News

- Home

- JPMorgan European Growth & Income benefits from strong stock selection

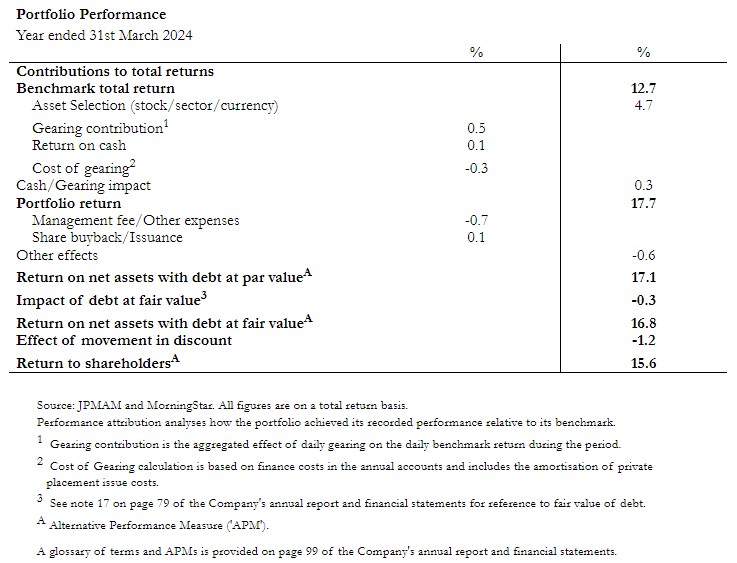

JPMorgan European Growth & Income (JEGI) has announced its annual results for the year ended 31st March 2024, during which it continued its outperformance in what its chairman, Rita Dhut, says “remains a tricky backdrop of evolving inflation expectations and geopolitical difficulties”. During the year, JEGI provided NAV and share price total returns of 16.8% (with debt at fair value) and 16.5% respectively, both ahead of its benchmark, which returned +12.7%. Strong relative stock selection was the main reason for the NAV outperformance of 4.1%.

Dhur also says that, in Europe, muted economic growth was the backdrop of this reporting period, which is unsurprising given the sharp increases in the level of interest rates in 2022 and 2023. But this has had the desired effect on inflation, with rapid declines observed during the last 12 months. The worries early in the reporting period regarding a wider fallout from the failure of Credit Suisse and of a ‘hard landing’ for global economies seem to have eased. However, Germany, Europe’s largest economy, has been particularly affected by the economic slow down of China and continuing trade tensions with China, which is an important market for many European companies, lurks in the background. Despite this melting pot of machinations, European stock markets have shrugged off these issues producing healthy returns over the period.

During the year, JEGI’s net revenue attributable to shareholders (after tax) was 10.8% higher at £13,683,000 (2023: £12,354,000). An aim of JEGI’s restructuring was to provide shareholders with a predictable dividend income at a level that is consistent and frequent, based on 4% of the preceding year end net asset value per share. JEGI pays quarterly dividends in July, October, January and March. In line with the above aim, in respect of the year ending 31st March 2024, the company’s dividend was 4.2 pence per share, amounting to £18.1m (2023: £17.4m). For the year ending 31st March 2025 the board is expecting to adopt the same approach with 4% of the net asset value per share as at 31st March 2024 being paid as dividend for the year ending 31st March 2025. On 21st May 2024, the board declared a first interim dividend of 1.2 pence per share in respect of the financial year ending 31st March 2025, payable on 5th July 2024. As was the case for the company’s dividends in respect of the year ended 31st March 2024, to the extent that brought forward revenue reserves are not sufficient, dividends will be paid from distributable capital reserves for the financial year ending 31st March 2025.

There has been no change in the investment manager’s permitted gearing range, as previously set by the board, of between 10% net cash to 20% geared. At 31st March 2024 the company was 4.5% geared (31st March 2023: 3.1%).

Dhur comments that, during the year, the average discount across the investment trust sector remained at gaping levels. She adds that, although the initial widening was indiscriminate, particular signs of stress is evident in those trusts with significant alternative investments with worries over liquidity, realisation and valuation of the underlying positions. This does not appear to be a particular issue for JEGI but the board therefore remains alive to dislocations beyond its comfort levels, addressing imbalances in the supply of and demand through buybacks. The board says that it does not wish to see the discount widen beyond 10% under normal market conditions (using the cum-income NAV with debt at fair) on an ongoing basis. The precise level and timing of repurchases is dependent on a range of factors including prevailing market conditions. In the period under review, 5,268,397 ordinary shares were bought into Treasury. From 1st April 2024 to 29th May 2024, 200,000 ordinary shares were bought into Treasury. No ordinary shares were issued.

The company’s ordinary share discount as at 31st March 2024 was 12.1% to NAV with debt at fair value. The average discount of a peer group of six companies as at the same date was 10.0%. On 29th May, 2024, the company’s ordinary share discount was 10.3%, which compares to an average discount of the same peer group of 8.7% as at the same date, though Dhur comments that this hides variation in strategy and performance across the sector.

“Following a somewhat muted first half performance from Continental European equities as economic growth slowed in the face of a series of interest rate hikes, the market bottomed in late October and ended the Company’s financial year up 12.7% in Sterling terms. Investors started to believe inflation was back on a downward trend due to a series of softer inflation prints. This boosted market expectation in the ECB potentially reducing interest rates sooner than expected. The ECB’s last hike was in September, by December its outlook statement was more nuanced and by April this year the market was expecting the ECB to be the first Central bank to start cutting rates again. At the same time, it started to look possible the tightening cycle would not tip the economy into recession. As real wages have turned positive consumer confidence has improved which has been reflected in stronger PMI releases from the service side of the economy. Meanwhile it appears as though manufacturing destocking has run its course and new orders have shown signs of picking up again. With this backdrop, investors began to hope Central Banks were on track to successfully lower inflation while engineering a soft landing.”

“Our investment process focuses on identifying companies with improving operational momentum, higher quality characteristics, and lower valuations. Not every company in the portfolio ticks all three boxes but the portfolio as a whole does. During the year under review this has resulted in a clear tilt towards cyclicals and financials. Within retailers we increased the position in Industria de Diseno Textil (Inditex), the fashion retailer which owns brands such as Zara and Massimo Dutti. Inditex’s sourcing model and ongoing reinvestment in its stores and technology has allowed it to steadily compound growth and free cash flow despite the emergence of more competition from online and discount players.

“The Company remains exposed to the technology sectors. Within semiconductors it has a position in ASML which manufactures tools to produce the chips required, for example, in the emerging Artificial Intelligence market. ASML’s order intake continues to beat expectations and gives some visibility on future earnings. Within software we increased the holding in SAP which has seen clients accelerate their migration to its S4/HANA enterprise resource planning software as well as a more widespread move towards the Cloud. SAP specifically cites clients’ demand for AI as a key development.

“We also increased exposure to the bank sector by adding names such as Danske Bank and BAWAG. Many bank stocks have been trading at low valuations but at the same time have well capitalised balance sheets delivering steadily rising earnings estimates and generating double digit returns on tangible equity. This has allowed the sector to return significant amounts of capital to shareholders through both dividends and share buybacks.

“To view the graph of MSCI Europe Banks vs MSCI Europe exUK Total Return please see the Company’s annual report and financial statements, which will be available to view on the Company’s website shortly after release of this announcement.

“The Company’s biggest underweight is to the healthcare sector. Many of the equipment and services names have seen estimates downgraded quite dramatically and also trade on expensive valuations. Within the pharmaceutical sector we have focused on those companies where the operational momentum continues to improve, Novo Nordisk and Novartis in particular, and avoiding those with relentless downgrades such as Bayer and Lonza.

“To view the graph of Novo Nordisk vs MSCI Europe exUK Total Return please see the Company’s annual report and financial statements, which will be available to view on the Company’s website shortly after release of this announcement.

“One of the advantages of using both quantitative and fundamental analysis in our investment process is that it allows us to consider a wide range of potential investments before determining which companies to investigate in more fundamental detail. It is noticeable certain smaller companies are gathering interest after a prolonged period of underperformance. We have added a number of names in this area such as Danieli which manufactures machines for steel production including electric arc furnaces which are more eco-friendly, and Bilfinger which has focused its business away from construction projects towards buildings and facilities management and services.

“To view the bar chart of the Company’s active and absolute sector positions relative to benchmark please see the Company’s annual report and financial statements, which will be available to view on the Company’s website shortly after release of this announcement.”

“The portfolio outperformed its benchmark index by 4.1% with the NAV rising 16.8% (with debt valued at fair) with most of this coming from stock selection. Novo Nordisk was again the top contributor to performance as it continued to deliver growth ahead of expectations driven by its diabetes and obesity franchise. The potential market for its weight loss drug Wegovy is enormous, particularly as the product appears to have a beneficial impact on related conditions such as cardio-vascular problems. In the short term there are concerns about Novo Nordisk’s ability to fill that demand but the company has taken steps to expand its manufacturing capacity to address that issue.

“The biggest detractor from performance last year was RWE, a German utility, which underperformed as power prices pulled back faster than we expected earlier this year. Nestle, another stock traditionally seen as defensive, also detracted from performance as it reported disappointing results with lower volumes than expected. Elsewhere the portfolio’s holdings in LVMH and Richemont also performed poorly as earnings expectations struggled in the face of weaker news from China.

“On a more positive note, Unicredit, an Italian bank, was the portfolio’s stand out holding in financials, almost doubling during the year. It has consistently beaten analysts’ estimates and raised guidance throughout the year confounding concerns that these upgrades would tail off when interest rates stopped rising. Despite the increase in the share price the stock’s valuation has hardly rerated because earnings have risen almost as much. Given the strong returns that Unicredit is making and its robust balance sheet the company is returning significant amounts of excess capital to shareholders through both dividends and share buybacks.”

“Looking ahead, equity returns will likely hinge on whether the economy can continue to deliver steady growth and slowly declining inflation. At the moment we remain cautiously optimistic as consumer confidence in Europe continues to improve. Meanwhile it looks as though the manufacturing inventory correction has run its course and new orders have started to show signs of picking up again. At the time of writing the Q1 reporting season has only just started so it is too early to see if this optimism is reflected in quarterly reports.

“Inflation continues to moderate as expected. Given the recent stronger inflation prints from both the US and the UK it now looks likely that the ECB will be the first central bank to cut rates, assuming of course that there isn’t a similar hotter blip in Europe too. An unexpected and meaningful rise in inflation is perhaps the biggest threat to this soft/no landing scenario.

“Numerous political and geopolitical uncertainties do remain a concern – but for now the market seems to shrug them off. While the gold price hit new highs recently, the oil price, despite rising in the first quarter, remains well below the levels seen in early 2022 at the time of the Russian invasion of Ukraine.

“Lastly European equities continue to trade on an extreme discount to US equities, a discount that has grown following the strong performance from technology stocks in the United States during 2023. This argument may not be new to prospective investors; however, the European equity market today can offer comparable levels of quality and growth potential. This valuation support is however recognised by European companies, who are buying back more stock than ever before. Your investment managers continue to believe there are opportunities to create value through stock selection.”

Please review our cookie, privacy & data protection and terms and conditions policies and, if you accept, please select your place of residence and whether you are a private or professional investor.

Due to data protection policies, USA residents can not access our data.

Your content has been curated