Thriving under pressure

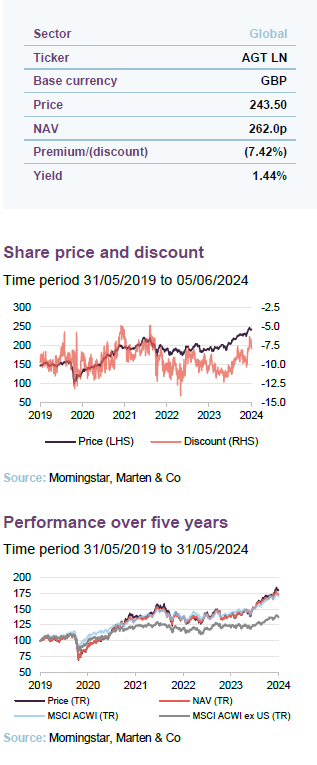

AVI Global Trust (AGT) has gone from strength to strength as its managers identify a wealth of opportunities. A share price total return of over 30% in the past year highlights the value of the company’s strategy of targeting high-quality companies whose shares are trading at a discount to their intrinsic value.

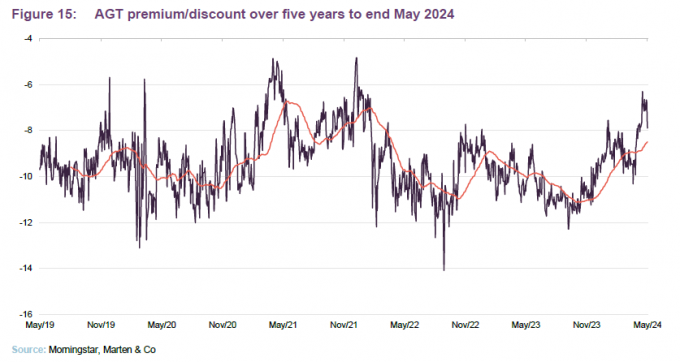

Against a backdrop of markets adjusting to structurally higher interest rates, expect this momentum to continue, and the value of less correlated market returns such as those provided by AGT to increase. Despite its strong performance, the company continues to trade on a discount of 7.4%. Given its track record and increasingly optimistic outlook, we believe this is an attractive entry point for investors, particularly for those looking to manage exposure to increasingly concentrated and expensive market indexes.

Extracting value from discounted opportunities

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include holding companies, closed-end funds, and asset-backed special situations.

| 12 months ended | Share price total return (%) | NAV total return (%) | MSCI ACWI total return (%) | MSCI ACWI ex US total return (%) |

|---|---|---|---|---|

| 31/05/2020 | (9.5) | (9.7) | 7.5 | (1.6) |

| 31/05/2021 | 53.0 | 48.2 | 23.6 | 24.4 |

| 31/05/2022 | (0.2) | 3.4 | 4.8 | (2.5) |

| 31/05/2023 | 0.1 | 0.6 | 2.7 | 1.4 |

| 31/05/2024 | 31.4 | 27.2 | 20.3 | 13.6 |

Source: Morningstar, Marten & Co

Market Backdrop – High quality companies at a discount

More information is available at aviglobal.co.uk

AVI Global Trust (AGT) has carved out an increasingly successful niche targeting high-quality companies whose shares are trading at a discount to their intrinsic value. Over the last 10 years this strategy has generated an annualised NAV total return of almost 10%.

Its foundations are built on fundamental, bottom-up analysis to identify investments which are generally held over the long term, with the managers placing little stock in short-term market sentiment and often-misplaced economic forecasting.

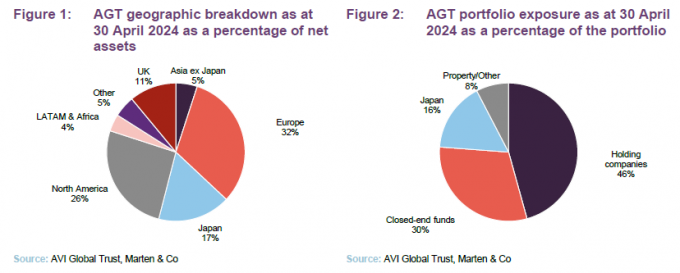

The company’s global remit provides the managers with complete flexibility to construct a portfolio of high-conviction investments, both geographically and across investments styles. The lack of restrictions has meant the fund has been able to mostly avoid poorly-performing sectors of the market, such as the UK, in favour of opportunities elsewhere, including Europe, Japan, and Latin America where they have identified a range of idiosyncratic factors that continue to drive fundamental performance.

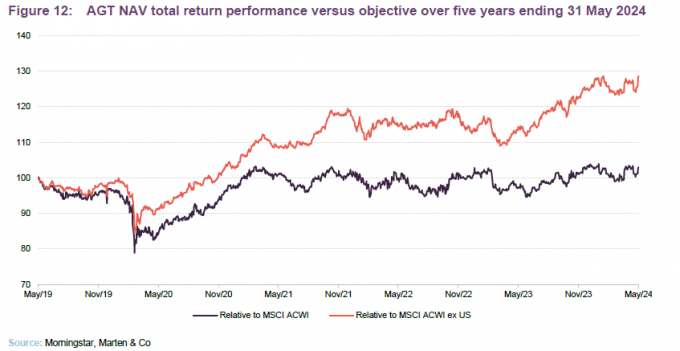

Strong returns come despite US underweight exposure

Interestingly, for much of the last decade, AGT has also maintained relatively limited exposure to North American markets, which, broadly speaking, have tended to trade more on momentum than the fundamental, bottom-up, analysis that the managers favour. This underweight makes the performance of the AGT portfolio all the more impressive given the degree to which the dominance of the US has contributed to global market benchmark growth.

More recently, however, the managers have begun to identify an increasing number of opportunities across the US, particularly among global conglomerates where they have noticed a changing attitude towards corporate actions, such as spin-offs, to add value. Since our first note in 2021, AGT’s allocation has steadily increased to around 26%.

AGT has successfully navigated the headwinds of an easy-money economy

AGT’s performance over the past decade has been achieved during a period of anaemic growth, falling interest rates, and suppressed volatility. Dubbed the ‘financial repression’ years, this era of ‘easy’ money juiced the returns of speculative assets and momentum trading, which was more or less the antithesis of the AGT strategy. That the trust was able to generate double-digit compound growth during this period speaks to the execution of the manager.

Uncorrelated returns

With this in mind, in recent years the manager has looked to drive the beta of the portfolio even further away from that of broader market indices. In many cases, the shift has been a natural one as sentiment has swung from one extreme to another over the past 18 months, highlighting the fallibility of attempting to time markets.

The outlook is no more certain than it was 18 months ago, evidenced by the recent pivot in interest rate pricing in the US, with policy makers now arguing over whether current financial conditions are too loose, although interest rate cuts are still the most likely outcome.

Focus on active engagement

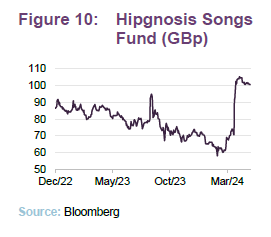

The AGT managers see no utility in gaming these debates, committing instead to more tangible factors within the company’s control to drive performance. This includes active engagement by the AGT team with boards and managers, such as its involvement in the sale of Hipgnosis, which we discuss in more detail on page 9.

Portfolio

Signs of the increasing array of opportunities available to the managers were evident in the company’s 2023 financial performance. The NAV total return was +15.3%, for the 12 months to 30 September 2023. This was notably higher than comparative benchmark returns (the MSCI All Country World Index was up +10.5% and the and the MSCI All Country World Index ex-US +10.1%). The share price total return was +14.8%.

This performance was driven by stock selection, with several of the company’s large, high-conviction holdings outperforming over this period including Apollo, KKR, FEMSA and Schibsted. The latter two are good examples of the types of idiosyncratic “events” to which the manager is attracted, with the companies undertaking strategic and structural changes to unlock value.

This momentum has continued to build and so far this year, AGT has generated a total return of 10.68%.

Greater focus on event-driven returns

This performance is reflective of what the manager describes as some of the most attractive investment landscapes it has seen in many years, with this optimism evidenced by the deployment of gearing for the first time since 2021. To take advantage of these conditions, the manager has also been busy optimising existing portfolio positions, selling some holdings to fund investments where it sees greater scope for attractive, event-driven returns over shorter timeframes. This included the complete exit of Pershing Square Holdings in January 2024 a company which they have held since 2017 (generating an IRR of +21%).

AGT has also seen a number of strong contributions to its NAV growth so far this year, most notably from the Hipgnosis Songs Fund. We discuss this performance and the additional portfolio activity in more detail on page 5.

Asset allocation

AGT’s asset allocation is driven by the manager’s stock selection decisions. Since we last published, using data from October 2023, the main shift in AGT’s geographical position has been an increase in the UK, from 3% to 11% (with the build up of holdings in Frasers, Entain, and some UK-focused REITs) and a fall in Asia ex Japan exposure (excluding Japan) which has dropped from 11% to 5%, driven in part by the sale of SK Square and others.

In terms of its portfolio exposure (Figure 2) the major shift has been a steadily increasing position in the property sector, particularly within UK commercial property where NAVs have been written down and discounts are wide. This is a reflection of the increasing range of opportunities now available to the managers driven by growing economic uncertainty, and also the benefits of the company’s unconstrained investment approach.

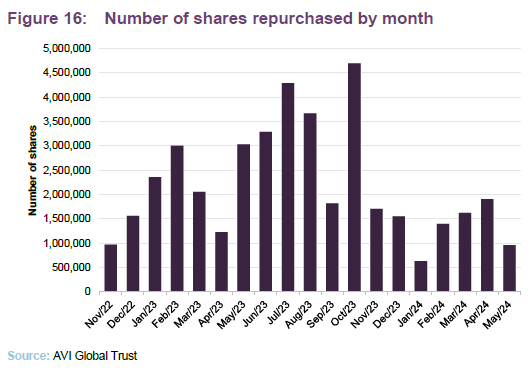

Gearing was 11.2% at end April 2024

As noted above, AGT has been steadily increasing its gearing, which was 11.2% at the end of April 2024, up from 4.2% when we last published. This is the highest level since the onset of the COVID-19 epidemic. The managers are at pains to point out that this increase is not driven by improving market sentiment but instead reflects the increasingly attractive discount opportunities that are available. AGT should also receive a sizeable cash inflow from the takeover of Hipgnosis.

Portfolio activity

As noted above, the managers have been busy recently. In the six-month period to 30 April 2024, the company has fully exited holdings in Pershing Square and Godrej Industries, and has made substantial reductions in Apollo Global, FEMSA, KKR, and Schibsted B.

Alongside the increased gearing, the proceeds were used to fund new positions in GCP Infrastructure, Entain, and Chrysalis Investments, and significant increased exposure to Bollore, News Corp and Hipgnosis Songs Fund.

The main motivation for these trades was to increase the portfolio’s exposure to idiosyncratic catalysts and away from generic market risk.

New positions

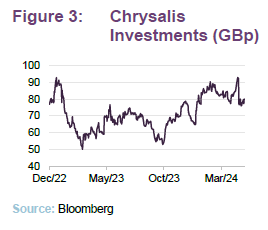

Chrysalis Investments

Chrysalis Investments (CHRY) is a globally-focused closed-end fund which invests in later-stage private companies with long-term growth potential. The company has had an increasingly challenging time over the last few years as markets have taken a more cautious view on growth assets and companies generating negative cash flows that require additional funding for growth. Recognising this, CHRY has made considerable effort to increase the resilience of its portfolio, the vast majority of which is now profitable or funded through to profitability.

In October 2023, CHRY announced a new capital allocation policy that, provided it has sufficient cash on hand to support the portfolio, will prioritise £100m of distributions to shareholders. A rumoured sale of its position in Graphcore could be the catalyst to kickstart this process.

Despite this, CHRY has continued to trade at a discount of around 46% on what the AGT manager believes is a conservative NAV. Given significant positions – such as Starling and Klarna – may not be too far from a liquidity event, AGT’s manager believes that there is a significant opportunity for shares to re-rate.

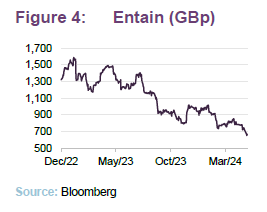

Entain

Entain (ENT) is a London-listed sports betting and gambling company with investments across a range of markets including the UK, Europe, and the US. The company’s shares have collapsed in recent years as operational changes, including the departure of three CEO’s, have coincided with regulatory changes in the UK that have posed a significant headwind to growth. As such, based on AGT’s NAV estimate, the company now trades on a 37% discount.

Prior to the recent turmoil, ENT had successfully executed an aggressive acquisition strategy giving it an attractive collection of leading brands, including BWIN (2016) in Europe, Ladbrokes Coral (2018) in the UK and BetMGM, a joint venture with MGM Resorts focused on online betting in the US.

MGM tried to buy Entain in 2021 but was rebuffed. The AVI team feel that, after a period of consolidation in Entain’s share price, there is considerable potential upside in the stock. AGT has noted that with a swarm of activists on Entain’s shareholder register, it does not believe the current valuation discount to the sum of its parts will persist indefinitely.

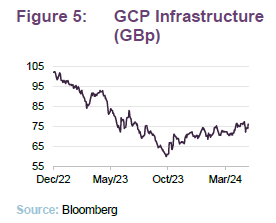

GCP Infrastructure

GCP is a London-listed, closed-end fund investing predominantly in UK infrastructure debt. The company has borne the brunt of the interest rate driven sell-off and selling pressure related to the cost disclosure issues affecting UK-listed investment companies.

GCP currently trades on a stubborn discount of 27%, which has remained around this level for over a year. Despite the negative headline performance, the company has continued to execute well, delivering a positive NAV total return while introducing a successful capital recycling programme. This has led to a material reduction in leverage, most recently following the sale of its interest in loan notes secured against Blackcraig Wind Farm, and the authorisation of a £15m buyback programme. The manager of AGT sees these structural changes as an increasingly attractive catalyst that should begin to realise the underlying value of GCP’s assets.

Top 10 holdings

AGT’s portfolio remains relatively concentrated, reflecting the high conviction levels held by the manager, with the top 10 accounting for 54.5% of the portfolio.

Since we last published, Brookfield Corporation, Apollo, and KKR have dropped out of the list to be replaced by News Corp, Bollore, and D’Ieteren.

Looking at the three new entrants to the list:

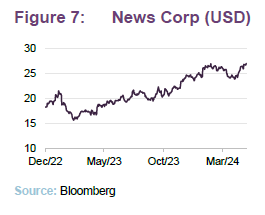

News Corp

News Corp is a US-listed holding company controlled by the Murdoch family. It owns a collection of attractive assets, including a stake in REA Group (Australia’s leading online real estate portal), Harper Collins (a large, high-margin publishing business that is a beneficiary of digitalisation) and Dow Jones, which – in addition to the Wall Street Journal – holds a pricing database covering niche areas such as oil contracts and shipping rates.

AGT believes many of these assets are misunderstood and therefore misvalued, highlighted by a wide discount to AGT’s assessment of its NAV. Importantly, this is also the view held by the News Corp management, who are aware of the sum-of-the-parts discount and have become increasingly vocal about unlocking this value. This was a key catalyst for AGT, which significantly increased its investment following comments from the CEO regarding “a revolution, not evolution”, which the manager believes is about as clear a signal as can be about the potential break-up of the current structure.

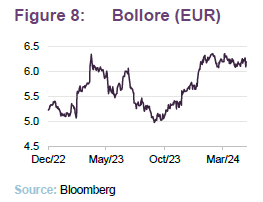

Bollore

Bollore is one of the last of a dying breed of complex European holding companies. Controlled by Vincent Bollore, it holds significant value tied up in a self-ownership loop structure of attractive assets including Vivendi and Universal Music Group. The manager added to its position earlier in the year, identifying a number of potential catalysts for the stock. The most notable of these was an announcement that Vivendi – in which Bollore owns just shy of a 30% stake – will be broken up into four different businesses in an effort to reduce the sum-of-the-parts discount at which it trades. The AGT manager notes that this has occurred when Bollore has a substantial net cash balance for the first time in many years. It believes this could pave the way for further shareholder-friendly manoeuvres in addition to buybacks and or tender offers.

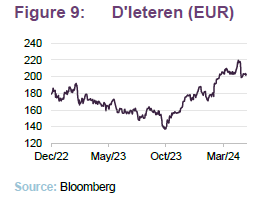

D’Ieteren

D’Ieteren is a Belgian family-controlled holding company which owns a 50% stake (worth around 63% of its NAV) in Belron, the global no.1 operator in vehicle glass repair and replacements. AGT’s initial position was an opportunist play on an oversensitive market reaction to D’Ieteren’s earnings back in 2022, which saw it underperform the MSCI Europe index by 17%. Since then, the manager has been steadily adding to the company during periods of weakness, most recently in January and February 2024, which proved to be prescient following D’Ieteren’s March earnings, which saw its shares jump 16%.

The manager outlines the structural upside which exists for D’Ieteren, most notably via its holding in Belron and the proliferation of advanced repair jobs which favour the company’s scale. However, the fundamental investment case remains a valuation story, with the company still trading on a substantial discount of over 30%. To realise this value, the manager believes some form of corporate event is probable in the coming years given the presence of private equity co-ownership at Belron, who are highly incentivised to increase the equity value. Any suggestion of this should act as a catalyst for D’Ieteren shares.

Other portfolio developments

The major recent development was the announcement of an offer by a Blackstone-backed entity to purchase Hipgnosis Songs Fund.

Hipgnosis Songs Fund

It has been a roller coaster year for the Hipgnosis Songs Fund (SONG). Plagued by concerns around valuations, asset sales, and management disputes, shares collapsed by over 50% before a bidding war for the portfolio sparked a sharp rebound. The background to these events is long and complex, covered in detail across our website, previous notes, and recent commentary from AGT. The outcome, a significant realisation for AGT, provides perhaps one of the best examples of the value that can be added through the company’s investment strategy.

In total, AGT generated a total return of almost 30% following a series of investments which were ramped up towards the end of 2023 as the manager saw an opportunity to influence the outcome of the developing turmoil. AGT played a key role in fighting off a proposed related-party sale of a portion of SONG’s catalogues and also made the case against the company continuing in its present form.

A new board led efforts to find a way out of the company’s problems and these interventions culminated in a bidding war, delivering good value for AGT and SONG’s wider shareholder base. At the end of April 2024, the company was AGT’s largest position following the rebound in its shares. However, for all practical purposes, it can be considered as a cash equivalent with the existing bid (which is at a 43% premium to the close price prior to the commencement of the offer period) seen as highly likely to prevail.

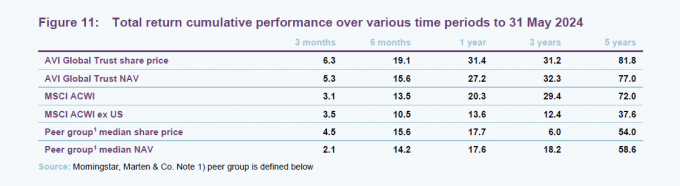

Performance

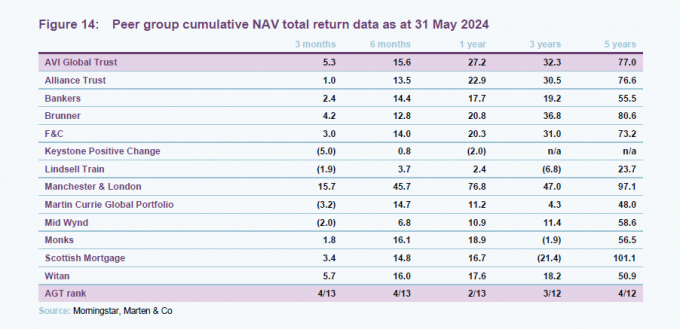

AGT continues to generate good total returns ahead of both major benchmarks while comfortably outperforming peer group averages. As noted, the returns against the MSCI ACWI are particularly impressive given its underweight to the US, which has continued to dominate global markets and now makes up over 70% of that index.

Importantly, the bulk of AGT’s returns have been generated from stock-specific factors that are uncorrelated to broader market performance. With the macroeconomic outlook remaining uncertain, these attributes are likely to become more attractive as valuations and benchmark returns revert to historical norms.

Peer group

Up-to-date information on AGT and its peers is available on our website

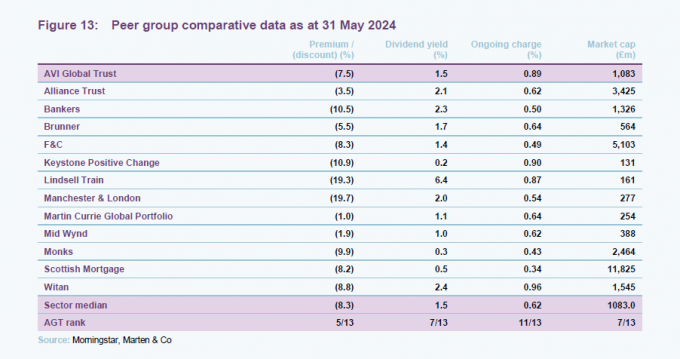

AGT is a constituent of the AIC’s Global sector. For the purposes of this note, we have compared AGT with the other members of this sector which invest predominantly in listed equities.

Given its strong growth over the last six months, the company’s discount has narrowed relative to this peer group since we last published. Its yield is about middle of the pack, although none of these trusts invests with the primary intention of generating a high yield. AGT’s ongoing charges ratio is at the higher end of this peer group, but we would argue that none of these figures is particularly high.

In NAV performance terms, AGT ranks towards the top of the sector over most time periods.

Fund profile

Holding companies, closed-end funds, and asset-backed special situations

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include family-controlled holding companies, closed-end funds, and asset-backed special situations such as asset-rich Japanese operating companies.

New benchmark

The company compares itself to the MSCI All Country World Total Return Index, expressed in sterling terms, for performance measurement purposes. In previous years, it had used a World ex US benchmark on the grounds that the trust had a structural underweight exposure to the US, primarily because there are fewer opportunities to invest in family-controlled holding companies there. For this note, we have included comparisons to both indices. In subsequent notes we will just use the new benchmark.

It is worth noting that the performance benchmark has no influence over portfolio construction and that AGT’s active share is always likely to be close to 100%.

AGT’s AIFM is Asset Value Investors (AVI). AVI was established in 1985, when the trust’s current approach to investment was adopted. At that time, AGT had assets of just £6m and was known as the British Empire Securities and General Trust, later shortened to British Empire Trust. The trust adopted its current name on 24 May 2019.

Hear about the fund

Previous publications

Readers interested in further information about AGT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 17 or by visiting our website.

| Title | Note type | Date |

|---|---|---|

| Double discount on quality-focused portfolio | Initiation | 25 January 2021 |

| Focused high conviction portfolio | Update | 5 August 2021 |

| Bargain hunting | Annual overview | 20 May 2022 |

| Doubly blessed | Update | 8 March 2023 |

| An historic opportunity | Annual overview | 21 November 2023 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| This marketing communication has been prepared for AVI Global Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from | receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the | period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.