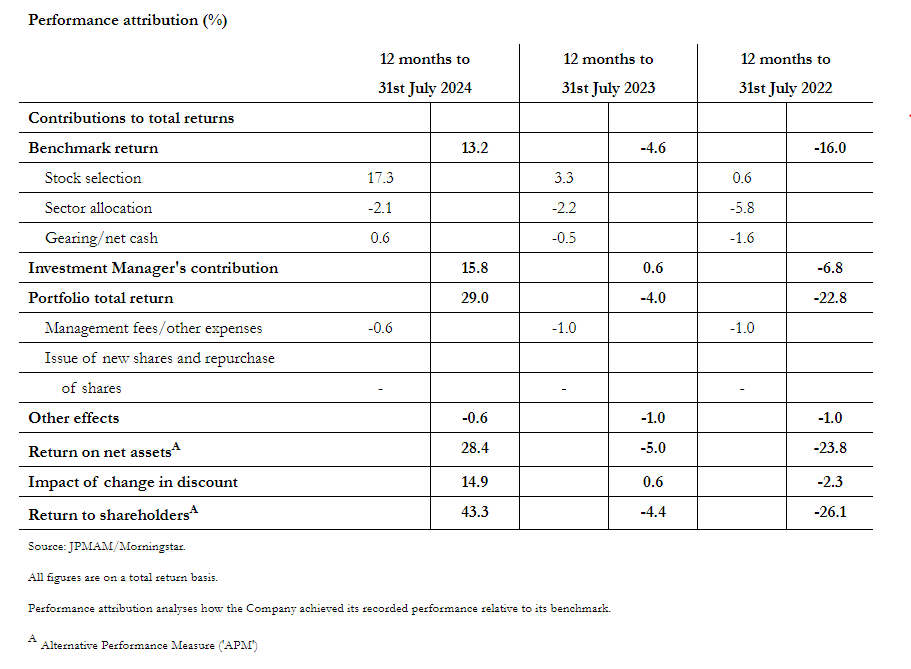

JPMorgan UK Small Cap Growth & Income (JUGI) has published its annual results for the year to 31st July 2024, which its chairman, Andrew Impey, says has been a “momentous year” for the company. During the year, JUGI provided an NAV total return of 28.4% and a share price total return of 43.3%, both massively ahead of the 13.2% return provided by the benchmark, the Numis Smaller Companies plus AIM index (excluding Investment Companies), during the period. Stock selection was the big driver of the outperformance in NAV terms – adding 17.3% to performance – while sector allocation was a small negative, detracting 2.1%. Discount narrowing also added 14.9% to the share price total return.

JUGI says that it intends to pay total dividend of 15.04p per share for the financial year ending 31st July 2025 as a result of the introduction of an enhanced dividend policy (now 4% of JUGI’s NAV at the previous year end), equivalent to a 49.5% increase on the previous year (2024: 10.06p). Dividends will now be paid quarterly. This does not change the company’s investment objective of achieving capital growth from the portfolio.

There has also been a significant reduction in its ongoing charges ratio from 1.02% to 0.71%. JUGI has benefited from the significant increase in scale provided by the merger with JPMorgan Mid Cap Investment Trust in February 2024, resulting in the acquisition of approximately £192.8m of net assets from JMF.

Gearing

JUGI’s board believes that a moderate level of gearing is an efficient way to enhance long-term returns to shareholders, albeit at the cost of a small increase in short-term volatility. On 29th September 2023, JUGI’s £50m borrowing facility (with an option to increase the facility up to £60 million) was extended and then renewed in March 2024 with Scotiabank for a period of 364 days. The new facility includes an accordion option to increase the amount drawn to £90m. At the year-end, £55m was drawn on the loan facility representing a gearing level of 8.7% (2023: 9.5%) of net assets. As at 9th October 2024, gearing was 7.9%.

Investment managers’ comments on performance and market background:

“The financial year to 31st July 2024 proved to be another turbulent one as geopolitical risks continued to escalate. The appalling war in Ukraine raged on, followed last Autumn by the atrocities in the Middle East and rising tension in that region. The United States continued to be the growth engine of the developed world. However, while the UK economy suffered a short and mild recession in the last two quarters of 2023, it has bounced back in 2024, proving to be the fastest growing economy in the G7. Political stability has been re-established in the UK following the July General Election when Labour was voted into power. Post our year end, after 14 consecutive rate rises, the Bank of England cut interest rates by 25 basis points to 5% as inflation cooled noticeably towards the target rate of 2%.

“Against this backdrop, the Numis Smaller Companies plus AIM (ex Investment Trusts) Index produced a strong return of +13.2% for the financial year. It should be noted that almost all of this positive performance was in the Company’s second half. The Company outperformed strongly and produced a total return on net asset value of +28.4% in the period, while the share price total return was +43.3%, as the share price discount to net asset value reduced considerably post the Company’s Combination with JPMorgan Mid Cap Investment Trust plc at the end of February 2024.”

Investment managers’ comments on the portfolio

Investment managers’ comments on the portfolio

“In February 2024 the Company successfully completed the Combination with JPMorgan Mid Cap Investment Trust plc and was renamed JPMorgan UK Small Cap Growth & Income plc. In addition to the significant number of common holdings that were already owned in both portfolios, we transferred eight new names into the enlarged Company, as well as the proceeds from the disposals we made in JPMorgan Mid Cap Investment Trust prior to the Combination. New names included Bellway (a leading UK housebuilder), Shaftesbury Capital (central London focused REIT), Serco (global outsourcing service provider) and Virgin Money (a challenger bank), which subsequently received a bid from Nationwide. Following the Combination, we swiftly deployed the proceeds to align the combined portfolio with our strategy. We are now utilising the enlarged gearing facilities that were introduced post the Combination. Our smaller company strategy remains unchanged, but as investors you will now also benefit from reduced fees and an enhanced dividend policy, in addition to the other benefits of greater scale, such as improved liquidity, and lower costs as a percentage of assets.

“Of the three largest positive contributors to performance over the year, two were also notable contributors to last year’s performance. These were our sizeable positions in Ashtead Technology (subsea rental equipment into the oil and gas and renewables markets) and Bank of Georgia (one of the two dominant banks in the flourishing economy of Georgia). The third key contributor was Warpaint London (affordable cosmetics). All three companies have a substantial growth runway ahead of them, and continued to grow significantly and produce strong results ahead of market expectations. In addition, a number of our smaller positions produced outsized returns in the year. These included Keller (the world’s largest geotechnical specialist contractor), XPS Pensions (pensions consultant and administrator) and the housebuilder Redrow. On the negative side, the main detractors were our holdings in Serica, Indivior and Watches of Switzerland. We exited the latter two positions but maintained a reduced holding in Serica, a North Sea oil & gas company, on valuation grounds.

“In addition to the changes made during the Combination outlined above, the portfolio continued to evolve as we adapted to changes in the economic environment. New additions included Ascential, the events business, and the retailer Currys as the consumer outlook improved and inflationary pressures began to ease. We also bought a new position in Marston’s, the pub company, to increase further our exposure to the domestic consumer, after its significant disposal of its brewing joint venture had removed concerns over the balance sheet. During the year we also sold out of certain holdings including Big Technologies and CAB Payments on concerns about current trading.”