Even ahead of so-called ‘Liberation Day’, tariff talk was once again the paramount mover of markets over March. The Fed’s Jerome Powell has noted that inflation will rise in response to tariffs, amid concerns that aggressive trade policies could hamper the central bank’s ability to cut rates. This was reflected in consumer confidence readings, which nosedived to their lowest points in four years. In the same vein, Goldman Sachs raised its perception of recession probability from 2.5% to 3%, whilst also lowering its GDP growth forecast from 2.0% to 1.5%. A worst monthly performance since 2022 for the S&P500 and Nasdaq Composite indices signified deteriorating sentiment towards American equities. Investors have been reducing their exposure to US mega cap tech, adding to the $1.1tn combined valuation fall for the ‘Magnificent 7’ so far this year. Notably, Tesla is down 35% this year, fuelled by concerns over Elon Musk’s role in the presidential administration, whilst Nvidia has fallen 20% over the same period.

‘The current trade war is much more costly than

Trump’s first in 2018-2019’

William Reinsch, Centre for Strategic &

International Studies

Last month’s shift of investor interest from the US to Europe has been sustained, which has been reinforced by renewed commitments and cooperation by European leaders towards their defence. Most notably, the German government passed reforms to its constitution, potentially allowing for a defence allocation of 3.5% GDP. Another major stimulus for the country’s growth will be the €500bn infrastructure fund recently approved by lawmakers. Rising military spending saw an index of European defence and aerospace stocks, build on a 33% increase this year. Despite these improvements, European consumer confidence was still dampened by tariff concerns.

Going into March, business confidence in the UK looked resilient. The UK also experienced a defence rally, which helped the FTSE 100 hit an all-time high early in the month. Although, by the end of the month, the index had delivered its worst monthly performance since October 2023, again largely attributable to tariff concerns. It should also be said that the market reaction to the government’s Spring Statement was mixed.

Alliance Witan

‘There is a clear risk that President Trump’s mooted tariff increases may trigger a trade war that damages growth not just in the US, but globally‘

JPMorgan Claverhouse

Wages are rising, inflation has fallen from its high levels in 2023 and the Bank of England expects to reduce interest rates

Pacific Horizon Investment Trust

Asian economies have not only avoided crisis in this challenging environment, but many have prospered, outpacing growth in many Western nations

At a glance

| Exchange rate | 31 March 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2918 | 2.7 |

| Pound to euros | GBP / EUR | 1.1944 | (1.5) |

| US dollars to Japanese yen | USD / JPY | 149.96 | (0.4) |

| US dollars to Swiss francs | USD / CHF | 0.8843 | (2.1) |

| US dollars to Chinese renminbi | USD / CNY | 7.2570 | (0.3) |

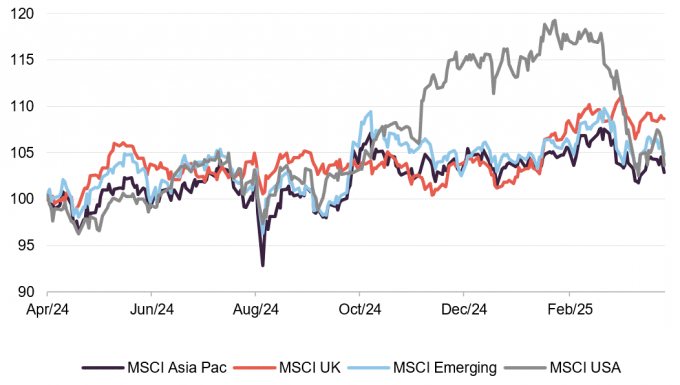

MSCI Indices (rebased to 100)

As discussed, US equities continued their decent throughout March, as other major markets were also preoccupied about the effects of ‘reciprocal tariffs’. While U.S. and German bond yields edged higher, the broader environment favoured a flight to quality, fuelling a global bond rally.

Tariff concerns also affected oil prices – increased supply is meeting the prospect of weaker demand – eventually reaching their lowest levels since 2021 on Friday 4 April.

Time period 31 March 2024 to 31 March 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 31 March 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 74.74 | 2.1 |

| Gold (US$ per Troy ounce) | 3123.57 | 9.3 |

| US Treasuries 10-year yield | 4.21 | (0.1) |

| UK Gilts 10-year yield | 4.68 | 4.3 |

| German government bonds (Bunds) 10-year yield | 2.74 | 13.8 |

Global

New Star Investment Trust, 24 March 2025

President Trump’s policies of deregulation, tax cuts and import tariffs should generate economic growth in the US and provide an element of support for US stocks in the short term but may stoke inflation. If overall equity markets weaken in response to renewed inflation fears, lowly-rated equities in the UK and in emerging markets may prove defensive. US and UK inflation is already proving more persistent than previously expected, with the result that the Federal Reserve and the Bank of England may keep their official interest rates higher for longer.

. . . . . . . . . .

Manchester & London, 19 March 2025

The US economy remains robust which is unsurprising considering its make-up is driven by consumption and consumption has a high correlation to high employment and wage growth. We have consistently said that US Interest Rates will have to be ‘Higher for Longer’ and Technology shares hate surprise increases in discount rates. To be specific, our portfolio has a strong negative correlation to surprise increases in 10-year Treasury yields. There are many forecasts for an impending recession in the USA because that is what happened historically each time rates were raised so steeply. We believe that “every time is different”. We are not so convinced that the recession outturn is already written but we do worry about escalating global debt levels and increasing long term discount rates.

General IT spending is likely to pick up through 2025 as companies focus on optimisation and automation. Spending is being prioritised into Ai & Cloud and these are the areas we have refocused our portfolio on. Spending will likely focus on platforms that can offer a wide spectrum of services including the management of your data. The era of the networked desktop has moved to the data centre connected end point and this means that those with the scale and resources to invest will win. For the minnows, we have further bad news, which is that in a few further years we may start to see Quantum Computing applications become more prevalent and these will require even greater scale.

Few now doubt that we have entered the Era of Ai. We believe that we still have a long way to travel down this road and that those that bank quick profits now will rue the day they did so. The press make a lot of noise and the vast majority of it should be ignored (example: DeepSeek). We are Era-long investors, and our portfolio is firmly focused on Ai Deliverers not “.ai show-boaters”. Having said that, we will be pragmatic and we will have to pivot.

Make no mistake of this, the West is now in a cold war with China and the Chinese are our enemy. The world is a far more dangerous place and will become so if we remain complacent of the new reality. In the meantime, the regulation and statis of the UK & Eurozone surely lead to a slow and withering aging of Europe as it is outcompeted on either side by the USA and China. The situation in the UK & Eurozone is so bad now that it is viewed by the US and China as a comedy zone that can be ignored (see Ukraine negotiations).

We have no idea what the future holds but we believe that since 1771 there has been a glacial shift in the utility as economic units from Man to the Machine. Those that have backed the technological advancement of the Machine over this period have quite commonly made excess investment returns. We believe that Ai is, in part, just an extension of software, albeit with non-sequential processing and non- deterministic outcomes (Software 2.0). Hence, we feel that expecting the Era of Ai to develop along the same rough path as the Era of Software is not irrational and offers investors some comfort and guidance. The next decade could be one of the most interesting eras for technology investing ever. It is of a low probability but still possible that we could see Ai completely transform the global economy in the short period of a decade whereby the effective Total Addressable Market of Software 2.0 sees a greater than 10 fold growth.

. . . . . . . . . .

Dean Buckley, chair, Alliance Witan, 6 March

Since the start of President Trump’s second term of office in January, tariffs have created uncertainty about the outlook for equities. Diplomatic tensions over efforts to end the war in Ukraine and conflict in Gaza have also raised geopolitical risks. Furthermore, European bond markets are adjusting to the prospect of increased borrowing to fund higher levels of defence and infrastructure spending. While there is a risk that heightened levels of uncertainty will impact on business and consumer confidence, global growth and corporate earnings forecasts are currently healthy, giving some grounds for cautious optimism, especially if there is a broadening out of market leadership.

. . . . . . . . . .

Martin Connaghan and Samantha Fitzpatrick, senior investment directors, Murray International, 5 March 2025

Geopolitical tensions, including ongoing conflicts and trade disputes, remain headwinds. The conflict in Ukraine continues to impact energy markets, while political instability in the Middle East and a potential escalation of tensions in the Indo-Pacific region further complicates the trade outlook. Colossal debt levels, exacerbated by pandemic-related spending and years of abnormally low interest rates, should remain a critical concern, as should the fact that nobody seems willing to acknowledge, debate, let alone attempt to address the issue.

While the long-awaited outcome of the US presidential election is now known, the full implications are still unclear. Capital markets have thus far focused on the reflationary aspects of President Trump’s agenda; whether these moves are sustainable will depend on the new administration’s economic priorities. The unified Republican government will almost certainly extend the expiring and expired provisions from the Tax Cuts and Jobs Act and pursue further tax cuts. However, the scale and composition of these measures are uncertain. The Federal Reserve is likely to cut rates more slowly than it otherwise would have done, which, combined with higher debt issuance and inflation, risks putting further upward pressure on US and global bond yields.

President Trump has clearly stated that he considers tariffs an effective means of rectifying perceived trade imbalances and unfair trading practices. However, there remains uncertainty over how tariffs play into President Trump’s broader trade strategy. His first term saw tariffs threatened and used to seek concessions from trade partners. If he pursues this approach in his second term, tariff threats would likely be used more frequently than their actual application.

On balance, President Trump’s policy agenda is likely to result in higher nominal GDP growth, with the bulk of the increase coming through higher inflation due to potentially looser fiscal policy, higher tariffs and lower immigration. This policy means interest rates are likely to fall more slowly than they otherwise would have done. Over the medium term, the Fed could face rhetorical pressure from President Trump if rates and the US Dollar do not evolve as the administration would like. At the same time, the new President is likely to change some of the personnel at the Fed when he gets the chance in 2026. There is a risk that heavy-handed interference in the Fed prompts disquiet in markets around the central bank’s independence.

The UK economy has slowed sharply, with activity surveys consistent with only modest expansion at best. The package of measures contained in the budget should support near-term growth. However, increasing evidence shows that firms are responding to the upcoming cost shock from a higher minimum wage and the increase in national insurance by slashing hiring plans. The combination of higher gilt yields and lower growth means that the headroom against the government’s fiscal rules has been wiped out, and the Office for Budget Responsibility is likely to confirm this in March. Tighter spending plans and tax increases are indeed likely, therefore. In Europe, weak activity data, including a disappointing retail sales outturn over November, confirmed that the Eurozone recovery is fragile. Uncertainty arising from President Trump’s trade measures will pose a further headwind to growth. With the restrictiveness of European Central Bank policy being reduced, the Eurozone’s economy is likely to avoid a recession, though risks remain. The portfolio’s broad exposure to a balance of global and more domestically focused businesses in the UK and Europe remains as dividend yields and relative valuations remain attractive.

. . . . . . . . . .

Sir James Leigh-Pemberton, chair, RIT Capital Partners, 3 March 2025

The global economic landscape and financial markets may continue to exhibit resilience, but we are mindful that they also face a range of risks. These include the stubbornness of inflationary pressures, growing levels of government borrowing and the renewed possibility of tariffs. We have already seen significant moves in government bond yields as these risks become more apparent. Equity valuations feel somewhat stretched, and the US Federal Reserve faces a delicate balance, navigating between sticky inflation and growing concerns about economic slowing in 2025. Policy makers in governments and central banks face a difficult balancing act between stimulating growth, fiscal prudence and bringing inflation down to targeted levels, while perceptions of growing wealth inequality give rise to increasing political polarisation.

That said, there are also reasons for optimism. In the US, strong consumer demand, full employment and fiscal stimulus continue to drive robust economic growth, while the trend of inflation has been downward. Corporate earnings continue to be strong, and innovation, particularly technology-led, has the potential to drive further productivity gains. Within the private equity market, we have also seen an increasing number of successful IPOs and a recovery in M&A transactions, providing a more fertile ground for exits.

. . . . . . . . . .

UK

Jeremy Rig, chair, Henderson High Income, 26 March 2025

As we entered 2025 with continuing volatility in financial markets, the re-election of President Trump to the White House has provided a rather unpredictable backdrop to the global economy. In particular, the widespread imposition of tariffs on America’s trading partners has caused inflation and interest rate expectations to remain higher with a potentially negative impact on global economic activity and there has been a significant financial impact across Europe from the decision to substantially increase defence spending commitments in light of the situation in Ukraine.

Closer to home in the UK, the growth mantra of the recently elected Labour government appears at odds with the substantial tax increase for the corporate sector announced in the Budget, and the cost of government borrowing has increased as investors worry about higher debt levels to fund investment and spending amid a further decline in productivity. The Bank of England has continued to trim interest rates in the early part of 2025 to support the economy as growth prospects have been lowered but they will have to tread a fine line between lowering interest rates further and keeping inflationary pressures under control.

Whilst the backdrop remains challenging, there is some good news for UK listed companies which retain healthy balance sheets and many are buying back their own shares, highlighting the relatively attractive valuation of UK companies versus their overseas peers. It is also important to remember that quoted UK companies derive a substantial proportion of their earnings from overseas activities providing good protection against the risk of weaker UK activity.

. . . . . . . . . .

David Fletcher, chair, JPMorgan Claverhouse, 20 March 2025

Although the US presidential election alleviated some of the political uncertainty affecting the US market the early actions of the new US administration has resulted in increased economic uncertainty and volatility. The real threat of widespread tariffs by the US and potential reciprocal actions by those countries directly impacted cast a shadow over the short term economic outlook in the US and elsewhere. In addition the US Administration’s foreign policies have increased uncertainty globally while the world tries to come to terms with the consequences. The war in Ukraine, the international relationships with Russia and China, together with the ongoing conflict in the Middle East, are all pressing geopolitical issues and concerns. As a result it is unlikely in the short term that there will be any diminution in volatility. In Europe there are already signs that defence spending will increase across the continent as countries seek to reduce their reliance on the US. However many countries, including the US, are looking to address their budget deficits and focus on growing their economies.

In the UK, the near-term outlook is mixed. Consumer and business confidence have weakened, jobs growth is stagnant and many businesses will be adversely impacted by increases in the minimum wage and National Insurance contributions announced in the new government’s first budget. While the recent interest rate cut is welcome The Bank of England has also forecast lower GDP growth this year and inflation remains stubbornly higher than hoped. However, on a more positive note, wages are rising, inflation has fallen from its high levels in 2023 and the Bank of England expects to reduce interest rates, with further interest rate cuts this year. These developments should hopefully help consumer confidence and activity over time, especially if the new government implements concrete initiatives to boost growth, as it has promised. However, the last few months have seen an increase in volatility and this is unlikely to lessen in the short term given the geopolitical and global economic outlook.

Despite the near-term uncertainties around the UK’s economic prospects, the Board shares the Portfolio Managers’ positive outlook for UK equities and for the Company over the medium term. UK stock valuations continue to be low by historic standards in both absolute terms and relative to other markets, and this is generating many opportunities to invest in the kind of quality businesses with high and growing dividends targeted by the Portfolio Managers.

. . . . . . . . . . .

Georgina Brittain and Katen Patel, portfolio managers, JPMorgan UK Small Cap Growth & Income, 24 March 2025

Geopolitical tensions remained very much in the foreground during the first half of our financial year to January 2025. Russia’s war against Ukraine continued, although at the time of writing this report there are very positive signs of an end in sight. For much of the period under review, the fighting in Gaza also continued, but thankfully hostilities there look to have ceased. US elections saw Trump win a landslide victory, bringing with it the strong likelihood of tariffs on numerous products, while in France and Germany politics was also in the forefront.

In the UK, post Labour’s win in the July election, the new Government severely dented both business and consumer confidence, initially by incessantly talking down the UK economy, and then with its first Budget. This contained large tax increases, centred mainly on employers’ National Insurance burden. Interest rates were reduced by 25 basis points twice in the six months, in August and November, to a still high level of 4.75%, as inflation continued to reduce.

Against this backdrop, the Numis Smaller Companies plus AIM (excluding Investment Trusts) Index was down by -3.9% for the six month period.

. . . . . . . . . . .

James Henderson and Laura Foll, Law Debenture Corporation, 11 March 2025

The UK economy is suffering from a lack of productivity growth. The result of this is for the economy to register very little expansion and this in turn means the desire of the electorate for increased government expenditure in the major areas of health, education and defence cannot easily be met. The decline in gilt prices in the final quarter of the year likely reflects the concern over the level of supply that will be forthcoming in future years, rather than any immediate worries over surging inflation. However, the flat lining of the economy masks from top-down observers the reality that there are sound companies in the UK that are growing their profits and generating cash. This, when combined with over half the profits of UK quoted companies coming from overseas activities, means there remain plenty of good investment opportunities for those that pay close attention to companies and valuations, rather than being continually gloomy about the prospects of the UK.

. . . . . . . . . . .

Frank Ashton, non-executive chair, Athelney Trust, 11 March 2025

Over the past decade, the UK’s share of the global equity market has diminished, decreasing from 8.7% in 2010 to 3.7% in 2024. This decline reflects the superior performance of the US economy, a higher volume of IPOs, and substantial returns from US stocks.

The AIM underperformance continues, however there are still good potential opportunities for large gains, even taking into account the negative (but better than expected) impact of the October Budget’s reduction of IHT relief.

The UK’s primary stock index increased by approximately 20% from 2015 to October 2024, whereas the major US index grew by more than 250% during the same period. This disparity underscores the challenges facing UK capital markets, including low liquidity, diminished investor confidence, and a shrinking pool of capital. However, there are signs that investors are increasingly questioning the ability of US stocks to continue on the same trajectory, and also proving more nervous at potential threats like AI from China’s DeepSeek. In January President Trump called the release of its R1 model, cheaper to develop and using less memory than the West’s OpenAI model ChatGPT, a ‘wake-up call’ for US companies.

Investor sentiment over 2024 favoured US and European stocks over UK equities. Global fund managers have reduced their overweight positions in US stocks from 36% to 19%, while increasing their allocations to European stocks. This shift indicates a growing preference for areas perceived to offer better value, further contributing to the underperformance of UK equities.

The decline of active equity funds in the UK has also impacted the Initial Public Offering (IPO) market. Since 2016, £150 billion has flowed out of active funds due to disappointing performance, high fees, and a shift towards passive funds and alternative assets. This trend has starved active managers of funds, affecting their ability to participate in IPOs and contributing to a weak IPO market.

. . . . . . . . . . .

Asia

Gabriel Sacks, Flavia Cheong and Xin Yao Ng, abrdn Asia Focus, 28 March 2025

As we look ahead, the consensus is that Asia and emerging markets may face challenges due to Donald Trump’s policies, tariffs, and interest rates. US deregulation and tax cuts could bolster the US dollar, which is unfavourable for Asia.

On the flip side, Asia’s attractive valuations offer potential for upside surprises, driven by structural tailwinds. It is also encouraging to see a greater appreciation for shareholders, with the value-up theme being promoted by shareholders and authorities in South Korea and China. This has positively impacted our engagement efforts with companies across the region.

We remain positive on Asia, expecting that China may adopt more aggressive stimulus policies to mitigate the tariff impact. At the Two Sessions parliamentary meeting held in early March 2025, the Chinese leadership reiterated their pro-growth policy agenda with a particular focus on stimulating household consumption which should help unlock excess savings accumulated during the pandemic.

Elsewhere, Asian corporates are in good shape with low debt levels, strong competitive positions and a broadly favourable macroeconomic backdrop with little inflationary pressure. Challenges remain but the companies held in the portfolio have dynamic management teams, robust financials and high barriers to entry with globally competitive business models. They have fared well against several shocks in the past and we are very excited about their growth prospects looking ahead.

. . . . . . . . . . .

Pacific Horizon Investment Trust, 11 March 2025

Many of the headwinds which hampered Asia for the past several years persist, including the strongest US dollar in decades and geopolitical tensions. Yet Asian economies have not only avoided crisis in this challenging environment, but many have prospered, outpacing growth in many Western nations. This success underscores the much-improved macroeconomic position of Asia today, particularly compared to Western economies.

Combining Asia’s favourable macroeconomic position with its structurally faster growth rates and valuations at multi-year lows relative to developed markets, Asia ex Japan appears to be in a sweet spot. Nevertheless, performance thus far failed to fully reflect this positive position.

Two major catalysts could change this. Firstly, a weakening US Dollar would be a substantial tailwind. While predicting short-term currency movements is difficult, longer-term structural factors may put significant downward pressure on the Dollar, including record high valuations, potential US interest rate cuts, continued fiscal expansion, mounting debt, and the drive to re-industrialise the country.

Secondly, an improvement in sentiment for China could be transformative. The country remains a key concern among investors, with the MSCI China Index still more than 40% below its early 2021 peak. While challenges persist, especially in the real estate sector, China appears to have hit an important inflection point in September. The government moved decisively to support the economy, with stimulus plans that are significantly more meaningful than anything seen since the Covid-19 pandemic, including explicit support for the property and equity markets. Notably, these plans have been personally overseen and approved by President Xi Jinping.

Support for China’s private sector has continued to strengthen in 2025, with Premier Xi personally endorsing its importance at a public meeting with major technology companies in February. This shift in policy contributed to the strong performance of MSCI China over the past six months.

The potential for further market gains is significant, given the low valuations of many high-quality Chinese companies and the substantial household savings accumulated over recent years (more than $10tr since the Covid-19 pandemic).

. . . . . . . . . . .

Global emerging markets

Maria Luisa Cicognani, chair, Mobius Investment Trust, 10 March 2025

Global trade dynamics are evolving, and policy shifts in the U.S. may have ripple effects across developed and emerging markets alike. Recent tariff measures have the potential to impact supply chains and consumer prices, with trade relations between the U.S., Canada, Mexico, and China remaining a focal point. While these developments create short-term volatility, they also open doors for regional trade realignments and new economic partnerships.

For emerging markets, one key consideration is the potential impact of a stronger U.S. dollar. Factors such as proposed tax reforms, deregulation, and tariff policies could contribute to inflationary pressures, prompting the Federal Reserve to maintain higher interest rates. In turn, a strong dollar increases the burden of dollar-denominated debt in emerging markets and heightens currency volatility. Exporting economies may respond by adjusting currency valuations to maintain competitiveness, a strategy previously seen during trade tensions with China. While such adjustments could mitigate inflationary pressures in the U.S., prolonged dollar strength may pose challenges for emerging markets, particularly those with high external financing needs.

On a more positive note, the U.S. policy shifts seem to be fostering stronger economic cooperation in Europe and among emerging economies. Trade flows are being redirected, and some countries stand to benefit as China continues to diversify its investments and production footprint, particularly in South Asia, the Middle East, and South America. Additionally, local products could become more competitive vs imports under a strong US dollar. The global momentum toward technological innovation remains strong, with rapid advances in artificial intelligence and digitalization expected to drive productivity gains across industries. We anticipate that all sectors will benefit from continued technological advancements, particularly in healthcare, green energy, energy transition, and manufacturing.

On the geopolitical front, the U.S. administration appears to be taking a more inward-focused approach, recalibrating its global engagement while emphasizing its leadership in North America. This has led to a shift in transatlantic relations, prompting Europe to assume a more proactive role in global diplomacy. At the same time, changing power dynamics are influencing international alliances, with countries such as Iran and Russia strengthening their positions in key geopolitical regions. The outlook for peace and stability in the Middle East remains uncertain, and evolving global alignments will play a crucial role in shaping future developments. Given these factors, Europe is likely to step up its role in defending democratic values, securing its borders, and supporting the self-determination of its allies. Consequently, defense spending is expected to continue its upward trajectory.

. . . . . . . . . . .

India/Indian subcontinent

India Capital Growth Fund, 27 March 2025

Economic growth has been reflected in India’s vibrant and fast-growing corporate sector, which continued to expand and diversify over the year. This, in turn, has supported stock markets, which delivered another strong year of returns.

India’s recent run of strength has its origins in the reforms enacted by Prime Minister Narendra Modi’s first government in 2014-19. The government took a slew of tough decisions, including currency reform and tax harmonisation. This put in place the foundations for the rapid growth that India has experienced in recent years. It has helped shore up government finances, which has allowed for significant growth in capital spending, particularly on infrastructure.

The government has also sought to boost domestic manufacturing through the Production Linked Incentives (PLI) scheme, which provide tax breaks and financial support for companies who want to set up manufacturing in India. This has helped India challenge China’s manufacturing dominance and brought new companies to the country in areas such as consumer electronics and mobile phones.

This has led to near-uninterrupted growth for the Indian economy over the past decade. India remains in the middle of a virtuous cycle of growth, with a potentially lengthy pathway ahead. Nominal GDP per capita for India is just $2,375, compared to $12,604 for China. Modi continues to pursue an ambitious reform agenda, incorporating infrastructure building and financial market liberalisation.

That said, there have been bumps along the way. The general election, held between April and June, did not deliver the resounding victory for Modi that had been expected. Although Modi secured a third term, his Bharatiya Janata Party (BJP) was forced into a coalition having failed to achieve the 272 seats necessary for a parliamentary majority.

The government’s reliance on coalition partners, including the southern Telugu Desam Party (TDP) and the eastern Janata Dal (United) (JD (U)), is unlikely to result in substantial changes to the government’s domestic political programme. The states represented by these two parties may want more in terms of capital commitments, but the government’s broader economic agenda should remain intact.

More troubling was the recent GDP growth figure, which showed expansion of just 5.4% year on year for the July to September period. This was notably weaker than expected and some way below the Reserve Bank of India’s projection of 6.8%. It has subsequently adjusted its forecast from 7% to 6.6% in 2025.

The weakness is at least partially attributable to the election. The Electoral Commission does not allow any announcements in the run-up to an election, and government decision-making slows as the administrative machinery is re-directed towards election preparation. Capital spending slowed as a result, but is likely to return to more normal patterns in the quarter ahead.

A bigger concern has been weakening consumption. Plenty of explanations have been offered, but the causes remain opaque. Higher food inflation is likely to have played a part. More recently, rural consumption has revived, but urban consumption remains weak. It is possible that the spending mix has changed and spending data is not picking up a shift to higher end goods and services. Certainly, demand for premium products remains strong. Ultimately, we believe the caution is likely to be short-lived. Consumers still have the capacity to spend, with savings levels robust.

It is important not to over-state this recent slowdown. India’s growth path is not about to be derailed – it is simply a question of degree. The government’s balance sheet remains healthy, with the fiscal deficit declining and significant Foreign Exchange reserves. This gives it the firepower to support the economy and sustain spending on infrastructure development. The currency has been stable despite a volatile global environment, while tax revenues have held up. It has been another strong year for the Indian economy.

. . . . . . . . . . .

Andrew Watkins, chair, Ashoka India Equity Investment Trust, 7 March 2025

India may very well be a direct beneficiary of a more peaceful world. Whilst President Trump intends to adopt a more protectionist stance and, among many other things, impose tariffs on imports, such a situation may accelerate the move of manufacturing from countries like China to India, as I have referred to several times in the past, thus further benefitting its already fast-growing economy, now the world’s fifth largest. However, there is likely to be short-term disruption as his strategy plays out.

Global stock markets have endured a rocky start to 2025 as bond yields rose over concerns for growth prospects and persistent inflation, and what Donald might do next, amply characterised by his recent spat with Ukraine’s President Zelensky. By the time you read this half-year report, I believe most seasoned commentators would have expected such concerns to be overblown, especially so with regard to India, but this has not proven to be the case.

The speed of India’s growth has led some to question over-inflated valuations and this has had a negative impact on stocks, particularly those in the mid-cap and smaller-cap sectors. It is difficult to know with any certainty how long this downturn will last but with Prime Minister Modi’s re-election firmly in the rear-view mirror and with his plans for continued economic growth in train, there are genuine reasons to remain optimistic for India’s long-term growth prospects with attendant index-beating investment returns likely for our shareholders.

. . . . . . . . . . .

North America

Middlefield Canadian Income, 25 March 2025

Despite both the TSX Composite and S&P 500 closing near all-time highs, many areas of the market, such as dividend payers and small-caps, did not meaningfully participate in the 2024 market rally. Technology and communication services stocks led to the upside while cyclical and value sectors lagged. In British Pounds, shares in the Fund generated a total return of 20.6 per cent and a NAV total return of 15.1 per cent. In local currency, the S&P 500, NASDAQ Composite, and the TSX Composite returned 25 per cent, 30 per cent and 22 per cent, respectively. The TSX lagged the S&P 500 by 3 per cent in 2024, due to its lower exposure to technology stocks and greater weighting to cyclical and value sectors. The Fund’s benchmark is more concentrated in higher-yielding dividend stocks and returned 9.6 per cent, lagging the TSX by nearly 12 per cent. Price-to-earnings multiples remain depressed for the TSX, resulting in a 4x multiple discount relative to the S&P 500.

We are encouraged by several trends that emerged in mid-2024. Firstly, the Bank of Canada (BoC) began its first rate-cutting cycle in 4 years through a series of rate cuts totalling 175 basis points. Meanwhile, 10-year bond yields fell by more than 100 basis points from their 2023 highs as inflation concerns abated. Second, market breadth improved as companies and sectors that lagged throughout 2023 and H1’2024 benefitted from a relief rally. We believe this market broadening could represent the early stages of a prolonged recovery in dividend-paying stocks that should continue throughout 2025.

President Trump’s second term has introduced significant trade policy uncertainty. Despite all the trade noise, Canada’s economy remains on sound footing and is compelling for investors seeking attractive valuations and higher levels of income. While the scale and scope of potential US tariffs remain unpredictable, the Fund is well-positioned due to its diversification across resilient, high-quality sectors. With a focus on Canadian financials, pipelines, and REITs, the Fund is largely insulated from more tariff-targeted manufacturing industries, such as steel, aluminium, autos, and lumber. Similar to President Trump’s first term, we believe rational economic interests will prevail and the USMCA trade agreement will ultimately be renegotiated with minimal impact on Canadian equities. The U.S. represents over 75 per cent of Canadian exports and is an extremely important end-market for these sectors. US, Canada, and Mexico share over $1.5 trillion in annual trade, supporting 17+ million jobs across the three economies. This trilateral trade flow is one of the largest in the world, underscoring the significance of the USMCA agreement in maintaining economic stability in North America. Given this deep integration, renegotiations will likely aim to preserve trade stability rather than disrupt it.

The Canadian federal election which has been called for 28 April 2025, will be a key event to watch with potential positive implications for economic policy, trade, and capital markets. A Canada-first mentality is gaining traction, emphasizing deregulation, pro-business policies, and strengthening domestic industries. A more conservative, business-friendly government could lead to increased investment in key sectors such as energy infrastructure, along with streamlined regulatory processes to encourage economic growth. In addition, diversifying trade partnerships beyond the US could present significant opportunities for Canadian pipeline and energy companies. These developments could also lead to increased foreign investment in Canada, strengthening the Canadian dollar. However, trade policy negotiations will bring uncertainty in the markets, particularly if US protectionist policies weigh on exports.

. . . . . . . . . . .

Vietnam

Vietnam Holding, 21 March 2025

Vietnam’s GDP growth during the period was solid, driven primarily by robust domestic consumption and increased investment in infrastructure. Full year GDP growth was 7.09%, ahead of the government’s own target of 6.5%. This was mainly due to the country’s resilient manufacturing sector amid unprecedented global challenges, from geopolitical uncertainties and extreme weather disruptions to rapid digital transformations and fast-changing stakeholder needs. 2024 also marked a notable improvement from the 5.05% growth recorded in 2023. Indeed, the fourth quarter alone in 2024 saw a 7.55% increase, the fastest quarterly expansion in over two years.

The impressive economic growth momentum helped Vietnam shine bright compared with other nations in the region, and this is expected to continue in 2025 despite emerging external threats, such as the structured slowdown of China, a likely trade war sparked by US president Trump’s tariffs and interconnected global interest rate and FX risks.

Vietnam’s government is aiming for 8.0% GDP growth in 2025 with a strategic focus on increasing productivity. We believe its various policy initiatives coupled with renewed positive sentiment and investor demand will support stronger domestic consumption fueled by disbursement of public investments.

The government’s renewed focus on expediting infrastructure projects-particularly in transportation, energy, and logistics-has already provided a boost to public expenditure, which reached a record level of USD 26.5bn for the full year. Ho Chi Minh City’s first metro-line opened in December, with an encouraging mass adoption of over 1 million users in its first few weeks of operating.

Vietnam continues to attract significant amounts of foreign direct investment (“FDI”), with several multinational corporations announcing expansion plans and new investments in the country’s manufacturing and technology sectors. The full year registered FDI reached USD 38.2bn, and disbursed FDI reached USD 25.4bn.

Vietnam continues to position itself as a modern industrialised nation with, for example, new criteria for high-tech investments having come into effect late in the month and AI technology champions feted by the country’s corporate awards. We expect significant technological advancements in 2025 with Vietnamese banks and retailers already digitalising more but also with even greater foreign direct investment in related projects. For instance, Vietnam is awaiting the potential investment of USD 1.5bn from Elon Musk’s SpaceX – for its Starlink satellite internet services. This will pave the way for more digital developments across the country and underline its significance as a key satellite internet market in Southeast Asia, offering Starlink access to its increasingly tech-savvy population and expanding digital economy.

. . . . . . . . . . .

Biotechnology and healthcare

RTW Biotech Opportunities, 31 March 2025

The Russell 2000 Biotech Index and the Nasdaq Biotech Index (NBI) returned +2.5% and -1.4%, respectively, in 2024. The Russell 2000 Biotech Index remains below levels first reached in 2018. Interest rate worries dominated for much of the year and continued to after the US Federal Reserve’s latest shift in December. While the results of the first round of Inflation Reduction Act (IRA) drug negotiations were on the better end of expectations, the uncertainty surrounding RFK Jr’s nomination and subsequent appointment as Trump’s Secretary of Health and Human Services became a new reason for some to stay on the sidelines. Coming into 2024, the biotech sector had already underperformed the S&P 500 by a record amount and this continued through the year with -26% and -22% relative performance for the NBI and the Russell 2000 Biotech Index, respectively. Eli Lilly basically carried biopharma, generating ~US$200B in market cap while the rest of pharma (-US$180B) and biotech (+US$20B) combined, lost value. The total market cap of small and midcap biotech is only US$700bn, less than Lilly alone and about the same value as the market cap that Nvidia lost on “DeepSeek Monday” (i.e. 27th January 2025). If some flows are diverted from AI-tech to biotech, the impact on biotech could be significant given the relative market caps we see these days.

M&A was too small to get things going. While five-hundred-million-dollar-plus acquisition volumes remain near record highs (27 vs last year’s record 26), dollar value dropped to US$44 billion vs US$140 billion in 2023. This was the first year in twenty that we did not see an M&A deal over US$5 billion in value as there was a shift towards earlier stage assets as some buyers (namely Lilly, Novo, AbbVie, and AstraZeneca) are focused on revenues beyond 2030. To compound matters, China’s bear market has increased the supply of early-stage assets looking for capital, giving buyers more options. Despite this dynamic, we don’t think this spells the end for larger late-stage deals. Merck, Bristol, Roche, Novartis, and Sanofi are still on the hunt for revenues this decade and Lilly and Novo are sure to get more aggressive as their obesity revenues grow. Several large pharma companies face losses of exclusivity patent cliffs totalling approximately US$500bn over the next decade and currently have approximate US$1 trillion of dry powder (cash plus debt capacity) to make acquisitions. Only western biotech companies have the late-stage assets needed to fill their needs and a more friendly Federal Trade Commission (FTC) in the US should lower the barriers that have discouraged bigger deals in recent times.

IPOs made incremental progress towards normalisation. 17 companies made it out this year versus 12 last year. This is consistent with a slow transition from a bear market (less than 10) to a healthy one (more than 30). Consolidation also continued. After peaking in 2021 at 590 publicly traded small and mid-caps, the number is now 547. Most small and mid-cap companies have been disciplined around spending, with cash burn trending lower to extend runways. Public follow-on financing activity returned to near record levels as companies with good data were able to raise the capital they needed. Venture financing is extremely robust. Every category from Series A to D surged in 2024 supported by many “mega-rounds” (i.e. more than US$250m) in the As and Bs, the fuel for future waves of innovation.

. . . . . . . . . . .

Pedro Gonzalez de Cosio, Biopharma Credit, 25 March 2025

The life sciences industry is expected to continue to have substantial capital needs during the coming years as the number of products undergoing clinical trials continues to grow. All else being equal, companies seeking to raise capital are generally more receptive to non-dilutive debt financing alternatives at times when equity markets are soft, increasing the number and size of fixed-income investment opportunities for the Company, and will be more inclined to issue equity or convertible bonds at times when equity markets are strong. A good indicator of the life sciences equity market is the New York Stock Exchange Biotechnology Index (“BTK Index”). While there was substantial volatility during the period, the BTK index increased 6 per cent. during 2024 compared to 3 per cent. during 20233. Global equity issuance by life sciences companies during 2024 was $58.2 billion, a 42 per cent. increase from the $41.1 billion issued during 20233. Similarly, convertible bond issuance by life sciences companies increased to $9.7 billion in 2024 from $9.7 billion in 20233. We anticipate 2025 equity and convertible bond issuance to remain comparable to 2024 levels which should continue to support appetite for non-dilutive debt during the remainder of 2025. Acquisition financing is an important driver of capital needs in the life sciences industry in general and a source of investment opportunities. An active M&A market helps drive opportunities for investors such as the Company, as acquiring companies need capital to fund acquisitions. Global life sciences M&A volume during 2024 was $131.3 billion, a 41 per cent. decrease from the $221.9 billion witnessed during 20233, driven mainly by the volatility in the equity markets. We are encouraged by the number of M&A opportunities that are starting to build up which should lead to a more active market in the near term.

. . . . . . . . . . .

Infrastructure

BBGI Global Infrastructure, 28 March 2025

For the infrastructure sector, interest rate trends are particularly critical, as borrowing costs influence asset valuations, capital flows and deal activity. Infrastructure deal activity moderated, reflecting a measured approach to capital deployment. Publicly traded infrastructure assets have seen valuation compression, reflecting capital market volatility and higher interest rates.

Looking beyond near-term macroeconomic factors, long-term secular trends continue to reinforce infrastructure’s role as a critical asset class. Key investment themes shaping the next decade include digitalisation, decarbonisation, demographics, and modernisation and renewal of aging infrastructure.

According to the Global Infrastructure Hub[v], the world faces an infrastructure investment gap of approximately US$15 trillion by 2040, highlighting the urgent need for private capital. With governments constrained by high debt and fiscal deficits, specialist investors like BBGI are well positioned to bridge this gap. BBGI’s team is dedicated to identifying attractive core infrastructure opportunities that offer long-term cash flow visibility, strong inflation linkage and a meaningful social purpose.

The disconnect between private market valuations – evidenced by recent secondary market transactions in the core infrastructure sector – and the valuations currently ascribed by the public markets to the listed infrastructure sector continues to persist. Activity in the secondary market, particularly private market participants, reaffirms BBGI’s confidence in the attractiveness of these asset classes.

. . . . . . . . . . .

Technology and technology innovation

Mike Seidenberg, lead portfolio manager, Allianz Technology Trust

AI is creating a new wave of technology innovation every bit as exciting as the Internet. AI has the power to reshape the global economy, changing the way companies operate. This year promises even more groundbreaking AI developments, plus favourable regulatory changes and rapid digitalisation.

In 2025, we expect AI spending to shift from infrastructure development to include more software and services as the use cases for AI emerge and expand. This expansion should drive efficiency gains, spark innovation and create new business models. For example, autonomous systems such as self-driving cars, drones, and robotics have the power to revolutionise transportation, logistics, national security, medical treatment and factory production.

In cybersecurity, AI is becoming a powerful tool to detect anomalies, predict threats and automate responses to attacks. In advertising technology, AI is delivering personalised consumer experiences, optimising advertising spending and creating dynamic advertising campaigns that are faster, better targeted and more cost-efficient.

The year ahead is likely to see both headwinds and tailwinds as the new US administration policies could be more unpredictable than previous administrations. On the one hand, we are likely to see more merger and acquisition activity as interest rates trend downward and the US welcomes a more relaxed regulatory environment and companies are gearing up for strategic acquisitions to fuel growth and expand market share. Conversely, businesses like predictable policies which provide clarity and things like tariffs can create pause in the spending environment.

There may be more volatility in the semiconductor sector in the year ahead as a result of geopolitical tensions, policy shifts and supply chain disruptions. Restrictive export controls, tariffs and national security concerns may conspire to create a bumpy ride for the sector in 2025. However, this volatility also presents opportunities. AI-driven data centre spending is strong and supply-constrained in key areas, while cyclical semiconductor companies (including personal computers, handsets and industrial companies) with limited AI exposure are navigating an inventory correction, and there is the potential for a recovery later in the year.

The momentum from key growth trends such as AI and digitalisation, coupled with a more favourable regulatory environment and a boost in merger and acquisition activity, should support the technology sector in the year ahead. Looking even further ahead, exciting developments in areas such as quantum computing, augmented reality, artificial general intelligence and space exploration are on the horizon. However, this needs to be tempered with the risks around geopolitics and supply chains and highlights the need for disciplined risk management.

. . . . . . . . . . .

Debt

Robert Kirkby, chair, CVC Income & Growth, 26 March 2025

It is clear that 2025 will be another year of significant change and volatility whether it be trade wars and tariffs, or varying inflation rates or armed conflicts. The impact that these effects have on inflation and central bank interest rates is uncertain, with commentators having different perspectives and opinions based on a raft of imponderables. As a variable rate vehicle, how rates behave will influence the overall performance of the Investment Vehicle, noting of course that the opportunities sleeve of the Investment Vehicle provides interesting potential to increase the overall NAV through capital appreciation. Over the life of the Investment Vehicle this sleeve has generated approximately 15% gross annualised returns. However, despite these uncertain times and the increased volatility the Investment Vehicle Manager remains optimistic on performance.

One of the benefits of change, is that commercial businesses respond and take strategic action, this may include Merger and Acquisition (“M&A”) activity, capital investment, opening of new geographies etc. and all of this creates new or renewed need for financing, which creates new issuing opportunities for our Investment Vehicle. In addition, businesses that may be in some distress provide the opportunity to purchase secured loans at a discount to par. The Managers of our Investment Vehicle reviews these opportunities and will take advantage of the opportunity when they have insights that lead them to conclude there is a recovery story with material potential upside.

Overall demand for loans remains strong. There are growing new money issuances arising from increased M&A volumes where sponsors are taking advantage of strong market conditions to refinance more expensive private debt facilities into loans. We understand that this trend will continue to pick up through 2025. This should lead to a healthy supply of new issuance and continued growth of our market, and hence more investment opportunities.

. . . . . . . . . . .

M&G Credit Income, 27 March 2025

Geopolitical risk, which became the predominant driver of market moves in the latter part of last year, has continued to ratchet up in the early part of 2025. The trade and defence policy shifts of the Trump administration have upended the well established international order, creating a global economic realignment which is seeing historical alliances reshaped. The already rapid escalation of President Trump’s tariff war has seen a notable weakening in US equity and credit, with uncertainty on the extent of the tariffs, their permanence and the scope of retaliatory action, spooking investors and causing market volatility to spike. Additionally, a change in the supportive stance for Ukraine in its war against Russia seen under the Biden administration, and Trump’s apparent hostile position on NATO, has catalysed a paradigm shift in Europe with an urgent reprioritisation of defence spending which will require looser fiscal policy going forward. This has caused increased volatility and widening in European government yields.

The volatile backdrop to the first quarter of this year has also seen a softening in sterling credit spreads. However, this should viewed in the context of retracing the grind tighter seen over the last few months, during which multi-decade lows were reached, rather than anything more notable at this stage. Viewed over a longer term horizon, public sterling credit is still screening expensively on a spread basis, despite the attraction for all-in yield buyers remaining strong given the elevated rates component.

. . . . . . . . . . .

Private equity

Hamish Mair, investment manager, CT Private Equity Trust, 28th March 2025

We have experienced significant changes over the last five years. Post pandemic markets are significantly more volatile. Across the developed world public debt is at record levels, a legacy of the pandemic and the earlier period of ultra-low interest rates. According to the Institute of International Finance global debt reached a record high of $318 trillion in 2024. The debt burden has been further increased by a normalisation of interest rates, further stretching public budgets many of which were already challenged by aging populations and climate change. Geopolitical risks have also increased significantly, with Russia’s invasion of Ukraine, war in the Middle East, an increasingly assertive China and a significant shift in US foreign policy. Meanwhile listed markets have become increasingly concentrated, in a few very large US technology stocks (at the end of 2024 the ‘magnificent seven’, Nvidia, Apple, Amazon, Alphabet, Meta, Microsoft and Tesla, accounted for nearly a quarter of the MSCI World index) increasing systemic risk.

Most of the conditions required for a recovery in 2025 appear to be in place. Interest rates and inflation have moderated and are expected to decrease further in many markets, debt availability and pricing has improved, and there is plenty of capital in private equity funds that managers are keen to invest. The key to building the recovery’s momentum is business and investor confidence. This is threatened by persistent uncertainty: geopolitical tensions are high, wars continue in the Middle East and Ukraine, new trade wars threaten, and radical changes to US foreign policy require countries across the globe to adapt. There are likely to be significant changes in 2025. While this presents risk it also provides significant opportunities for those able to adjust and to act with confidence.

. . . . . . . . . . .

Leasing

Rob King, non-executive chair, Tufton Assets, 18 March 2025

Shipping is a global industry strongly influenced by geopolitics which has come into focus recently. In January, the US government increased the scope of sanctions to include 180+ tankers and associated commercial entities primarily aiming to reduce Russian energy revenues. Separately, the US also blacklisted prominent Chinese companies including China Cosco Shipping for suspected military links. The Investment Manager notes that sanctions typically remove capacity from legitimate commercial service – thereby tightening shipping markets.

The introduction of higher bilateral trade tariffs represents another wildcard. Within January, there have been several changes in proposed US tariff schemes which have also prompted retaliatory measures. It remains unclear whether these tariffs are being used as temporary negotiation tools or will they remain in place representing longer-term hurdles to free trade. Similarly, there is little clarity on the early proposal of increased US port charges for Chinese-built vessels which is scheduled to be debated later in March. Port charges are generally the Charterer’s responsibility, and this is likely to be the case for any increases. Further, only 4 of the Company’s 20 vessels are Chinese-built.

In January, Houthi rebels signaled an intention to cease attacks on vessels although there remains considerable uncertainty over how quickly this may happen and normalise transit through the Suez Canal. The Houthi announcement appears to be linked to the Gaza ceasefire deal which is itself conditional and thereby uncertain.

Finally, prospects have been raised for peace between Ukraine and Russia brokered by the current US administration. While such a possibility would be widely welcomed, the Investment Manager believes the subsequent normalisation of traditional trade routes and patterns between Europe and Russia likely happens slowly.

2025 looks set to have several geopolitical avenues for disruptive change. Disruption of traditional trade patterns often plays out to the benefit of shipping in terms of effect on tonne-mile trade demand growth. Nevertheless, the industry (like most others) also remains dependent on global GDP and trade growth. The Board and Investment Manager continue to monitor geopolitical developments.

. . . . . . . . . . .

Renewable energy infrastructure

Octopus Renewables Infrastructure Trust, 27 March 2025

While market conditions remain volatile, we are encouraged by positive structural tailwinds, including declining interest rates and the continued global commitment to the energy transition. The renewable energy sector is not only here to stay – it is accelerating, with evolving technologies in renewables infrastructure playing a pivotal role.

Whilst there has been some pull-back from oil and gas majors and US financials in reaction to the change in sentiment from the new US administration, the broader global momentum behind decarbonisation continues to build. Strong policy support, corporate net-zero commitments, and increasing demand for sustainable infrastructure assets are driving the energy transition forward. Governments worldwide continue to push ambitious decarbonisation targets, with the EU Green Deal and UK’s Net Zero Strategy providing long-term policy certainty and financial incentives for clean energy investment in ORIT’s core markets. In continental Europe, easing macroeconomic pressures – particularly through declining interest rates – are expected to support infrastructure valuations and bolster investor confidence. Power price volatility remains a challenge, but a continued focus on fixed-price contracts, corporate PPAs, and diversified revenue streams will help mitigate risk and stabilise returns.

. . . . . . . . . .

Commodities and natural resources

Keith Watson and Robert Crayfourd, Golden Prospect Precious Metals, 12 March 2025

Despite retracing from an all-time-high of $2,790/oz, in the immediate aftermath of Trump’s re-election as US President, to close the year with a gain of over 27%, gold’s upward momentum has resumed and at the time of writing it has risen a further 13% in the year-to-date and currently stands at over $2,940/oz.

Trump’s early days in office have been marked with geopolitical aggression through tariffs and trade war threats, and deflation expectations have shifted to inflationary pressures as these policies stoke higher prices. This is restricting the Federal Reserve’s ability to cut rates and pushing up the rate on the US 10yr Treasury bond, which given their $36trn debt pile is increasingly raising sustainability questions in a new higher rate environment.

This backdrop continues to support demand three-fold:

1) From Central Banks as they seek to protect against US trade aggression,

2) From retail bar and coin purchases as individuals seek to protect against currency devaluation and, increasingly,

3) From financial markets as investors seek to gain protection against market volatility and risks around government debt affordability in a higher rate environment. Financial market participation is a major swing factor, as the swings from selling to buying are far more material proportionately than say central bank demand increasing by 10%. The only pocket of apparent weakness is jewellery in response to higher prices (-11% YoY), but this is known and has already happened thus doesn’t present a demand risk from the already reset lower level.

As a result, demand for physical metals remains robust and it is encouraging that healthy central bank net buying continues to more than offset weak retail demand, as consumers adjust to the new higher price environment, with the PBOC’s return after a brief seven-month hiatus, also supportive.

In part this appears driven by a lack of generalist inflows to the sector, as resource sector specialists are generally overweight precious metal miners, but have seen little inflows. The key we believe to bringing more generalist and retail money back into the precious metal miners sector is 1) capital returns via dividends and buybacks, 2) cost discipline underpinning margin sustainability and also 3) general market volatility to lead investors in to search for protection.

. . . . . . . . . . .

Property

Chris Phillips, chair of Social Housing REIT

The macroeconomic environment remained challenging throughout the year. Concerns that interest rates would remain ‘higher for longer’ put sustained pressure on property valuations. Nonetheless, the general decline in inflation (despite a modest uptick in the final quarter) is providing some relief and we are optimistic that UK interest rates will continue to decline further during 2025 which should be positive for property sector valuations.

The UK residential sector continues to face a major imbalance between supply and demand. The new Labour government has set out its ambitions to facilitate a much-needed increase in the delivery of new homes, albeit with a target supply level remaining unchanged at 300,000 homes per year. However, supply responses in the built environment are complex and will take time to deliver. The demand for specialised supported housing (SSH) continues to rise, resulting in high levels of occupancy across the SSH sector and the company’s portfolio.

Central and local government continue to provide financial support for individuals who require housing and care. This strong demand dynamic, combined with inflation-linked rental growth, has helped offset some of the broader valuation declines of the group’s property portfolio over the last 12 months.

. . . . . . . . . .

Duncan Garrood, chief executive of Empiric Student Property

The purpose built student accommodation (PBSA) market continues to demonstrate resilience in the face of wider macroeconomic headwinds, underpinned by sustained student demand for prestigious UK universities and modern accommodation. Investor appetite is fuelled by the undersupply of high-quality operational beds, long-term predicted growth in demand and constrained delivery of new supply with reducing supply of the traditional alterative HMO accommodation.

Overall, the demand and supply imbalance in PBSA continues unabated, however this is highly nuanced in some markets, which have greater supply, demonstrating a level of price sensitivity. Participation rates in the UK’s higher education sector remains historically high with over 2.4 million full-time students. The UK remains an attractive, high quality, and relatively affordable destination of choice for international students compared to other markets, with students of Chinese origin continuing to dominate the UK’s international student market.

The growth in student numbers, which accelerated post pandemic has since normalised, aligning with longer term trends. The continued growth in domestic 18-year-olds and a forecast recovery in international students is expected to ensure this continues to remain robust. The recent three per cent increase in the tuition fee cap to £9,535 is not expected to impact application numbers from UK domestic students.

A clear flight to quality continues with higher tariff, typically the Russell Group’s research-led, universities experiencing year on year growth in applications to the detriment of medium and lower tariff universities. This validates our strategy of focusing our portfolio on these cities, which deliver growth and investment.

It is anticipated that the sector will continue to have a significant shortfall in supply, with only 11,270 new beds delivered in 2024. Viability remains a key challenge for developers, with higher build costs, increased development periods, enhanced building safety requirements, sustainability demands, increased financing costs and a challenging planning environment continuing to discourage development.

Supply will therefore be increasingly focused on the best performing markets which are fuelled by continued favourable student demand where higher rents improve development viability. The shortage of housing options for students is also being compounded by the continued loss of HMOs, exacerbated by the recent Autumn Budget and proposals within the Renters Rights Bill which currently continues its way through Parliament.

. . . . . . . . . .

Simon Laffin, chair of Care REIT

Real estate opportunities are often underpinned by powerful structural trends. We’ve seen this in the last decade, with the growth in e-commerce, digitisation and student numbers fuelling huge demand for logistics assets, data centres and student accommodation. An ageing society underpins the demand, and therefore investment rationale, in our segment of healthcare. We believe that the challenge of caring for an ageing society is the next structural trend, with the potential to create attractive returns for care homeowners who choose the right assets and partner with the right operators. Within this trend we see three main themes: ageing, acuity and affordability.

The UK will be home to an unprecedented number of older people in the coming decades. There are currently 6.5 million people aged over 75 in the UK and that number is forecast to increase by 55%, to 10.1 million, over the next 25 years. This change will happen during the lifetime of most of our leases.

Rising numbers of older people will directly lead to more demand for care home beds. However, the market has not responded by increasing supply. In fact, between 2012 and 2021, the supply of beds in nursing and residential care homes fell from 11.3 per 100 people aged over 75 to 9.4 – a 17% decrease. This reflects the high cost of developing new homes, coupled with inefficient smaller operators leaving the market.

While rising life expectancies are good news, the downside is that most people will spend the last 15 years of their life with some ill health. Around 10% of people over 80 have care needs that make it difficult for them to live at home.

Dementia is the most common acute condition affecting people in care homes. Around 70% of care home residents suffer from some form of memory loss, which ranges from mild confusion to severe dementia. The Alzheimer’s Society projects that the number of people in the UK with some form of dementia will rise from just over 1.1 million in 2025 to 1.6 million in 2040, with the greatest rise being among people with a severe form of the condition. Dementia and Alzheimer’s disease is already the leading cause of death in England and Wales, accounting for 11.4% of deaths in 2022 (source: ONS).

Since the COVID-19 pandemic, our tenants have reported that people are moving into care homes later than before, that they’re more likely to be frail or ill and that their stays are shorter. This is creating a longer‑term shift in the industry, with increasing demand for care providers who can deliver higher‑acuity care.

However, many people are kept longer in hospital due to the shortage of care home beds and their inability to pay for residential or home care. This means they’re in the wrong setting for the care they need, particularly if they have dementia. On average during 2023 there were just over 12,000 people in hospital every night who had no clinical reason to be there but could not be safely discharged. Half of those people, nearly all of them elderly, had been waiting more than 21 days to be discharged. This “bed blocking” increases costs for the NHS and has a knock-on effect on other patients, who can’t be admitted to hospital without a vacant bed. The government has made reducing NHS waiting lists one of its main political aims. Achieving this will require adequate capacity in properly funded care homes.

Most care home residents in England are state-funded, with this source of funding being particularly important for people living in the Midlands and the North.

However, there is no national government budget for adult social care in England and a person’s care needs might be met by their local authority’s social services budget or by their local NHS Trust. The individual or their relatives may also have to contribute to the cost. Most local authorities support their adult social care costs through a council tax levy and, in certain situations, local authority or NHS funding is means tested.

This complexity and the pressure on public sector finances mean waiting lists for social care have grown in recent years, with a doubling of the number of people waiting for over six months. While waiting lists for NHS care are well known, the waiting lists for social care are much less publicised.

With local authority budgets likely to remain hugely constrained and demand continuing to rise, the affordability of care home places will be crucial. The economics of our sector mean that existing homes are more likely to meet this affordability test than new developments. An existing home providing good care can cost less than £100,000 per bed. In contrast, a high-quality new care home is often £200,000 or more per bed, reflecting high construction costs and limited land supply. The higher build costs of new homes lead to higher rents for tenants – up to 20% of their revenues as opposed to our average of 12.5% – which they have to pass on through higher fees for residents.

This restricts the size and growth of this segment of the market and means that higher fees don’t automatically translate into better care, which depends more on the quality and stability of the staff than the building.

From an investment perspective, an existing home generally offers better risk-adjusted returns. We can buy a home at less than its replacement cost and invest in it to add more beds, allow the tenant to offer more services such as dementia care, and improve its facilities and environmental performance. A bed in a well-run existing home is likely to be in high demand, generating a long-term and steadily growing income stream, which supports its capital value.

. . . . . . . . . .

Lynda Shillaw, chief executive of Harworth Group

Demand [for industrial and logistics] continues to be driven by structural factors, including growth of online retail, cloud computing, the dramatic proliferation of AI, and the increased infrastructure requirements that come with all three. Take-up for Grade A industrial and logistics space of 100,000 sq ft units and larger was up 6% in 2024, to 22.6m sq ft, outperforming the pre-pandemic average of 21.2m sq ft, according to Jones Lang LaSalle (JLL). Three-quarters of this total take-up was of new, rather than second-hand, space, indicating significant business focus on new facilities. A fall in the level of build-to-suit space was more than offset by an increased level of speculative take-up of 7.4m sq ft, which compares to average pre-pandemic speculative take-up levels of 4.5m sq ft.

Despite occupiers remaining active, the market is not seeing a corresponding impact on net absorption and overall vacancy as occupier demand is being driven by more strategic reasons than business growth alone, which is resulting in deals taking longer to complete and older space coming back into the market. Notwithstanding, H1 2025 requirements are forecast to be up year-on-year with a focus nationwide on units of 100,000-200,000 sq ft. According to JLL, 74% of 2024 take-up was within our regions and the Midlands made up the lion’s share at 58%.

Prime yields were broadly stable across 2024, but the volatility in bond markets is expected to impact Q1 2025 transaction appetite, as investors and vendors wait to see how the market settles down. Investors and developers are increasingly focused on strategic acquisitions and developments that meet occupier needs and sustainability requirements and are best placed to benefit from rental growth. UK prime headline rents enjoyed 6% growth over 2024 and, while this is down year-on-year and materially below the pandemic peak of almost 18% in 2021, it is still above average pre-pandemic levels of 4.1%, based on JLL research.

The UK data centre market is in a material growth phase, with more recent interest outside of London and the South East. While different commentators have varying projections of the state of the UK market and potential growth, consensus is clear that the market is set to experience a double-digit CAGR out to 2030, driven by growing adoption of multi-cloud computing and network upgrades required to support the roll out of 5G alongside the need for more data storage and transmission from ecommerce, digital content, social media and the Internet of Things.

Limited availability of land and power, together with sustainability regulations, and their impact on cost and time to deliver, are the pressing issues for both operators and investors in the UK and globally. Since the start of 2024, Savills has tracked over 415 acres of UK land deals to data centre operators that were, in the main, previously promoted for industrial and logistics use. This has had the effect of removing, on average, close to one year’s worth of potential industrial and logistics supply from the market.

Residential volumes remained subdued in 2024, with the market in the early stages of recovery. Front and centre of government policy are bold ambitions to increase housing activity, delivering 1.5m new homes by the next General Election, with planning reform at the heart of supporting this and wider economic growth. It’s fair to say that delivery against this target will be back-end loaded, with housebuilder volumes in 2024 still not recovering to 2022 levels and new government initiatives to drive up volumes being mobilised.

Local housing targets have been reintroduced and the presumption in favour of development strengthened with government task forces formed to unlock the ‘grey’ belt. While planning reform is still expected to be a relatively protracted process, the shift to drive growth and develop new homes is a positive signal to the sector and, from a supply side perspective, positive also for strategic land. However, the returns for landowners need to remain attractive for land to come forward to meet the scale of what is proposed.