighted its ongoing campaign with NC Holding, which manufactures conveyors and multi-story parking equipment. NC holdings is a particularly noteworthy campaign, because it is one of the rare occasions where the AVI team was able to win a shareholder resolution at am AGM, as other major shareholders backed them to achieve a majority vote.

AVI recently announced the passing of three proposals at NC Holdings’ AGM. These resolutions were:

- giving shareholders the authority to determine dividends at general meetings;

- the payment of a 65 Yen per share dividend (equal to a 70% payout ratio); and

- the implementation of an incentive-based stock compensation plan for NC Holding’s directors.

As a testament to AVI, it believes that the aforementioned reforms are one of only a handful of shareholder-proposed special resolutions to have ever passed in Japan and that AVI is one of only three shareholders who had their resolutions successfully passed despite opposition by the company during this June’s AGM season.

AVI was unsuccessful with three of its other proposed reforms, as despite these achieving majority shareholder support, they did not meet the two-thirds threshold required to pass. AVI has asked the NC Holdings board to respect the wishes of the majority of shareholders. It will persevere with its engagement with NC Holdings, encouraged by the success it has achieved to date and the support of other shareholders.

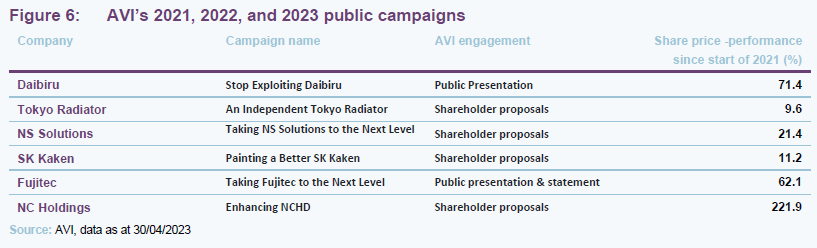

Whilst NC Holdings is the most recent example of success, there are several others provided by the AJOT team, as can be seen in Figure 6. We note that a successful outcome in one area does not mean that AJOT’s campaigns are concluded. For example, the team is into its third year of engagement activities with SK Kaken.

Asset allocation

At the end of May 2023, AJOT’s gearing was 6.0%.

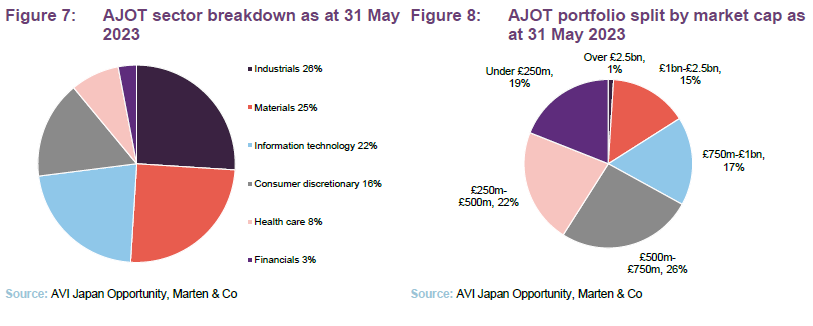

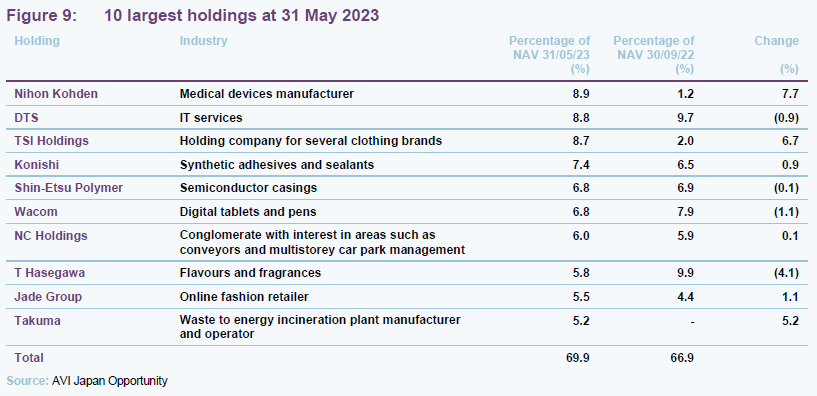

At 31 May 2022, AJOT had 26 holdings, just one more than when we last published, and the portfolio has continued to become a little more concentrated, with a higher percentage of the portfolio accounted for by the top 10 (69.9% at 31 May 2023 versus 66.9% as at 30 September 2022) since we last published. As discussed in our last note, this is a product of a deliberate strategy by the manager to exert greater influence over the companies in its portfolio.

We note that there has been a general shift within AJOT away from more conventional ‘value’ companies and into higher-quality businesses. While lower-valued companies are, by their very nature, easier to take large positions in, the team remarks that the share prices of these companies can demonstrate sustained underperformance in the absence of successful engagement campaigns, something which has dragged on AJOT’s performance historically. Higher-quality companies, although more expensive, do offer greater share price upside, irrespective of AVI engagement activities.

10 largest holdings

There have been some substantive changes to the line-up of AJOT’s top 10 holdings since we published our last note (using data as at 30 September 2022). Dropping out of the list are Fujitec, NS Solutions, and C. Uyemura. Replacing them are Nihon Kohden, TSI Holdings, and Takuma. All of the stocks that exited the top 10 are still held within the portfolio. Locondo changed its name to Jade Group.

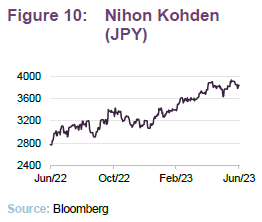

Nihon Kohden

Nihon Kohden, a medical devices manufacturer, is a position that the managers have been building since about October 2022. Nihon Kohden is a notable leader in patient monitoring equipment, with one third of its revenues being derived from overseas. With a 5.4% compound average growth rate over the past 20 years, it is an example of a high-quality business with good defensive characteristics, given the structural expenditure on healthcare. The AJOT team believes that Nihon Kohden will continue to reward shareholders even without its intervention. However, the AVI team believes that Nihon Kohden could improve its margins by 10–15% via a greater integration of digitisation, something which they continually discussing with its management. Given that Nihon Kohden trades on a 12x EV/EBIT multiple, compared to the 17x of its average peer, the team remains confident in its potential upside.

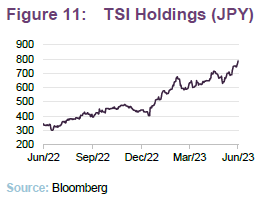

TSI Holdings

TSI Holdings is a holding company which contains several clothing brands, spanning a range of different fashion types from sports to high-end brands. TSI can best be described as ‘classic Japanese value’, whereby its balance sheet hoards excessive levels of cash, as well as holding a large amount of non-core assets like real estate and investment securities. The sum total of these types of assets accounts for c.96% of TSI’s market cap.

The opportunities to increase shareholder returns are enormous when it comes to TSI; not only from distributing its excess cash and liquid assets to its shareholders, but also increasing the value it can derive from its world-leading brands. Operating margin is currently a mere 1%, with its management targeting a 4% margin by 2025. The team is expecting as high an upside as three times from its current valuation, conditional on certain reforms being achieved.

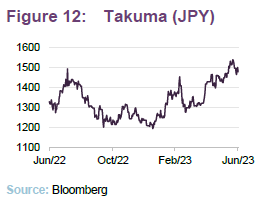

Takuma

Takuma is a relatively new investment for AJOT. At the time when we talked to the management team, AVI had not engaged with the company. The company is a waste to energy incineration plant manufacturer and operator. Waste is sorted to remove non-combustibles and then the remaining waste is burnt to generate heat to turn into electricity. This is a common way of dealing with waste within Japan. However, the nation’s plants are ageing, with many having been installed about 30 years ago. Takuma takes on design, build, operate and transfer contracts. These tend to be structured so that there is no to low margin at the design and build phase, but typically 20-year operational contracts are profitable. Takuma’s counterparts are local governments, and hence creditworthy. Takuma is not responsible for waste collection.

AVI says that Takuma trades on about 3x EV/EBIT despite boasting some defensive characteristics. Cash/liquidity accounts for about 48% of Takuma’s market cap and non-core investments another 14%. This is not a company that the manager believes can generate significant growth beyond the normal replacement cycle for these plants. AVI does not see any incentive for local governments to change the system.

Performance

AJOT’s long-term outperformance demonstrates the benefits of AVI’s activist approach. Not only can AJOT benefit from the wider tailwinds supporting the Japanese small-cap market, such as renewed foreign investor confidence, but it can also benefit from extremely idiosyncratic factors. This comes as a direct result of their successful engagement campaigns, which can deliver sudden, powerful positive re-rating of a company’s share price.

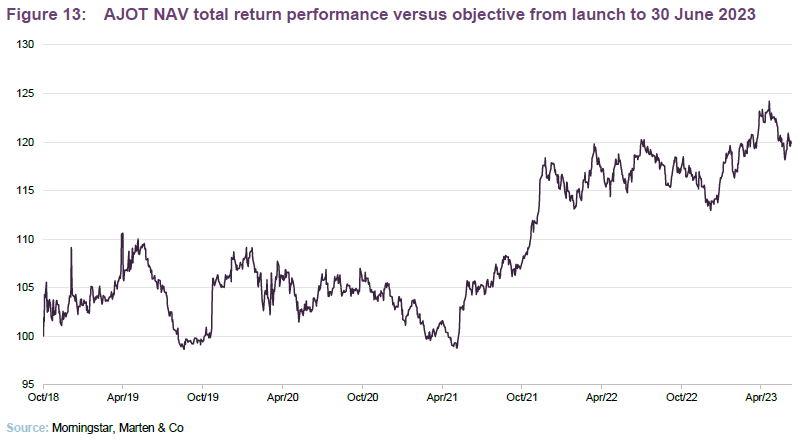

However, as can be seen in Figure 13, most of this performance came from 2021 onward. This is in part due to increased success in their engagement campaigns, but also due to the shift toward higher-quality stocks, which allowed AJOT greater ability to capitalise on wider market tailwinds.

One of the major factors that has impacted AJOT’s near-term performance is the relative strength of sterling, as the trust does not hedge its currency returns. Sterling has appreciated c15% relative to Yen, and this has had a direct, negative impact on AJOT’s performance. However, this would only impact its nominal performance, as its benchmark would also suffer equally.

Performance attribution

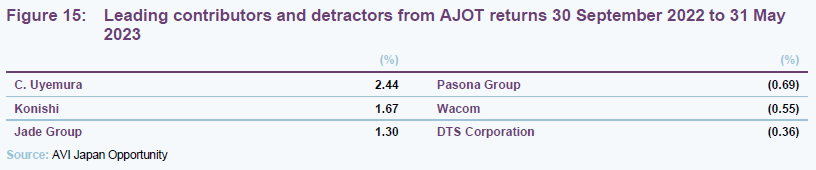

AVI provided us with data on the leading contributors and detractors from AJOT’s returns over the period from 30 September 2022 (the data used in our last note) and the end of May 2023.

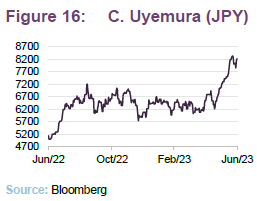

C. Uyemura

Uyemura is a manufacture of surface finishing materials and technologies, some of which are used in the production of semiconductors. Uyemura’s contribution to AJOT’s returns is as much a reflection of good asset allocation practices as it is the company’s market leading position. Rather than see an uplift from governance reforms, Uyemura has instead benefitted from the powerful tailwinds behind global semiconductor demand, whereby its surfacing technologies are critical in the production of certain types of semiconductors. Because of its market leading position, its share prices surged during the re-rating of semiconductor stocks across the world. The strength of the surge was so great that the AJOT team prudently trimmed its position, as it was also concerned about a possible reversal in the tailwinds.

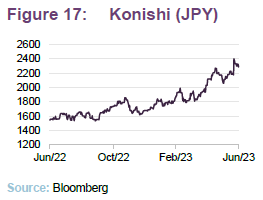

Konishi

Konishi is an adhesive manufacturer, known best for its household glue brand BOND. As one would expect, given the presence of its brand, it has a dominant position in Japan’s domestic adhesives market, and has even expanded into infrastructure repair works. Thanks in part to the successful engagement by the AVI team, Konishi’s management announced its first buy back and a more aggressive approach to marketing. Unsurprisingly, its shares rallied 10% upon this announcement.

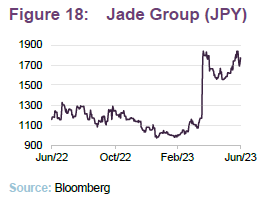

Jade Group

Jade Group is a prime example of why AJOT’s increased focused on the ‘quality’ factor is warranted, as well as the cultural shift toward shareholder alignment by company management. Jade Group is an online fashion retailer, having recently changed its name from LOCONDO. Jade Group saw a bumper 2022 financial year, beating its profit forecasts by more than 10%, with the company’s management providing a very bullish +33% and +76% sales and profit growth forecast for its current financial year, as well as initiating a share buyback program. Part of this aggressive growth forecast has come from its heavy investments in logistics, as well as its ability to secure distribution rights for major global brands, with Reebok being the most recent example. Given the positive indication coming from its management, Jade Group’s share price jumped some 50% upon its management team’s announcement.

While AVI owns 10% of Jade Group’s outstanding shares (across all their strategies), it has not needed to engage in an aggressive campaign, as Jade Group’s management is already conscious of the inherent undervaluation of the company, believing its market cap should be in the ¥30bn-50bn range, rather than the ¥20bn it currently trades on.

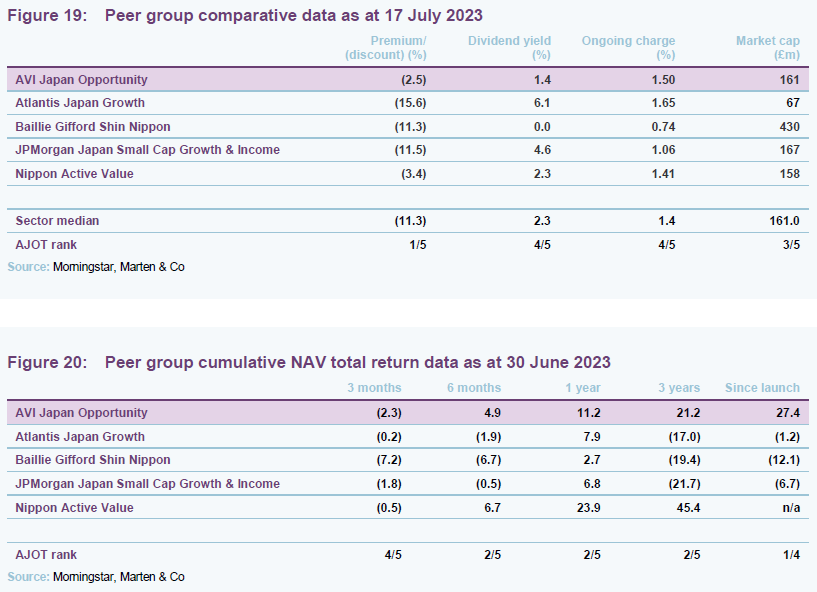

Peer group

Up-to-date information on AJOT and its peers is available on our website.

AJOT is a constituent of the AIC’s Japanese Smaller Company sector. Within this peer group, the closest comparator is Nippon Active Value, which has a similar investment approach to AJOT. The other three are more focused on growth stocks, and this accounts for much of the disparity in the performances of these funds.

Relative to Nippon Active Value, AJOT is a bit larger and trades on a higher rating.

Since it was launched, AJOT’s returns lead those of the peer group by some margin. Over most other periods, it vies with Nippon Active Value (which has a similar investment approach) for the top of the table. These two funds have concentrated portfolios and their differentiated approach may mean that their returns tend to deviate more from benchmark indices and the wider peer group in the short term.

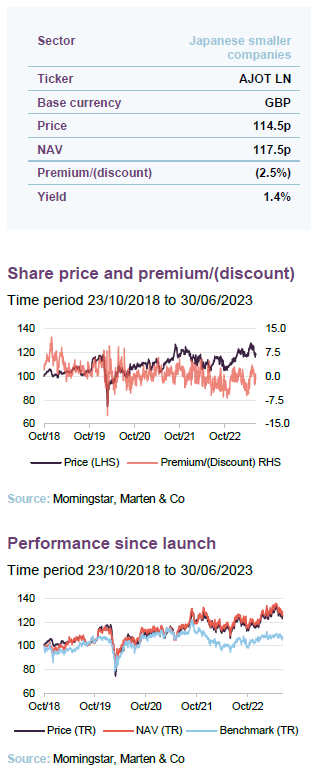

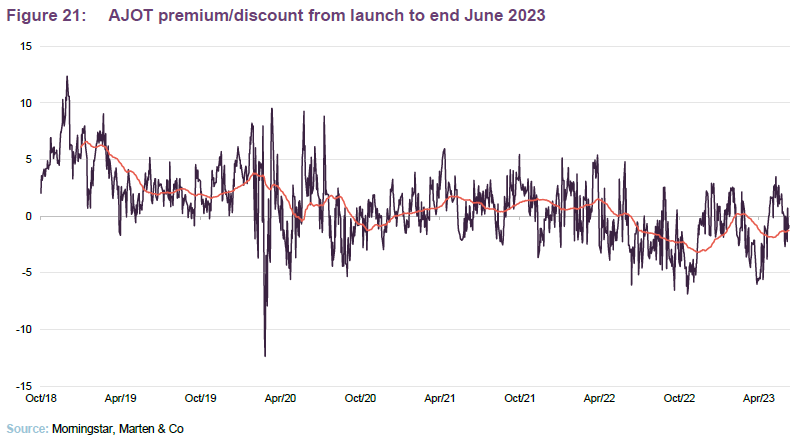

Premium/(discount)

Over the 12 months ended 30 June 2023, AJOT’s shares traded as high as a 4.8% premium to NAV and as low as a 6.9% discount. The average discount over the period was 1.4%. On 17 July 2023, AJOT was trading at a 2.5% discount.

The board recognises that it is in the interests of shareholders to maintain a mid-market price for the ordinary shares that is as close as possible to NAV. The board monitors the discount over rolling four-month periods and will buy back stock if the average discount exceeds 5%. The discount should also be limited by the regular exit opportunities, the next of which is likely to be available in October 2024.

At the AGM held in April 2023, shareholders gave the directors authority to issue just shy of 28.1m ordinary shares (then, 20% of AJOT’s issued share capital) over the following 15 months (or up to the next AGM, whichever is the earlier). Shares will only be issued (or reissued from treasury) at a price equal to NAV plus a premium at least sufficient to cover the costs associated with issuing the shares.

The board was also granted permission to repurchase up to 14.99% of the ordinary shares in issue in March 2023. Shares repurchased may be held in treasury.

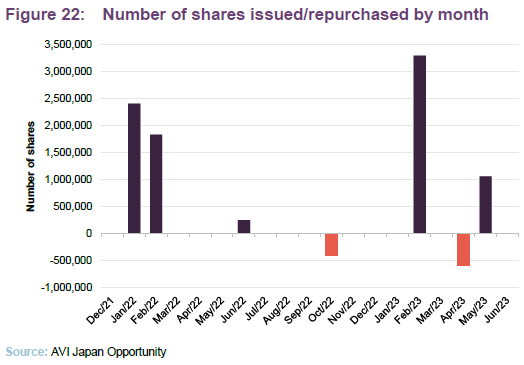

Figure 22 shows the issuance and repurchase of shares by month over the period since 31 December 2021. AJOT has been able to take advantage of periods where it was trading consistently at a premium and has succeeded in expanding overall. Some credit must be given that, when the discount very briefly spiked out in the market turmoil following the ‘mini’ budget, the board acted swiftly to repurchase 400,000 shares into treasury. Likewise, when unsettled markets led to the emergence of a discount in March, the board bought back 585,000 shares and that led to the swift elimination of the discount.

Fund profile

More information is available at the fund’s website www.ajot.co.uk.

AJOT is an investor in Japanese companies. Its focus is on good-quality small and mid-cap listed companies that have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage proactively with these companies to unlock their value potential.

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund, one of a seven-strong team focused on Japan, one of whom is based permanently in Japan, and the majority of whom are Japanese-speakers. The team is also complemented by a secondment from a leading Japanese law firm.

AVI and its employees are aligned with shareholders.

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has AUM of about £1.1bn. AVI began investing in Japan over two decades ago and AJOT was launched in October 2018 to focus on the opportunities presented by that market. At the end of May 2023, AVI owned 2,611,786 shares in AJOT, more than double the position as at 30 September 2022.

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in Sterling terms. The index does not inform AJOT’s portfolio construction. AJOT will have a high active share relative to the performance benchmark.

Previous publication

Readers interested in further information about AJOT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 23 or by visiting our website.

Figure 23: QuotedData’s previously published notes on AJOT

| Title | Note type | Date |

| Progress on a number of fronts | Initiation | 20 July 2021 |

| The tortoise triumphs | Update | 15 February 2022 |

| Maintaining its firepower | Annual overview | 21 October 2022 |

Source: Marten & Co

Legal

This marketing communication has been prepared for AVI Japan Opportunity Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.