Here’s an anomaly – a UK REIT trading at net asset value (NAV). Having endured a miserable three years of high interest rates and persistent inflation, there have been very few listed property companies whose shares have rated close to par in that time. Even fewer have traded at a premium and been able to raise money.

AEW UK REIT (AEWU) managed just that last week when it issued 150,000 shares from treasury at a small premium to NAV. Okay, that raised a small sum, but it was indicative of the success the company – favoured by retail investors – has had over many years.

Figure 1: AIC’s Property – UK Commercial peer group, ranked by 10-year NAV total returns

Source: AIC

Frustratingly for the company and shareholders, it has been unable to grow substantially to match its sector-leading performance. It remains miniscule at a £170m market valuation – making it too small for the large institutions to allocate to and, with 60% retail investors on the share register, too difficult to tap current shareholders for vast sums.

Management and the board of directors are at pains to grow and, as they told me this week at a dinner marking the trust’s 10-year anniversary, are exploring every avenue. Consolidation is one route, however finding a company with an appealing portfolio with synergies to its value-add approach is proving tricky, even before it gets down to the nitty-gritty of merger negotiations.

I’m told conversations have taken place with institutional investors keen to back the manager’s intensive asset management strategy, but the large sums that they want to invest (upwards of £30m) would create a less than desirable skew to the share register.

It would seem the company is in between a rock and a hard place. The secret to its success has been its ability to buy well, grow income through various initiatives and crystalise profits (achieving average premiums to price paid of 38% over its 10-year history). And rinse and repeat.

Whilst that will continue to be the recipe, it would be great to see it have the firepower to deploy into its £100m investment pipeline, especially with property valuations currently at the bottom of the market.

Secret sauce

It is easy to see why retail investors back AEWU in such numbers. It has maintained an 8.0p per annum dividend (currently yielding 7.5%) over its 10-year history through actively managing its portfolio, which has propelled it to be the standout performer in its peer group.

The Property – UK Commercial peer group is a shadow of its former self, with its ranks depleted by takeovers and wind-downs over the last couple of years. Its closest peers are Custodian Property Income REIT (CREI), which launched at a similar time to AEWU, and Schroder REIT (SREI), which has been going more than two decades. The rest are either long-income property companies such as Alternative Income REIT (AIRE) and Value & Indexed Property (VIP) or sector-specific like Life Science REIT (LABS) and Regional REIT (RGL).

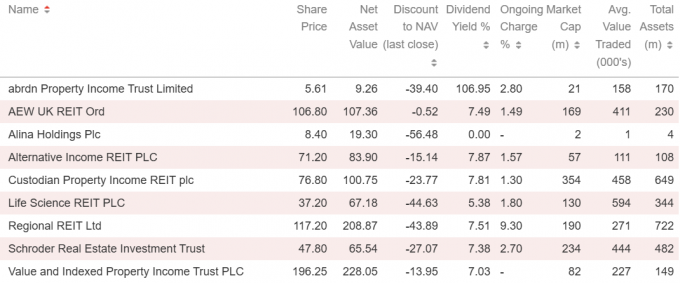

Figure 2: Peer group overview at 9 October 2025

Source: AIC

As well as being in the eye of the storm (including sticky inflation and high interest rates impacting valuations, weak UK capital markets, consolidation of wealth managers, and cost disclosure rules causing investor confusion), returns have not been helped by an investor shift away from diversified REITs to single-sector specialist counterparts.

AEWU is unapologetic about its sector agnostic approach. This allows it to look at every investment opportunity within its wheelset (smaller lot sizes below £20m – too small for the likes of private equity and pension funds and too large for individual investors) without being confined. It also means management can flex with the times and be able to move early on new investment themes.

It has done that to great affect when reducing its office exposure before it became evident that capital expenditure requirements to keep buildings relevant would rocket, and returning to the retail sector at the bottom of the market.

Once it acquires assets, the management team works to execute its identified asset management plans to achieve rental reversion and valuation gains – whether that be through refurbishment and repositioning properties, letting up vacant space, taking advantage of lease events to bring in new tenants on higher rents, or negotiating lease terms with current tenants.

As mentioned earlier, once it feels it has maximised rental growth opportunities, it will take the profit and move on to the next high yielding asset. This means that its dividend is often left uncovered by earnings whilst it redeploys capital – not too much of a problem if it can minimise these periods and make up the gap.

It has also been able to take advantage of low-cost debt, which it fixed at 2.96% just at the right time in May 2022. However, that matures in 2027 and whilst it would take some crystal ball gazing to determine what debt markets will look like then, the current landscape does not look promising. Even so, it would take some Truss-ian levels of uncertainty for it to get anywhere close to the 8.1% net initial yield of the portfolio.

With AEWU proving its recipe for success over the past 10 years, we hope that size will not get in the way of another decade of outperformance.