Pantheon Infrastructure

Investment Companies | Update | 6 March 2024

Compelling opportunity

At just over two years old, the Pantheon Infrastructure Trust (PINT) can claim to have seen a lot in its short life. Its positive NAV return over this period, despite increasingly challenging economic conditions, is a testament to the execution of the fund’s advisers, and the stability of its assets.

Whilst the company’s shares have fallen, this is more a reflection of negative market sentiment towards the broader infrastructure sector than any fundamental weakness on the part of PINT. Promisingly, as inflation began to trend lower, sentiment towards the sector improved steadily, particularly for companies such as PINT which maintained financial discipline as funding costs rose. Over the last few weeks, discounts have widened once more due to the rebound in inflation. However, despite these short-term fluctuations, we believe the PINT portfolio remains well positioned for significant growth.

Global high-quality infrastructure with strong ESG credentials

PINT aims to provide access to a globally diversified portfolio of high-quality infrastructure assets, primarily in developed OECD markets, which are expected to generate sustainable attractive returns over the long term. It targets co-investment assets that have strong ESG credentials and underpin the transition to a low-carbon economy.

Market Backdrop

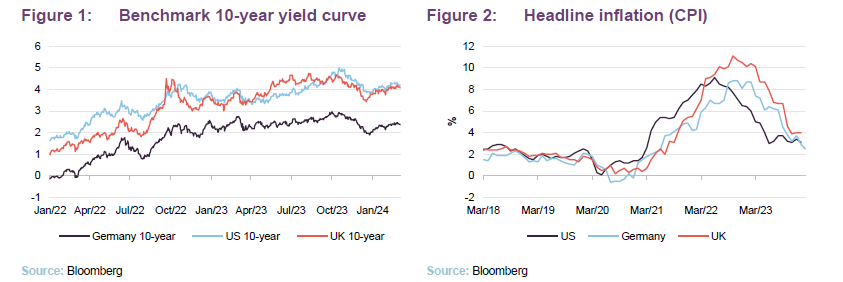

By now, the challenges faced by PINT and the broader infrastructure sector over the past 12-18 months are familiar. As interest rates rose to stem the tide of a dramatic surge in inflation, investment flowed towards risk-free government debt and away from capital intensive sectors such as infrastructure and utilities where income premiums no longer justified capital risks. Since the end of 2023, however, the narrative has improved, with yields tumbling in December as inflation finally appeared to surrender to falling energy prices and the eventual normalisation of supply chains.

As markets began to price in a series of rate cuts over 2024, easier financial conditions juiced a global equity rally despite headline inflation still running at almost twice the target rate in the UK and Eurozone. Unfortunately, this enthusiasm hit a speed bump in January as an unexpected uptick in inflation across developed markets sent yields skyward once more. The data provides a timely reminder that although rate cuts remain likely in 2024, market pricing for imminent and rapid cuts may be too aggressive in light of the macro backdrop.

For a period, easier financial conditions helped support a steady recovery in PINT’s shares. While this has reversed over the last few weeks, there remain several factors that should hold the company in good stead going forward.

For one, while inflation remains elevated, particularly in the UK and Eurozone, based on current data it seems reasonable to assume that rates have peaked for the cycle and should be on their way down in 2024. This removes a key pillar of uncertainty for the infrastructure and utilities sectors where much of the recent selling has been driven by negative sentiment surrounding rates, rather than the fundamental reality of many companies within the sector. With interest rate expectations now heading down, this should allow the market to take stock of companies such as PINT which are, in our view, now drastically oversold.

The mechanical impact of falling rates should also be beneficial for PINT, reducing financing costs and discount rates, while its yield of around 5% becomes increasingly attractive as risk-free rates normalise. However, whilst the market views falling interest rates as a positive, it is important to make the distinction between disinflation driven cuts and cuts which stem from concerns around growth. In the US, where growth remains above trend, it appears to be the former; however, with GDP forecasts in the UK and Eurozone barely above zero, it is hard to make the same judgment.

With its diversified portfolio, PINT has exposure to US markets (36%) where growth remains resilient; however, around 60% of its assets are in weaker markets in the Eurozone and UK. It would be easy, then, to assume that this is a negative for PINT. However, the ‘defensive growth’ sectors favoured by the managers should actually have a net positive effect on the portfolio as capital flows towards sectors of the market that can offer real growth despite deteriorating economic conditions. PINT has investments in secular growth industries with inflation linkages, regulated revenues, and recession-proof demand.

Q3 update

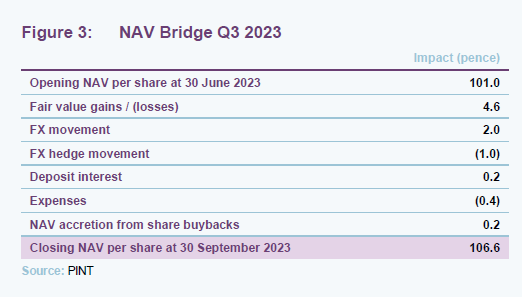

The NAV increased by 5.5%, driven by improvements in the underlying fair value of its assets

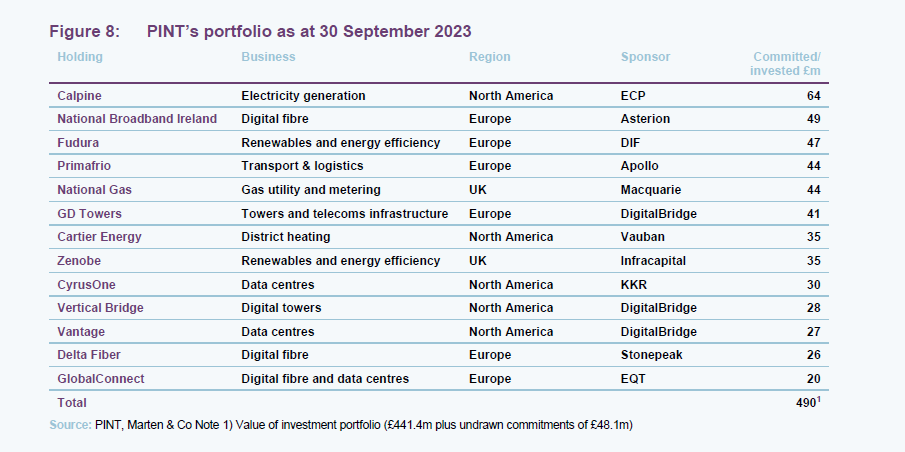

PINT’s third quarter update for the three months to 30 September 2023, published on 15 December 2023, provided further evidence of the company’s resilience. The NAV increased by 5.5%, driven by improvements in the underlying fair value of its assets, particularly Calpine, CyrusOne, National Gas and GlobalConnect. Notably, all but two of its investments achieved positive returns. Foreign exchange movements also contributed thanks to appreciation of both the EUR and USD vs. the GBP. Full contributions to NAV throughout the quarter are shown in Figure 2.

Investment activity during the period included a £35m commitment to invest in UK battery storage and EV fleet specialist, Zenobe (with the funds drawn subsequent to the period end). This is discussed in more detail on page 6.

Cash totalling £19.4m was advanced under existing commitments. This was primarily on the investment into GlobalConnect, which had been committed to in the previous quarter. The company also invested £2.8m into the acquisition of its own shares at a weighted average discount of 21.6% to the NAV.

Asset allocation

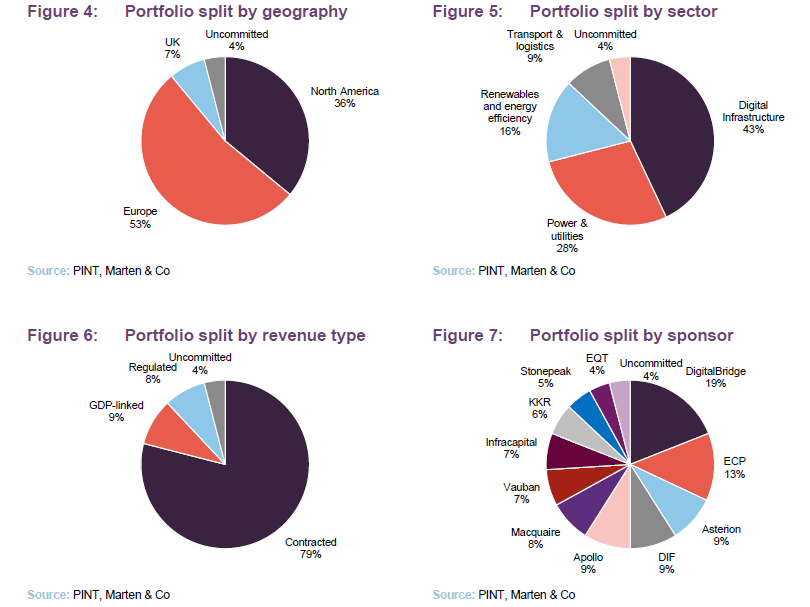

The following charts are based on PINT’s Q3 2023 update using data as at

30 September 2023 (note: the charts reflect the portfolio as a percentage of GAV).

Since our last note, there has been a significant move in the company’s cash position following investments in Zenobe and GlobalConnect (a pan-Nordic data centre and fibre business). As such, the company’s uncommitted capital fell from 19% to 4%, while its European exposure increased to 53%.

In terms of sector allocations, the additions to the portfolio have increased renewables and energy efficiency and digital infrastructure exposure.

As at 30 September 2023, the company had a NAV of £506.5m, comprising the investment portfolio valued at £441.4m, net working capital of £68.5m and a derivative mark-to-market liability of £3.4m. In addition, the company has a £115m revolving credit facility which was unused, reflecting the conservative approach to balance sheet management that has served it well as financing costs have risen dramatically.

New investments – Zenobe

£35m commitment to Zenobe in conjunction with Infracapital

On 7 September 2023, PINT announced that it had committed £35m to Zenobe (zenobe.com) through a co-investment vehicle managed by Infracapital, the infrastructure equity investment arm of M&G. Infracapital, an existing investor and majority shareholder, contributed c.£270m, with funds managed by New York listed alternatives giant KKR investing c.£600m, to acquire joint control of Zenobe.

Zenobe is the leading EV fleet and battery storage specialist in the UK, supporting bus operators through fleet electrification and charging infrastructure design, while also providing a range of services involving transmission grid-scale batteries to National Grid.

The investment was the latest in a series of fundraising by Zenobe, which had already secured around £1.8bn of equity and debt finance since it was founded in 2017. The scale of the deal highlights the potential value that exists in the space and further investments over the past six months point towards a company which is expanding rapidly, capitalising on its competitive advantage in battery technology, and EV infrastructure.

The company’s market leading position was identified by Pantheon as a significant factor in its investment decision. The dominant positioning of its grid-connected batteries and services has enabled Zenobe to negotiate long-term trading floor contracts and grid services contracts including a deal to supply reactive power to the grid, the first battery project of its kind to achieve such an arrangement. These types of contracts greatly increase the downside protection of the investment and have enabled the company to secure capital to finance new projects, including a £147m project finance deal announced in January for its Kilmarnock South battery storage site, allowing Zenobe to fully capitalise on the rapidly developing thematic tailwinds driving the sector.

As more intermittent renewables supply comes online, such projects are expected to become increasingly important to manage grid capacity. This increases the capacity of the transmission system without having to upgrade infrastructure. Currently, the UK has just 4.5GW of storage in operation, (3GW of pumped hydro, and 1.5GW of batteries), and the government’s Climate Change Committee estimates that the UK will require 18GW of flexibility capacity to hit its decarbonisation targets by 2030.

The ability to attract financing further entrenches the competitive advantage established by the company’s existing scale, and this is helped further by the technical and commercial expertise required to grow these battery assets and services. This includes sourcing and developing grid connection points which are crucial given the localised nature of voltage fluctuations and battery requirements, with the company leveraging the knowledge of its advisors, including the company’s non-executive chairman Steve Holliday (a former CEO of National Grid).

By 2026, Zenobe aims to support ~4,000 electric buses, trucks, and commercial vehicles on the road

Whilst initially established as a pure play battery technology business, the company has also been investing heavily in fleet electrification, predominantly through EV buses and related infrastructure, with plans to expand this into other forms of heavy-duty vehicles. The segment now represents a significant portion of the company and by 2026, Zenobe aims to support ~4,000 electric buses, trucks, and commercial vehicles on the road, significantly increasing its market share, which already stands at ~25% of the UK’s EV bus market, and benefitting from market leading position in Benelux, Australia and New Zealand.

Its successful expansion in the EV space is thanks in part to the company’s unique approach to the existing bus services, which are traditionally operated by councils and private bus operators often working within tight financial constraints. Zenobe provides funding solutions for EV bus operators, along with guarantees around charging and infrastructure provisions, mitigating both the technology and operating risks that would pose a significant barrier to the operators looking to transition their vehicles and systems from diesel to electric.

Leveraging this service, the company has also been able to lock in contracts and integrate physical infrastructure with some of the leading providers in these markets, increasing switching costs and making it harder for other players to enter the market. These relationships have also been beneficial for the company’s growth ambitions, with global operators integrating Zenobe’ s electric bus and charging infrastructure in their already established overseas markets. There are currently ~37,500 buses in operation in the UK of which only~1,800 are electric, implying a considerable growth opportunity with over 95% of the country’s bus fleet yet to transition to electric.

Crucially, although current regulations have been supporting adoption through various subsidies and other measures, operational costs for EV buses have come down drastically. In some cases, supported by Zenobe’s long term financing, bus operators are beginning to see that electric vehicles are comparing favourably to diesel equivalents meaning adoption can be driven purely through commercial means in the future, a milestone which lays the foundation for a significant ramp up in growth.

Given the company’s exposure to a range of commercial batteries, Zenobe has also committed significant resources to creating a circular economy by recycling and repurposing batteries that no longer meet specific commercial requirements for the EV side of the business. When the battery comes to the end of its useful life in its EV bus application, it is still applicable for smaller capacity applications such as portal power and on-site static power for construction sites, festivals and film shoots that require on site temporary power sources. Zenobe can earn revenues from these refurbished batteries and pass the monetary and carbon savings onto customers compared to the alternative diesel generator.

Each of Zenobe’s business segments continue to grow strongly and since PINT’s initial investment, the company has maintained its momentum, announcing several new rounds of financing to help fuel its growth strategy. With an established base in markets across the UK, New Zealand, and Australia, the company is now targeting expansion into the US, and Europe, a key to which will be the guidance of new partner, KKR who bring a global network and extensive expertise in scaling growth assets.

For PINT, the opportunity to invest alongside partners KKR and Infracapital in a highly sought-after asset highlights the quality of their existing relationships and pipeline. With the investment making up around 7% of the PINT fund, the potential upside from Zenobe’s expansion is significant, and provides investors with a unique opportunity to gain exposure.

Outside of Zenobe, PINT also made a recent investment in pan-Nordic data centre and fibre business GlobalConnect, which we covered in our last note. You can view this here.

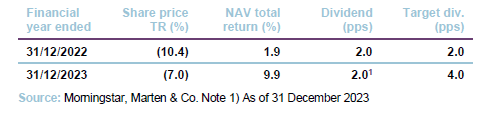

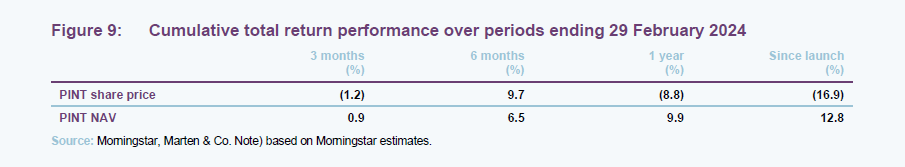

Performance – strong NAV growth

Despite broader macro-economic headwinds, PINT’s portfolio has continued to grow solidly, reflecting the quality of its underlying assets. As we have discussed, this is particularly notable given that around 60% of its assets are invested in markets where growth has been flat or negative over the past year, highlighting the benefits of a portfolio that is able to generate stable earnings regardless of the economic cycle.

Unfortunately, the company’s share price performance does not currently reflect its underlying fundamentals, with market sentiment still tied to the trajectory of interest rates in the short term.

Peer group

Up-to-date information on GCP and its peers is available on the QuotedData website

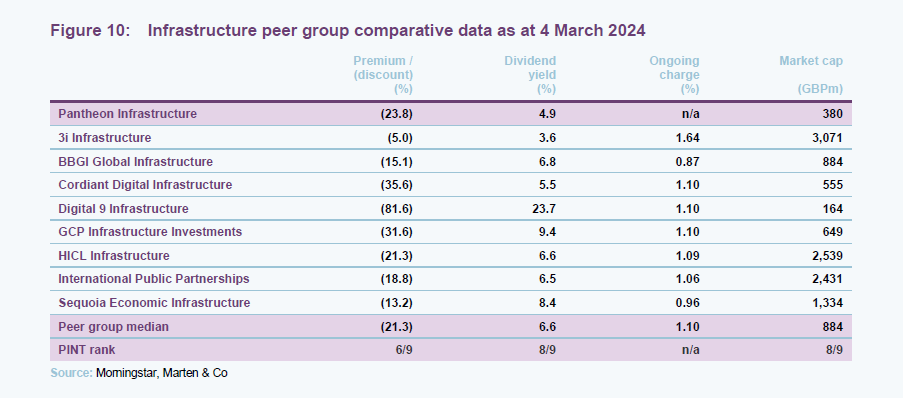

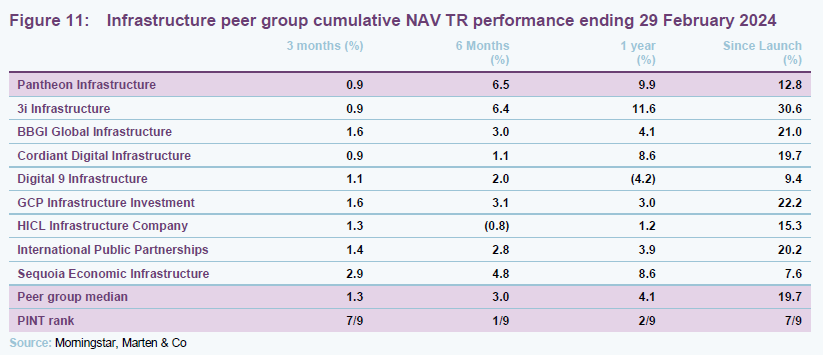

PINT sits within the AIC’s infrastructure sector, which is made up of three funds that invest predominantly in public/private partnership project equity (BBGI, HICL and International Public Partnerships), two digital infrastructure funds (Cordiant Digital Infrastructure and Digital 9 Infrastructure), two infrastructure debt funds (Sequoia Economic Infrastructure, and GCP Infrastructure), and one fund (3i Infrastructure) which invests more in demand-driven assets. We have excluded the Infrastructure India fund due to its risk profile, which does not align with the rest of the sector.

Median discounts in the infrastructure sector have been trending in the right direction over the last few months, reflecting improving global sentiment around the trajectory of interest rates; however, they remain deeply depressed compared to historic averages. PINT’s discount is just on the wrong side of the peer group median, although it is worth noting that 3i infrastructure, the company with the most similar structure to PINT, trades on a much tighter discount of just 5.0%. Promisingly, PINT’s NAV returns are amongst the best in the sector in over the past 12 months and we expect that this should provide some support to PINT’s share price going forward.

PINT’s 6.5% NAV total return over the past six months is the best in the peer group and its 9.9% return over the past year sits just behind the leader, 3i Infrastructure. Returns since launch reflect the lag effect as the capital raised at IPO was deployed. Over time, this effect should become less pronounced as those investments mature.

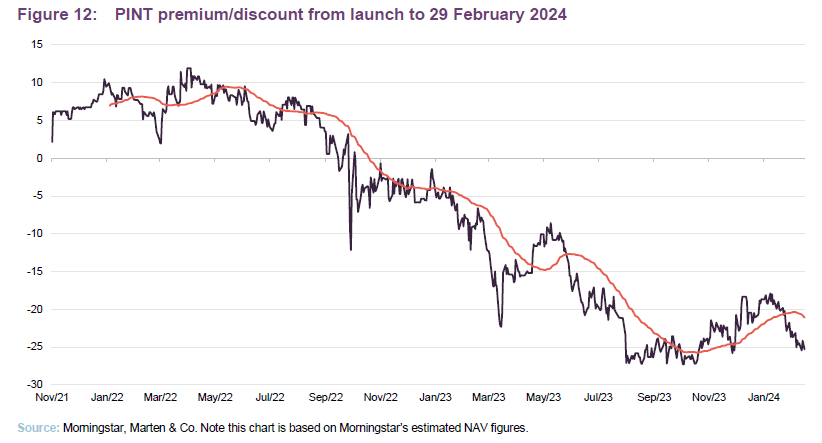

Premium/(discount)

Over the 12 months period to 29 February 2024, PINT’s shares traded between a discount of 27.3% and 6.6%. On average, the discount was 19.8%. As of publishing, this was 23.8%.

In order to help address the current share price, PINT’s board authorised a buyback programme on 31 March 2023, with a total consideration of up to £10m. Over the six months to 30 September 2023, 4.835m shares were bought back into treasury. Since then, a further 5.615m shares have been repurchased into treasury.

As of publishing, every constituent of the AIC’s infrastructure sector is trading on a discount. Whilst we would agree that some level of re-pricing was necessary, given the effects of one of the fastest-tightening cycles in history, the depth of the current sell-off appears to be far detached from the fundamental realities. This is especially the case when we consider the earnings resilience of many of these companies, particularly for PINT, given the structure of its portfolio.

Balance sheet

PINT now has access to a £115m RCF plus a £185m uncommitted accordion facility

As of September 30,2023, PINT had undrawn commitments of £48.1m including the £35m Zenobe commitment announced on 7 September 2023, and its £115m revolving credit facility (RCF) was fully undrawn. Functionally, the increase in the RCF provides PINT with an efficient and flexible way to cover its risk buffers and working capital needs. It also provides additional liquidity in the event of potential investment opportunities. However, the managers have noted their intention to maintain a conservative balance sheet and see the facility as a bridge to a capital raise rather than an opportunity to deploy.

Positively, the portfolio remains fully funded, with no outstanding capex commitments, limiting the risks which have weighed on some of the others trusts in the sector.

Fund profile

Readers may wish to consult our initiation note, which was published on 17 March 2023

Pantheon Infrastructure (PINT) targets risk-adjusted total returns of 8–10% per annum comprising capital growth and a progressive dividend. This is achieved through equity and equity-related investments in private infrastructure assets alongside other leading private asset investment managers and institutional investors.

The company is designed to allow investors to gain exposure to a high-quality mix of yielding and growth infrastructure assets with strong downside and inflation protection in developed markets. Target assets typically benefit from defensive characteristics, including contracted cash flows, inflation linkage, conservative leverage profiles and strong Environmental, Social and Governance (ESG) credentials.

The fund’s initial focus has been on digital infrastructure (data centres, fibre networks, mobile telecom towers and the like); renewables and energy efficiency (wind, solar, sustainable waste powered electricity generation, smart meters); power and utilities (energy utilities – transmission and distribution, water and conventional power generation); and transport and logistics (ports, rail, roads and airports).

The board believes that PINT can offer investors stable, predictable cash flows, inflation protection, embedded downside protection, and sub-sector diversification.

Previous publications

Readers interested in further information about PINT may wish to read our previous notes.

Figure 13: QuotedData’s previously published notes on PINT

| Title | Note type | Publication date |

| Reliable income streams with inflation protection | Initiation | 17 March 2023 |

| Traveling in the right direction | Update | 11 September 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

This marketing communication has been prepared for Pantheon Infrastructure Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.