Fuel for (AI-powered) thought

Pantheon Infrastructure’s (PINT) portfolio is focused on areas of secular growth. It helps both enable and take advantage of technological progress and global connectivity. It is also supporting the shift towards more sustainable energy generation. The success of its approach is particularly evident in the area of data centres – the focus of much of this note – where PINT is directly exposed to the voracious demand for energy to power the unfolding Artificial Intelligence (AI) revolution.

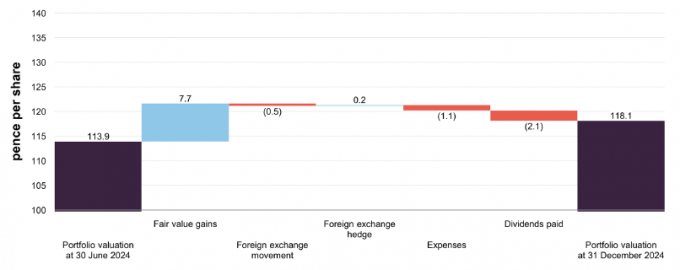

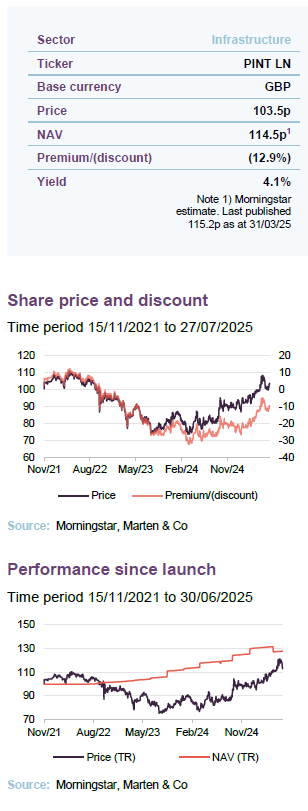

Investors are beginning to take more notice of this opportunity. PINT’s NAV returns have been strong since launch in late 2021, at 27.9% (to 30 June 2025, based on Morningstar NAV estimate). The share price, however, suffered along with all infrastructure investments during much of 2022 and 2023, as rising interest rates reduced the attractiveness of assets with long-term return profiles. However, more recently, with rates lower and more stable, PINT’s share price has rallied, helped by a rapidly narrowing discount.

Global high-quality infrastructure with strong ESG credentials

PINT aims to provide access to a globally diversified portfolio of high-quality infrastructure assets, primarily in developed OECD markets, which are expected to generate sustainable attractive returns over the long term. It targets co-investment assets that have strong ESG credentials and underpin the transition to a low-carbon economy.

| Financial year ended | Share price TR (%) | NAV total return (%) | Dividend(pps) | Target div. (pps) |

|---|---|---|---|---|

| 31/12/2022 | (10.4) | 1.9 | 2.0 | 2.0 |

| 31/12/2023 | (7.0) | 11.0 | 4.0 | 4.0 |

| 31/12/2024 | 11.5 | 14.9 | 4.2 | 4.2 |

| Domicile | United Kingdom |

|---|---|

| Inception date | 16 November 2021 |

| Manager | Pantheon Ventures (UK) LLC |

| Market cap | £473.3m |

| Shares outstanding (exc. treasury shares) | 468,625,000 |

| Daily vol. (1-yr. avg.) | 960,374 shares |

| Net gearing | Nil |

Exit of Calpine

Calpine was PINT’s largest holding, at about 15% of assets. The company is being sold to Constellation Energy for $16.4bn.

In our last note we went into some detail on Calpine, PINT’s largest investment representing c15% of the portfolio. Calpine is a US generator of electricity from natural gas and geothermal resources, with the bulk of its fleet powered by natural gas.

We had not expected an exit for some time, but sponsor Energy Capital Partners (ECP) announced the sale to Constellation Energy for $16.4bn in January of this year. This represents PINT’s first realisation since IPO in 2021, with the transaction set to close before the end of 2025, conditional on regulatory approval. It is expected that the first sale proceeds will also be received before the end of 2025, with further payments to follow. The realisation is structured as $4.5bn cash and $11.9bn in Constellation stock (50m shares based on a volume weighted average share price of $238). NASDAQ-listed Constellation is the largest producer of carbon-free energy in the US, through its nuclear, solar and wind generation assets across numerous states particularly in the Midwest and Northeast. Its nuclear division alone accounts for nearly 20% of American clean energy output. The Federal Energy Regulatory Commission gave regulatory approval for the deal on 24 July 2025, and now the sale only remains subject clearance by the Department of Justice and other customary closing conditions.

The sale marks an outstanding achievement for PINT. The original investment in June 2022 was for c£46m, or c$54m with hedging used to mitigate against any material foreign exchange movements. The pre-sale MOIC (multiple on invested capital) as at 31 December 2024 was already 2.3x. The exact impact on PINT’s NAV depends on the Constellation share price. Based on the price on 30 June of $323, the implied uplift on the 31 March PINT NAV is from 115.2p to just over 121p.

Shareholders should note that until the position has been exited, PINT’s NAV will reflect the share price of Constellation Energy, which has been somewhat volatile since the announcement. The exposure is the equivalent of c.0.65 cents per share for every $10 movement in the Constellation share price (see Figure 1 for a chart of this). ECP will determine and execute the strategy to exit the Constellation position after the expiry of the lock-up periods. In the meantime, PINT may explore hedging or liquidity options post-sale completion.

Whilst the resultant exposure to nuclear through the Constellation stake is not a breach of PINT’s investment policy, which applies at the point of investment, the board has recognised that it may not be desirable for some shareholders. It will bear this in mind when assessing the impact on the asset allocation, although it should be noted that the stock portion of the proceeds will be subject to certain lock-up restrictions.

AI-driven demand for data centres

A typical ChatGPT query requires about 10x the power of a standard Google search

In our last note we touched on the opportunity for PINT from increased demand for data centre capacity due to the increasingly widespread adoption of AI. For example, weekly users of ChatGPT increased from 300m to 400m just between December 2024 and February 2025, and its creator OpenAI forecasts this figure hitting 1bn by the end of the year. The International Energy Agency (IEA) says that a typical ChatGPT query requires 2.9 watt-hours of electricity compared to 0.3 watt-hours for a standard Google search – clearly all these AI queries translate to a huge increase in energy demand.

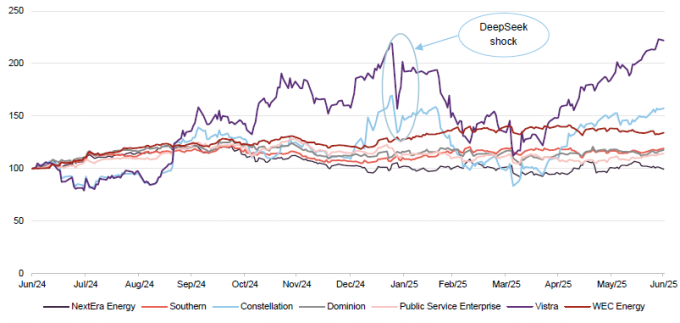

This thesis was somewhat called in question in late January 2025 with the release by Chinese AI company DeepSeek of its new R1 model. This seemingly performs about as well as Western models, but at a fraction – perhaps around a quarter – of the energy usage. It does this by taking a selective activation approach, only activating a small fraction of the model’s parameters for any given task. As well as adversely impacting the share prices of US companies directly exposed to AI, one of the spillover effects was a sudden fall in the value of listed US energy producers, as investors worried that the anticipated power bonanza might be smaller than anticipated. This can be seen in Figure 1, showing the share price performance of the seven largest US-listed power producers. The chart shows steep falls in late January in the prices of Vistra and Constellation Energy in particular (the latter being the acquirer of Calpine).

Figure 1: Share price performance of listed US power producers

Source: Bloomberg

However, the chart also shows a subsequent strong recovery, beginning towards the end of April. Vistra’s shares are now above their January high, and Constellation’s are close. Indeed, six of the seven companies have risen in value over the past 12 months, with only NextEra falling slightly.

This rebound was partly due to positive wider market conditions, as US President Trump announced a pause in the implementation of reciprocal tariffs that he had previously announced on “Liberation Day” on 2 April; the original announcement had caused convulsions in the equity, bond, and currency markets. However, the rebound was also due to a general reassertion of the theme of increased AI-driven energy demand.

It seems likely that, whatever the precise models and tools used, we are only at the beginning of an AI-powered transformation in how businesses and organisations across a range of sectors operate. Governments are helping to accelerate this change through public funding, legislation, research collaboration and infrastructure development. For example, the UK government has announced its AI Opportunities Action Plan, a strategic initiative backed by leading technology firms, while President Trump has issued an executive order to enhance the US’s global AI dominance.

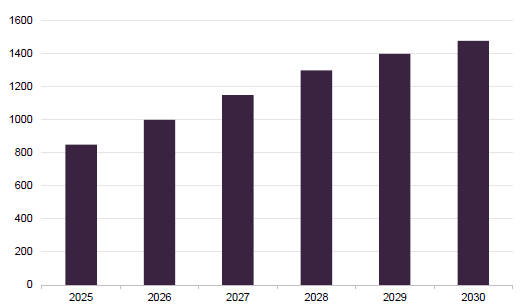

Figure 2 shows the forecast increase in overall global data centre electricity consumption in the coming years.

Figure 2: Forecast global data centre electricity consumption (TWh)

Source: International Energy Agency, ABI Research

There are several drivers of this projected increase, including cloud computing, streaming and digital services. Even stripping out the impact of AI, global data centre demand is still expected to grow by 16% per annum in the next five years according to McKinsey & Company research. However, AI is a disproportionately energy-intensive contributor, and the same McKinsey research suggests that the demand for specifically AI-ready data centre capacity could rise by 33% a year between 2023 and 2030. Around 70% of the total demand for data centre capacity by that later date will be for those equipped to host advanced AI workloads. Therefore, significant upgrades to the legacy systems in existing data centres will be required. Data centres globally are projected to account for 3.7% of electricity consumption in 2030, up from around a third of that figure as recently as 2022.

When it comes to the challenge from DeepSeek (and potentially other non-Western competitors), the development seems likely to spur major Western technology firms to increase their research and development in order to stay ahead. If DeepSeek can prove over the longer term that the future of AI will not be as energy-intensive as once thought, it could in fact be a positive development for the data centre sector. The sector has been struggling to meet the overwhelming demand for capacity, and the emergence of DeepSeek’s innovative software techniques could ease pressure to meet unsustainable capacity growth expectations. DeepSeek’s success could also hasten the evolution of the AI theme from the “infrastructure layer” to the “application layer”, with a boom in lower-cost AI-based applications boosting lower-latency data centres.

How PINT stands to benefit

PINT is particularly well positioned to take advantage of this huge increase in data centre demand. Around 40% of its portfolio, including Calpine, is invested in data centre and energy & utilities assets. The operators of data centres typically provide the physical space, systems, and associated capex costs in exchange for rent from tenants. PINT’s exposure to power markets will diminish as Calpine exits the portfolio upon completion of the takeover by Constellation Energy, and the subsequent sale of Constellation stock. However, PINT will retain significant exposure to the data centre market principally through two investments, CyrusOne and Vantage Data Centres.

CyrusOne

PINT has been invested in CyrusOne alongside KKR since 2022, making it one of the earliest investments of the 13 companies in the portfolio. CyrusOne is the third-largest data centre platform in the US, with 55 operating currently across North America and Europe, totalling more than 4m square feet of capacity, and a further 50 centres under construction or in development. The company serves around 1,000 clients in total, including around 200 Fortune 1000 companies.

Many of the company’s customers are “hyperscalers”; that is, the large technology companies that require massive computing power, storage, and network infrastructure. Contracts with hyperscalers are typically up to 12 years, with high visibility of cash flows, as power costs are passed through to customers. Indeed, across CyrusOne’s assets its customer base is largely investment-grade quality, with limited churn.

The company has recently appointed James Miller, ex-Microsoft senior site acquisition manager, as senior director of site acquisition in Europe and Krupal Raval, former managing director at Equinix, as chief strategy officer. Both bring extensive experience to enhance the company’s growth strategy across the US and Europe.

In October 2024, KKR entered into a $50bn strategic partnership with ECP. The collaboration is intended to accelerate the development of data centre, power generation, and transmission infrastructure to support the global expansion of AI and cloud computing. This partnership combines KKR’s deep expertise in digital infrastructure and the broader energy value chain with ECP’s leading platform in electrification and power and renewable energy generation.

In June 2025, CyrusOne announced plans for a new £1.2bn data centre campus in Buckinghamshire, dubbed “LON6” as its sixth UK facility. Once operational, it will offer 90 megawatts (MW) of capacity across 30,000 square metres of space. Construction is expected to begin in late 2026 with first capacity available in early 2028. The LON6 project emphasises sustainability, with its 71% “biodiversity net gain” significantly exceeding the UK’s 10% regulatory requirement.

Other recent developments include the breaking ground of CyrusOne’s FRA7 campus in Frankfurt, an 81MW facility that will represent one of Europe’s largest waste heat utilisation projects. The process is designed to enable heat from the servers to be absorbed into a water system connected via heat exchangers to pipe network infrastructure, that will in turn connect to the buildings on the development.

In June 2025, the company announced a strategic partnership with E.ON to overcome data centre grid capacity constraints in Europe, including the design and delivery of local power generation solutions, starting with delivering additional 45MW IT capacity to FRA7 – bringing the campus’ total IT capacity to 126MW by 2029.

Elsewhere, the company has announced plans for two data centres in East Milan that will deliver 27MW and 54MW of energy respectively, with sustainability again being a key focus.

Vantage Data Centers

PINT is invested in Vantage alongside DigitalBridge. Vantage is a leading global provider of data centre campuses tailored for hyperscalers, cloud providers and large enterprises. Its hyperscale customers provide a strong growth pipeline, long-term contracts and low churn.

DigitalBridge and Silver Lake (an American global private equity firm focused on technology investments) provided a substantial additional capital injection in 2024, which reinforced Vantage’s balance sheet. Most recently, Vantage secured $5bn in green loan financing to support its North American expansion, including a $2.25bn construction loan for its New Albany, Ohio campus. This is a 70-acre facility that will house three pre-leased hyperscale data centres totalling 192MW of energy across 1.5m square feet. The first facility is due to be operational by December 2025.

In partnership with VoltaGrid, Vantage plans to deploy over 1 gigawatt (GW) of on-demand power generation across its North America portfolio to address grid constraints in key markets.

Asset allocation

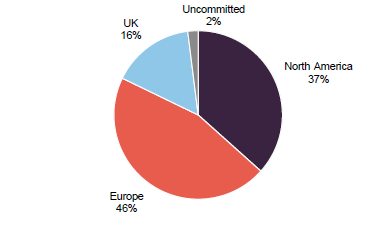

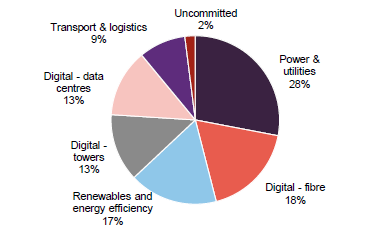

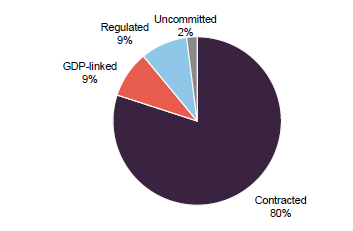

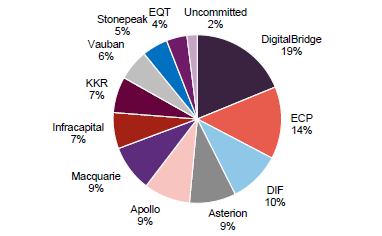

The following charts are based on PINT’s Q1 2025 update using data as at 31 March 2025 (note: the charts reflect the portfolio as a percentage of gross asset value).

Figure 3: Portfolio split by geography

Source: PINT, Marten & Co

Figure 4: Portfolio split by sector

Source: PINT, Marten & Co

As at 31 March 2025, the company had net assets of £540m, comprising the portfolio of 13 assets valued at £521m and £19m of net working capital. At that date there were £10m of undrawn commitments to infrastructure assets. The business plans of the companies in the portfolio were fully funded at the time of PINT’s investment.

If needed, PINT has a £115m revolving credit facility (RCF) which remains undrawn. The manager has indicated that it would not be likely to use the RCF without good visibility of how it would be repaid, potentially from increasing near-term certainty around realisations.

Figure 5: Portfolio split by revenue type

Source: PINT, Marten & Co

Figure 6: Portfolio split by sponsor

Source: PINT, Marten & Co

Figure 7: PINT’s portfolio as at 31 March 2025

| Holding | Business | Region | Sponsor | Valuation (£m) | MOIC (x) |

|---|---|---|---|---|---|

| Calpine | Electricity generation | North America | ECP | 74 | 2.1 |

| Primafrio | Transport & logistics | Europe | Apollo | 50 | 1.4 |

| Fudura | Renewables and energy efficiency | Europe | DIF | 50 | 1.4 |

| National Broadband Ireland | Digital fibre | Europe | Asterion | 48 | 1.3 |

| National Gas | Gas utility and metering | UK | Macquarie | 46 | 1.3 |

| GD Towers | Towers and telecoms infrastructure | Europe | DigitalBridge | 44 | 1.2 |

| CyrusOne | Data centres | North America | KKR | 38 | 1.5 |

| Zenobe | Renewables and energy efficiency | UK | Infracapital | 37 | 1.2 |

| Cartier Energy | District heating | North America | Vauban | 31 | 0.9 |

| Vantage Data Centers | Data centres | North America | DigitalBridge | 31 | 1.1 |

| Delta Fiber | Digital fibre | Europe | Stonepeak | 27 | 1.2 |

| Vertical Bridge | Digital towers | North America | DigitalBridge | 24 | 1.0 |

| GlobalConnect | Digital fibre and data centres | Europe | EQT | 21 | 1.1 |

| Total | 521 | 1.3 |

The portfolio remains unchanged since our last note (which used data as at 30 June 2024). Although the Calpine sale to Constellation Energy was announced in early 2025, it will continue to be reflected in the portfolio until the sale completes, which is anticipated to be in Q4 2025. The fair value (before foreign exchange movements) of Calpine fell £6.4m over the quarter due to the drop in the Constellation share price, although since March the price has rallied strongly. As outlined on page 3, based on the Constellation share price on 30 June 2025 of $323, the implied uplift on the 31 March PINT NAV is from 115.2p to just over 121p. There was a smaller negative movement on Delta Fiber, which is tracking behind plan with lower long-term penetration expectations, due to an overbuild in the Netherlands.

For readers wanting a broad introduction to each of the holdings in the portfolio, this was provided in our last note here: Powering up.

There were positive underlying valuation movements on National Gas, Primafrio, Vantage Data Centers, GD Towers, National Broadband Ireland and Zenobe. Primafrio has begun to see the benefit of new distribution centres impacting its top line, while National Broadband Ireland has passed 66% of its target footprint with an average take-up rate of around 35% – this is ahead of where PINT expected it to be at this stage.

Source: PINT, Marten & Co

Dividend payments

With the payment of its 2.1p interim dividend, PINT met its target for a 4.2p income return to shareholders for the financial year. A further 2.1p was declared as a second interim dividend and was paid to shareholders on 22 April 2025.

Dividend cover for 2024 was 0.7x, up from 0.3x in 2023. As further realisations are achieved, dividend coverage should further increase, and we expect that full cover may be achieved in relatively short order.

The dividend policy remains sustainable and future increases are possible. The board says that it acknowledges the breadth of opinion in relation to the progression of the dividend, and intends to maintain an active dialogue with shareholders around any future increases in the dividend going forward.

Fund profile

Pantheon Infrastructure (PINT) targets risk-adjusted total returns of 8-10% per annum, comprising capital growth and a progressive dividend. This is achieved through equity and equity-related investments in private infrastructure assets in Western Europe and North America alongside other leading private asset investment managers and institutional investors.

The company is designed to allow investors to gain exposure to a high-quality mix of yielding and growth infrastructure assets with strong downside and inflation protection in developed markets. Target assets typically benefit from defensive characteristics, including contracted cash flows, inflation linkage, conservative leverage profiles and strong sustainability credentials.

The fund’s initial focus has been on digital infrastructure (data centres, fibre networks, mobile telecom towers and the like); renewables and energy efficiency (wind, solar, sustainable waste-powered electricity generation, smart metres); power and utilities (energy utilities – transmission and distribution, water and conventional power generation); and transport and logistics (ports, rail, roads, and airports).

The board believes that PINT can offer investors stable, predictable cash flows, inflation protection, embedded downside protection, and sub-sector diversification.

SWOT analysis

Strengths

- Strong NAV performance since launch, and a recent share price rally as the discount narrows.

- Progressive dividend policy and the dividend is likely to be fully covered shortly.

Weaknesses

- PINT is subject to market sentiment towards its sectors and the wider economic environment, particularly interest rate movements.

Opportunities

- Structural increase in demand for data centres, due to growth of AI and cloud computing, being met by companies in PINT’s portfolio.

- Although the discount has narrowed, there is the potential for it to narrow still further. The trust traded at a premium for some time after launch.

- Clear international support for the themes to which PINT is exposed, particularly AI and more sustainable energy generation.

Threats

- The course of the development of AI is uncertain, with potential surprises such as the emergence of DeepSeek, which uses much less energy than other models.

- Potential discount widening, in response to poor performance and/or poorer sentiment towards infrastructure sectors.

Bull vs bear case

Performance

Strong NAV performance since launch in 2021. More recently, returns for shareholders have also been good as the share price rallied and discount narrowed

Although PINT’s performance is generally correlated positively to inflation, periods of particularly high inflation and rapid increases in interest rates – as was seen from mid-2022 onwards – can negatively impact returns.

Dividends

PINT met its 4.2p target in the most recent financial year. Dividend policy is sustainable and future increases are likely. Full coverage likely soon.

Increases would potentially stop being sustainable if conditions changed. For now, the dividend is uncovered by revenues, at 0.7x in 2024. Full coverage in the future is likely, however.

Outlook

PINT is exposed to growing sectors that are crucial for building the economy of the future. This is most clear in AI-driven data centre demand.

AI is a new and rapidly evolving technology where the shape of that evolution is uncertain; see, for example, the unexpected disruption caused by DeepSeek.

Discount

PINT still trades at a discount that could narrow further and potentially move to a premium, as happened for a period after launch. This could come about from inflation and interest rates further subsiding and from beneficial long-term structural growth themes.

The discount could widen significantly due to circumstances beyond PINT’s control, as happened from late 2022. This could be caused by higher interest rates or any newsflow perceived as negative for the underlying assets.

Previous publications

Readers interested in further information about PINT may wish to read our previous notes.

| Title | Note type | Publication date |

|---|---|---|

| Reliable income streams with inflation protection | Initiation | 17 March 2023 |

| Traveling in the right direction | Update | 11 September 2023 |

| Compelling opportunity | Update | 6 March 2024 |

| Powering up | Update | 11 November 2024 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| This marketing communication has been prepared for Pantheon Infrastructure Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from | receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the | period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

| Authorised and regulated by the Financial Conduct Authority. 50 Gresham Street, London EC2V 7AY 0203 691 9430 www.QuotedData.com www.martenandco.com Registered in England & Wales number 07981621 2nd Floor Heathmans House, 19 Heathmans Road, London SW6 4TJ |

|---|