Dawn of a new era for uranium

The supply-demand dynamics that exist in the uranium sector, in which Geiger Counter (GCL) invests, are as strong today as they have ever been, its managers state. They add that nuclear has become a keystone of global efforts to decarbonise the global electricity supply, and is now benefitting from favourable government policy and vast investment. To meet an international agreement to triple nuclear capacity by 2050, which was reached at COP28, trillions in investment is needed in infrastructure spend, the managers contend, adding that demand for uranium to meet the growth in capacity is set to soar. The managers believe that supply-side constraints, including a downgrade in production guidance from the world’s largest uranium producer and a pact by many established western nuclear markets to wean themselves off dependence on Russian enrichment, means that further appreciation in the uranium spot price should follow.

Capital growth from a diversified global portfolio of uranium stocks

GCL aims to provide investors with capital growth by investing in a portfolio of securities of companies involved in the exploration, development and production of energy, as well as related service companies. Its main focus is the uranium sector, but up to 30% of assets can be invested in other resource-related companies. These include, but are not limited to, shares, convertibles, fixed-income securities and warrants.

Market outlook

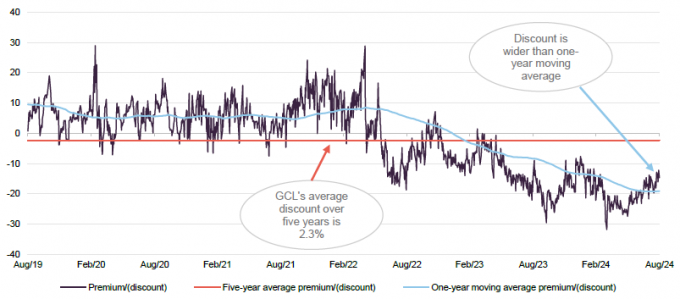

Uranium spot price broke $100 in January 2024

The uranium market appears to have pulled back over the past few months, having seen the spot price break $100 for the first time in almost 20 years in January this year. The spot price retreated to $79.33 in August, but even accounting for the decline, uranium has climbed 214% over the past five years, as shown in Figure 1.

Figure 1: Spot uranium price 2000 – 2024 (US$/lb U3O8)

Source: Cameco, Marten & Co

The uplift in the price of uranium may be testament to the magnitude, and speed, of pivot to nuclear energy by global governments. As discussed at length in our most recent annual overview note on GCL, Powered up for growth, published in November 2023, nuclear energy appears to have become the basis of carbon emission reduction strategies across the world. There seems to be recognition by global governments – from the US, China, Japan and across Europe – that nuclear power will play a pivotal role in reaching net zero, due to the fact it produces zero carbon emissions and does not produce other greenhouse gases through its operation. This has seen it included in green policy frameworks the world over.

International commitment to triple nuclear generating capacity by 2050

The managers says that the COP28 UN climate conference in December 2023 provided more evidence of nuclear power’s integral role in the decarbonisation of energy, where a monumental international agreement was reached to triple nuclear generating capacity by 2050.

For this to be achieved, they add, trillion of dollars of investment will be needed to fund a vast number of new projects and long-term demand for uranium would almost certainly surge. Due to a lack of sensitivity to the uranium price on the cost of nuclear energy generation – at $80/lb the uranium cost is estimated to make up around 6% of the overall cost in the production of electricity meaning that material increases in the spot price are manageable for utilities, in their view. GCL’s managers have confidence that the price of uranium will continue to rise.

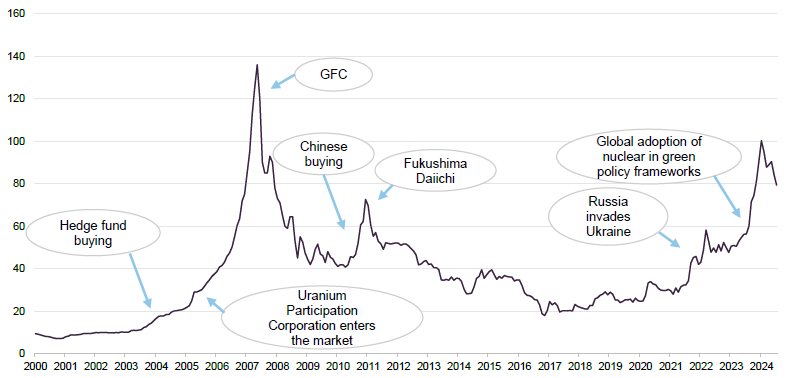

Global nuclear reactor construction – much more required

According to the World Nuclear Association, there are 64 reactors currently under construction across the world, with a further 88 planned (with approvals and funding or commitment in place, and most expected to be in operation within the next 15 years) and 344 proposed (site proposals, timing uncertain).

270GW shortfall in global nuclear operating capacity to meet 2050 target

Figure 2 shows that total operable reactor net capacity in 2023 was 395.4GW, with 71.4GW currently under construction (across the 64 projects), 84.9GW planned (across 88) and 365.1GW from the 344 proposed projects. All of these projects combined would add 521.4GW to the current operating capacity. This leaves a shortfall of almost 270GW on the 2050 target of tripling nuclear capacity (from 395.4GW at the end of 2023 to just under 1,200GW), as shown in Figure 2.

Figure 2: Global nuclear operating capacity (GW)

Source: World Nuclear Association, Marten & Co

Favourable policy adds to substantial demand

The international commitment to triple nuclear energy generating capacity by 2050 is being backed up by individual government policy, the managers say. This is being enacted by the COP28 nuclear power signatories including the US, Canada, Japan, and many European countries, and will see existing reactor lives extended and new reactors built and improve the resilience of the global nuclear fuel supply chain, the managers add.

The US

Advance Act to reinvigorate US nuclear industry

In early July, President Biden signed into law the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (Advance) Act that aims to reinvigorate the country’s nuclear industry. The Advance Act seeks to address what is regarded as an arduous permitting process – often cited as a key hurdle to get nuclear projects up and running – by simplifying the Nuclear Regulatory Commission’s (NRC’s) approval process and lowering fees that companies must pay in the review process.

It will also direct the NRC to license nuclear plants at retired fossil fuel sites. Retrofitting former coal-fired power plants, which are already hooked up to the electrical grid, could save on construction costs and avoid lengthy siting reviews. A 2022 Energy Department study identified more than 300 retired or operating fossil fuel sites that could be converted to nuclear.

Furthermore, a review of the US’s nuclear power industry, published in May this year, highlights proposals to restart some of the 12 mothballed merchant reactors, offering funding and tax credits allowing them to effectively compete against other subsidised renewables.

Billions invested to expand uranium enrichment capacity to wean off dependency on Russia

To free itself of dependence on Russian uranium enrichment services (around 20% of fuel used by the US nuclear reactor fleet is supplied through enrichment contracts with Russian suppliers), the government has invested billions to support the expansion of US-based commercial uranium enrichment capacity. Additionally, a five-country strong alliance – known as the Sapporo 5 (made up of the US, UK, France, Cananda and Japan) – was set up on the sidelines of COP28 with the aim of establishing a secure and resilient global nuclear fuel supply chain free of Russian influence. The Sapporo 5 also announced their intention to invest a combined $4.2bn to expand enrichment and conversion capacity over the next three years.

With everything appearing to be in place for the growth in the delivery in nuclear reactors in the US, the state of Illinois recently removed its moratorium on new large-scale reactor builds and passed legislation allowing construction of small modular reactors (SMRs) from 2026. GCL’s managers believe the move could be replicated by other states across the country, including Virginia – where, incidentally, the largest unmined US uranium deposit (Coles Hill) exists. This is owned by ISO Energy, a GCL portfolio company, that could benefit materially.

A Trump administration unlikely to have major impact on shift towards clean energy

Despite rhetoric to the contrary, a victory for Trump in November may have surprisingly little impact on the US’s shift towards clean power, the managers contend. Regardless of his vow to repeal the IRA, it will be harder to achieve in practice, especially given that four-fifths of benefits from the IRA go to Republican congressional districts, they add.

The Advance Act had bipartisan support from Congress, perhaps indicating that nuclear will continue to be at the forefront of the US’s energy output, no matter the party of the presiding president.

Asia

In Asia, China’s nuclear roll out continues apace, with 15 reactors currently under construction and a 52% year-on-year increase in investment. Its nuclear power generation capacity is on track to exceed 100GW before the end of the decade, the managers say, which would see it overtake the US as the largest nuclear power market.

In India, the Atomic Energy Commission has announced plans to expand nuclear output to 100GW by 2047, from around 8GW today. Meanwhile, Japan has added uranium to its critical minerals list, making investments eligible for government-backed funding, while authorities have approved 20-year life extensions for two operational reactors at Sendai.

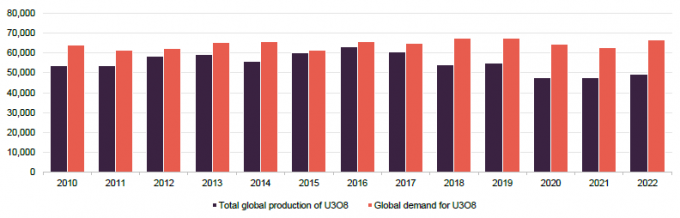

Supply-demand imbalance

Figure 3 shows that the uranium market has been in a supply deficit for an extended period of time, which the managers say is due to years of very little investment in production after the Fukushima accident in 2011. Over the last three years of available data, 2020-2022, supply has met just 74%, 76% and 74% of global demand respectively.

Figure 3: Global U3O8 production and global U3O8 demand 2010-2022 (tonnes)

Source: World Nuclear Association – data updated May 2024, Marten & Co

The supply-demand gap is not going to be narrowed quickly, the managers state. A number of supply-side issues exist; that seems likely to result in an elevated uranium spot price persisting for many years.

Nuclear power plants are capital intensive, long-term investments, with uranium supply typically tied to long-term contracts. Given this, and the fact that nuclear power stations are expensive to ramp up and down, demand for uranium tends to be price-inelastic, at least in the short to medium term.

The managers add that life extensions of existing reactors have occurred globally, while a roll-out of SMRs, which are cheaper and quicker to construct, is another route being explored to increase capacity (as is the case in the UK, where SMRs are set to become a major part of ambitions for up to a quarter of all UK electricity to come from nuclear power by 2050).

The mounting pressure to address the future deficit between supply and demand, should support a further step up in the price of uranium, GCL’s managers contend.

Supply-side issues

The highly concentrated nature of uranium production (with the top five producers collectively controlling around 60% of production and the top 10 around 85%) means the market is extremely vulnerable to supply-side shocks, the managers say. This was the case following Russia’s invasion of Ukraine, which highlighted an over-reliance on Russian- and Kazakh-origin fuel by established markets.

Kazatomprom production guidance for 2025 downgraded

Kazakh state uranium producer Kazatomprom, which is the largest global producer of U3O8 and controls over 40% of global uranium mining, cut its production guidance for 2025 by 17% below its previous target output. The downside guidance was due to an ongoing regional shortage of sulphuric acid and construction delays on newly developed deposits.

US to ban Russian imports from 2028

Meanwhile, global governments and utilities appear increasingly focused on the need to diversify supply away from Russia, which controls almost 50% of the uranium enrichment market. For example, the US Senate voted to ban the importation of Russian-sourced material from 2028, with the bill legally formalised in April this year. The managers believe that surer sources of supply will mainly come from North American companies, with several uranium mines restarting operations.

Other supply-side issues include the following:

The military coup in Niger last year added to the supply-side complexities. Niger is the world’s seventh-largest producer of uranium, possesses Africa’s highest-grade uranium ores, and is the second-largest raw uranium exporter to the EU (accounting for up to a quarter of supplies, with France a major importer). The newly installed military government revoked the uranium mining licences of France’s state-owned Orano, which the managers say raises the likelihood that Niger is strengthening ties with Russia.

Production at Cameco (the world’s largest publicly traded uranium company) appears to have been largely contracted out for the next five years, with sales agreements from 2024 to 2028 at comparable levels to that of attributable production over the period. We look at Cameco in greater detail on page 10.

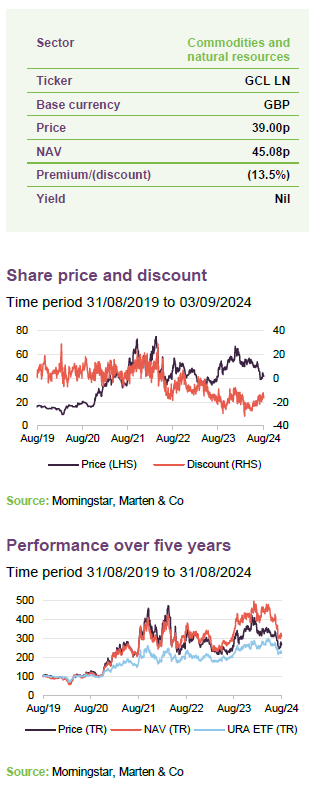

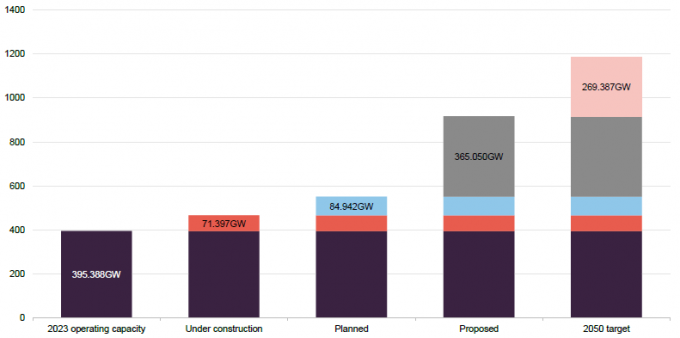

Positive news flow not reflected in share prices

Despite global backing for the advancement of nuclear as a pivotal role in clean energy production, backed up by policy and billions in investment, and the severe supply-demand imbalance, the share prices of uranium equities, ETFs and physically-backed uranium vehicles have shown pronounced weakness in recent months. This has been reflected in GCL’s share price and NAV (see page 11 for the performance section), with the company now trading at a 13.5% discount.

Asset allocation

GCL’s portfolio is highly concentrated

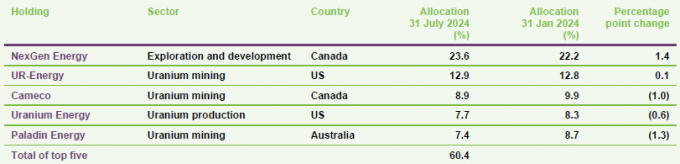

As at 31 March 2024, GCL’s portfolio had exposure to 42 issues, in line with the 42 issues as at 30 September 2023 (six months prior). GCL’s portfolio is highly concentrated, with the top five holdings accounting for 60.4% of the fund (see Figure 6).

GCL’s portfolio is inherently low turnover

In part reflecting the managers’ investment style, but also the concentrated nature of the industry, GCL’s portfolio is inherently low-turnover. Changes in the composition of the top five holdings (discussed in more detail below) are frequently driven by differences in near-term relative performance, rather than other considerations. The managers typically expect portfolio turnover to be around 10% per annum, but much of this will be trimming stocks whose prices have got ahead of themselves, and adding to holdings where the managers see more value.

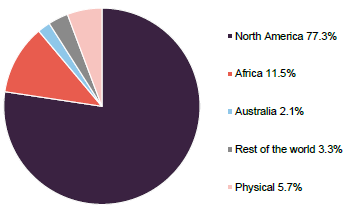

Figure 4: GCL portfolio split by geography

Source: Geiger Counter Limited, Marten & Co

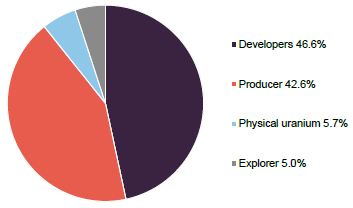

Figure 5: GCL portfolio split by sectoral allocation (1)

Source: Geiger Counter Limited, Marten & Co. Notes: 1) as a proportion of gross assets.

Figures 4 and 5 show that the portfolio’s geographical allocation is focused on companies in North America. Typically, around a half of GCL’s portfolio is invested in what the managers believe are safer assets; that is, producers or companies backed by physical uranium, while pure exploration plays are a limited component of the portfolio.

As at 31 March 2024, GCL had four unlisted investments and four unlisted warrants.

GCL has a significant exposure to physically-backed uranium entities through its holdings in Sprott Uranium Trust (5.8% at 31 March 2024) and Yellow Cake Plc (1.1%). However, in comparison to alternatives such as the URA exchange traded fund (ETF), GCL is underweight Cameco and Kazatomprom.

Top five holdings

Figure 6 shows GCL’s top five holdings as at 31 July 2024 and how these have changed since over six months.

Source: Geiger Counter Limited, Marten & Co

Reflecting both the concentrated nature of the uranium sector and the manager’s long-term, low-turnover approach, the names in the top five portfolio holdings may be familiar to regular followers of GCL’s portfolio announcements and our notes on the company. The makeup of GCL’s top five holdings is the same over the past six months; however, there has been some movement in exposure weightings. Some commentary on the largest holdings is provided in the next few pages. Readers interested in other names in GCL’s portfolio should see our previous notes, where many of these have been discussed (see page 18 of this note for links).

NexGen Energy (23.6%)

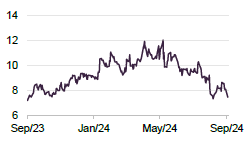

Figure 7: NexGen Energy share price (CAD)

Source: Bloomberg

NexGen Energy (www.nexgenenergy.ca) has been GCL’s largest holding, by a significant margin, for some time. It is a uranium exploration and development company with a portfolio of projects that are centred on the Athabasca Basin in Canada, where it holds over 259k hectares of land. NexGen’s southwestern Athabasca Rook 1 property hosts the Arrow Deposit, the South Arrow discovery, the Harpoon discovery, the Bow discovery and the Cannon area. All of these are 100% owned by NexGen.

In May, the company issued a $250m convertible bond to a US fund, MMCap, in exchange for 2.7Mlbs physical pounds of U3O8. The bond appears to have been poorly received by the market, as shown in Figure 7. GCL’s managers say that the rationale for the deal was that owning pounds ahead of development would aid them with future contracting with both utilities and also with project debt negotiations. They added that they believe the group remains pre-eminently placed in the uranium sector.

Derisking the Rook 1 project permitting process is a far more important factor, the managers contend. In an economic study update, NextGen revised up capex assumptions – in part due to broader cost inflation but also to reflect more comprehensive underground tailings treatment. The proposed Rook 1 project includes a new underground mine and mill development. The managers says that Rook 1 is the largest and also one of the most advanced development stage uranium mining projects in the world.

UR-Energy (12.9%)

Figure 8: UR-Energy share price (CAD)

Source: Bloomberg

Long-time GCL holding UR-Energy (www.ur-energy.com) is a junior uranium mining company that operates an in-situ uranium recovery facility at its Lost Creek property in south-central Wyoming. It also owns the Shirley Basin and Lucky Mc mine sites in the Shirley Basin and Gas Hills mining districts of Wyoming. The company’s tailings facility at the Shirley Basin site is also one of the few remaining facilities in the US that is licensed by the NRC to receive and dispose of by-product waste material from other in-situ uranium mines.

UR-Energy could benefit substantially from US government support for the nuclear sector, as well as its intention to create a strategic inventory of uranium and related services.

GCL participated in a recent placing by UR-Energy, which was undertaken at a 20%-plus discount to its prior share price. Consequently, this appears to have resulted in a fall in its share price.

Cameco (8.9%)

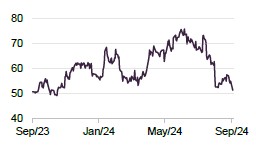

Figure 9: Cameco share price (CAD)

Source: Bloomberg

Cameco (www.cameco.com), the world’s largest publicly-traded uranium company, is another long-term holding of GCL. It has been one of GCL’s largest underweight positions relative to the Global X Uranium ETF, which had a 21.6% exposure to Cameco at 3 September 2024. The managers believe that Cameco’s market leading position in the sector justifies its place and weighting within the portfolio.

Cameco’s land holdings, including exploration, span about 1.9 million acres, the majority of which are located in northern Saskatchewan, at the Athabasca Basin. It is home to two of the world’s largest high-grade uranium deposits, in Cigar Lake and McArthur River/Key Lake.

Last year, Cameco acquired Westinghouse Electric Company, one of the world’s largest nuclear services businesses providing nuclear plant technologies, products and services, which should leave it well-positioned for the increasing need for secure, reliable and emissions-free baseload power. Cameco has the licensed capacity to produce more than 30 million pounds of uranium concentrates annually, backed by more than 469 million pounds of proven and probable mineral reserves.

However, Cameco is contracted out for the next five years, which the managers say will mean it will see very little benefit from uplifts in the uranium spot price.

Uranium Energy (7.7%)

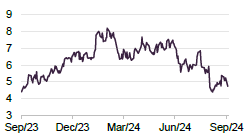

Figure 10: Uranium Energy share price (USD)

Source: Bloomberg

Uranium Energy (www.uraniumenergy.com) has an extensive portfolio of in-situ recovery (ISR) mining uranium projects in the US, as well as conventional projects in Canada. ISR technology uses fluid to recover uranium from the ground without digging and moving tonnes of earth. The company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming, anchored by central processing plants. It has further fully permitted ISR uranium projects across the US.

The managers say that the company is set to benefit from an uplift in contracting by US and Western utilities, being one of a very few sources of contract supply in projects that can deliver in a two-to-three-year timeframe.

Paladin Energy (7.4%)

Figure 11: Paladin Energy share price (AUD)

Source: Bloomberg

Paladin Energy (www.paladinenergy.com.au) is a Western Australian-based uranium production company that currently has one operating mine – the Langer Heinrich Mine in Namibia (which it owns 75%). At full production, the Langer Heinrich Mine’s annual uranium output is enough to supply more than 10 1,000-Mwe nuclear power plants for a year. The mine has already produced over 43 million pounds of U3O8 over 10 years. Paladin also holds a portfolio of exploration and development facilities in Canada and Australia.

The managers say that Namibia is one of the most stable countries politically in Africa, and the most reliable to trade with. The mine is returning to strong production, they add, and first production was achieved in March 2024, with the company projecting production of over 77 million pounds of U3O8 in the future.

In June, Paladin tabled an all scrip offer to acquire Athabasca Basin developer Fission Energy (another GCL portfolio company) at a near 30% premium. In what was perhaps a merger arbitrage play, GCL’s managers reduced its position in Paladin, which closed the month around 20% lower.

Performance

GCL and the broader uranium market have performed strongly over the last few years, perhaps in acknowledgement of nuclear’s vital role in the carbon-free energy mix. Supply-side concerns persist, the managers add, which has put pressure on the price of uranium and driven returns in the sector. Further upsides could follow as global efforts to decarbonise intensifies.

Subdued market sentiment in recent months has hit the share prices of companies in the sector, however, along with a weakening uranium spot price from its high in January 2024. It appears that a subsequent pause in buying activity lowered trading volumes in the spot market, while prices may have also been negatively impacted by reports of profit taking by hedge funds.

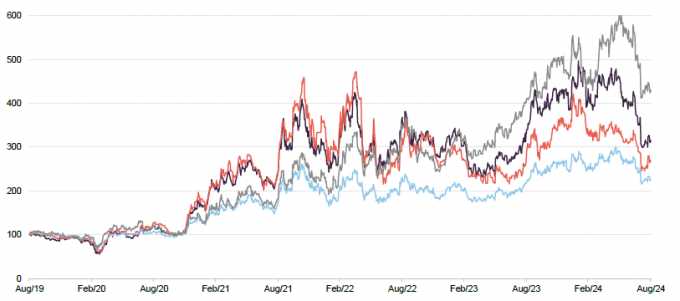

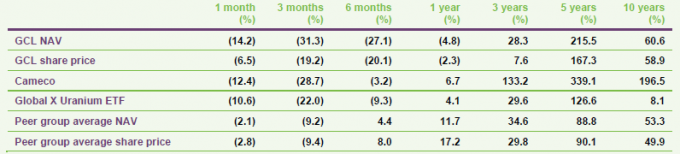

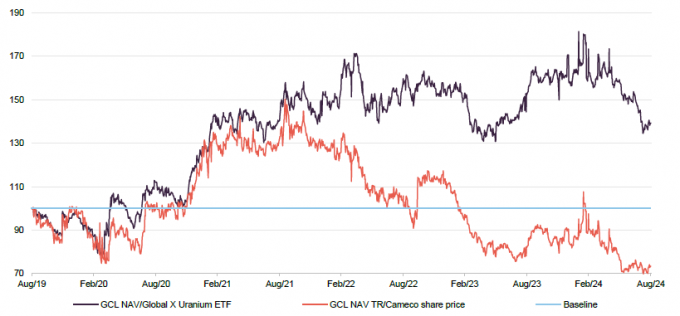

Figure 12: GCL share price and NAV versus the Global X Uranium ETF and Cameco – rebased to 100 over five years to 31 August 2024

Source: Morningstar, Marten & Co

Figure 12 shows that GCL has comfortably outperformed the Global X Uranium ETF in NAV terms. This is despite the company being vastly underweight relative to the ETF in Cameco, which has seen substantial growth in its share price over the last year. GCL’s share price has also consistently outperformed the Global X Uranium ETF over the longer-term periods of five and 10 years, as shown in Figure 13.

Figure 13: Cumulative total return performance over periods ending 31 August 2024

Figure 14 also illustrates GCL’s strong NAV performance relative to the Global X Uranium ETF from early 2021. Its performance relative to Cameco diverged at the start of 2022 as Cameco’s share price took off. Cameco is the blue-chip Uranium name that has been a go-to for generalist investors, the managers say, supporting the strong gains it has seen.

Figure 14: GCL NAV performance relative to the Global X Uranium ETF and Cameco – rebased to 100 over five years to 31 August 2024

Source: Morningstar, Marten & Co

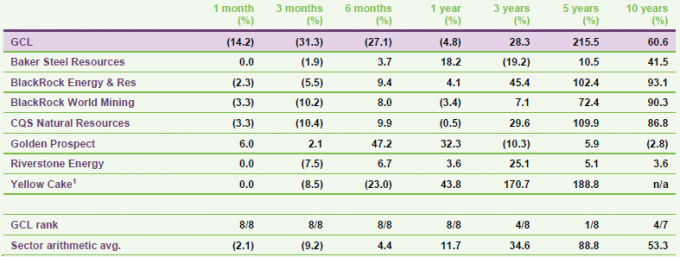

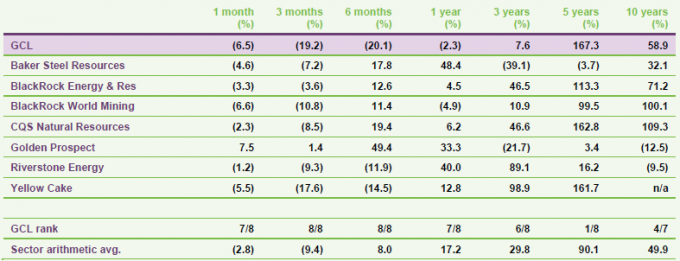

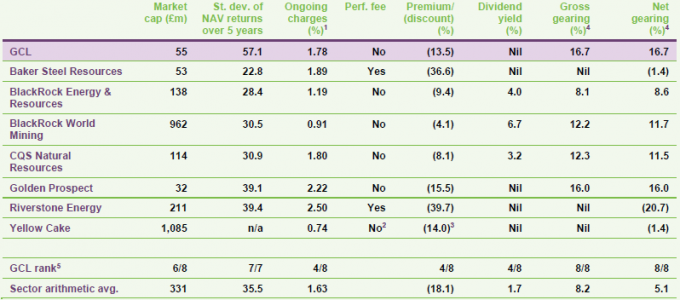

Peer group

GCL is a member of the AIC’s sector specialist commodities and natural resources sector, which is comprised of nine members. Seven of these are illustrated in Figures 15 to 17. We have excluded Global Resources Investment Trust (GRIT) and Tiger Royalties and Investments (TIR) on size grounds (both sub-£5m market cap).

Click here for a live comparison of the commodities and natural resources peer group

Whilst they are all members of the commodities and natural resources sector, the funds used in this peer group comparison are quite diverse, and GCL is the only fund that invests in listed uranium equities. We have added another fund to the peer group analysis, Yellow Cake Plc (YCA), which is focused on uranium, but invests in physical uranium. It should be noted that unlike GCL, which publishes daily NAVs, YCA tends to publish a NAV figure once a month. As such, there is greater uncertainty around its NAV performance versus that of the remainder of the peer group.

Within the wider peer group, GCL and YCA are not the only funds with a narrow focus – Golden Prospect Precious Metals is focused on gold; Riverstone Energy has a concentrated portfolio of energy companies primarily engaged in oil exploration and production; and the BlackRock funds are both primarily invested in larger-cap stocks. As such, none of the funds used are perfect comparators for GCL.

Figure 15: Peer group cumulative NAV total return performance to 31 August 2024

Source: Morningstar, Marten & Co. Notes: 1) Data for the calculation of Yellow Cake’s NAV performance has been sourced directly from the company’s announcements.

Figure 15 shows that GCL’s NAV has performed strongly over the long-term, outperforming the peer group by some margin over five years. Its 10-year NAV returns are arguably impressive, given the numbers reflect the decade-long bear market in uranium that was accelerated by the Fukushima disaster in 2011.

Figure 16: Peer group cumulative share price total return performance to 31 August 2024

Source: Morningstar, Marten & Co

GCL has also been one of the best-performing funds over the longer time periods in the peer group in terms of share price total return, as shown in Figure 16. A similar pattern to its NAV performance is witnessed in share price total return; albeit the returns are slightly different, reflecting the relative movements in the premium/(discount) over the individual periods.

Figure 17 shows that the volatility of GCL’s NAV returns is the highest within the peer group, perhaps reflecting the fact that it has a more concentrated portfolio than a number of the funds in the peer group, as well as having a narrow focus.

GCL’s ongoing charges ratio ranks in the middle of its peer group but above the peer group average. This reflects its relatively small size and it should come down as and when the fund grows. GCL does not pay a dividend, while its net gearing is above the sector average. This means that, all things being equal, it should benefit if uranium continues to perform well, but will suffer disproportionately if not.

Of the two uranium funds, GCL is the more expensive, but GCL has both a much longer track record and a superior performance record over the longer time period, although YCA is larger and has greater liquidity.

Figure 17: Peer group comparison – size, fees, discount, yield and gearing as at 3 September 2024

Fund profile

Further information can be found at: ncim.co.uk/geiger-counter-ltd

GCL aims to provide investors with attractive returns, primarily in the form of capital growth, by investing in a portfolio of securities of companies involved in the exploration, development and production of energy and related service companies. Its main focus is uranium, but to allow diversification beyond this highly concentrated sector, up to 30% of assets can be invested in other resource-related companies.

The board has proposed migrating GCL’s listing from The International Stock Exchange (TISE) to the main market of the London Stock Exchange. It said the move would broaden the appeal of the company to a wider range of shareholders. Shareholders will vote on the proposal at a general meeting on 9 September.

GCL does not have a formal benchmark and is not managed with the aim of providing outperformance relative to an index. Instead, the portfolio is managed with a more absolute return mindset, with the managers selecting securities that they believe will provide the best risk-adjusted returns over the longer term. Although the managers consider uranium to benefit from long-term structural growth drivers, the portfolio is focused on securities that the managers believe are undervalued. The expectation is that such securities will re-rate over time, and therefore provide the scope for capital appreciation beyond what the market expects.

GCL has a global remit, but its portfolio tends to be biased towards North American- and Australian-listed equities. The portfolio is predominantly invested in equities, but it is not restricted to these and can also invest in convertible securities, fixed-income securities and warrants.

CQS Group and New City Investment Managers

NCIM has managed GCL since its launch in July 2006

New City Investment Managers (NCIM) has been GCL’s investment manager since its launch in July 2006. On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies. In November 2023, CQS was acquired by Manulife Investment Management, which has US$1.4trn in AUM. There were no changes to the investment management team. Keith Watson and Rob Crayfourd are responsible for the day-to-day management of GCL’s portfolio.

No formal benchmark index

Reflecting both its specialist investment proposition and a relatively small universe, GCL does not have a formal benchmark. However, for the purpose of performance evaluation, the manager has traditionally made comparisons against the price of Cameco and the spot price of triuranium octoxide (U3O8 – the most stable uranium compound and consequently one of the more popular forms of the product).

This note includes comparisons against Cameco…

Cameco is the largest listed uranium producer in the world and the second-largest uranium producer globally. It also provides the processing services needed to produce fuel for nuclear power plants. Cameco has a Canadian listing and its share price and the associated total return series are readily available, so they have been included in this report. Comparisons against the spot price of U3O8 have not been included, due to reduced visibility of the U3O8 spot price and the fact that the majority of market practitioners cannot invest directly in this commodity.

… and the Global X Uranium ETF

Finally, the Global X Uranium ETF (URA) has also been used as a comparator in this note. This is a large (net assets of around US$2.72bn) and liquid ETF that provides investors with access to a broad range of companies involved in uranium mining and the production of nuclear components (this includes companies involved in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries). Its objective is to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index.

Previous publications

Readers interested in further information about GCL may wish to read our previous notes. You can read the notes by clicking on the links or by visiting our website.

| Title | Note type | |

|---|---|---|

| Nuclear exposure | Initiation | 20 March 2019 |

| Supply deficit unsustainable | Update | 21 November 2019 |

| Hot stuff | Annual overview | 6 August 2020 |

| Explosive performance | Update | 21 October 2021 |

| Powered up for growth | Annual overview | 29 November 2023 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Geiger Counter Limited.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.