There’s a good chance you have come across Exchange Traded Funds (ETFs) before – investment funds that trade on the stock exchange, a bit like shares. Most of them are passive instruments, which means they aim to track an index, such as the FTSE 100 (large UK companies) or the S&P 500 (the same in the US). However, not all ETFs work that way. This guide looks at “active” ETFs: how they’re different, how they work, and what to look out for if you are thinking of investing in one.

What are they?

Active ETFs are investment funds that are listed on a stock exchange and are managed by a professional investment team that chooses which assets to buy and sell. Unlike passive ETFs, which follow a pre-set list of investments (like an index), active ETFs give the manager more freedom to try and outperform – whether that means picking undervalued shares, avoiding risky sectors or shifting between asset classes.

In that sense, active ETFs behave a lot like actively managed open-ended funds (OEICs and unit trusts), except you can trade them at any time their exchange is open, just like a share. This means you don’t have to wait until the end of the day to know what price you are paying.

How do they work?

The structure of active ETFs is similar to that of their passive cousins. They are open-ended, meaning that new shares can be created (or cancelled) depending on investor demand. When there is more demand for shares new ones are created, and when there is more selling than buying the process goes the other way.

This helps keep the ETF’s market price closely aligned to the value of its underlying assets (called the net asset value or NAV). This is in marked contrast to investment trusts, where often wide discounts (or premiums) of market price to NAV can exist for a sustained period.

Most active ETFs don’t use borrowing or gearing, unlike some investment trusts. That can make them less volatile, but it also limits the manager’s ability to amplify returns (or losses).

Key terms to know

- Active Share: the percentage of the portfolio that differs from its benchmark index. A high active share (e.g. 80%+) suggests genuine active management rather than “closet indexing”.

- Authorised Participant (AP): a large institution (typically a bank or broker-dealer) responsible for creating and redeeming ETF shares directly with the fund. APs are essential to the functioning of the ETF structure.

- Bid-Offer Spread: the difference between the buying price (bid) and the selling price (offer) of the ETF on the stock exchange. Narrow spreads suggest good liquidity; wider spreads are more common in smaller or less-traded ETFs.

- Net Asset Value (NAV): the value per share of the ETF’s underlying assets, calculated daily. ETFs also trade at market prices, which can differ slightly from NAV due to supply and demand.

- Total Expense Ratio (TER): the annual cost of managing the ETF, expressed as a percentage of assets under management. Active ETFs generally have higher TERs than passive ETFs, but lower than traditional mutual funds.

- Tracking Error: the degree to which an ETF’s returns deviate from its benchmark. In active ETFs, a higher tracking error reflects the manager’s deliberate divergence from the index in pursuit of outperformance.

Shareholder structure

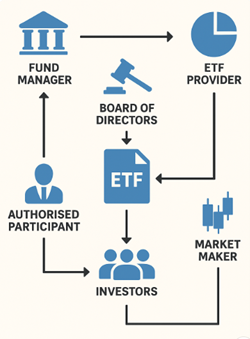

The ETF is overseen by a Board of Directors which is responsible for governance and fiduciary oversight. The ETF provider is typically the sponsor and architect of the fund, delegating day-to-day portfolio management to a Fund Manager. The Authorised Participant (AP) creates and redeems ETF shares in large blocks in the primary market, often in coordination with the Fund Manager. Market Makers operate in the secondary market, providing liquidity by quoting buy and sell prices to facilitate efficient trading for investors. These investors are the end-users of the ETF.

The board of directors

The ETF is overseen by a Board of Directors which is responsible for governance and fiduciary oversight. The ETF provider is typically the sponsor and architect of the fund, delegating day-to-day portfolio management to a Fund Manager. The Authorised Participant (AP) creates and redeems ETF shares in large blocks in the primary market, often in coordination with the Fund Manager. Market Makers operate in the secondary market, providing liquidity by quoting buy and sell prices to facilitate efficient trading for investors. These investors are the end-users of the ETF.

Why would you choose an active ETF?

There are a few reasons investors might prefer active ETFs over traditional funds or trusts:

- Easy to buy and sell – you can trade them on most investment platforms during market hours.

- Often cheaper than regular funds – active ETFs tend to have lower ongoing charges than their open-ended equivalents, though they are still more expensive than passive ETFs.

- Transparent – most active ETFs reveal their holdings each trading day, which is much more often than many active funds.

- Tax-efficient – unlike with UK-domiciled investment trusts, stamp duty is not charged on ETF purchases as they are technically structured as open-ended investment companies (OEICs) which are exempt.

What are the risks?

Like any investment, active ETFs carry risks:

- The manager might make poor decisions and underperform the broader market. If that happens, you may have paid a higher fee and ended up with worse returns than if you had simply bought a passive tracker.

- Liquidity – while ETFs are always traded on the market, some of the smaller or newer active ETFs don’t trade often, which can lead to wider bid-offer spreads.

- Active ETFs can only hold liquid, easily tradable assets, as they need to be able to create and redeem shares quickly. Therefore, they won’t invest in things like physical property, private equity or infrastructure projects – the sorts of assets that take time to buy or sell.

- Although ETFs are designed for the market price to stay close to NAV, there can still be brief periods – particularly in volatile markets – where the trading price deviates slightly from what the assets are worth. That said, for most equity-based active ETFs with decent size and volume, these gaps are usually very small.

Summary table

A quick summary of how active ETFs compare to other investment vehicles:

| Feature | Active ETF | Passive ETF | Open-Ended Fund | Investment Trust |

| Trading | Throughout the day | Throughout the day | Once per day | Throughout the day |

| Manager discretion | Yes | No | Yes | Yes |

| Priced at NAV? | Mostly (with small deviations) | Mostly | Always | Sometimes trades at wide premium/discount |

| Gearing? | Rare | No | No | Common |

| Income smoothing? | No | No | No | Yes (via revenue reserves) |

| Minimum investment | Usually very low | Very low | Sometimes higher | Very low |

| Transparency | Usually daily holdings | Daily holdings | Monthly or quarterly | Monthly or quarterly |

Is an active ETF right for me?

Active ETFs might suit you if:

- You want professional management but prefer a more flexible, cheaper and transparent option than a traditional fund.

- You are comfortable picking and trading funds through an online platform or broker.

- You don’t need dividend smoothing or access to more complex investments (like private equity or infrastructure).

They might not suit you if:

- You prefer the stability and oversight that comes with a board of directors.

- You are investing primarily for income and want consistent payouts.

Conclusion

Active ETFs sit somewhere between passive trackers and traditional funds – and can offer a good balance of control, cost-efficiency and active management. They are still a relatively new concept in the UK market, but their popularity is growing. Like all investments, it is important to understand what’s under the bonnet before you commit your money.

If in doubt, speak to a financial adviser.