Progress on a number of fronts

AVI Japan Opportunity Trust (AJOT) is not yet three years old, but it is making great strides in its various campaigns to improve shareholder value across a select group of Japanese companies. The value opportunity presented by the Japanese market is considerable, and this is true for smaller companies and value-style stocks in particular. Many of AJOT’s holdings trade close to the value of cash and listed investments on their balance sheets.

Attitudes to corporate governance and shareholder rights are changing in Japan, helped by supportive legislation. After a COVID-related lull in corporate activity last year, things are heating up (as we describe from page 6 onwards) and this is flowing through into AJOT’s NAV.

Asset Value Investors Limited (AVI) is AJOT’s investment manager. It highlights four reasons why an investment in AJOT offers a compelling opportunity, each of which is explored in this note (see page 4 for more detail).

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a focused portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors leverages its three decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

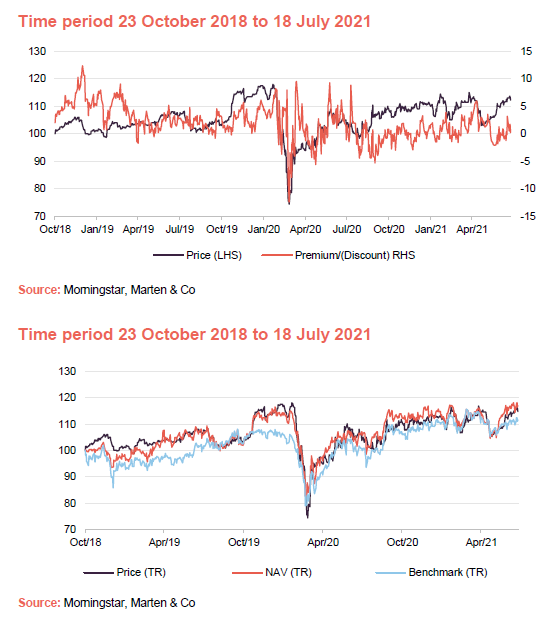

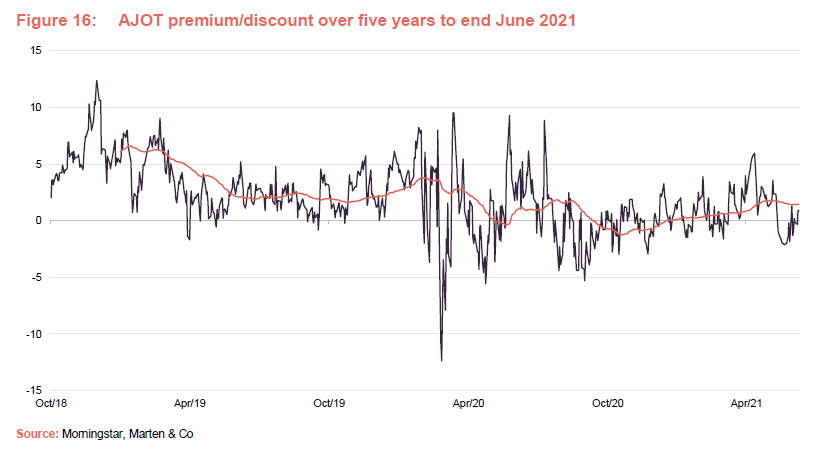

Over the year ended 30 June 2021, AJOT’s shares traded as high as an 8.8% premium and as low as a 5.3% discount. The average premium over the period was 0.5%.

The board recognises that it is in the interests of shareholders to maintain a mid-market price for the ordinary shares that is as close as possible to NAV.

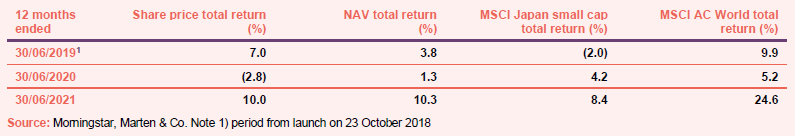

Last year, the Japanese small cap market was led by growth stocks. However, over 2021 to date, AJOT’s returns are toward the top end of its peer group and it remains ahead of its benchmark since launch, with performance over June 2021 particularly strong

Fund profile

AJOT is an investor in Japanese companies. Its focus is on good-quality small and mid-cap listed companies that have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage proactively with these companies to unlock their value potential.

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund. He is supported by a team which has expanded since AJOT’s launch and now numbers seven (see page 20).

Within the team, Jason Bellamy is based permanently in Japan. There are also a number of Japanese-speaking staff based in London. The manager says that this additional bandwidth to engage with companies is proving beneficial to the trust.

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has assets under management of about £1.2bn. AVI began investing in Japan over two decades ago and AJOT was launched in October 2018 to focus on the opportunities presented by that market. At the end of May 2021, AVI and its employees owned 1,852,669 shares in AJOT. This helps align the manager’s interests with those of other shareholders.

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in Sterling terms. The index does not inform AJOT’s portfolio construction. AJOT will have a high active share relative to the performance benchmark.

The opportunity

AVI highlights a number of reasons why it feels that an investment in AJOT offers a compelling opportunity, each of which is explored in this note.

- First, the Japanese market is undervalued, having underperformed other major markets and, within the market, small cap and value stocks have lagged by an even greater margin. This is despite strong earnings growth and resilient cash generation from these stocks.

- Next, within AJOT’s universe there are a surprisingly high number of cash/asset-rich, good quality companies whose valuations do not reflect these attributes.

- In addition, AJOT is a beneficiary of a trend towards improved corporate governance and higher levels of corporate activity within Japan.

- Finally, AJOT is no passive investor. AVI is engaging with each of the companies in the portfolio with the intention of unlocking their latent value.

The scale of the opportunity is considerable. At the end of May 2021, the portfolio was trading on 4.9x enterprise value to earnings before interest and tax (EV/EBIT) and, on average, the net value of financial assets – such as cash, investment securities and treasury shares – less liabilities – such as debt and net pension liabilities – was equivalent to 81% of the market cap of these companies.

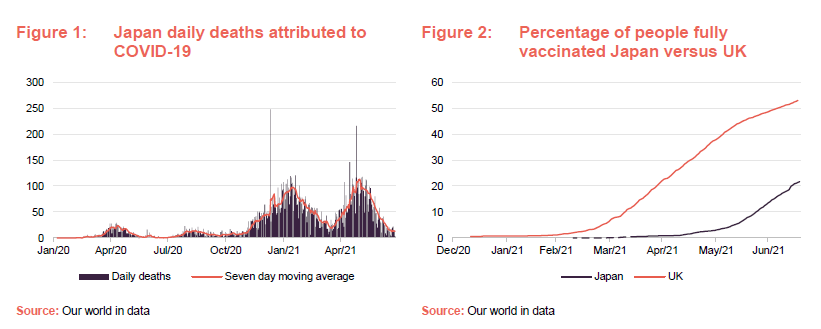

Japan, a market suffering from COVID

Over the past year and a bit, the Japanese economy has been held back by COVID-19 and the measures implemented to control the pandemic. Japan fared relatively well initially, but a failure to vaccinate the population allowed a second wave of cases to gain traction.

By 17 July 2021, Japan had fully vaccinated 21.4% of its population and administered at least one dose to around 33.5%. This has raised questions over the suitability of going ahead with the delayed Tokyo Olympics, but the government seems determined to press ahead, although it has abandoned plans to allow spectators at all events. AVI believes that progress is being made on vaccines, with three now approved and take-up accelerating. It expects that the economy will continue to strengthen.

Prime Minister Suga took over from Shinzo Abe in September 2020, but has seen his approval rating slide as a result of the mishandling of the pandemic. Investors were not expecting much change in policy between the two administrations, but one initiative that has been welcomed is a drive to digitalise more of Japan’s economy. For a country that is often perceived as a technological giant, many parts of the economy are surprisingly backward. This is starting to change.

AVI notes that the software sector is doing well. Outsourced IT providers – such as two of AJOT’s holdings; DTS and NS Solutions – are well-placed to take advantage of this. Few companies have an internal IT resource and so outsourcing is booming.

It might be fair to describe AJOT as a value portfolio, given its focus on companies with high cash balances and trading on low multiples. The global value rally engendered by the good news on vaccines last November did not appear to reach the Japanese small cap market. However, February’s sell-off in growth stocks did affect the Japanese small cap market. AVI feels that valuations look attractive and share prices are not justified by the fundamentals.

Much value to unlock

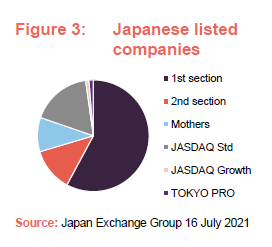

According to the Japan Exchange Group, there are almost 3,800 listed stocks in Japan. AVI believe a significant number of these are mispriced by virtue of their inefficient balance sheets and holdings of surplus cash or listed securities in particular.

AVI notes that a substantial proportion of Japanese stocks have little or no analyst coverage. Even where analyst coverage exists, AVI feels that the market does not price companies efficiently because analysts tend to draw conclusions and set price targets based on earnings multiples, rather than using a sum of the parts approach. The rationale for this is that, historically, the chance of persuading companies to optimise their balance sheets and getting any excess cash distributed to shareholders has been unlikely. Instead, these surplus assets and often-unproductive assets sit on the balance sheet for years; sometimes value has been destroyed.

In the 2000s, the aggressive actions of hedge funds trying to unlock value through activism met with mixed results and strong resistance. For example, in the face of action taken by a US activist investor Steel Partners against the Japanese company Bulldog Sauce, Japan’s Supreme Court ruled in favour of ‘poison pill’ defences, which allow companies to frustrate potential takeovers by changing voting rights or issuing shares, for example. Fortunately, over the following decade, attitudes to corporate governance in Japan changed for the better.

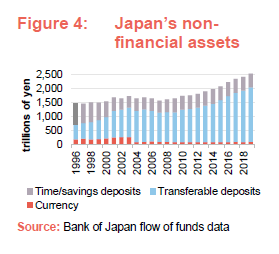

The sums involved are vast – at the end of the 2019 fiscal year, the Bank of Japan estimated that cash and deposits held by the private non-financial sector totalled JPY2,516trn (£16.4trn).

Improving corporate governance

The Japanese government recognised the sclerotic effect that this hoarding of assets was having upon the Japanese economy. In 2012, then-Prime Minister Shinzo Abe proposed a stewardship code, which was adopted in 2013. Signatories to the code are encouraged to disclose voting records and enter into constructive engagement with investee companies. A review of the code in 2020 introduced a focus on ESG and a request that institutions disclose why they voted the way they did.

Shareholder advisor service ISS recommends that shareholders vote against the re-election of directors of companies whose return on equity has been less than 5% per annum over the previous five years.

A corporate governance code was introduced in 2015 and strengthened in 2018. This included measures aimed at minimising cross-shareholdings (where two or more companies hold shares in each other), stressing the importance of companies earning more than their cost of capital, bringing in more independent directors, establishing independent nomination committees for new directors, improving disclosure and greater dialogue with shareholders, and maintaining a level playing field in the treatment of shareholders.

AVI says that the Japanese asset management industry has shifted its attitude since the introduction of the stewardship code. It feels that the industry is less passive than it was. However, it is rare that domestic institutions will criticise companies publicly. These asset managers tend to work behind the scenes rather than submitting proposals.

A 1% shareholding is enough to submit a proposal to shareholders at an annual general meeting (AGM). In practice, this happens relative rarely – AVI estimates that, across the entirety of the Japanese market, there are around 50 such proposals a year. Their rarity makes them more powerful in a way, as they tend to attract media attention. AVI says that the companies do not like the adverse publicity. Whilst AVI tends to use these as a last resort, it aims that AJOT is at least a 1% shareholder in its target companies so that the option is available. AVI notes that with a 3% stake, a shareholder can call an extraordinary general meeting (EGM). Companies can squeeze out minority shareholders (forcing them to sell their shares) with a two-thirds majority. Two thirds is also the threshold to get special resolutions passed.

The manager highlights that the emphasis is on building consensus rather than forcing the issue. It cites the example of the lift and escalator company Fujitec, where, despite only having a stake of about 2.5%, the publicity that AJOT achieved with its public presentation resonated with others, stimulated a debate and led to a good result for AJOT.

In AVI’s experience, other foreign investors are usually supportive of proposals, but often are not prepared to be public in their activism.

The manager notes that structures bolstered by cross-shareholdings are often difficult to penetrate and there is resistance to change being imposed from outside. In particular, the big banks and large industrial conglomerates have a tendency to close ranks against outside interference. This does not necessarily rule out such companies from AJOT’s portfolio, but the extra work involved must be justified by the opportunity available.

It is important to emphasise that AVI’s aim with investee companies is not just about getting cash returned to shareholders. It is happy to see sensible mergers and acquisitions (M&A), or action that improves margins and sales. Takeovers are just one potential catalyst, whether by private equity or a parent company. Consolidation within sectors is needed too. The manager feels that it helps AJOT’s cause that it is prepared to make sensible strategic suggestions.

While attitudes to shareholders will not change overnight, the direction of travel is clear, and companies are becoming more open to listening to shareholders’ ideas and are realising that governance needs to improve.

Engagement in practice

While preferring to engage privately, public action has always been part of AJOT’s mandate, using it as an ultimatum if satisfactory progress is not being made behind closed doors. In the early days of AJOT, the portfolio benefitted from two to four specific events in each year.

A good example of this was AJOT’s experience with Toshiba Plant Systems and Services (power plant construction) and NuFlare Technology (semiconductor machinery) which were taken over by their parent company, Toshiba, at the end of 2019.

Both were part of the wider Toshiba Corp group of companies and examples of parent-child structures that AJOT has been campaigning against since launch – partly on the grounds that the rights of minority investors are inadequately protected. Between them, the two positions accounted for about 12.5% of AJOT’s portfolio.

Following pressure from shareholders and regulators, Toshiba Corp launched tender offers for both subsidiaries at meaningful uplifts to then prevailing share prices. In NuFlare’s case, the situation was complicated by a counterbid by optical products company, Hoya Corp, but Toshiba prevailed, helped by another former subsidiary, Toshiba Machine, selling its 15.8% stake in NuFlare to its former parent. These bids added 5.6% to AJOT’s NAV over the year ended 31 December 2019.

As the numbers of independent directors on boards have increased in response to the Governance Code, minorities have found it easier to push back on take-out prices for similar takeovers.

Secom’s May 2021 bid for Secom Joshinetsu is the most recent example of this in AJOT’s portfolio. Secom is a security services company. The subsidiary operates in three Japanese prefectures. Its profitability is derived from maintenance and upgrade work rather than new contracts. About 75%–80% of Secom Joshinetsu’s balance sheet was in cash and it was trading on a fraction of the multiple of its parent. Once Secom decided to buy out its subsidiary, the independent board members on Secom Joshinetsu’s board resisted the parent’s approaches until the final take-out price was fairly close to what AJOT had been asking for (perhaps it was informed by AJOT’s prior communications with the board). The deal added 3.3% to AJOT’s end May NAV.

In 2020, with COVID to fight and earnings under pressure, there was a general feeling in the June AGM season (most Japanese companies tend to hold their AGMs in June) that it was inappropriate to be agitating for change. This translated into a lull in corporate activity. For AVI and likeminded investors, there was also a concern that companies could point to the cash on the balance sheet as justified ‘rainy day’ money in that environment.

However, Japan has seen its first successful hostile bid in some while – in late 2020, Nitori (a furniture retailer) bid for a competitor, Shimachu – and so far in 2021, there has been a strong bounce back in corporate activity levels.

AJOT’s current campaigns

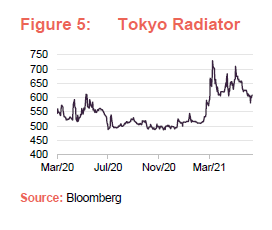

Tokyo Radiator Manufacturing

On 18 May 2021, AVI publicly raised questions over the independence of Tokyo Radiator from its parent company, Marelli, which in turn is controlled by US private equity firm KKR, which has a 40% stake. Marelli appoints Tokyo Radiator’s President.

Tokyo Radiator is a JPY8.7bn market cap company with cash of about JPY9.9bn. AVI notes that half of that cash is deposited with Marelli, it estimates at an interest rate of 0.4%, thereby providing cheap finance to the parent.

AVI asked that Tokyo Radiator:

- take back the JPY5.5bn cash deposited with Marelli and distribute JPY5.3bn of that to shareholders;

- create an audit and supervisory committee to strengthen the supervisory function of the board;

- establish a nomination committee and compensation committee, both with a majority of independent directors; and

- introduce a restricted stock-based compensation system for the non-independent directors (better-aligning them with minority shareholders.

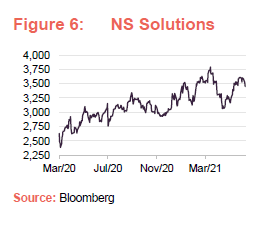

NS Solutions

AVI believes that IT services company NS Solutions, which has a market cap of JPY320bn, has about JPY145bn of surplus cash and investment securities, including a significant stake in Recruit Holdings, an HR company. AVI is keen that NS Solutions invests more in the digital transformation of its business, funding this from its cash pile.

Nippon Steel Corporation owns a 63.4% stake in NS Solutions. Tokyo Stock Exchange Prime Market companies need to have a free float of at least JPY10bn and 35% of issued share capital.

AVI proposed:

- a final-year dividend of JPY62 per share, making a total dividend for the financial year of ¥87 (NS Solutions had proposed a dividend cut from JPY65 to JPY52.5, which as AVI points out would be the first dividend cut since 2009);

- a 5.9% share buyback, which would be used in part to cut Nippon Steel’s stake to help meet the Tokyo Stock Exchange’s 35% free float requirement; and

- the introduction of a stock-based compensation scheme for directors.

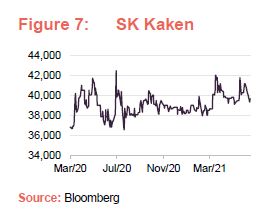

SK Kaken

SK Kaken is a paint and coatings business. AVI points out that the company has underperformed peers and the wider market, trades on less than 1x EV/EBIT and has cash in excess of JPY100bn compared to a market cap of about JPY126bn. About 40% of SK Kaken’s shares are owned by the founding family, who also occupy senior leadership positions. One problem that AVI has identified is that the numerical value of the share price is too high – making it harder to trade in the shares. Another is that SK Kaken has a relatively high number of shares held in treasury which AVI thinks might be seen as overhanging the market, depressing the share price.

AVI proposed that:

- SK Kaken’s shares be split on a 10 for 1 basis; and

- 90% of the company’s treasury shares be cancelled.

Encouragingly, ISS recommended that shareholders vote in favour of AVI’s proposals for each of these three companies and the proposals gathered widespread support from other minority shareholders as well as generating significant commentary in the Japanese press. Each of the proposals was rejected but AVI is undaunted. It expects that the debate that it has kickstarted will continue behind closed doors and, in time, we should see positive developments at these companies.

AVI submitted but later withdrew proposals to four other companies. The proposals were withdrawn after those companies agreed to take action to implement its proposals in whole or in part.

Investment process – how the portfolio is selected

AVI begins by screening the market for companies with excess cash/listed securities. A simple metric for this is to identify companies with greater than 30% of cash relative to their market cap. The data is not always accessible – it has taken a lot of work for the analysts to clean up the figures – for example, sometimes the cash has been lent to the parent company. Screening out the most illiquid companies leaves a pool of about 900 companies.

Not all of these are great businesses – many are effectively zombie companies existing just to provide employment or to service pension payments. It can take time for activism to bear fruit. A poor-quality investee company could destroy value faster than AVI can unlock it.

The next step, therefore, is to exclude loss-making and highly cyclical businesses. AVI wants to invest in companies of reasonably good quality, with resilient business models and the prospect of healthy profit growth. The targets are solid and sometimes high-margin businesses. This leaves about 200 companies.

AVI quantifies the fundamental value of these companies using measures such as EV/EBIT (enterprise value/earnings before interest and tax)– sometimes these are negative and almost all are at least low single digits.

The next question is how might AVI go about unlocking value; for example, are there like-minded shareholders? This step includes dialogue with other key stakeholders. Following this part of the process, the target list will have been whittled down to fewer than 100 companies.

Portfolio construction

From the target list, the manager maintains a single digit number of ‘ready to go’ opportunities on which it has performed detailed due diligence.

Each stock in the portfolio should have the potential to outperform the market on its quality and growth merits. Additional alpha comes from the events that unlock the underlying value.

AJOT is managed with about 20–30 positions and AVI is happy for AJOT to be at the low end of this. The manager applies a risk overlay to ensure that the portfolio is not over-exposed to any one sector or group of companies. The constituents of the portfolio would be roughly equally weighted, but position sizes vary with respect to the strength of the manager’s conviction and the stock’s liquidity. In addition, positions in stocks in which AJOT is engaged in an active campaign to unlock value may be higher.

There is some modest overlap between AJOT’s portfolio and AGT’s. The Japanese strategy was incubated in AGT before AJOT’s launch, and AGT has about 26% in Japan, but only half of its holdings are also represented in AJOT’s portfolio. The overlap has been falling with AJOT becoming more differentiated.

AJOT tends to focus on smaller companies, whereas AGT is constrained to larger opportunities by virtue of its size. AGT can provide additional firepower where this makes sense. Also, AGT can buy large stocks such as Sony and Nintendo which would not suit AJOT’s portfolio.

Ahead of a purchase, the analysts will prepare an internal note on the suitability of a stock for either or both of the portfolios and an allocation decision will be made based on liquidity.

Generally, AVI is prepared to be patient – it can take time to bring other stakeholders around to their way of thinking. The manager would exit a position if it became clear that the desired result was not achievable or if it felt that the quality of the stock had deteriorated markedly.

Investment restrictions

There are no limits on sector weightings within the portfolio. It is not expected that, at the time of investment, any single holding (including any derivative instrument) will represent more than 10% of AJOT’s gross assets. However, AJOT has discretion to invest up to 15% of its gross assets in a single stock if a suitable opportunity arises.

There are no restrictions on AJOT’s exposure to stocks with any given market capitalisation but the portfolio will normally be weighted towards small- and medium-sized companies.

Derivatives can be used for efficient portfolio management purposes and to provide gearing.

Asset Allocation

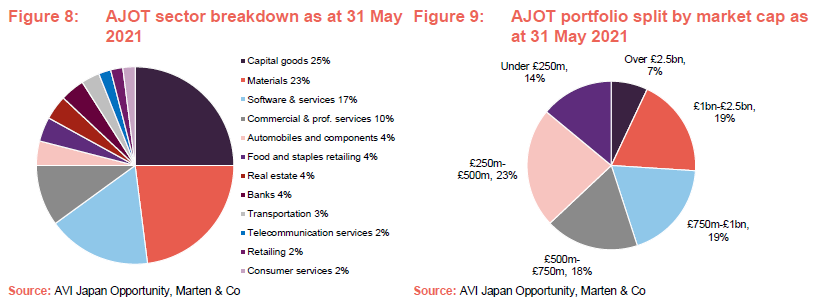

At 31 May 2021, AJOT had 29 holdings. The sector breakdown is a function of the manager’s stock selection decisions. AJOT’s focus on smaller companies is evidenced in Figure 9.

At the end of May 2021, on average 42% of the market cap of stocks held within AJOT’s portfolio was represented by cash on the companies’ balance sheets. Adding in holdings in investment securities and other financial assets, the ratio of net financial value to market capitalisation was over 81%.

A comparison of AJOT with the MSCI Japan Small Cap Index at the end of December shows that the portfolio had, on average, a much higher ratio of free cash flow to EV than the index (19.0% to 6.4%), a much lower EV/EBIT ratio (4.3x to 20.4x) and a slightly higher dividend yield (2.1% to 1.8%).

10 largest holdings

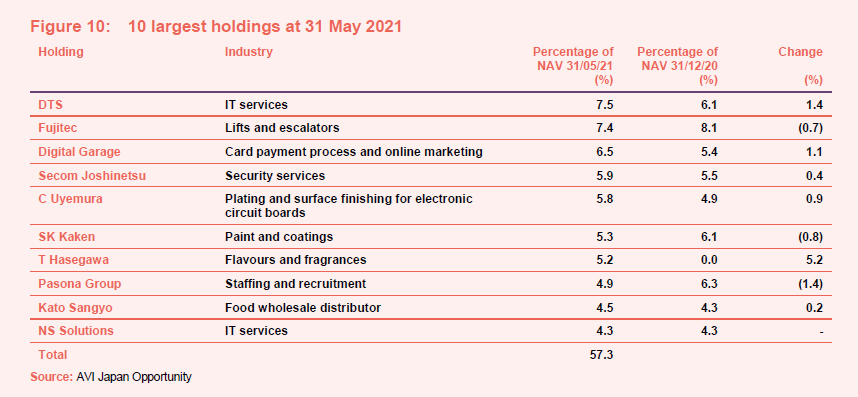

AJOT’s list of its 10-largest holdings has not changed much over the course of 2021, as might be expected given the investment approach. Two of the top 10 – SK Kaken and NS Solutions – were discussed above. AJOT has also been making progress with a number of other positions listed here.

DTS

An IT services company which is building its presence in fields related to digital transformation. It should benefit from government initiatives to transform the economy. AVI likes the business model and says that DTS is one of its highest-conviction ideas within the AJOT portfolio – hence its leading position in the table. The strength of the underlying business is complemented by significant excess holdings in financial assets.

Fujitec

A global lift and escalator company, competing with Kone, Schindler and Otis. AVI published research highlighting scope for operational improvements. In response, Fujitec carried out a strategic review and said it would focus on improving its return on equity, its opportunities in the Chinese market and its higher margin aftersales business. It will scrap its ‘poison pill’ arrangements at its 2022 AGM (these would have diluted any large shareholder displaying hostile intentions). AVI feels that there is scope for consolidation in the sector, but Fujitec now has a couple of years to demonstrate why it should go it alone, or even acquire its competitors.

Digital Garage

Digital Garage’s card payment processing and online marketing businesses should be a beneficiary of the drive to transform the Japanese economy. It recently established a Digital Solutions Department focused on delivering cloud-based solutions for clients. Digital Garage also has a tech venture business, which AVI says has a good track record. One feature of its balance sheet is a valuable stake in an online price comparison site, Kakaku.com. AVI believes that it suffers from an overly complex holding structure. However, AVI is encouraged by steps that the business has taken in an attempt to improve its rating.

C Uyemura

The company produces plating and surface finishing related chemicals for electronic circuit boards. AVI sees growth drivers for the business in fields such as electric vehicles, 5G and the internet of things as it moves into more advanced chip manufacturing. C Uyemura has been hoarding cash, however. Encouragingly, the company recently split its shares on a 2×1 basis and adopted a stock-based compensation plan.

T Hasegawa

A leading global player in the flavours and fragrances market. Sales and profits have stalled in recent years. It is expanding its US manufacturing capability and trying to develop its business in China, with a new research and development plant, and in South East Asia, with a new factory in Malaysia. The balance sheet has a high cash and listed securities exposure.

Pasona

Pasona is a multinational staffing and recruitment company with considerable excess holdings of financial assets – one of the highest in AJOT’s portfolio. This largely takes the form of a stake in Benefit One, which AVI believes is worth a multiple of Pasona’s market cap. Pasona’s underlying business is performing well.

Kato Sangyo

A food wholesale distribution business with considerable holdings in cash and investment securities. AVI notes that the company has delivered a 5% compound annual growth rate in revenue over 23 years.

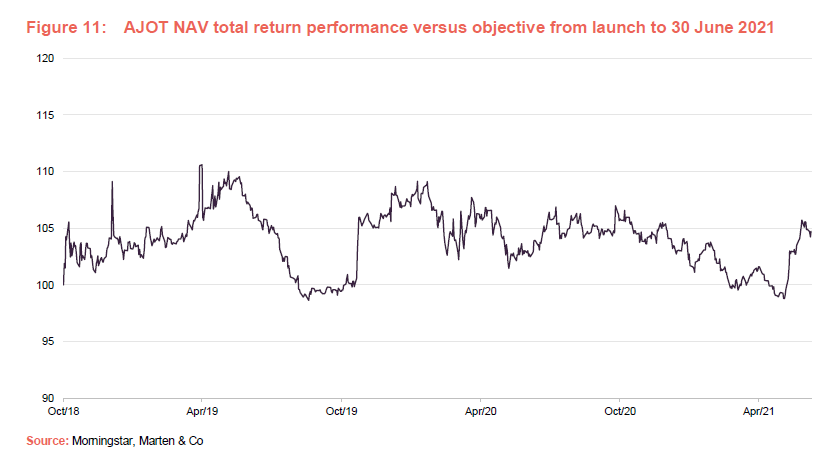

Performance

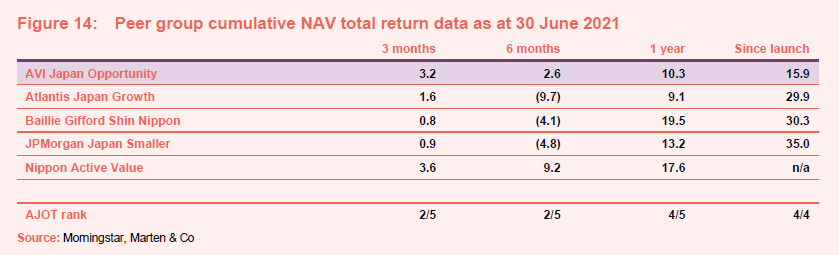

Last year, the Japanese small cap market was led by growth stocks. In the face of COVID-19 and a slowing economy, investors favoured companies that they felt could thrive regardless. As discussed previously, there was also a lull in corporate activity last year, which held back AJOT’s performance.

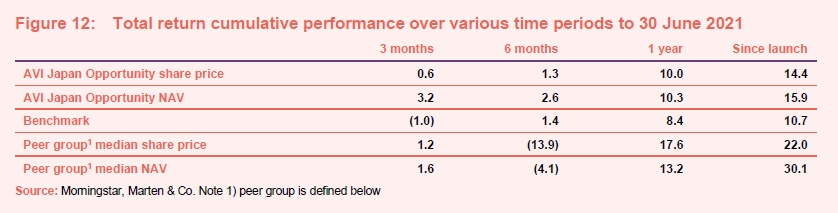

However, over 2021 to date, AJOT’s returns are toward the top end of its peer group and it remains ahead of its benchmark since launch, with performance over June 2021 particularly strong – perhaps reflecting recent campaigns.

Peer group

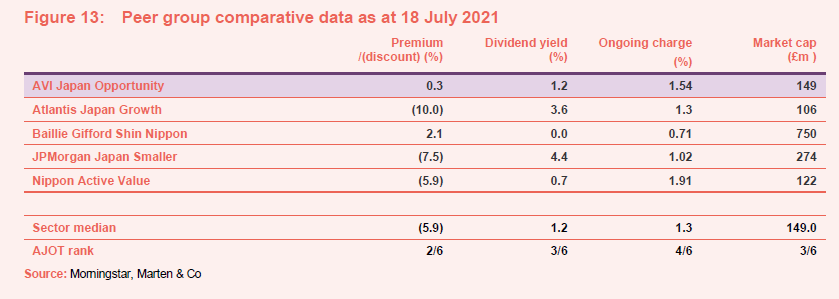

AJOT is a constituent of the AIC’s Japanese smaller company sector. Within this peer group, the closest comparator is Nippon Active Value, which has a similar investment approach to AJOT. The other three are more focused on growth stocks, and this accounts for much of the disparity in the performances of these funds.

Relative to Nippon Active Value, AJOT is about the same size and trades on a higher rating, but has a lower ongoing charges ratio.

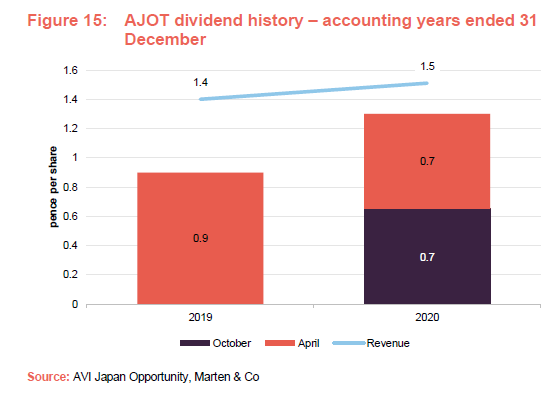

Dividend

AJOT is not managed to produce any target level of income. The board distributes substantially all of AJOT’s net revenue. Since last year, this has taken the form of semi-annual dividends declared in April and October.

At 31 December 2020, AJOT had accumulated revenue reserves of £1,216,000, which have been building since launch as revenue has been ahead of the level of distribution.

Premium/(discount)

Over the year ended 30 June 2021, AJOT’s shares traded as high as an 8.8% premium to net asset value and as low as a 5.3% discount. The average premium over the period was 0.5%. At 18 July 2021, AJOT was trading at an 0.3% premium.

The board recognises that it is in the interests of shareholders to maintain a mid-market price for the ordinary shares that is as close as possible to NAV. The board monitors the discount over rolling four-month periods and will buy back stock if the average discount exceeds 5%. The discount should also be limited by the regular exit opportunity.

At the AGM held in April 2021, shareholders gave the directors authority to issue up to 26,286,000 ordinary shares (then, 20% of AJOT’s issued share capital) over the following 15 months (or up to the next AGM, whichever is the earlier). Shares will only be issued (or reissued from treasury) at a price equal to NAV plus a premium at least sufficient to cover the costs associated with issuing the shares.

The board was also granted permission to repurchase up to 14.99% of the ordinary shares in issue as at 15 March 2021. Shares repurchased may be held in treasury.

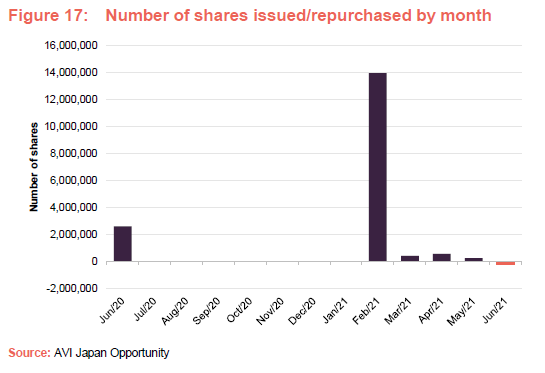

Figure 17 shows the issuance and repurchase of shares by month over the period since 31 May 2020. In February 2021, in response to demand, 12,107,323 new ordinary shares were placed with investors at 115.07p.

Fees and costs

Asset Value Investors Limited is AJOT’s AIFM and investment manager. The manager is entitled to a fee of 1.0% of the lower of AJOT’s market cap or its NAV. 25% of the management fee is reinvested in AJOT shares. The fee is invoiced monthly in arrears. The manager’s contract can be terminated by one year’s notice by either party.

The fee structure is one we like, as it gives the manager an incentive to work with the board to keep the discount narrow.

AJOT’s depositary is JPMorgan Europe Limited, and JPMorgan Chase Bank, London Branch is the company’s custodian. Link Company Matters Limited is the company secretary and Link Alternative Fund Administrators Limited is AJOT’s administrator.

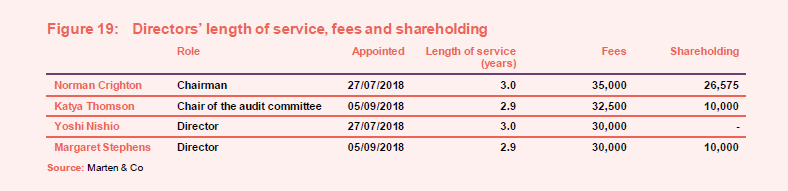

For the year ended 31 December 2020, the management fee amounted to £1.2m, directors’ fees (detailed on page 20) totalled £128,000 and other expenses were £510,000. AJOT’s ongoing charges ratio for this period was 1.56%, down from 1.64% for 2019.

Capital structure

At 18 July 2021, AJOT had 132,370,702 ordinary shares in issue and admitted to trading and no other classes of share capital. An additional 250,000 ordinary shares were held in treasury at that date.

The company’s accounting year end is 31 December and its AGMs are usually held in March/April.

AJOT has an unlimited life, but the directors intend to offer shareholders an opportunity to exit the company at a price close to NAV in October 2022 and every two years thereafter. The exact mechanism for this will be determined around six months in advance following consultations with shareholders.

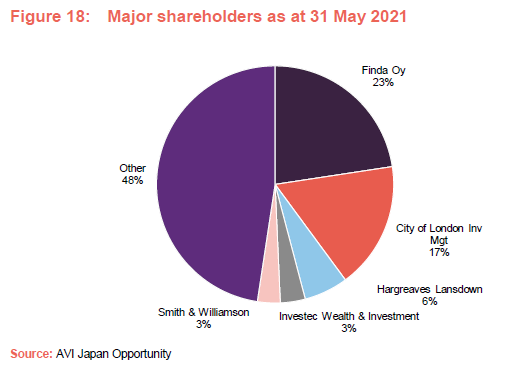

Major shareholders

Gearing and hedging

AJOT’s gearing is capped at 25% of NAV, at the time of drawing down any borrowings, but, in practice, should average around 10%. AJOT has an unsecured revolving credit facility provided by Scotiabank Europe Plc. The JPY4.33bn facility was renewed on 17 February 2021 and matures on 16 February 2022. The interest rate on amounts drawn is LIBOR +0.95%.

AJOT does not currently intend to hedge its underlying currency exposure, but the board and manager keep this under review.

Management team

Joe Bauernfreund (CEO and CIO)

Joe is the portfolio manager of AJOT and the named portfolio manager of AVI Global Trust. He joined Asset Value Investors in July 2002 as an Investment Analyst, following completion of a Masters in Finance from the London Business School. At first, Joe worked closely with John Walton in focusing on the European Holding Companies. He then covered the entire portfolio and became joint manager with John Pennink. Prior to joining Asset Value Investors, Joe worked for six years for a real estate investment organisation in London.

Tom Treanor (head of research)

Tom joined AVI in February 2011. He works closely with the analyst team providing support and guidance on prospective and current investments across the portfolio, in addition to taking responsibility for all investments in closed-end funds.

Tom spent nine years working for Fundamental Data/Morningstar in various roles involving closed-end fund analysis. He has a degree in Economics from the University of Leicester.

Daniel Lee (investment analyst)

Daniel joined AVI in February 2015. He focuses on researching Japanese companies.

Before joining AVI, Daniel completed internships at Pamplona Capital Management and Mercer. He has passed all three levels of the CFA exam, and graduated with a First Class Honours in Physics from the University of Bristol.

Jason Bellamy (investment consultant)

Jason joined AVI in March 2020. He works closely with the analyst team and leads on the engagement efforts in Japan. Jason brings more than 30 years’ experience in the financial services industry, working for and engaging with global companies, government bodies, regulators and international investors including Sumitomo Mitsui Trust Bank, First Trust Advisors and Aberdeen Standard Investments. He is based in Tokyo.

Jason has a degree from The London School of Economics & Political Science (University of London).

Kaz Sakai (investment analyst)

Kaz has been working with AVI since May 2020 researching Japanese companies as he completed his MBA at Harvard Business School and now joins AVI’s investment team in June 2021. Prior to Harvard, he was engagement manager at McKinsey & Company’s Strategy and Corporate Finance Practice in Tokyo. Kaz had previously been with McKinsey & Company from 2011–2016 as a general consultant in Tokyo and an RTS Practice Associate in Melbourne. He also gained valuable private equity experience from 2016-2018. He holds a B.S. in Geochemistry from the University of Tokyo and an MBA from Harvard Business School.

Makiko Shimada (investment analyst)

Makiko joined AVI in January 2021 from Goldman Sachs, where she was a member of the Advisory Group in Investment Banking Division in Tokyo for over three years. She holds a B.A. in Economics from the University of Tokyo.

Ross McGarry (junior investment analyst)

Ross joined AVI in June 2020. He researches global holding companies and provides support to the investment team.

Before joining AVI, Ross completed a one-year programme at Nomura on a UK M&A Investment Banking Industrial Placement. He has a BSc in Economics from the University of Bath.

Yuki Nicholas (Japan team assistant)

Yuki joined AVI in February 2020 as a Japan Team assistant to provide translating support, desk research and other secretarial support to the members of Japan Team.

Yuki previously worked for BZW Tokyo as an assistant to the investment strategist and the economist.

Board

AJOT has four directors, all of whom are non-executive and independent of the manager. No director sits on another board together with another member of AJOT’s board. The directors stand for re-election at each AGM.

Norman Crighton

Norman was, until May 2011, an investment manager at Metage Capital Limited where he was responsible for the management of a portfolio of closed-ended funds. He has more than 27 years’ experience in closed-ended funds having worked at Olliff and Partners, LCF Edmond de Rothschild, Merrill Lynch, Jefferies International Limited and latterly Metage Capital Limited.

His experience covers analysis and research as well as sales and corporate finance. Norman is also a non-executive chairman of RM Secured Direct Lending Plc, Weiss Korea Opportunity Fund and Global Fixed Income Realisation Limited.

Katya Thomson

Katya started her career at Deloitte LLP where she qualified as a chartered accountant in 1996. She has held senior positions in corporate finance at Lazard, ABN Amro Bank NV and Thomas Cook Group Plc. Katya is a member of the Institute of Chartered Accountants in England and Wales. She is also a non-executive director and chairman of the audit committees of Henderson EuroTrust Plc and Miton Global Opportunities Plc and director of The New Carnival Company CIC.

Yoshi Nishio

Yoshi Nishio began his career at Goldman Sachs International, where he had overall responsibility for the trading of Japanese equities and equity derivative products. Since then, he has combined his twin specialisations of finance and media as an investor, advisor and consultant. Much of his work has had a Japanese focus, with clients ranging from family offices to the office of the chairman of Columbia Pictures in Hollywood in the period following the studio’s acquisition by the Sony Corporation, to the Ministry of Finance of the Russian Federation. Yoshi is fluent in Japanese and in English.

Margaret Stephens

Margaret had a 28-year career with KPMG, 16 years as a partner. She was in the Asset Management Group specialising in fund structuring, international M&A and due diligence. She is a member of the Institute of Chartered Accountants of Scotland and trustee, director and chair of the Audit Committee of the Nuclear Liability Fund. Margaret was also a board trustee of the London School of Architecture until April 2020 and a non-executive board member and chair of the Audit and Risk Committee at the Department for Exiting the European Union until its closure in January 2020.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Japan Opportunity Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.