The trust that delivers

The trust that delivers

Henderson High Income Trust (HHI) launched in November 1989, with an objective of generating a high income from a portfolio consisting primarily of UK equities complemented by a modest weighting in fixed interest investments that have been used to enhance income.

Investors might have been forgiven for thinking that the second half of HHI’s objective, “maintaining the prospect of capital growth”, might fall by the wayside. However, by making imaginative use of the flexibility afforded by its investment trust structure, over the past 30 years, HHI has been able to deliver on both parts of its objective. Total returns have been well ahead of the wider UK market; over 14x since launch, compared to 9.4x from the MSCI UK Index.

The puzzle is that, despite an excellent long-, medium- and short-term record and a very attractive yield, the trust is trading at a discount. This is arguably more a reflection of anti-UK sentiment, which might improve soon, than any perceived problem with HHI.

High income from a diverse UK equity income portfolio

High income from a diverse UK equity income portfolio

HHI invests in a prudently diversified selection of both well-known and smaller companies to provide investors with a high income stream while also maintaining the prospect of capital growth. Gearing (borrowing) is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities, which helps dampen the overall volatility of the trust.

| wdt_ID | Year ended | Share price TR (%) | NAV total return (%) | Benchmark TR (%) | MSCI UK total return (%) | ICE BofAML SN-G2 (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Oct 2015 | 9.50 | 9.50 | 0.70 | 0.00 | 3.50 |

| 2 | 31 Oct 2016 | 6.40 | 6.80 | 12.90 | 13.50 | 10.50 |

| 3 | 31 Oct 2017 | 8.80 | 14.20 | 10.20 | 11.80 | 3.70 |

| 4 | 31 Oct 2018 | -4.00 | -5.70 | -0.70 | -0.90 | 0.30 |

| 5 | 31 Oct 2019 | 6.40 | 9.70 | 6.40 | 5.70 | 9.30 |

Fund profile

Fund profile

Henderson High Income Trust (HHI) invests in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high-income stream, while also maintaining the prospect of capital growth.

A majority of assets will be invested in ordinary shares of listed companies with the balance in listed fixed interest stocks (i.e. the trust will not hold unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked and which offer the potential for capital appreciation over the medium term. A maximum of 20% of gross assets may be invested outside the UK.

Gearing (borrowing) is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities. More information on gearing is provided on page 14.

Henderson Investment Funds Limited is the company’s alternative investment fund manager (AIFM) and it delegates investment management services to Henderson Global Investors (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

A history of reinvention but also consistency

A history of reinvention but also consistency

HHI is just about to reach a significant milestone, the 30th anniversary of its listing on the London Stock Exchange in November 1989. The trust, then called TR High Income Trust (the existing name was adopted on 21 March 1997), has had the same investment objective throughout its life. It expanded considerably in 1996 when it merged with Henderson Highland Trust. In August 2000, it was reconstructed as a split capital investment trust; ordinary shareholders were issued with zero dividend preference shares (ZDPs) alongside their ordinary shares. These ZDPs had a fixed life that ended on 30 September 2005. In the summer of 2005, it was decided that the trust should revert back to having a single class of shares with gearing provided by bank borrowings. This is the structure that HHI maintains today. In 2017, HHI expanded again as shareholders in Threadneedle UK Select Trust were given the opportunity to rollover their investment into HHI.

Remarkably, over its 30-year life, HHI has had just four managers. Perhaps more surprising is that three still manage funds within Janus Henderson’s range of UK equity income funds. Job Curtis was the manager from launch until 1995. Kate Murphy was manager for two years before Alex Crooke took over the reins in 1997. He passed on responsibility for HHI to David Smith in 2015 (he had been the deputy manager on the trust since 2012). Job, Alex and David still work together closely, as part of the 14-strong global equity income team, backed by an extensive team of fund managers – including the small cap team led by Neil Hermon – and analysts (both in London and in Denver).

Blended benchmark

Blended benchmark

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index. For the purposes of this note, we have replaced the All-Share with the MSCI UK Index.

Excellent long-term returns

Excellent long-term returns

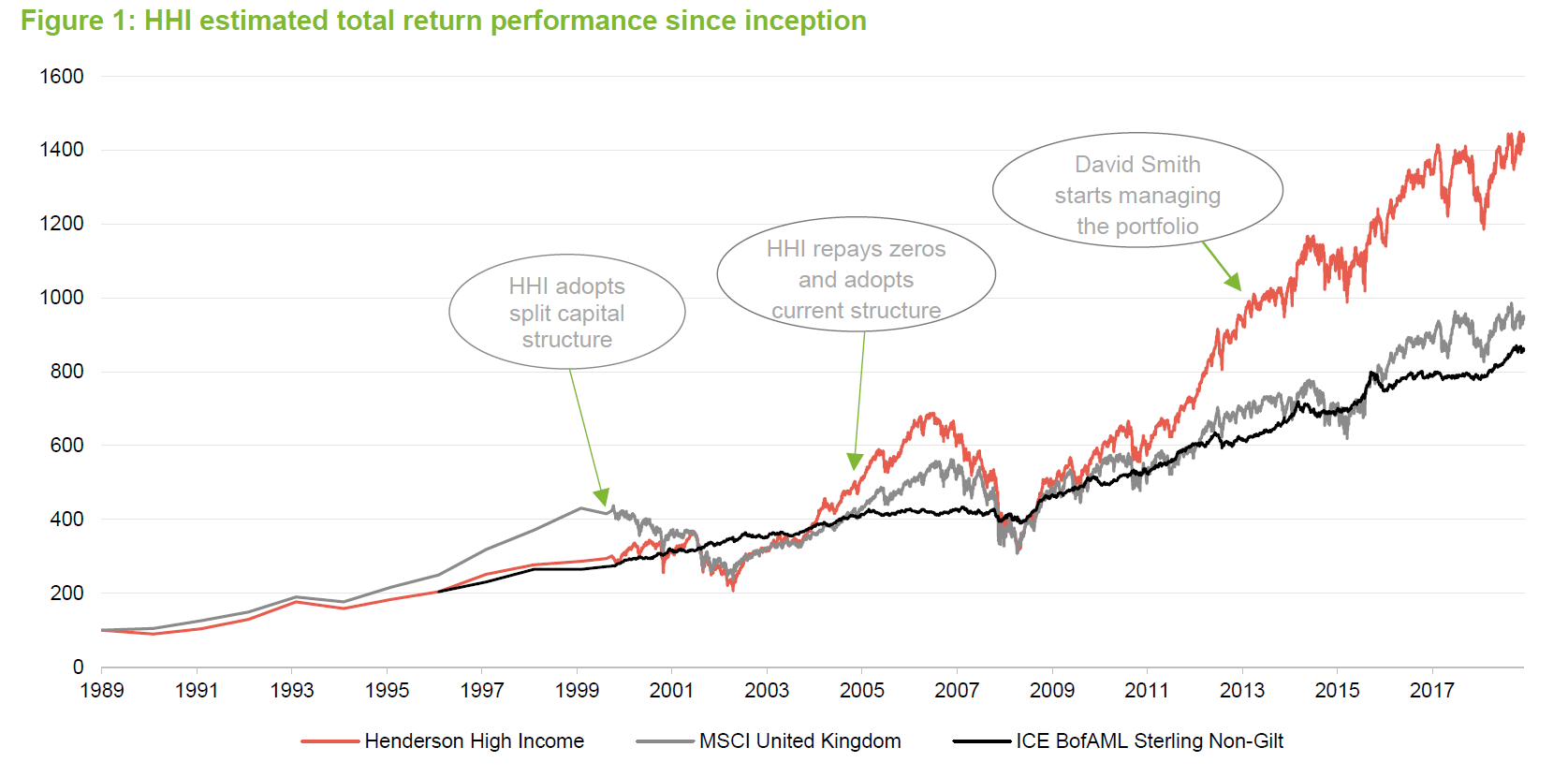

Over its life, HHI has delivered returns well ahead of both the UK equity market and sterling corporate bonds, with particularly strong performance over the past decade.

The chart in Figure 1 shows the HHI’s estimated total return performance since its exception. This uses annual total return data supplied by Janus Henderson Investors for the period from HHI’s launch to its reconstruction as a split capital trust in the summer of 2000. Thereafter, daily total return data is available from Morningstar and this has been used. From a launch price of 100p and dividends in the first full calendar year of 6p per share, the NAV rose to 177.7p on 14 July 2000 and an annual dividend in 1999 of 7.1p per share.

Figure 1 also includes comparisons against the MSCI UK Index and the ICE Bank of America Merrill Lynch Index. Data for the MSCI UK Index is available since HHI’s launch and so this series also starts at 100 in 1989. This shows that HHI has comfortably outperformed the MSCI UK Index since inception.

The total return series for the ICE Bank of America Merrill Lynch Index is only available from the start of 1997. We have therefore rebased that index to the value for HHI at the date the index. Figure 1 illustrates that HHI has comfortable outperformed the ICE Bank of America Merrill Lynch Index since this index’s inception.

Investors of £1 at launch have received 237.6p back in dividends. Had they reinvested these along the way, their shareholding would be worth over 14 times their original investment, compared to 9.4x for the MSCI UK Index. It is remarkable that a trust designed to provide a high income could have outperformed the wider UK equity market by such a margin.

Quality focus in face of uncertainty

Quality focus in face of uncertainty

David Smith acknowledges that we are late in the economic cycle and there is clear evidence of slowing growth. In the face of this, the portfolio has been made more defensive and there is a bias to quality within the portfolio.

Brexit has clearly overshadowed the UK market to the extent that it may have become oversold. David points out that the passing of the ‘Benn Act’ lessened the threat of a ‘no-deal’ Brexit and this triggered a rally in more domestic-focused UK stocks. These received further support in mid-October when hints of a deal started to emerge. Sterling’s strength is closely related to the threat of a ‘no-deal’ exit and this impacts on the valuations of stocks with overseas earnings.

In the face of this uncertainty, David has been focusing on companies whose earnings are likely to be less affected by whatever happens on the Brexit front. David feels that a Corbyn-led government may pose a greater threat to sentiment than the prospect of a ‘no-deal’ Brexit, and this is another reason to try to focus on quality and income sustainability, while seeking to balance the portfolio between domestic and overseas earners.

The portfolio has some exposure to industries such as oil and tobacco, which are out of favour with some investors on environmental, social and corporate governance (ESG) grounds, but nonetheless are still generating strong cash flows. Good governance is an essential requisite for stocks being considered for inclusion within the portfolio and David also considers environmental and social factors when assess companies. While a company operating in a contentious industry is not blocked, however, David seeks to understand the company’s policy to ESG risk factors and how they manage them. As with managing a business’s operational and financial risks, those companies with good processes towards managing ESG risk factors generally outperform. Janus Henderson uses a number of third party ESG research providers along with an internal dedicated team to help David analyse company specific ESG risks and rate their policies and processes relative to their peers. Those companies that score poorly are avoided while companies that only have an average rating can be owned but are actively engaged with.

The investment approach emphasises the importance of diversification within the portfolio. The mid-cap stocks within HHI tend to offer greater prospect of dividend growth than the big defensive companies (companies whose businesses are less sensitive to changes in economic conditions) that are the mainstay of most UK equity income funds. The income boost from the bond portfolio affords the opportunity to include these within the mix.

The managers of the bond portfolio (see overleaf) are convinced that the world is mired in low growth and low inflation, for the foreseeable future. When yields were rising in the second half of 2018, David was allocating more money to this part of the portfolio and that decision has helped both the revenue account and the trust’s performance in 2019.

Investment process

Investment process

David Smith is responsible for stock selection in the equity portfolio, asset allocating between bonds and equities and setting the day-to-day level of gearing. The split between bonds and equities in the portfolio varies, but is typically 20:80. The bond portfolio will usually be funded in whole or in part by gearing and the margin achieved on the bond portfolio (HHI’s cost of borrowing is about 2.5% and the yield on the bond portfolio is about 4.5%) supplements the income account and allows HHI to hold lower yielding, and higher dividend growth equities, without compromising the trust’s dividend paying ability.

The bond portfolio is managed by John Pattullo and Jenna Barnard, part of a five-strong Strategic Fixed Income team. They are supported by Janus Henderson’s wider fixed-income team. John and Jenna’s approach to managing bond portfolios, and their views on the fixed interest market, have been explored in depth in QuotedData’s notes on Henderson Diversified Income Trust, one of the other funds that they manage. These are available on our website.

Within the global equity income team, each manager has a good deal of autonomy and are accountable for the performance of their funds. The managers on the team are generalists, and get to know investee companies directly rather than relying on analysts’ views. That said, there is considerable proprietary research available to David – regular meetings and a centralised system enable the sharing of research across the whole group, including the analysts based in the US.

Three-legged stool

Three-legged stool

For inclusion within HHI’s portfolio, each stock has to pass muster on each of three criteria – fundamentals, financials and valuation. If a stock fails on one criterion, it will be excluded from the portfolio.

- Fundamentals – the process places strong emphasis on companies that display market leadership, good visibility of earnings, strong franchises, proven management and robust defensible business models with high barriers to entry that cannot be disintermediated.

- Financials – companies with the fundamental characteristics outlined above should also demonstrate sustainable returns. David is also looking for cash generative companies with robust balance sheets; that have invested in their businesses; have a sustainable dividend policy – the payment of dividends should not compromise investment in the business; and where management’s interests are aligned with shareholders.

- Valuation – companies should be paying dividends and offer the prospect of dividend growth. They should be valued at a discount to David’s estimation of their fair value (offering upside in absolute terms) and attractively valued relative to their peers. The valuation should also be underpinned in some way (for example, by realisable assets) so that the downside is limited. David aims to own companies for the long-term. He looks two-to-three years out when valuing businesses.

David believes that there is a sweet spot for equity income investors of companies offering yields between about 2% and 6%. Within this range, companies tend to offer a good combination of yield and dividend growth. Above this level, it is more common to see dividend cuts/omissions and stocks that fall into value traps.

achieve a balanced portfolio, David focuses on three types of stock: stable growth companies that can provide good dividend growth through a cycle, such as Relx and Diageo; high yielders that provide a good base level of stable, predictable income, such as GlaxoSmithKline and National Grid; and quality cyclicals that provide strong dividend growth during economic upswings but given their quality nature can still pay and maybe grow their dividend in more challenging times, such as Whitbread and Victrex. Utilising gearing and owning bonds to boost income means HHI can own lower yielding companies that offer more dividend growth, typically those stable growth companies and quality cyclicals.

Asset allocation

Asset allocation

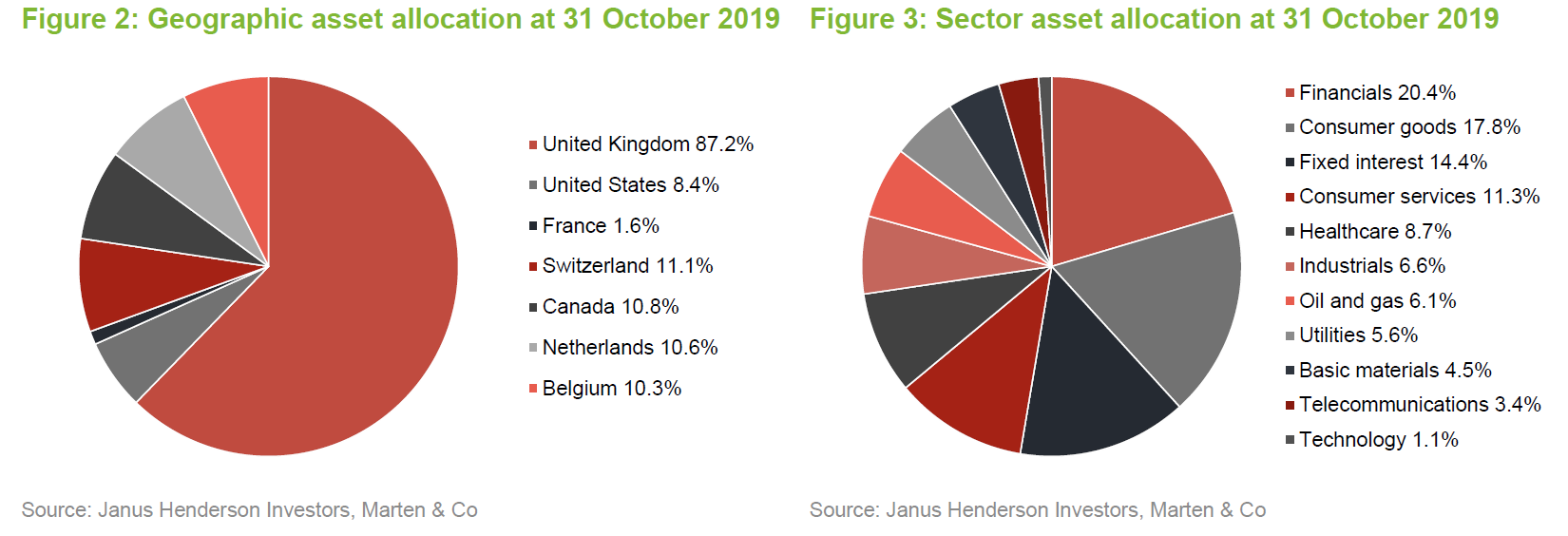

As Figure 2 shows, HHI is making use of its ability to access overseas companies. The sector allocation suggests that, relative to the UK market, the equity portfolio has an overweight exposure to consumer goods and services and an underweight exposure to oil and gas and industrials. Whilst the healthcare weighting broadly matches that of the UK market, it is one of the areas where the manager is using overseas stocks to complement the narrow choice available in the UK.

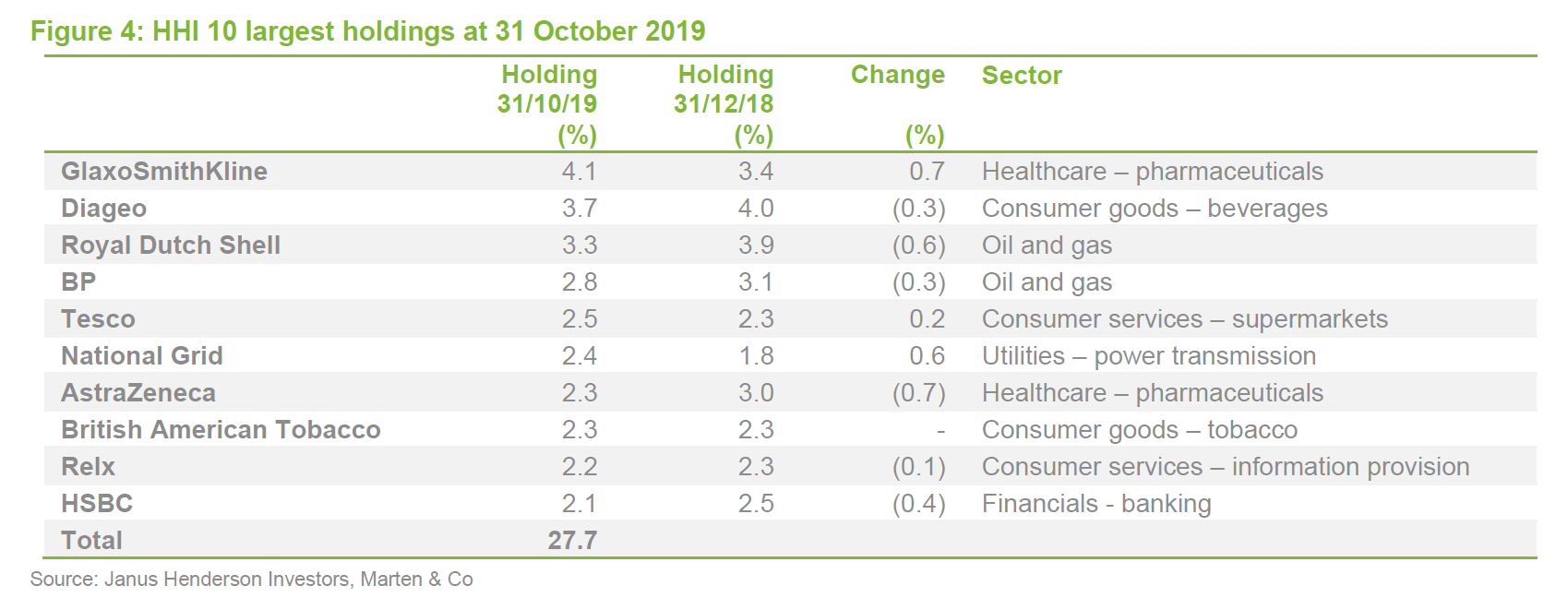

The list of the 10 largest holdings is relatively stable, as you might expect, given the investment approach. Each of the stocks featured was present in the portfolio at the end of 2018, although the manager has added to the positions in Glaxo SmithKline and National Grid.

The 10 largest holdings accounted for 29.3% of the portfolio at the end of 2018, and this had fallen slightly to 27.7%. The portfolio is reasonably diversified; at the end of October 2019, HHI had 102 holdings (including fixed interest investments).

Total gearing at the end of September was 22%, but a large part of this was being used to finance the fixed interest portfolio, which helps dampen the overall volatility of the trust. At the end of September 2019, fixed interest and preference share holdings made up 14.8% of the portfolio, equivalent to about 19% of net assets. Gearing towards equities is just 3% currently.

We asked the manager to talk us through some recent purchases and some less-typical investments within the portfolio. Purchases in 2019 include Reckitt Benckiser, Sanofi, National Express and Unilever. Sales include Barclays, ITV, Deutsche Post and Munich Re.

Hilton Food group

Hilton Food group

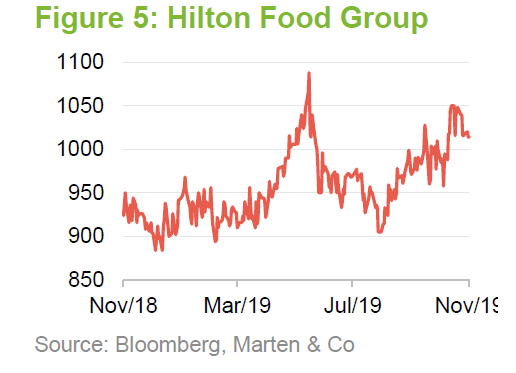

Hilton Food Group (www.hiltonfoodgroupplc.com) packages meat for Tesco at a facility in Huntingdon. HHI first invested when it had its initial public offering (IPO) in 2007 and it is now one of its highest-conviction positions. Hilton used to supply around half of Tesco’s meat but now has a near monopoly. After coming in for some criticism, Tesco has been seeking to improve relations with its suppliers and works with them more collaboratively. The increased scale of Hilton’s businesses has delivered cost savings that it has been able to share with Tesco. This isn’t all of its business, however. It has been expanding in Europe, where it serves a range of retailers including Ahold Delhaize, and in Australia, where it has been increasing its business with Woolworths. It offers a yield of 2.5%, growing at around 10% a year with good visibility of earnings.

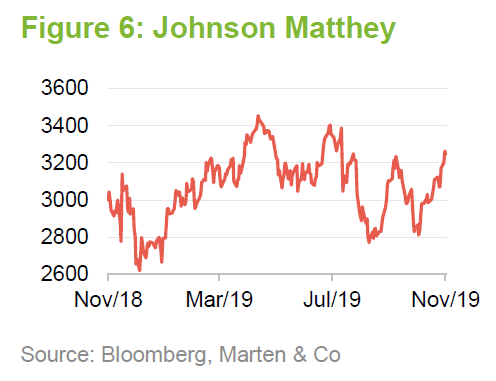

Johnson Matthey

Johnson Matthey

Johnson Matthey supplies the platinum-base catalysts incorporated in diesel vehicles. Despite it generating a high return on invested capital (ROIC), its shares have been weak as investors fret about the decline of diesel-fuelled vehicles in the face of demands to increase air quality. David believes that investors are overly negative about the prospects for this business and overly optimistic about the pace of growth of electric vehicles. He feels that revenue from catalyst sales (which accounts for about 40% of Johnson Matthey’s business), especially in relation to trucks, will be sustained at higher levels for longer.

The company also derives revenue from the sale of fine chemicals and industrial catalysts. It has exposure to new battery technologies. These are moving closer to commercialisation and revenue from this area could offset the decline of catalyst sales. The Johnson Matthey product is eLNO – a low-cobalt, nickel cathode that allows greater energy density within the battery and gives it a longer life. It also results in faster charging and speedier acceleration. Johnson Matthey has good relationships with OEMs, which could help with take-up of its product. David notes that battery stocks such as Umicore trade on much higher multiples than Johnson Matthey does (30x versus 12x).

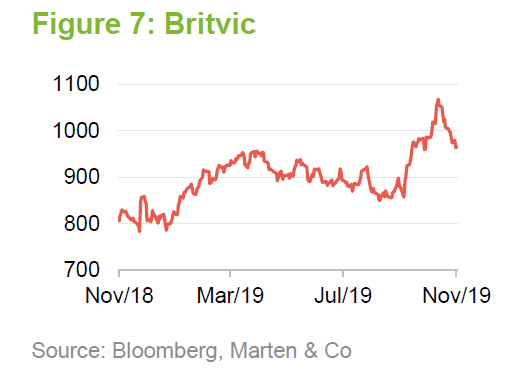

Britvic

Britvic

Britvic is a Pepsi bottler as well as the owner of brands such as Robinsons squashes. It has been investing in its manufacturing facilities and this could be a driver of revenue growth as it is now able to supply a wider variety of pack sizes – including 250ml cans, which offer higher profit margins than traditional 330ml cans.

Even small incremental sales growth can translate into much higher profits. David estimates that sales growth of 1%-2% could rise to 2%-3%. This could mean profit growth of 6%-7%, which coupled with buybacks, could mean earnings per share (EPS) growth of 10%. Britvic trades on 15x which is a discount to other consumer staples brands.

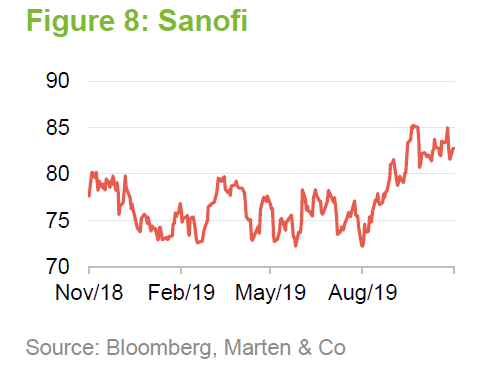

Sanofi

Sanofi

Sanofi was trading at a discount to the pharmaceutical sector, as it was seen as something of a sleepy company. A new finance director has joined (ex-Peugeot) and it is thought that he will aim to streamline the business and improve its profitability. Margins are too low currently. The company has also been investing in its pipeline, aiming to secure longer-term sales growth.

The inclusion of Sanofi and Roche within the portfolio allows HHI to have more exposure to the sector without having an overly concentrated position in Glaxo and AstraZeneca. This is the strength of being able to hold up to 20% in overseas stocks.

Other recent additions include British Airways and Bellway. David wanted to maintain some balance of exposure within the portfolio to cyclical stocks. Both companies are out of favour with investors and therefore fit well with the investment ethos.

Performance

Performance

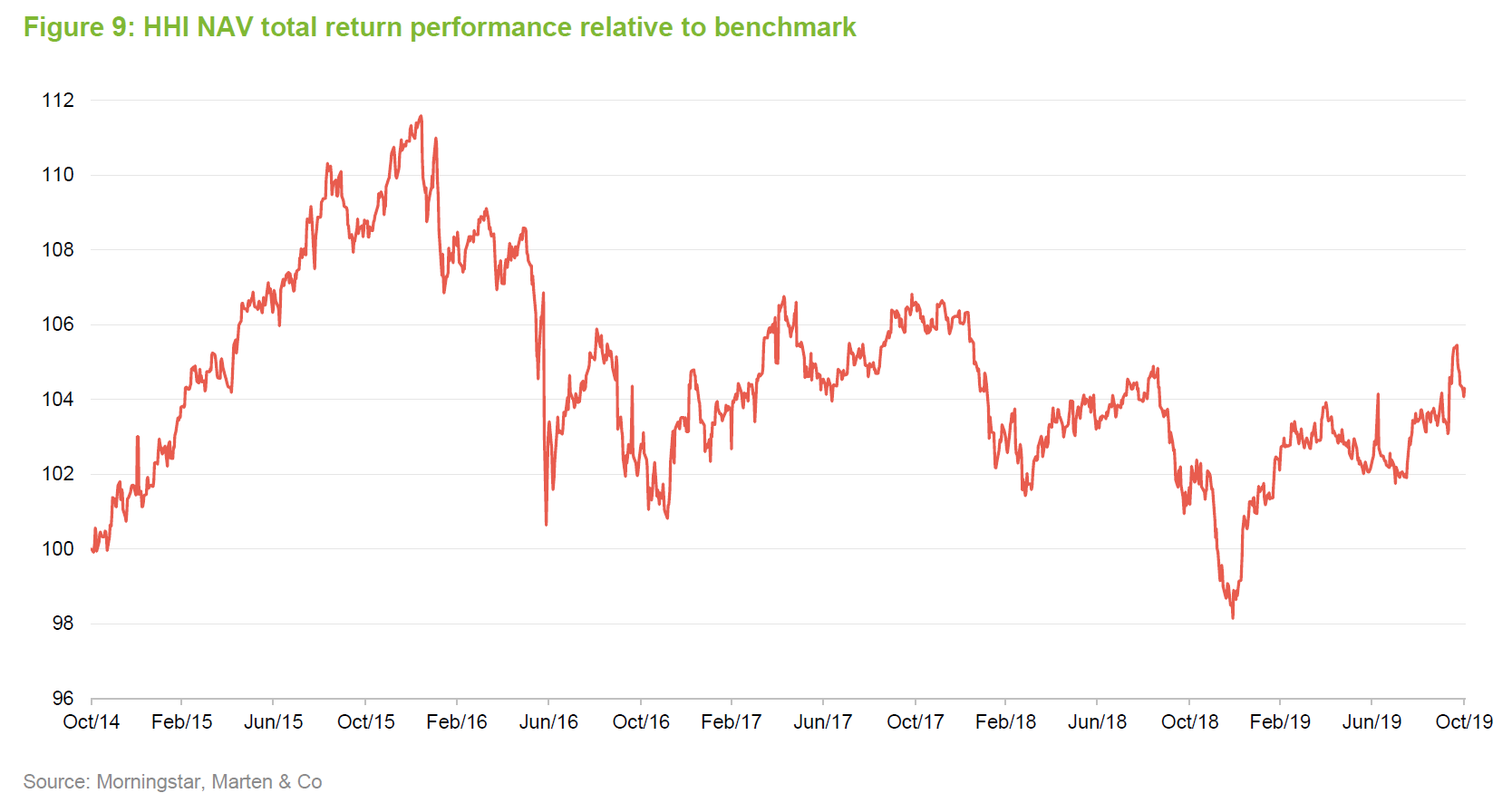

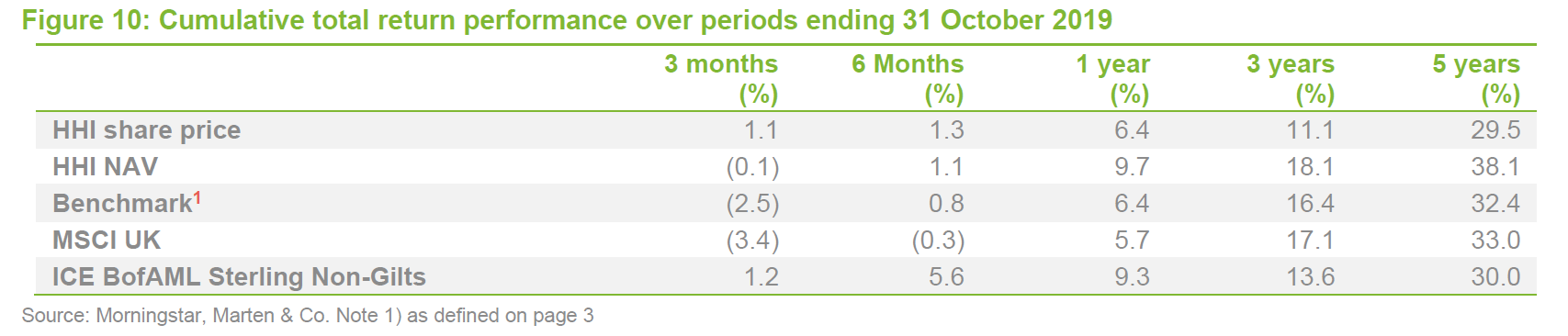

Over the five years to the end of October 2019, HHI has delivered an NAV total return ahead of the benchmark (as defined on page 3). Strong outperformance in 2015 was reversed in 2016, as investors became more focused on ‘growth’ stocks, and HHI’s domestically-focused portfolio was impacted by the Brexit referendum. In the face of these headwinds, the manager has been able to claw back some outperformance of the benchmark.

This is reflected in its cumulative performance numbers where HHI is now ahead of the benchmark over all of the time periods shown in Figure 10.

Shorter-term returns

Shorter-term returns

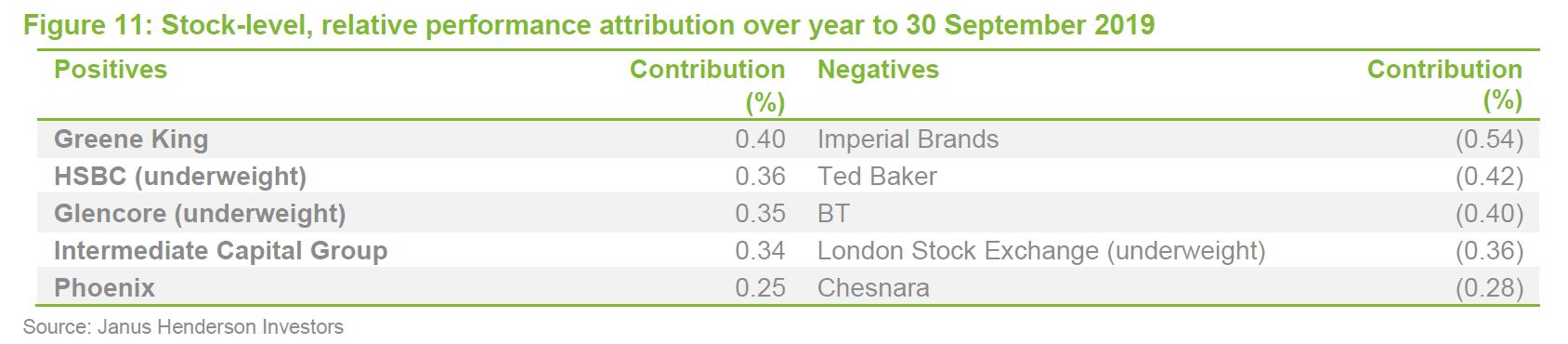

The manager kindly supplied us with some stock-level relative performance attribution data, covering the year to the end of September 2019.

Greene King was the subject of a £4.6bn recommended cash offer by a vehicle controlled by Li Ka-Shing. Shareholders approved the offer on 9 October 2019.

Relative to the wider UK market, it was helpful that HHI was underweight HSBC and Glencore, but not holding London Stock Exchange (LSE) held back returns. The LSE was the subject of a failed approach by Hong Kong stock exchange, but it is the company’s prospective tie-up with data provider Refinitiv that has driven its share price higher.

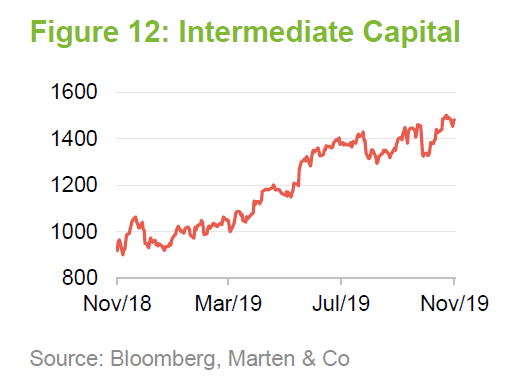

Intermediate Capital Group has been delivering strong growth in assets under management. Its dividend was upped by 50% year-on-year. Phoenix Group has been rebounding this year from poor performance in the second half of 2018. The company bought the Standard Life Assurance business in a deal that concluded at the end of August 2018. Its interim results statement, released in August 2019, suggested that the integration of the two businesses was going well.

On the downside, Imperial Brands has been hit by increased regulatory uncertainty surrounding is vaping business and, perhaps, the growth of ESG investing. Ted Baker was impacted by the loss of its founder and deteriorating profitability (which culminated in October with a profit warning).

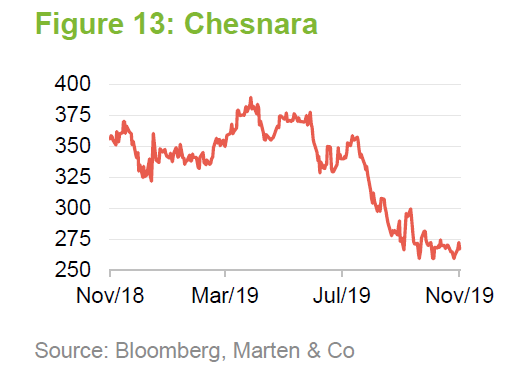

BT has a sizeable investment programme to fund, and there were concerns that this might put pressure on its dividend. Its share price has recovered since the end of September as those fears were allayed. Chesnara’s shares slid over the summer. Interest rate cuts weighed on financials generally but a High Court judgement that blocked the transfer of annuities from Prudential to Rothesay Life (one of Chesnara’s competitors) called into question Chesnara’s ability to grow through acquisition.

Peer group

Peer group

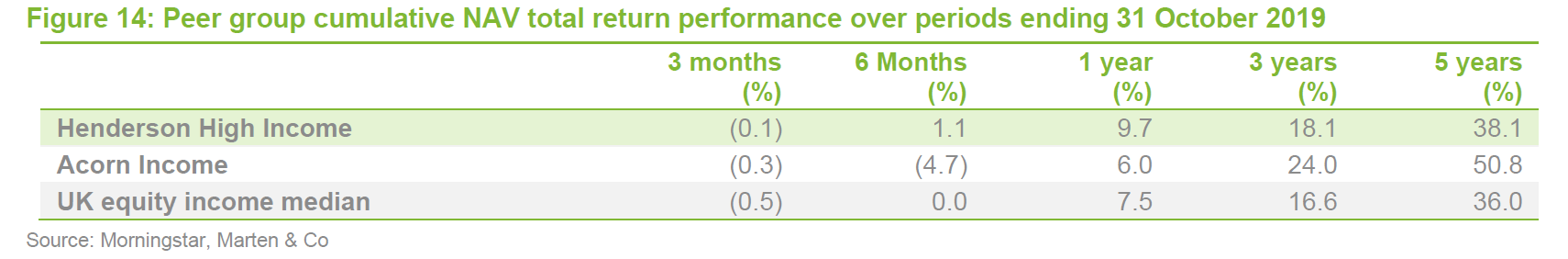

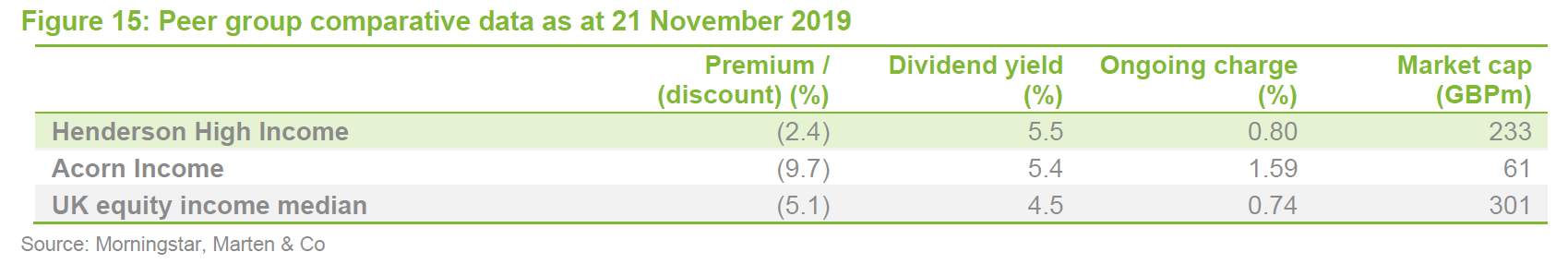

HHI sits within the AIC’s UK equity income and bond sector. There is just one other constituent, Acorn Income, and that is a split capital trust with a small-cap focus. Acorn’s capital structure amplifies NAV moves, both positive and negative. The manager feels that the trust is best compared to the UK equity income sector.

The UK equity income sector is far more populous, with 26 constituents. HHI’s returns are well-ahead of the median of this peer group over all time periods and, were it a constituent, HHI would be the highest yielding. Within that group are a few investment companies with unusual structures or asset exposures including British & American (highly geared and significant biotech exposure), Value & Income (large property weighting) and Law Debenture (subsidiary engaged in commercial activity). The closest comparator to HHI is probably Shires Income, which is a smaller trust and whose fixed interest investments are largely represented by preference shares.

As Figure 14 shows, Acorn Income’s capital structure has helped it outperform HHI over three and five years, but HHI’s returns are consistently ahead of the UK equity income median over all time periods.

HHI’s discount is narrower than Acorn Income’s, reflecting the volatility of that trust and its small size, but broadly in line with the median of the UK equity income sector. Its yield ranks second only to Acorn Income and its ongoing charges ratio is about average for its size. There are 13 funds in this analysis which are smaller than HHI. One of these is already being absorbed by a larger trust. There is room for consolidation within the sector and, on past performance, HHI could be a consolidator (as it has done in the past).

Dividend

Dividend

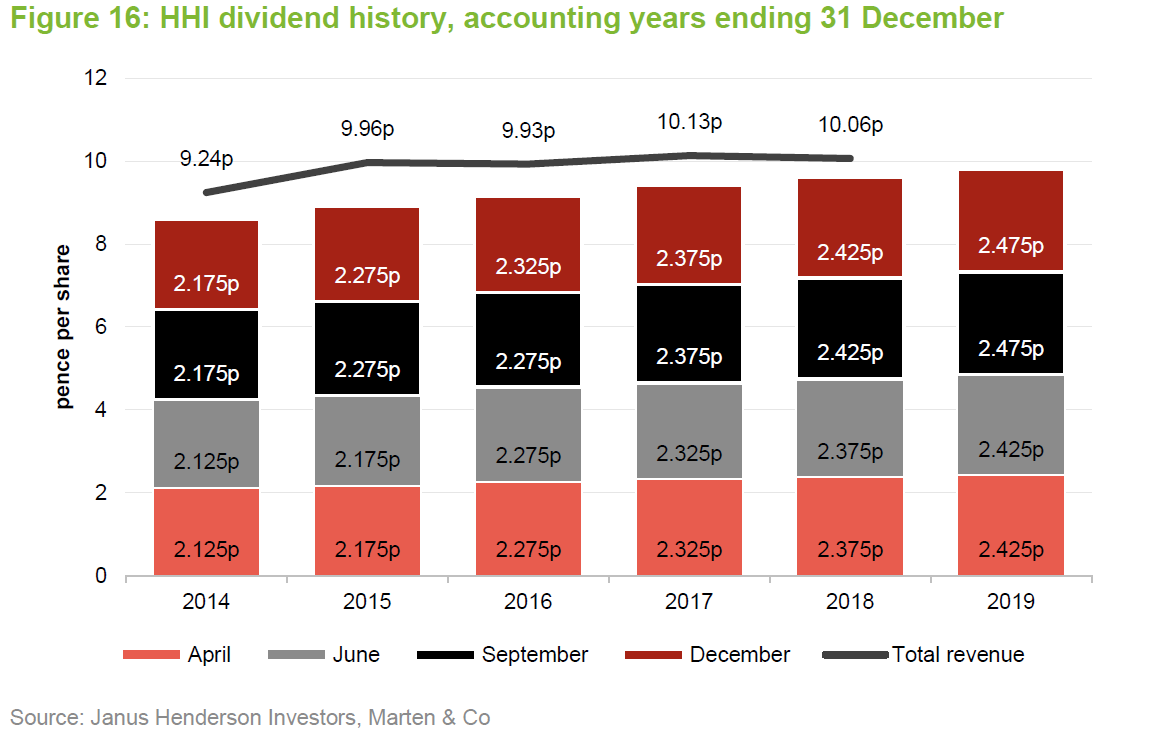

HHI pays quarterly dividends, roughly equal in size, that go ex-dividend in April, June, September and December. As Figure 16 shows, HHI tends to pay dividends that are well covered by earnings. The consequence is that the trust has been building its revenue reserve. This stood at £9.57m at 31 December 2018, equivalent to just over nine months of dividend.

The total dividend for 2019 will be 9.8p. This is almost 14% higher than the level in 2014 and well-ahead of the increase in inflation (between December 2014 and September 2019, UK CPI increased by 8.4%).

Since 2012, when David Smith started working on the trust, the emphasis has been on growing the dividend and this has been achieved, as Figure 16 shows. The small drop in revenue in 2018 over 2017 reflected a small drop in the quantum of special dividends declared in 2018.

Longer-term charts of HHI’s dividends show a dip in 2005, this reflects the shift from a split capital structure to a more conventional one that we discussed on page 3, and another in 2010. This latter one is misleading – the timing of the payments was adjusted slightly and one quarter’s dividend fell into the next calendar year – shareholders did not miss a dividend payment.

Discount

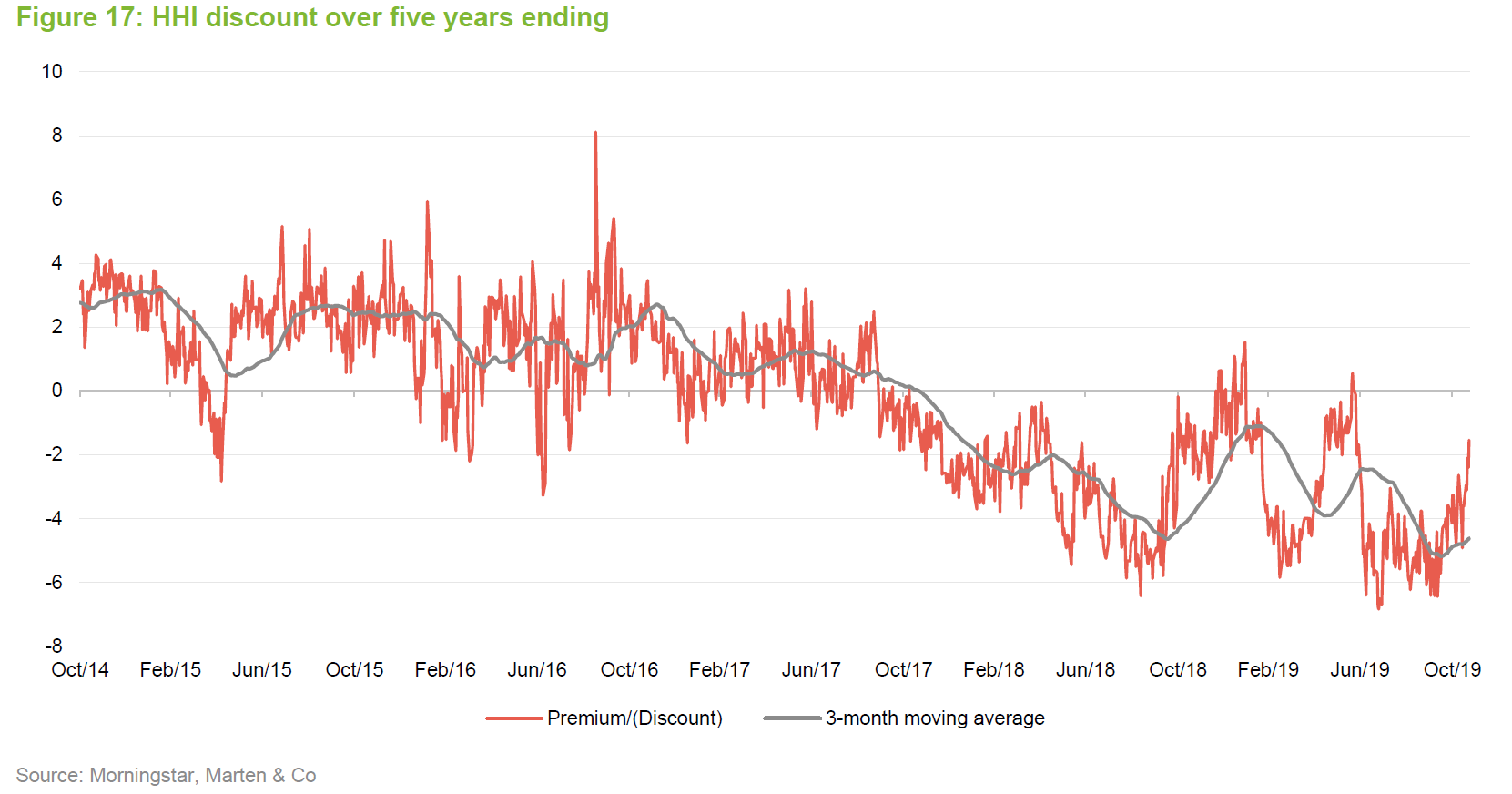

Discount

HHI’s discount has been on a widening trend over the past three years. Over the year to the end of October 2019, the discount moved within a range of a 6.8% discount to a 1.5% premium and averaged a 3.1% discount. On 21 November 2019, the discount was 2.4%.

Although the discount is wider than the board and manager would like, it has not been so wide over the course of 2019 that the board felt it necessary to use the buyback powers granted by shareholders. At each annual general meeting (AGM), the board asks shareholders to approve the issuance of up to 10% of the issued share capital and the repurchase of up to 14.99%. Shares repurchased may either be cancelled or held in treasury and reissued when there is sufficient demand. Shares will only be issued at a premium to net asset value (which would enhance the asset value for existing shareholders).

Fees and costs

Fees and costs

HHI’s base management fee is charged at 0.5% on the first £250m of adjusted gross assets (gross assets less current liabilities and less any investment in Janus Henderson or the funds it manages and advises) and 0.45% on assets above this figure. There is also a performance fee, calculated annually, of 15% of returns above the benchmark return plus 1%. The performance fee is capped at 0.4% of average adjusted gross assets in the year under consideration, with the excess carried forward for up to three years to offset against subsequent underperformance. There is also a high watermark.

Janus Henderson and its subsidiaries provide accounting, company secretarial and general administrative services to HHI, and delegates some functions to BNP Paribas Securities Services.

The company’s ongoing charges ratio rose from 0.75% to 0.80% from 2017 to 2018. This reflects a decline in the NAV – fixed costs were spread over a smaller base.

Capital structure and life

Capital structure and life

At 21 November 2019, HHI had 128,596,278 ordinary shares in issue and no other classes of share capital.

The company’s accounting year end is 31 December and AGMs are held in May, in London. The rollover of assets from Threadneedle UK Select (referred to on page 3) brought with it several shareholders in the Channel Islands. The company organised a presentation by the manager in Guernsey shortly after the 2019 AGM and may repeat the exercise in future years.

At the next AGM, shareholders will be asked whether they want to approve the continuation of the trust. It seems reasonable that the resolution could pass fairly convincingly, given the trust’s record.

Gearing

Gearing

HHI is permitted to borrow up to 40% of gross assets but, in practice, gearing will usually be lower than this, and the majority of it tends to be used to finance fixed interest investments rather than just gearing the equity portfolio. The trust should exhibit lower volatility of returns than a pure equity trust with similar levels of gearing. HHI has a £45m floating rate revolving credit facility provided by Scotiabank, which will expire on 29 June 2020, and a £20m unsecured note which pays a sterling coupon of 3.67% per annum (split into two equal payments in January and July). The note will expire on 8 July 2034.

At 31 October 2019, HHI’s net gearing was 24%.

Board

Board

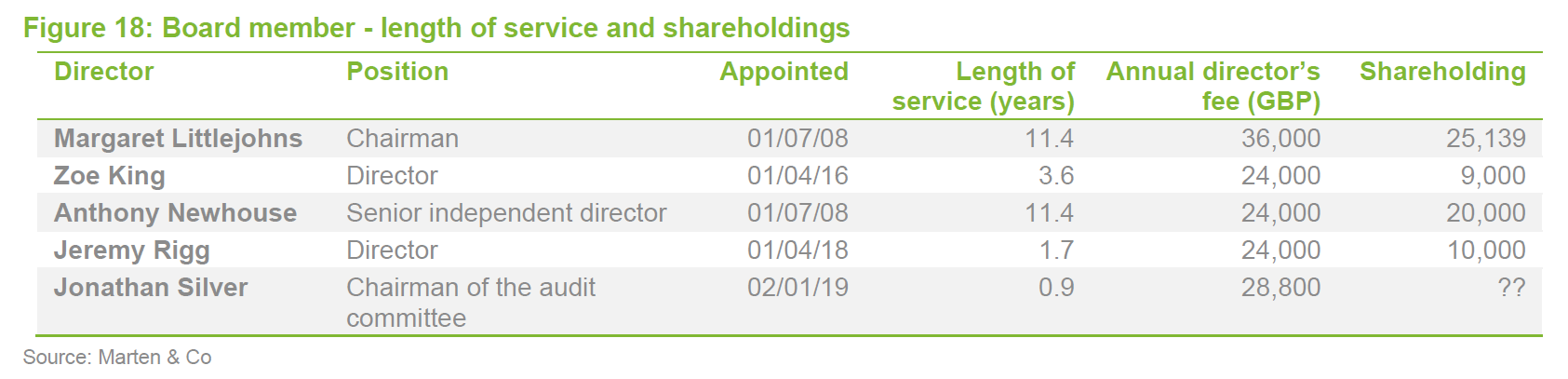

HHI’s board consists of five directors, all of whom are independent of the manager, non-executive and who do not sit together on other boards. HHI is implementing a board succession plan over a five-year time frame (between 2016 and 2021). The newest recruit to the board was Jonathan Silver, who replaced Janet Walker as chairman of the audit committee. Margaret Littlejohns intends to step down as chairman in May 2021, following the continuation vote planned for the 2020 AGM.

One large shareholder voted against the re-election of Anthony Newhouse at the 2019 AGM, presumably on the grounds that he has been on the board since 2008. However, this is a non-issue given that Mr Newhouse will step down from the board following the AGM in 2020, in line with the board’s succession plan.

Margaret Littlejohns

Margaret Littlejohns

Margaret spent the early part of her career with Citigroup, gaining 18 years’ experience in both the commercial and investment banking divisions, latterly specialising in derivatives and market risk management. Between 2004 and 2006, she co-founded two start-up ventures providing self-storage facilities to domestic and business customers in the Midlands, acting as finance director and company secretary until the businesses were sold to a regional operator in 2016. She was a non-executive director of JPMorgan Mid Cap Investment Trust plc from 2009 to 2019, and latterly chairman of its audit and risk committee. In 2017, she became a non-executive director of Foresight VCT Plc and in 2018 she was appointed to the board of UK Commercial Property REIT Limited, where she serves as chairman of the risk committee. She is also a trustee of The Lymphoma Research Trust and a member of the development committee of Southern Housing Group.

Zoe King

Zoe King

Zoe is a director of Smith & Williamson Investment Management Limited, specialising in the management of private client portfolios. She also acts as an independent director to the Dunhill Medical Trust investment committee and is a member of the Trinity College Oxford investment committee, the Carvetian Capital Fund investment committee and the Stramongate S.A. shareholder advisory committee. She was formerly a vice president at Merrill Lynch Mercury Asset Management and a fund manager at Foreign & Colonial Investment Management. She graduated from Oxford University in 1994.

Anthony Newhouse

Anthony Newhouse

Anthony is a solicitor who was a partner in Slaughter and May until 2008. He began his career in the City in banking and joined Slaughter and May in 1976, becoming a partner in 1984. He had a wide-based domestic and international corporate finance practice, advising many UK-listed and other corporate entities. He has subsequently been a member of the PwC advisory board, a visiting professor at the London Metropolitan University Business School and is currently an honorary treasurer of the Royal Philharmonic Society.

Jeremy Rigg

Jeremy Rigg

Jeremy has over 20 years’ experience within the investment management industry, having held roles at Schroder Investment Management (UK) Limited and as a senior investment manager at Investec asset Management. In 2004, he was a founding partner of Origin Asset Management, a boutique equity investment manager, which grew successfully and was acquired by Principal Global Investors in 2011. Jeremy is currently an independent investment consultant. He graduated from St Andrews University in 1989.

Jonathan Silver

Jonathan Silver

Jonathan has held various senior financial positions, including 21 years as chief financial officer on the main board of Laird Plc from 1994 to 2015. He is a non-executive director and chairman of the audit committee of Spirent Communications Plc, a position he has held since 2015. He is also chairman of the audit committee at Invesco Income Growth Trust Plc, having been appointed in 2007. Since 2017, he has been a non-executive director of East and North Hertfordshire NHS Trust. Jonathan is a member of the Institute of Chartered Accountants of Scotland.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson High Income plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.