From the onset of the new year, the outlook for the US economy has been largely positive, with the US Chamber of Commerce stating that it could grow more than 3% over 2025. Likewise, the IMF has expressed similar confidence as it expects that the US will outperform the European, Japanese, and Canadian economies this year. However, the Trump administrations’ aggressive trade measures could lead to rises in inflation, and the DOGE-related chaos in government departments may threaten those growth forecasts. Considering this, the Federal Reserve pushed back the chance of interest rate cuts, with a resilient job market also being a contributing factor to its decision.

‘Economists broadly expect the US economy to continue with its expansion in 2025, but the one wild card is the economic effect of Trump’s policies’

Bryan Mena, CNN Business

Conversely, sentiment in the UK could be encapsulated by January’s major bond sell-off, with 10-year gilt yields reaching their highest level since 2008 (moving in tandem with US Treasuries), supposedly prompted by concern over rising costs. Taking this into account, the UK Consumer Confidence Index (CCI) fell by five points to -22, meanwhile EY has predicted that the country’s economy will struggle to grow by more than 1% over 2025. On the other hand, CPI inflation slowed in December, and that probably gave the Bank of England confidence to cut its interest rate by 0.25% early in February.

As expected, the European Central Bank cut its interest rates by 25 basis points at the end of the month. Inflation is not dead in the Eurozone, with the latest figures fuelled by rising energy costs. However, the ECB is faced with anaemic growth. German consumer confidence improved very slightly over January, with a surprise uplift in the Ifo Institute’s business climate index. This comes despite trade concerns and is seemingly encouraged by hopes of reforms to be ushered in by the country’s next government. A standout performer in the Eurozone has been Spain, building on its 3.4% growth in 2024, surpassing both Madrid’s and the ECB’s predictions, assisted by its lowest unemployment rate in sixteen years.

CT Managed Portfolio

‘For the first time since the second half of 2021, the investment company sector was very modestly ahead of mainstream UK equity indices‘

Invesco Asia Trust

‘There is the opportunity for India to be one of the biggest beneficiaries of a US pivot of trade away from China and Europe‘

Invesco Asia Trust

‘China continues to wrestle with its problem of excess property supply and bad debts within the housing and banking sectors‘

At a glance

| Exchange rate | 31 January 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2395 | (1.0) |

| Pound to euros | GBP / EUR | 1.1960 | (1.0) |

| US dollars to Japanese yen | USD / JPY | 155.19 | (1.3) |

| US dollars to Swiss francs | USD / CHF | 0.9109 | 0.4 |

| US dollars to Chinese renminbi | USD / CNY | 7.2446 | (0.7) |

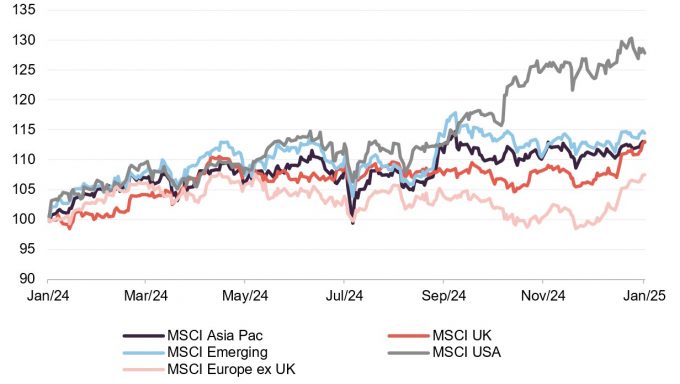

MSCI Indices (rebased to 100)

The dollar was supported by the US’ economic strength, along with global concerns of tariffs. Against the dollar, the euro fell amid rising inflation and interest rate cuts. Oil prices started the month strongly due to perceived higher demand but became volatile due to factors such as planned tariffs on Canadian supply.

Time period 31 January 2024 to 31 January 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor

| Indicator | 31 January 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 76.76 | 2.8 |

| Gold (US$ per Troy ounce) | 2798.41 | 6.6 |

| US Treasuries 10-year yield | 4.54 | (0.7) |

| UK Gilts 10-year yield | 4.54 | (0.7) |

| German government bonds (Bunds) 10-year yield | 2.46 | 4.0 |

Global

Dave Warnock, chair, CT Global Managed Portfolio, 29 January 2025

The US equity market performed strongly over the period while UK equity market returns were much more muted although they did finish the period on a more positive note. The period immediately following the UK general election in July saw the stock market perform strongly; however, the focus soon moved to the Budget at the end of October. Fears of measures thought likely to be included dampened investor sentiment. As a result, the UK equity market gave up ground, though rallied in November, perhaps as Budget uncertainty was replaced by certainty, and perhaps as the US Presidential election result, or at least its clear outcome, was viewed positively by investors.

For the first time since the second half of 2021, the investment company sector was very modestly ahead of mainstream UK equity indices with the average sector discount broadly unchanged at an historically wide 15%.

Whatever one may think of the results of the UK and US elections, both were at least decisive. Such ‘certainty’ is often good for stock markets. However, the economic impacts of both elections are less obvious at this stage and while short term interest rates have fallen a little – and less than had been hoped by now – longer term rates have risen, a move that tends to be bad for stock markets. The rate of inflation is proving stubborn, and both the US and UK Governments’ borrowing requirements look challenging. None of these observations is new news and so should be discounted already by stock markets. As ever, markets respond in either direction to events or news that is not discounted. With a new and seemingly quite unpredictable US President having taken office, the potential for new news is even higher than usual.

. . . . . . . . . .

Alex Crooke, Bankers Investment Trust, 15 January 2025

The year started with optimism that, despite higher interest rates, the world would avoid an economic recession. The view that central banks had engineered a soft landing carried equity markets to new highs through the first half of the year. Once more, technology shares and anything related to Artificial Intelligence (‘AI’) led the way although the broader market, especially the financials, did participate. In the summer, new job creation slowed and inflation stopped its descent causing a wobble in markets. This was amplified by negative news coming out of Asia and Europe, as their economic growth stalled. Investors sought new policies in markets like China and Germany to stimulate growth but politicians offered little to support their equity markets.

Meanwhile in July the Japanese currency reached breaking point and sharply corrected against the US dollar, disrupting the Yen carry trade. However, it did not take long for renewed optimism to be established as interest rates in Europe and then the US, finally started to be cut. Our financial year ended the week before the US presidential election with markets at all time highs, buoyed by the prospect of a Trump win.

. . . . . . . . . .

Edinburgh Worldwide Trust, 22 January 2025

After several years of macroeconomic headwinds, the background for smaller companies growth investing in 2024 improved materially. With inflation abating across many geographies while growth and employment remained resilient, many central banks moved to ease their monetary policies and began to cut interest rates. This includes the US Federal Reserve, which cut its interest rates for the first time since the Covid pandemic. Investors began to broaden their risk appetite beyond the handful of megacaps, which had dominated market performance and capital inflows until then. While this macroeconomic backdrop is more favourable to our investing style, we are acutely aware of the many uncertainties that can derail markets.

Geopolitical tensions exist in many parts of the world, notably in the Middle East and between Russia and Ukraine. National security and economic protectionism remain key considerations. Efforts to revitalise domestic manufacturing and to lessen the reliance on China have resulted in a new wave of tariffs and sanctions on Chinese exports, ranging from critical metals to electric vehicles to advanced technologies like AI. China’s response has been to restrict the export of materials and technologies where it dominates the supply chain. Politically motivated economic policies are not new but have become a prominent feature of this age and add a new dimension of uncertainty and complexity to the operations of many global companies.

Foreign policy and the fragility of the global order continue to be the topic of debate after a wave of elections across many key geographies, most notably the presidential election in the US. The US market’s response so far has been strong on expectations that the incoming administration’s policies will be progrowth, including deregulation and a reduced corporate tax environment. However, the future of the US global alliances remains very much in question and could have profound implications for the global balance of power.

. . . . . . . . . .

UK

Neil Harmon and Indriatti van Hien, fund managers, Henderson Smaller Companies, 29 January 2025

Inflation has fallen significantly, and we have seen the start of interest rate cuts around the globe. What is not clear is the timing of when rates will be cut further and the speed of their descent. Optimism for a rapid decline in rates has faded, particularly in the UK and US, as a consequence of the inflationary impacts of the recent UK Budget and the Trump and Republican ‘red sweep’ election victory in the US. In the meantime, the delayed transmission mechanism of past interest rates and their impact means that economic conditions are set to remain challenging in the short term. Notwithstanding this, the prospect of a monetary easing cycle is likely to support global equity markets and slowly allow valuation multiples to normalise.

Geopolitics remain challenging with the ongoing conflicts in Ukraine and the Middle East and continuing tensions between China and the US. In the US, Donald Trump will start his second term as President with a full agenda focused on cutting domestic taxes and government spending, raising tariffs, cutting immigration, de-regulation and the ending of current global military conflicts. This will probably lead to significant volatility for global financial markets. In the UK, the Labour Government’s ‘honeymoon period’ post its landslide election victory was short-lived culminating in a poorly received Budget which was perceived as anti-business and potentially inflationary. We, however, welcome Labour’s commitment to ‘boost investment’ and in particular its pledge to ‘increase investment from pension funds in UK markets.’ Any incremental flow into the UK could breathe life into a generally under-owned and, more importantly, undervalued UK equity market.

In the corporate sector we are encouraged by the fact that conditions are intrinsically stronger than they were during the Global Financial Crisis of 2008-2009. Company balance sheets are more robust and, in recognition of the deep undervaluation of their own equity, we are seeing an increasing number of companies buying back stock.

. . . . . . . . . . .

Aberforth Geared Value & Income Trust, 28 January 2025

The top-down backdrop for stock markets was inauspicious around AGVIT’s launch. The war in Ukraine continued, as did the conflict between Israel and Hamas. The risk of escalation buffeted oil prices and equity valuations. Political uncertainty was an additional challenge. The results of the elections in the UK and the US were broadly as expected, though the markets are now digesting the implications of policy change under the new regimes. Politics are more unclear elsewhere. An election looms in Japan, while South Korea has seen its president attempt to impose martial law. In Europe, June’s election for the European parliament was the catalyst for a snap election in France, where a stable government has yet to be established. Meanwhile, Germany is also facing elections early in 2025 following the collapse of the ruling coalition.

On the economic front, the UK pulled out of the recession in the second half of 2023. The recovery has been tentative so far, but prospects for wage growth above the rate of inflation, lower mortgage rates and high household savings offer encouragement for the coming year. In Europe, Germany continues to struggle to escape recessionary conditions. Its export reliant industrial economy is contending with Chinese and Japanese competition, while demand for its products from China and elsewhere is depressed. The bright spot has remained the US, though even here recent macro-economic data have been patchy and hint at slowing growth.

Despite these challenges, equities have not performed badly, even stripping out the boost to the US market from the “Magnificent Seven” and artificial intelligence. The main reason was optimism about the interest rate cycle – for equity markets, the promise of a lower cost of money can overcome a host of other issues. The prospect of lower rates was fuelled by that lacklustre growth environment described above and by improving inflation data, as the pace of inflation continued to subside from the very high rates of 2022. Interest rate cuts were duly forthcoming, with the European Central Bank cutting in June, the Bank of England in July and the Federal Reserve in September. Stockmarkets’ great hope is that the Federal Reserve can achieve the historically elusive “soft landing” – taming inflation without tipping the US economy into recession.

However, towards the end of 2024, politics intruded to unsettle the narrative of disinflation and lower interest rates. The Republican clean sweep in America’s Presidential and Congressional elections increased the likelihood of potentially inflationary policies, such as trade tariffs, lower immigration and tax cuts. It remains to be seen whether tariffs are implemented in full force or are more of a negotiation tactic. And it is still unclear whether the new Department of Government Efficiency can mitigate the impact of tax cuts on budget deficits. Therefore, the assumption of a swift return to the lower inflation and interest rate environment of the pre-pandemic era has been undermined. It is notable that US bond yields have risen and that the market now expects a slower pace of interest rate cuts than it did before the elections.

. . . . . . . . . . .

Ashe Windham, chair, Miton UK Microcap Trust, 9 January 2025

Financial assets have a history of generating exceptional returns in trends that can extend for long periods, before abruptly changing without warning, when those same assets then deliver sub-normal returns, sometimes for an equally long time. A particularly good example was the outperformance of the Japanese stock market up until the last day of 1989, at which point the market suddenly reversed and its returns then disappointed for the following three decades. With this in mind, investors in US large cap equities will need returns from other assets at some point. Many commentators anticipate that the UK stock market with its capital-intensive bias, and its culture of delivering a major part of its return via good and growing income, will be one such means of diversification.

In spite of large scale selling of UK equities by investors over the last three years, the UK stock market itself has already started keeping pace with the mainstream US indices, despite its lack of a megacap technology stock tailwind. This may mark the start of a new long-term trend of UK stock market outperformance. If this occurs, UK-quoted microcaps appear to have the greatest upside potential, in part because they are starting from such extraordinarily low valuations after their recent period of underperformance. If UK microcaps outperform the UK majors, as they have done historically, and UK majors are set to outperform international comparatives, then a small and microcap strategy should have strong potential.

. . . . . . . . . . .

Adam Avigdori and David Goldman, managers, BlackRock Income & Growth – 6 January 2025

Global developed equity markets have continued their broad rallies throughout 2024 following a trend that started in late 2023. Following a lengthy period of uncertainty through the COVID-19 era, with sharply rising interest rates and inflation, equity markets have now settled down. The combination of falling interest rates and supportive macroeconomic conditions including stable labour market indicators presents a benign backdrop for equity markets. The promise of greater fiscal spending in the US, China and parts of Europe have served to buoy equity markets further, although have contributed to rising government bond yields as the spectre of fiscal deficits and inflationary pressures loom large for bond investors.

More recently, following a period of extended economic weakness, the Chinese Government began a more concerted accommodative campaign aimed at accelerating economic growth and arresting deflationary pressures. Recent policy moves have sought to improve and encourage lending into the real economy with a sizable fiscal easing programme announced. Whilst the scale of the easing is large, western markets and commentators have remained sceptical of its impact and effectiveness whilst awaiting evidence to the contrary. In the UK, the recent budget promised and delivered a large-scale borrowing and spending plan whilst sizable increases in minimum wage and public sector wage agreements likely support a brighter picture for the UK consumer. UK labour markets remain resilient for now with low levels of unemployment while real wage growth is supportive of consumer demand albeit presents a challenge to corporate profit margins.

With the UK’s election and budget now over, the market’s attention will focus on the subsequent policy actions of the new US administration under Donald Trump. The global economy has benefited from significant growth and deflation ‘dividend’ it has received from globalisation over the past decades. The impact of a more protectionist US approach and the potential implementation of tariffs may challenge this dividend. We would anticipate asset markets to be wary of these policies until there is more clarity as we move through 2025. Conversely, we believe political certainty, now evident in the UK, will be helpful for the UK and address the UK’s elevated risk premium that has persisted since the damaging Autumn budget of 2022. Whilst we do not position the portfolios for any election or geopolitical outcome, we are mindful of the potential volatility and the opportunities that may result, some of which have started to emerge.

The UK stock market continues to remain depressed in valuation terms relative to other developed markets offering double-digit discounts across a range of valuation metrics. This valuation anomaly saw further reactions from UK corporates with a robust buyback yield of the UK market. Combining this with a dividend yield of 3.7% (FTSE All Share Index yield as at 31 October 2024; source: The Investment Association), the cash return of the UK market is attractive in absolute terms and comfortably higher than other developed markets. Although we anticipate further volatility ahead, we believe that in the course of time risk appetite will return and opportunities are emerging. We have identified several potential opportunities with new positions initiated throughout the year in both UK domestic and midcap companies.

We continue to focus the portfolio on cash generative businesses that we believe offer durable, competitive advantages as we believe these companies are best placed to drive returns over the long term. Whilst we anticipate economic and market volatility will persist throughout the year, we are excited by the opportunities this will likely create; by seeking to identify the companies that strengthen their long-term prospects as well as attractive turnaround situations.

. . . . . . . . . . .

Asia

Neil Rogan, chair, Invesco Asia Trust, 21 January 2025

The new Trump administration seems intent on pursuing a protectionist trade policy with high tariffs, the deterrent or punishment (depending on your point of view) for actions deemed unfair trade practices. Loosening US fiscal policy through tax cuts will tend to put upward pressure on US interest rates although the ultimate effect on the US dollar will depend upon how much US government spending can be controlled. The effects on Asia are not necessarily negative but the outcome is less predictable and the tail risks are higher.

Meanwhile within Asia, China continues to wrestle with its problem of excess property supply and bad debts within the housing and banking sectors. The Chinese government’s long game of prioritising domestic social stability will be tested again if it has to replace lower export growth with stronger domestic growth. But the economic resources are available to force that switch if necessary and there has been a series of government announcements aimed at boosting the property market to jump start economic growth.

India is at an interesting juncture following a long bull market, which has seen the stock market gain 94% over the last five years. With the market now trading on a 23x historic price to earnings multiple, it looks expensive and it is concerning that many domestic investors are untested in a bear market. Yet there is also the opportunity for India to be one of the biggest beneficiaries of a US pivot of trade away from China and Europe.

Elsewhere the challenge is to what extent those Asian companies with high levels of US sales can navigate Trump’s new tariff regime. Increasing production in the US or reducing production within China will help. At the macroeconomic level, prioritising domestic growth over exports would also help. However, these changes will take time to offset the immediate dislocations from tariffs.

Change is inevitable and outcomes are uncertain. Many have already defaulted to a pessimistic scenario or are waiting on the sidelines but there is a significant probability of a positive outcome. Even a muddling-through outcome could produce positive returns, especially given the relatively low starting valuations for many of Asia’s stockmarkets. It is a fantastic opportunity for active investors and stockpickers.

Japan

Richard Ashton, manager, CC Japan Income & Growth – 21 January 2025

We believe that Japanese equities continue to offer a compelling investment opportunity despite the strong performance of recent years. With even greater encouragement from the government, regulators and shareholders, Japanese companies are adopting ever higher standards of corporate governance and implementing more attractive capital allocation policies. This is creating a favourable environment for investors in which significant opportunities to generate a total return, based on capital growth and compounding shareholder distributions, are achievable.

Japan has remained on the periphery of investment decisions for foreign and domestic investors alike for several years, but we believe this is changing. The more attractive investment landscape has encouraged heavy participation from international private equity investors seeking the cheap valuations on offer. Increased participation in the market by domestic investors is a particularly notable feature, following the revamp of the Nippon Individual Savings Account (“NISA”) savings programme, and recognition that companies are delivering an attractive return profile for long-term investors. Our optimism in the outlook is increased by the fact that the investment opportunity created by corporate developments now coincides with signs of improving domestic economic fundamentals and the potentially significant positive benefits to Japan of the global geopolitical realignment.

. . . . . . . . . . .

North America

Baillie Gifford US Growth, 20 January 2025

Given the strong run historic returns, it would be fair to question whether the US market’s tremendous run can continue. We remain optimistic. The US market’s performance has been underpinned by superior fundamental progress. The earnings of US-listed businesses have grown much faster than those of companies listed elsewhere. Furthermore, the US continues to produce more than its fair share of exceptional growth companies. These businesses are powering the global innovation economy. Indeed, just as the US led the way during the rise of the internet, it is doing so again with generative AI. We think this new technology is consequential and will usher in a period of change on a scale that we haven’t seen since the industrial revolution.

Change such as this creates opportunities for growth investors. This Company aims to give investors exposure to the exceptional US growth companies which are benefiting from and driving change. We are uniquely well placed to do this given our ability to invest across both public and private markets. Many great growth companies remain off limits for investors due to their private status. This Company enables investors to cost effectively access exceptional private companies like SpaceX and Databricks and participate in the upside that’s being unlocked by these unique and innovative businesses.

. . . . . . . . . . .

Commodities and natural resources

BlackRock Energy and Resources Income, 31 January 2025

Mining

This year followed a similar pattern to 2023 with the mined commodities experiencing a wide variety of returns with gold on one hand up over 30% and coking coal on the other down a little less than 30%.

The commodity prices that came under the most pressure were the steel inputs of iron ore and coking coal as weaker Chinese demand and a lack of supply disruptions, that had been a feature of recent years, caused these markets to be soft. Looking forward in these markets, the outlook is improving. For iron ore, when the price touched around US$90 per tonne in August 2024, we started to see some higher cost supply curtailed, suggesting that this could be a reasonable longer-term price for the industry. On the coking coal side, the recent sale of some key producing assets led to a more consolidated industry which will, hopefully, bring supply discipline and a more robust pricing environment.

Although the future growth in demand for many mined commodities is likely to be driven by energy transition across developed and developing countries, we cannot forget that the Chinese economy probably still remains the key driver for the Mining sector. The concerns around the health of China’s economy surged again during the summer with the China Purchasing Managers’ Index falling below 50% in May and staying below 50% through the summer. Towards the end of the third quarter there was a series of stimulus announcements from the Chinese authorities that initially caused a remarkable risk-on rally with the Chinese stock market (Shanghai Composite Index) rising almost 30% during the three weeks from the middle of September. Despite the policy support and stock market reaction, the real economy has been slower to respond, and this can be seen in the continued growth of steel exports from China with higher exports implying weaker domestic demand for steel.

One of the brighter spots in the industrial commodities was aluminium, where the price rose almost 20% over the course of the year. The demand story for aluminium for many years has been an attractive one – it is widely used in high voltage cables and thanks to better research and development, has been able to be substituted for more expensive copper in air conditioning units and even some wiring applications. Its lightweight properties have also driven demand growth from the automobile industry where it has been substituted for steel. However historically there has been more than adequate supply of aluminium to meet demand as China grew production in an almost unconstrained manner, placing new refineries and smelters close to coal fields to benefit from cheap energy. With China’s growing focus on the environment and a desire to keep the energy onshore (aluminium exports can be seen as energy exports given how energy intensive the production process is), the authorities have placed a capacity ceiling of 45 million tonnes per year on the industry. This has slowed the production growth as seen on the chart contained within the Annual Report and Financial Statements and we expect this restraint to continue. In addition to improving margins for producers in China, the restraint should limit aluminium export growth and tighten the supply-demand balance in the ex-China market, which would benefit the aluminium holdings in the portfolio.

The mergers and acquisition (M&A) environment continued to remain active for the Mining sector during 2024 with the headline-grabbing attempt by BHP to acquire Anglo American, which ultimately ended in no deal being consummated. This was another example of companies recognising the benefits of “buying versus building” as both the capital intensity of building new assets continue to rise and the rising risk associated with getting assets permitted and built also grinds higher. We would expect this desire by companies to consolidate the industry to continue into 2025, but it will require boards and management teams to take a long-term view. At current commodity prices and cost structures, the prices being demanded by sellers of assets look expensive, so a belief in tighter markets to come and ultimately higher commodity prices is necessary to justify most potential M&A transactions or greenfield investments.

Energy Transition

Over the past twelve months, the Energy Transition sector has continued to power ahead, with global solar panel installations expected to increase to 600GW, a rise of 35% on 2024, according to Bloomberg New Energy Finance. This compares to solar installations of 252GW in 2022, which was in itself a record year. In recent years, factors impacting on the energy transition have shifted from a focus on decarbonisation to prioritisation of energy security, reshoring of critical supply chains and we are now seeing an additional driver in the form of increasing electricity demand expectations.

The US policy in the form of the US CHIPS Act and the Inflation Reduction Act (IRA) has supported a rapid increase in corporate investment in US manufacturing of key technologies including EV battery production, leading-edge semiconductor fabrication plants, solar panel and wind turbine manufacturing. Companies supplying the necessary equipment for these facilities have benefited from increased demand and Trane Technologies, (energy efficient commercial heating, ventilation and air conditioning) and Ingersoll-Rand (energy efficient pumps and compressors) were among the top contributors to performance.

Large scale investment in the hardware required for generative artificial intelligence (AI) model training and subsequent querying has created increased demand for a number of related industries. In addition to microchips, AI data centres require specialist design and power management. Data centre and critical infrastructure design group, Vertiv Holdings and power management specialists, Schneider Electric, saw strong share price performance over the year. Supplies to electricity grid connections and power transformers reported quarterly results consistently ahead of market expectations with increased orderbooks and performed strongly during the year.

Within Energy Transition, elevated interest rates, overcapacity in the solar and EV supply chains and uncertainty around the direction of US policy caused market sentiment to remain negative for parts of the renewable power sector, particularly for non-US companies, given a wide valuation differential between US and European stock markets. European renewable utilities were sensitive to changes in interest rate expectations and underperformed following the US elections.

Following the US elections, there was a pullback in valuations of renewables companies. In 2016, we saw similar initial negative share price reaction to renewables, yet the sector went on to outperform over the remaining presidential term and we see stronger demand drivers for these companies today.

Whilst some policies or parts of the IRA may be changed, such as EV subsidies, lesser support at the federal level for offshore wind, or lower duration of tax credits for renewables, we do not see the core aim of reshoring of manufacturing to be reversed and we see opportunity in some of the market moves.

Traditional Energy

Oil prices traded within a US$70-US$90/barrel range for most of the year, ending towards the lower band, but a level that enables the oil & gas industry to generate significant profits. Despite the significant ongoing investment into low-carbon alternatives, the world has yet to break the link between economic growth and oil demand and the 12-month period set a new record for oil demand at 102.6 million barrels per day (source: US Energy Information Administration December 2024). In contrast, North American natural gas markets saw a distinctly looser market throughout most of 2023 and 2024 as supply growth continued well ahead of the anticipated inflection in US LNG export (thereby driving up demand). Henry Hub prices spent most of the prior two years in contango with gas production companies having to curtail significant volumes to help rebalance the market.

Oil prices were driven by several notable factors during the year. On the supply side, large new oil producing projects in Guyana and Norway, which have been under construction for several years, ramped production in 2024 and US shale oil producers led US production higher to 13.5 million barrels per day. On the demand side, global consumption has continued to increase. However, the main source of oil demand growth in recent years has been China, which saw significantly slower-than-expected growth due to lower levels of construction activity and continued substitution away from diesel and into natural gas within the heavy-duty truck sector. The International Energy Agency (IEA) revised downwards its estimate of 2024e oil demand growth expectations from China from 700,000 barrels per day to less than 200,000 barrels per day. With oil demand growth barely sufficient to absorb the new oil supply, global oil markets were well-supplied throughout the year, leading the Organisation of Petroleum Exporting Countries to delay adding back previously curtailed production to support oil prices. Despite the marked slowdown in Chinese growth the agency has been revising its expectations for 2025e demand upwards, notably in Asia ex-China.

Commodities, including oil, have long been used by investors as a hedge against increased geo-political risk and this was again evident in 2024. Houthi militant attacks on international shipping in the Red Sea during the first quarter of the year resulted in disruption to global trade routes. A majority of ships therefore diverted to taking the longer route between East and West around the Cape of Good Hope, rather than the Suez Canal route. Oil prices rose during this period, and later moved higher with escalation of events in the Middle East between Iran and Israel in October, on the risk of disruption to energy infrastructure. As risk of further escalation subsided, the Brent oil price tracked lower towards US$70 into the year end.

Energy holdings delivered a positive return in the period, modestly ahead of the benchmark. In our view, selected pipeline companies may benefit from the increased power demand in the US with reshoring of manufacturing trends and the build out of AI data centres. Increased demand for power in the US from hyperscalers, the large technology cloud service providers investing in AI data centres, has driven a resurgence in demand for nuclear power and a higher uranium price.

Outlook

The economic growth outlook for China remains important for the mining sector with the country accounting for the largest part of demand for many mined materials including iron ore and copper. The incoming US administration has announced an intention to add further tariffs on goods imported from China and in order to maintain economic growth, we expect China to stimulate its domestic economy. In the past, such stimulus measures have included infrastructure and the property sectors, which may drive increased demand for certain metals. The supply of many metals remains constrained after a period of relative underinvestment in new production capacity, providing the potential for a supportive pricing outlook for mining companies.

The energy transition involves shifting from a predominantly oil & gas-based economy to lower carbon sources of energy, which are more materials intensive. The scale of the renewables industry, which continues to expand rapidly, is at a level that is already a material source of demand growth for certain metals, including copper and silver and the expected increase in power demand, from reshoring manufacturing and AI data centres will likely add to this trend. Companies within the mining sector have much stronger balance sheets today, with relatively low debt, enabling increased pricing to feed through to profits and shareholder distribution, whilst we find companies trading at attractive valuations.

The outlook for the oil and gas industry appears uncertain, with a much wider-than-usual range of potential outcomes, both positive and negative. Our base case is that new oil production meets or exceeds oil demand growth in 2025. However, the potential for a supply shock is higher-than-normal given elevated geopolitical tensions. In one of its final acts, the previous US administration introduced tighter oil-related sanctions on Russia, targeting the tankers transporting the country’s crude production and the insurers backing this so called ‘shadow fleet’. However, it remains unclear what the new US administration’s policy on Russia will be. Meanwhile, there is also the potential for the Trump administration to retighten the enforcement of sanctions against Iranian oil supply, which have been relaxed over the past 4 years. Ultimately, however, OPEC+ spare capacity at record levels means this could be used to help balance the market and effectively cap upside.

On the demand side, importantly, we are no longer seeing downgrades to estimates around demand from China (the key factor that held oil back through 2024) and in some instances, we are starting to see upgrades. Company valuations generally remain inexpensive in our view, offering investment opportunities but this uncertainty increases the need to be selective. Beyond 2025, we see demand exceeding supply, with fewer sizeable new oil production projects. Looking ahead, we believe that the duration of oil demand growth remains underappreciated and not reflected in energy company valuations today. Many energy companies are able to deliver attractive levels of cash flow generation at the expected oil price range of US$60-US$80/barrel and have strong balance sheets. The energy intensity of global economic growth is expected to increase over the coming years because of electrification, power demands of artificial intelligence, emerging market economy growth and the reshoring of supply chains, which may be supportive for natural gas and nuclear assets.

Reform of US planning regulations may further support midstream companies, whilst energy typically offers a hedge against geo-political risk and inflation.

The outlook for energy transition related companies appears exceptionally strong, however US policy uncertainty may continue to impact on market sentiment towards renewables in the near term. There is a fundamental and pressing need for increased electricity generation in the US and Europe and renewables will have to be part of that solution, due to speed to roll out and low cost, even without considering corporate decarbonisation targets. Whilst we see increased demand for combined cycle gas turbines (CCGTs) and for nuclear power, supply bottlenecks and time to build will likely drive increased demand for readily available renewable generation.

The energy transition will not follow a straight line, and we have seen challenges to market sentiment over the past year. This market caution has led to some companies trading on attractive valuations, in our view. We see several potential catalysts in Europe and in the US. The headwind of high interest rates is steadily reversing and industry destocking within the EV supply chain, which has impacted on underlying demand for semiconductors, appears to have largely finished. The new US administration may drive an acceleration of investment into all forms of energy for national security reasons (energy security, re-shoring of manufacturing of key technologies, AI data centres), whilst in Europe, tighter vehicle emission regulations may lead to an increased demand for EVs. It is possible that reform to planning may facilitate project permitting which could be a significant positive in enabling faster build out of renewable projects.

The Energy Transition is one of the key megatrends which will play out over the next 2-3 decades, although these trends will not be linear. Your Company’s portfolio, with its mandate flexibly to invest across all 3 sectors and actively to select beneficiary companies, is well positioned to take advantage of the growth this trend will deliver.

. . . . . . . . . . .

Private equity

Alan Devine, chair, Patria Private Equity, 29 January 2025

The past couple of years have been tough for the investment trust sector, including private equity trusts. At the same time, there has been a lot of attention on the semi-liquid space in private equity, which aims to open the asset class to more investors.

I continue to believe that investment trusts are the best way for smaller investors to access private equity, due to features like daily liquidity, the evergreen nature of the portfolios and long-term track records, and I feel optimistic going forward. There are other ongoing market developments which potentially offer tailwinds to PPET’s underlying portfolio and the evolution of its share price.

Firstly, private equity investment activity is picking up, with a number of high-profile deals announced in 2024, and I expect this trend to continue into 2025. Increased activity will drive portfolio company exits and cash distributions and should in theory act as a tailwind to NAV growth, since exits are typically realised at an uplift to prior valuation.

The latter point has the potential to provide more confidence to investors, in relation to private equity valuations. I remain hopeful that will help drive further buy-side demand for private equity trusts like PPET. Furthermore, any additional cuts in interest rates by central banks have the potential to catalyse both PE market activity and investor interest in PE investment trust shares.

On cost disclosures, I welcome the forbearance by the FCA and we look forward to understanding what the new regulatory regime will look like. However, I am optimistic that a long-term solution will be found that fairly represents the investment trust sector, proving investors of all types with a straightforward, accurate and comparable representation of costs. Private equity trusts like PPET stand to be one of the main beneficiaries of this change.

. . . . . . . . . . .

Property

David Hearn, chairman, Safestore

The self-storage market in the UK, France, Spain, the Netherlands and Belgium remains relatively immature compared to geographies such as the USA and Australia. The SSA Annual Survey (May 2024) confirmed that self-storage capacity stands at 0.89 sq ft per head of population in the UK. The most recent report relating to Europe (FEDESSA’s 2023 report) showed that capacity in France is 0.41 sq ft per capita. This compares with closer to 7 sq ft per inhabitant in the USA and 2 sq ft in Australia. In the UK, in order to reach the US density of supply, it would require the addition of around another 18,500 stores as compared to 2,700 currently.

Our interpretation of the most recent 2024 SSA report is that operators remain optimistic about their trading and the future growth of the industry. The level of development estimated for the next three years is similar to that witnessed in recent years and we do not consider this level of new supply growth to be of concern, especially as we believe new supply helps to create increased awareness of what is a relatively immature product in Europe. We estimate new supply to represent around 5% to 6% of the traditional self-storage industry in the UK. These figures represent gross openings and do not consider storage facilities closing or being converted for alternative uses. We estimate that a small proportion of these sites compete with existing Safestore stores as many new developments happen in areas with lower barriers to entry in which we tend not to operate.

New supply in London and Paris is likely to continue to be limited in the short and medium term as a result of planning restrictions, competition from a variety of other uses and the availability of suitable land.

Consumer awareness of self-storage appears to be increasing but at a relatively slow rate, providing an opportunity for future industry growth. The SSA survey indicates that approximately half of consumers have low awareness about the service offered by self-storage operators or had not heard of self-storage at all. Since 2014, this statistic has only fallen 14ppts from 61%. Therefore, the opportunity to grow awareness, combined with limited new industry supply, makes for an attractive industry backdrop.

Self-storage is a brand-blind product. 52% of respondents in the 2024 SSA Survey were unable to name a self-storage business in their local area. The lack of relevance of brand in the process of purchasing a self-storage product emphasises the need for operators to have a strong online presence. This requirement for a strong online presence was also reiterated by the SSA Survey where 76% of those surveyed (76% in 2023) confirmed that an internet search would be their chosen means of finding a self-storage unit to contact, whilst knowledge of a physical location of a store as reason for enquiry was only c. 30% of respondents (c. 30% in 2023).

There are numerous drivers of self-storage growth. Most domestic and business customers need storage either temporarily or permanently for different reasons at any point in the economic cycle, resulting in a market depth that is, in our view, the reason for its exceptional resilience. The growth of the market is driven both by the fluctuation of economic conditions, which has an impact on the mix of demand, and by growing awareness of the product.

Our domestic customers’ need for storage is often driven by life events such as births, marriages, bereavements, divorces or by the housing market including house moves and developments and moves between rental properties. We have estimated that UK owner-occupied housing transactions drive around 8-13% of the group’s new lets.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.