In the US, hopes for near-term interest rate cuts may have been dashed by the Federal Reserve (Fed). In a recent speech, governor Lisa Cook noted that services inflation was running above pre-pandemic levels. She forecast that forecast ‘that three- and six-month inflation rates will continue to move lower on a bumpy path’, but thinks that ‘the job market is roughly where it was before the pandemic – tight but not overheated’. Cook’s sentiment for American jobs is supported by consumer attitudes, with 38.1% of consumers describing the availability of jobs as ‘plentiful’, an improvement from May’s reading of 37%. Moreover, the S&P Global US Manufacturing PMI index reached a three-month high in June, posting at 51.7, up from 51.3 in May, once again surpassing expectations.

‘Interest Rates Don’t Care Who You Vote For’ – John Stepek, Bloomberg

In a contrast to the Fed’s monetary decisions, the European Central Bank followed its Swiss neighbour in cutting rates, from 4% to 3.75%, the first ECB rate cut in five years. As for the next round of cuts, the ECB’s Olli Rehn stated that it would be ‘reasonable’ for further cuts to come by the end of the year, so long as ‘disciplinary process continue(s) as projected’. Despite encouraging monetary policy, the HCOB Eurozone composite PMI dropped from 52.2 in May to 50.8 in June, notably below market expectations. On the other hand, the index still indicated a fourth consecutive month of private sector growth.

Amidst uncertainty in the run up to the UK’s election, attitudes towards UK equities seem to be modestly improving with Joe Davis, global chief economist at Vanguard, expecting the economy to see success irrespective of who leads the new government, supported by an ‘increase in disposable income and some of the inflationary pressures easing off’. The Bank of England’s maintained its sixteen-year high rates of 5.25%, however Governor Andrew Bailey was ‘optimistic’ about falls in inflation. This optimism also corresponded with James Briggs, of Janus Henderson, feeling ‘relatively upbeat’ in his outlook towards UK stocks.

Mid-caps outperformed the broader market and were spurred on by a pick-up in overseas inbound bids

Schroder UK Mid Cap Fund

The Indian market has delivered 13.0% annualised returns over both five- and ten-year periods, handsomely outpacing the Chinese and Emerging Markets indices

JPMorgan Indian Investment Trust

While the Chinese economy remains sluggish, having failed to reap fully the benefits from the post-COVID reopening, there are undoubtedly signs of improvement

Fidelity China Special Situations

At a glance

| Exchange rate | 28 June 2024 | Change on month % | |

| Pound to US dollars | GBP / USD | 1.2645 | (0.5) |

| Pound to Euros | GBP / EUR | 1.1801 | 0.5 |

| US dollars to Japanese yen | USD / JPY | 160.88 | 2.3 |

| US dollars to Swiss francs | USD / CHF | 0.8988 | (0.4) |

| US dollars to Chinese renminbi | USD / CNY | 7.2673 | 0.4 |

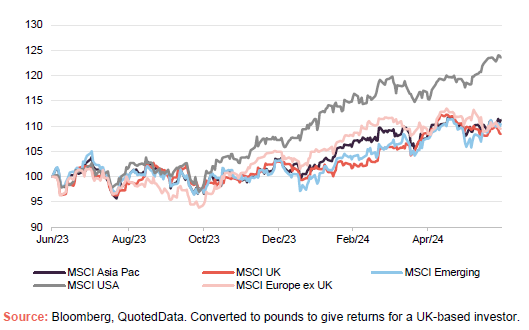

MSCI Indices (rebased to 100)

Emerging markets did well in June, helped by strong performances from Taiwanese, South African, Indian, and Korean stocks. The US market moved higher too, once again it was the AI-related mega cap stocks making the running. By contrast, the UK and Europe were the laggards, despite the European rate cut.

The Japanese yen weakened again, to levels not seen in almost 40 years. The delay to US rate cuts is the main problem here. Oil was stronger, partly on the back of heightened tensions in the Middle East.

Time period 28 June 2023 to 28 June 2024

| Indicator | 28 June 2024 | Change on month % |

| Oil (Brent – US$ per barrel) | 86.41 | 5.9 |

| Gold (US$ per Troy ounce) | 2326.75 | (0.0) |

| US Treasuries 10-year yield | 4.40 | (2.3) |

| UK Gilts 10-year yield | 4.17 | (3.4) |

| German government bonds (Bunds) 10-year yield | 2.50 | (6.2) |

Global

Alex Crooke, fund manager, The Bankers Investment Trust, 25 June 2024

The six month period to the end of April 2024 has been a good time to be invested in equity markets, as a strong recovery in share prices led to most markets reaching new all-time highs. Investors were optimistic that fading price inflation would lead to the tight monetary policy being eased by rate cuts. However, as it turned out, rates were not cut during the period in any major market and instead it was the delivery of stronger-than-expected corporate profits that underpinned higher share prices. In most sectors, companies experienced improving margins as higher prices stuck and energy costs fell.

The US market was marginally the better performer during the period, closely followed by Europe, Japan and the UK. The best performing stocks continued to be those focused on delivering artificial intelligence (‘AI’) solutions, particularly in the US market. However, recovery was fairly broad based in most markets as financials, industrials and retail exposed companies performed best, while energy, utilities and telecoms were laggards.

In meetings with our investee companies, we are hearing positive messages about orders improving, restocking from customers and margins holding up. Inflation has fallen close to central bank targets and the first interest rate cuts have started in major economic regions. The overall outlook is more positive than six months ago and should support the increase in share prices we have seen this year.

. . . . . . . . . . .

Sebastian Lyon, manager, Personal Assets, 18 June 2024

A year ago, we wrote about the burgeoning effects of rising interest rates and our expectation of slower economic growth combined with the risks of a recession. Signs of stress in the banking sector abated following the collapse of Silicon Valley Bank and Credit Suisse. The sting of tighter monetary policy has, thus far, largely been offset by aggressive fiscal stimulus, especially in the United States. Nevertheless, monetary policy always works with a lag, usually of 12 to 24 months, so with interest rates having peaked as recently as the summer of 2023, we are unlikely to have experienced their full effect. In the meantime, equity markets have been buoyed by the excitement surrounding generative Artificial Intelligence (‘AI’) and large language models such as ChatGPT-4. We have been taken aback by investors’ willingness to speculate so soon after the profitless tech boom of 2020/21, which quickly turned to bust. Whether history will repeat itself is open to question. However, the scale of investment in capacity is reminiscent of the investment made in fibre during the dotcom boom. How sustainable this is, and whether such investment ultimately earns an economic return, remains to be seen but benefits are likely to accrue to more sustainable and recurring business models.

Despite renewed speculation in some parts of the equity market, bond markets have continued to disappoint. The secular bear market in bonds, which began in 2020 when yields troughed during the pandemic, has continued with rising yields (and falling prices). It is becoming clear that we have entered a new era of upward yield pressure and a commensurate rising cost of capital. While western bond markets have performed poorly, this may take time to be reflected in equity valuations, which remain high by historic levels. This new regime is the reverse of the 2010s, when benign inflation and low growth meant rate hike expectations were continuously dashed and bond yields ground ever lower. At the beginning of 2024, the consensus forecast was for no less than six interest rate cuts over the coming year from the US Federal Reserve and the Bank of England. Yet four months on, interest rate cuts have not been forthcoming. Fewer cuts, when they eventually arrive, may imply interest rates bottom at a higher level than many expect, with further implications for long-dated bonds and equities. We suspect there is a need to acclimatise to this new environment. Despite easy comparisons from price levels of a year ago, inflation has remained stickier than expected with core levels still stubbornly above targets in the US and the UK.

Gold remains essential portfolio insurance and provides diversification for the company. During the financial year, the price of the yellow metal rose by +15% to $2,295oz. (+16% in Sterling). This strength has caught many investors by surprise as higher interest rates implied a higher opportunity cost for holding a zero-yielding asset like gold. Yet gold has outperformed the S&P 500 US equity index this century, demonstrating its substance and scarcity in an increasingly febrile and financialised world. Heightened geopolitical tensions and the gradual reversal of globalisation explain the continued attraction of an asset that is no one’s liability, as well as sustained demand from central banks seeking to diversify their reserve assets away from western currencies, a process described as ‘de-dollarisation’. Savers may also be seeking protection from sticky and stubborn inflation. Those with long memories will recall that higher interest rates and bond yields did not stop the price of gold rising in the 1970s. With ballooning deficits, in a post-Covid world, politicians have long forgotten fiscal rectitude. The US government debt situation no longer looks sustainable and yet warnings are being ignored by both presidential candidates. It is not entirely surprising that international investors are seeking to diversify into the longest standing reserve asset.

Grounds for caution remain. There is evidence of retail investor speculation including participation in cryptocurrencies and ‘meme’ stocks. Meanwhile the most recent Bank of America global fund manager survey highlights that fund managers are at their most bullish since the last equity market peak in November 2021. This is a time for patience and prudence, not ebullience.

. . . . . . . . . . .

Managers, Edinburgh Worldwide – 5 June 2024

We believe the current stock market risks misinterpreting the dynamics of asymmetry, principally concerning that which has been delivered versus potential future asymmetry. If you follow stock markets, especially the US stock market, you will have likely heard a reference to the “Magnificent 7” (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla) which are all attracting investors based on their potential to be beneficiaries from the development of AI. To be clear, these are exceptional companies, they have become highly dominant in their respective areas, and several of them have arguably become the digital utilities through which large chunks of commerce and data now flow. But early in this millenium, many of these companies were the upstarts. They are the ones that naysayers doubted, they were the ones pioneering new solutions, embracing digital tools, expanding their relevance to customers, skillfully executing yet avoiding the numerous pitfalls. Their prize has been highly asymmetric equity returns and handsome profits to those who owned them throughout that journey.

However, the prospect of future deeply asymmetric returns is fundamentally different from delivered asymmetric returns. Both should be respected but the former represents latent opportunity whereas the latter, by its very nature, represents diminishing opportunity and, if taken too far, can be detrimental as the inescapable law of large numbers catches up. The adage that it’s better to travel than to arrive is critical to maximising asymmetry – just make sure the journey is a long one. It’s for this reason that we hunt for such businesses when they are immature and below the conventional investment radar at the outset.

Momentum, both positive and negative, tends to exert a pendulum-like effect on equities, be it FOMO-induced or fear-driven. Periods of momentum are unavoidable for long-term growth investors, and many of our most successful investments will have both benefitted and suffered from such trends for short periods in the past. But occasionally there are periods or themes at play in stock markets where this momentum seemingly takes on a gravitational-like force, sucking the air out of the broader market and blinkering investors to the broader opportunities beyond.

While we undoubtedly see great opportunity for AI to transform huge swaths of both business and consumer activity, it feels that stock markets have too bluntly anointed the benefits of these deep changes to a handful of winners – which would crudely fit with the Magnificent 7 alongside a handful of ex-US companies involved in aspects of semiconductor production. We see parallels to this dislocation in the healthcare industry where the arrival of GLP-1 obesity drugs has monopolised much of the healthcare innovation debate. We get that dominant businesses deserve their rewards – and our experiences in owning Tesla for a decade are tantamount to this – but we can’t escape thinking that there must be easier ways to make money in today’s bifurcated stock market.

When a hot contemporary theme hits a momentum-craving, but otherwise directionless, stock market then we believe that dangers build. In this current atypical business cycle this dynamic seems to be exacerbated by the Interest rate waiting game currently being played out in financial markets where observers and policy-setters dissect the moderating inflation picture with a robust economic picture. We think the backdrop discussed above has been deeply unhelpful to investors in earlier-stage, growth-hungry companies. The combination of condensed investor time horizons and higher interest rates, alongside a couple of hugely dominant mega-company skewed themes, means our preferred hunting ground hasn’t had the attention it deserves and has been arguably shunned by many.

We don’t have all the answers to when these apparent dislocations will fully correct but we sense that is starting to change. In part, because some of the themes discussed above have likely been pushed quite far. Simultaneously, the realisation that high inflation isn’t endemic plus a global economy that appears resilient, despite everything that has been thrown at it over the past 4 years, creates a solid foundation for investors to begin projecting out over longer-term time horizons.

. . . . . . . . . . .

Dan Higgins, Marylebone Partners, 29 May 2024

We can see reasons why markets could rise further over the rest of 2024. Inflation is seemingly under control, the global economy is in reasonable shape, and corporate earnings are fairly robust. Moreover, financial conditions are broadly supportive, and allocators are more sanguine about the economy even as they adjust to a more realistic outlook for interest rates.

However, this is no time for complacency. Potential risks on the horizon include a record number of political elections, signs of stress in Commercial Real Estate, and the troubling geopolitical situation in the Middle East.

Although valuation alone is rarely the trigger for a new bear market, headline multiples for equity markets are full once again. This leaves some ‘long-duration’ growth stocks susceptible to a de-rating if inflation proves stickier than expected.

. . . . . . . . . . .

UK

Robert Talbut, chair, Schroder UK Mid Cap Fund, 26 June 2024

UK equities rose over the period. Mid-caps outperformed the broader market and were spurred on by a pick-up in overseas inbound bids. Consumer discretionary and real estate companies performed well amid a sharp drop in interest rate expectations following a more dovish tone from the BoE. Financials and industrials also outperformed as economically sensitive areas of the market in general did well amid an improving outlook for the global and UK economy. As the period progressed, expectations moved to price in a sooner-than-expected first UK interest rate cut as inflation undershot the BoE’s forecasts. The Office for National Statistics confirmed that annual inflation, as measured by the Consumer Prices Index, had fallen to 3.4% in February 2024, the lowest rate of price increases since September 2021, and from a peak of 11.1% in October 2022. Official data showed that the economy had entered a technical recession in the second half of 2023. This occurred as the tailwind of post-pandemic revenge spending came to an end and the headwinds of higher inflation and interest rates weighed on activity. However, the market was more focused on signs of recovery, with confidence among both consumers and manufacturers picking up over the course of the period. The reaction to the Spring Budget was largely muted.

Both the Board and our Investment Manager remain positive on the outlook for the UK economy, given a combination of low unemployment, rising household disposable income, and increased business investment. Additionally, there is an anticipation of the Bank of England (“BoE”) starting to cut interest rates by the end of 2024. The outcome of the General Election has the potential to positively influence market sentiment towards the UK. The fundamentals in many other economies that the Company’s holdings are exposed to are similarly sound. From a valuation perspective the UK stock market represents one of the cheapest regional equity markets in the world, with the UK mid-cap sector looking particularly attractive. We continue to remain optimistic about the outlook for UK mid-caps.

. . . . . . . . . . .

Adam Avigdori and David Goldman, BlackRock Investment Management, BlackRock Income and Growth, 20 June 2024

Equity markets entered 2024 in a buoyant mood following a strong and broad rally in the latter part of 2023. The outlook, and optimism, is a far cry from 12 months ago, when supply chains were hugely disrupted, and inflation was in double digits and well ahead of central banks’ targets prompting rapid and substantial interest rates hikes despite an uncertain demand environment. Despite this, equities had one of their best years on record outperforming bonds with double digit increases, in US Dollar terms, across most of the developed world and some emerging markets. In the US, the Nasdaq was the standout rising 54% driven by the largest seven companies that rebounded strongly (+c. 70%) after a poor 2022, when they had fallen 39% as a group. The FTSE All-Share Index returned 7.9% in 2023. Whilst China was the surprise negative in 2023, with no noticeable COVID-19 re-opening recovery and lacklustre growth despite government attempts to stimulate.

As we pass the first quarter of 2024, we believe markets have shifted into ‘goldilocks’ territory whereby slowing inflation has signalled the peak for interest rates while broad macroeconomic indicators that have been weak are not expected to deteriorate further. This is also helpful for the cost and availability of credit which has recently improved having been deteriorating through most of 2023. During December, bond markets had begun to price in 130bps of easing in the US and a not dissimilar amount in the UK and Europe. We believed that this quantum of cuts will prove to be overly aggressive without a significant deterioration in the economy which we don’t expect. That said, despite these expectations moderating significantly during Q1, stock markets have continued to make progress in the developed world. Labour markets remain resilient for now with low levels of unemployment while real wage growth is supportive of consumer demand albeit presenting a challenge to corporate profit margins.

Notably in 2024, geopolitics will play a more significant role in asset markets. This year will see the biggest election year in history with more than 60 countries representing over half of the world’s population going to the polls. While most, such as the UK’s are unlikely to have globally significant economic or geopolitical ramifications, others, such as the US elections in November, could have a material impact. We believe political certainty may be helpful for the UK and address the UK’s elevated risk premium that has persisted since the damaging Autumn budget of 2022. Whilst we do not position the portfolios for any particular election outcome, we are mindful of the potential volatility and the opportunities that may result.

The UK stock market continues to remain depressed in valuation terms relative to other developed markets offering double-digit discounts across a range of valuation metrics. This valuation ‘anomaly’ saw further reactions from UK corporates with the buyback yield of the UK, at the end of 2023, standing at a respectable c. 2.5%. Combining this with a dividend yield of c. 3.7% (FTSE All Share Index yield as at 30 April 2024. Source: The Investment Association) the cash return of the UK market is attractive in absolute terms and comfortably higher than other developed markets. Although we anticipate further volatility ahead as earnings estimates moderate, we know that in the course of time risk appetite will return and opportunities are emerging.

Whilst we anticipate economic and market volatility will persist throughout the year, we are excited by the opportunities this will likely create.

. . . . . . . . . . .

James Henderson, Laura Foll and Wendy Colquhoun, fund managers and chair, Henderson Opportunities Trust, 19 June 2024

In the short term, there will be some uncertainty ahead of the UK’s General Election in July. Looking further ahead however, it is likely that UK interest rates will be reduced in the coming months. The benefit to the economy could be a return of confidence. Corporate capital spend is more likely to be actioned by companies as they become more confident that the recession is behind them. For the consumer, the period of restraint could ease and retail spend could pick up from depressed levels in some categories. On top of this, there is a natural replacement cycle picking up in the economy as major projects which had been put on hold come through. The overall effect could be for UK economic growth to gain traction over and above what is in economists’ forecasts. The increased activity could feed through to a steeper than expected pick-up in corporate earnings, as the cost base of many companies is very controlled as a result of the disciplines learned in a testing period. The increased profits would be well received by investors and the very low valuations can improve.

In recent years, the landscape of the UK stock market has undergone a noticeable transformation, characterised by a gradual shrinkage in its size and scope. One indicator of this trend is the dwindling number of companies quoted on the Main Market. The number of companies in MUSCIT’s benchmark, the NSCI, has fallen to c.350 compared to around 1,000 at the turn of the century. The number of those companies traded on AIM has shrunk by 56% since its peak in 2007.

This is, to say the least, a very negative development for the UK as a whole. Historically, the British stock market has been renowned for its diversity and breadth, offering investors a wide array of investment opportunities across various sectors. The UK has been home to many world-leading companies with outstanding management teams and excellent corporate governance. However, the UK equity market has faced numerous challenges: relatively poor performance especially compared to the United States and some other overseas markets, multiple regulatory changes and of course Brexit. As a result, an increasing number of companies have chosen to delist, move abroad or to seek funding from private equity.

The ramifications of this trend extend beyond mere numerical decline, impacting the vibrancy and competitiveness of the UK stock market as a whole. A shrinking market not only reduces the breadth of investment opportunities available to investors but also diminishes the market’s role as a catalyst for economic growth and innovation. With fewer companies listed on the stock exchange, there is a risk of reduced liquidity and market depth, potentially deterring international companies from listing in the UK. It makes international investors less interested in investing in the UK and drives our own savers to look overseas. It is a sorry state of affairs when the average UK pension fund holds less than 4% in UK equities, a far cry from 39% back in 2000.

Sadly, for years the UK has been a notable outlier in its absence of support for its domestic stock market compared to other countries with an active investment environment. China has recently been stepping in to support domestic share prices through investments from state institutions, whilst part of the resurgence in the Japanese equity market has been attributed to the Nippon ISA that has been supporting domestic retail flows. Since 2014, France has had its own version of a Stocks & Shares ISA dedicated to supporting domestic and European quoted smaller companies. Investments in these ISAs now stands at over £2 billion.

. . . . . . . . . . .

Arthur Copple, chair, Montanaro UK Smaller Companies Investment Trust, 14 June 2024

In recent years, the landscape of the UK stock market has undergone a noticeable transformation, characterised by a gradual shrinkage in its size and scope. One indicator of this trend is the dwindling number of companies quoted on the Main Market. The number of companies in MUSCIT’s benchmark, the NSCI, has fallen to c.350 compared to around 1,000 at the turn of the century. The number of those companies traded on AIM has shrunk by 56% since its peak in 2007.

This is, to say the least, a very negative development for the UK as a whole. Historically, the British stock market has been renowned for its diversity and breadth, offering investors a wide array of investment opportunities across various sectors. The UK has been home to many world-leading companies with outstanding management teams and excellent corporate governance. However, the UK equity market has faced numerous challenges: relatively poor performance especially compared to the United States and some other overseas markets, multiple regulatory changes and of course Brexit. As a result, an increasing number of companies have chosen to delist, move abroad or to seek funding from private equity.

The ramifications of this trend extend beyond mere numerical decline, impacting the vibrancy and competitiveness of the UK stock market as a whole. A shrinking market not only reduces the breadth of investment opportunities available to investors but also diminishes the market’s role as a catalyst for economic growth and innovation. With fewer companies listed on the stock exchange, there is a risk of reduced liquidity and market depth, potentially deterring international companies from listing in the UK. It makes international investors less interested in investing in the UK and drives our own savers to look overseas. It is a sorry state of affairs when the average UK pension fund holds less than 4% in UK equities, a far cry from 39% back in 2000.

Sadly, for years the UK has been a notable outlier in its absence of support for its domestic stock market compared to other countries with an active investment environment. China has recently been stepping in to support domestic share prices through investments from state institutions, whilst part of the resurgence in the Japanese equity market has been attributed to the Nippon ISA that has been supporting domestic retail flows. Since 2014, France has had its own version of a Stocks & Shares ISA dedicated to supporting domestic and European quoted smaller companies. Investments in these ISAs now stands at over £2 billion.

We were pleased to hear the Chancellor of the Exchequer recently announced plans to introduce a UK ISA. Although this initiative alone is unlikely to revive the UK equity market, it is nonetheless a step in the right direction. The possible re-bundling of research and broker commissions – currently disallowed under the MiFID II regime – could also help encourage retail investors back into the market. There are other avenues to explore in future such as: incentivising companies to list and remain listed by reviewing tax incentives and simplifying listing rules; abolishing Stamp Duty; and addressing the implications for the smaller end of the market of the ever-growing consolidation amongst wealth managers.

. . . . . . . . . . .

Linda Wilding, chairman, Odyssean Investment Trust, 11 June 2024

For much of the period since the Company launched UK equities, particularly UK Smaller Companies, have been out of favour, despite the compelling value they have been offering for the past couple of years. Whilst the Portfolio Manager and my predecessor must have felt like lone voices at times, pleasingly over recent months there has been a much broader recognition of this anomaly and opportunity.

It’s impossible to predict the timing of any reassessment and re-rating of UK equities, nor the specific catalyst or catalysts driving this. Assuming we are at the peak of the interest rate cycle, the first interest rate cut might be one such catalyst.

Whilst we wait for this re-evaluation, further M&A activity is possible. The portfolio was not a major beneficiary of M&A in the year under review, potentially due to its skew towards industrial companies – a sector where there was limited M&A during 2023. However, it is notable that M&A activity among industrial companies has appeared to re-emerge in 2024, just as trading conditions appear to be on the cusp of recovering

. . . . . . . . . . .

Europe

Jon Ingram, Jack Featherby, and Jules Bloch, managers, JPMorgan European Discovery Trust, 19 June 2024

Because of the attractive valuations European smaller companies currently trade at, we think the expected return for the asset class is higher than usual. In addition, the macroeconomic headwinds the asset class faced over recent years are now fading. The market expects the ECB to cut interest rates during 2024 and this should boost investor sentiment, thereby benefitting small cap companies.

Furthermore, the latest data points suggest that global and European economies are more resilient than anticipated. Indicators such as Purchasing Managers’ Index (‘PMI’) appeared to have bottomed. And for the first time in years, major European economies are seeing growth in real wages, which should continue to improve consumer confidence.

The asset class should receive further support from the resurgence of mergers and acquisitions (M&A) activity. There has been a lull in deal flow within the European Small Caps space in recent years, but attractive valuations and the prospect of lower rates could drive a marked pick-up in M&A activity.

Small cap companies are also likely to be supported over the longer-term by emerging themes such as Artificial Intelligence (AI) and drug-assisted weight loss. To date, both these themes have mostly played out in the mega cap space. However, the main point for small cap investors is that most of tomorrow’s winners might be today’s small caps. For example, Amazon and ASML were small caps back in 2000, while Tesla and Meta were not even founded.

It is our strong conviction that many of the companies which will be most successful in capitalising on the AI revolution, pharmaceutical breakthroughs and other emergent structural trends over the coming years are yet to be identified, or even conceived, and are thus most likely to emerge from the small cap space.

We expect this confluence of attractive valuations, favourable macroeconomic trends, and long-term thematic developments to act as key drivers for small caps, which have outperformed every asset class globally over the past 25 years.

. . . . . . . . . . .

Alexander Fitzalan Howard, Zenah Shuhaiber, and Tim Lewis, managers, JPMorgan European Growth and Income, 31 May 2024

Looking ahead, equity returns will likely hinge on whether the economy can continue to deliver steady growth and slowly declining inflation. At the moment we remain cautiously optimistic as consumer confidence in Europe continues to improve. Meanwhile it looks as though the manufacturing inventory correction has run its course and new orders have started to show signs of picking up again. At the time of writing the Q1 reporting season has only just started so it is too early to see if this optimism is reflected in quarterly reports.

Inflation continues to moderate as expected. Given the recent stronger inflation prints from both the US and the UK it now looks likely that the ECB will be the first central bank to cut rates, assuming of course that there isn’t a similar hotter blip in Europe too. An unexpected and meaningful rise in inflation is perhaps the biggest threat to this soft/no landing scenario.

Numerous political and geopolitical uncertainties do remain a concern – but for now the market seems to shrug them off. While the gold price hit new highs recently, the oil price, despite rising in the first quarter, remains well below the levels seen in early 2022 at the time of the Russian invasion of Ukraine.

Lastly European equities continue to trade on an extreme discount to US equities, a discount that has grown following the strong performance from technology stocks in the United States during 2023. This argument may not be new to prospective investors; however, the European equity market today can offer comparable levels of quality and growth potential. This valuation support is however recognised by European companies, who are buying back more stock than ever before.

. . . . . . . . . . .

Japan

June Aitken, chair, CC Japan Income & Growth, 21 June 2024

The Japanese market remains attractive, supported by domestic policies and improving economic conditions. Japan’s corporate governance reforms are driving capital efficiency and shareholder returns with increasing momentum behind larger dividend payouts and share buybacks. Rising wages and higher capital expenditure are also expected to bolster economic resilience and equity market performance.

However, challenges include a weak yen, a potential global economic slowdown, and continued geopolitical uncertainties with conflicts in the Ukraine and the Middle East contributing to global instability and negatively influencing energy prices and economic outlook. Additional uncertainty arises from the upcoming US Presidential elections and the policies that the new administration may adopt towards China, trade agreements, and international alliances.

The yen continued its significant decline falling a further 4.0% against the dollar and 6.9% against the pound during the reporting period. The Bank of Japan’s potential shift from its long-standing ultra-loose monetary policy, including possible interest rate hikes, could support yen appreciation. The Federal Reserve is expected to pause or lower rates, narrowing the interest rate differential between the US and Japan, in the near future. This might further bolster the yen, however any yen strength could also pose challenges for Japanese exporters, potentially impacting corporate earnings.

Despite these risks, the ongoing structural reforms and domestic policies, and the end of deflation offer a compelling case for long term investment into Japanese equities. The country continues to leverage its technological expertise, particularly in robotics, artificial intelligence (AI), and semiconductor manufacturing. Japan is benefitting from the global trend of “friendshoring” with companies diversifying supply chains to reduce reliance on China. A significant example is TSMC’s investment in a new semiconductor plant in Japan.

Governance reforms continue to deliver positive outcomes, showing total shareholder payout ratios (dividends and buybacks) exceeding 50% and dividends forecast to increase by nearly 10% in fiscal 2024*.

. . . . . . . . . . .

Global emerging markets

Ashoka Whiteoak Emerging Markets Trust, 17 June 2024

Global GDP growth is projected to increase by 3.1% in 2024 and 3.2% in 2025, slightly higher than the consensus forecasts made six months ago. With the prospect of gradual disinflation and steady growth, the likelihood of a hard landing has receded, and risks to global growth are now more broadly balanced. As per the International Monetary Fund (‘IMF’), EM economies are likely to record relatively higher growth, led by the momentum from stronger structural reforms which could bolster productivity. On the downside, renewed commodity price spikes from geopolitical shocks could prolong tight monetary conditions and any further aggravation of the property crisis in China, the dominant EM economy by market capitalisation, could impinge on market sentiment.

US monetary policy is expected to become more accommodative, which could represent a positive development for EMs in the short term, especially given the previously weak cross border flows in 2023. Global headline inflation is expected to fall from an estimated 6.8% in 2023 (annual average) to 5.8% in 2024 and 4.4% in 2025. The drivers of declining inflation differ by country but generally reflect lower core inflation due to still-tight monetary policies and relative softening across labour markets. This should allow most central banks to move progressively to an easier monetary policy stance.

India’s economy delivered solid, above expectation GDP growth of 8.2% for the fiscal year ending March 2024. Its healthy macro-economic fundamentals, resilient corporate earnings as well as promising growth prospects continue to garner strong FDI as well as portfolio flows. A moderating inflation trajectory and benign current account deficit opens up room for RBI monetary easing. Fiscal policy will remain in consolidation mode, driven by a pickup in tax revenues and improved rationalisation of government outlays even as capex spending will likely remain robust. The imminent initial inclusion of Indian government bonds into the JP Morgan Bond index will also be supportive of local debt markets.

India’s diverse corporate sectors and generally improving ROE suggests it will remain one of the best EM equity markets within which to capture sustained outperformance. Also noteworthy has been the corporate deleveraging and cleaning up of banks’ balance sheets with a marked decline in non-performing loans. This in turn has kickstarted a robust recovery in private sector credit and capex underpinning stronger economic growth and profits, further enhanced by the government’s extensive infrastructure investment upgrade. ‘Made in India’ is still in its very early stages, but the likes of Apple and Samsung are expanding local production with India clearly one of the major beneficiaries of global supply chain reconfiguration. Furthermore, the value of India’s IT exports recently exceeded its oil import bill providing a cushion to the external sector. Moreover, unlike China, India’s economy is much more consumption than investment driven, and the thrust of policymaking in recent years has been towards capacity building which is likely to ensure that economic growth is sustainable and broad-based and not propelled by a rise in leverage.

China’s economy has been grappling with persistent deflationary pressures, exacerbated by its property crisis and stubbornly weak domestic demand. Over the past three years, policy uncertainty, muted fiscal stimulus and certain regulatory interventions have weighed on investor confidence. US-China relations, since the trade tensions began in 2018, have also been one of the factors constraining equity returns in China. While we are not influenced by strong ‘top-down’ macroeconomic views on China, we do expect domestic sentiment to improve gradually, driven by more proactively supportive government policies and stimulus, albeit the latter is likely to remain moderate by historic standards. The government’s ongoing focus on technology and innovation, manufacturing capacity upgrades and decarbonisation should also underpin economic growth. However, the private credit money multiplier remains impaired and both households’ and corporates’ animal spirits somewhat muted. Chinese companies are, however, actively exploring commercial opportunities abroad resulting in some potential new revenue streams, assuming tariffs do not become more of a challenge again post the US election.

Taiwan and Korea are significantly benefitting from the AI boom given their semiconductor and technology expertise whilst the recovery in global economic growth and trade is an added boon.

Meanwhile, despite some unhelpful domestic political interference, Brazil is poised to deliver a new positive structural growth story supported by tax reform and new financial inclusion policies which should raise productivity and trend growth rates.

In summary, even though the global growth outlook has improved over the last year, the Investment Manager is still operating against the backdrop of a macroeconomic environment characterised by challenges pertaining to potential commodity price spikes amid geopolitical risks, climate change, weather shocks, and faltering growth in China together with potentially unpredictable policies given the impending elections in many geographies. However, the fundamentals of EM economies have generally strengthened despite this challenging environment and, at present at an aggregate level, are recording lower inflation, lower debt levels and higher growth compared to their DM counterparts. However, at a disaggregated level, EMs offer different opportunity sets, with the most significant negative risk being from China’s slowdown (but this provides a rewarding backdrop for active stock picking).

. . . . . . . . . . .

Charles Jillings, manager, Utilico Emerging markets, 14 June 2024

It is very evident to us that EM offers huge opportunities.

Structural growth drivers remain fundamental: the key drivers of positive demographics, increase in urbanisation, rise of the middle class and strong GDP growth remain. Typically, EM have a young, growing, increasingly better educated working age population. This coupled with increasing rates of urbanisation, is resulting in the need for EM countries to invest in robust infrastructure such as energy, water and transportation to support this urban growth, providing UEM with numerous interesting and attractive opportunities. Further, the rise of the middle class that has growing discretionary income is driving an increase in consumption of goods and services but also demands for better quality of life assets such as road connectivity, air travel and faster data connectivity. EM are also witnessing on average stronger GDP growth than developed markets, with EM becoming more important within the global economy.

The emergence of global infrastructure megatrends: the structural growth drivers are being accelerated by global infrastructure megatrends that we are witnessing. Within “Energy Growth and Transition” significant energy investment is required to help support the strong GDP growth within EM with a focus on cleaner energy solution as countries drive to achieve lower or net zero emission targets. As EM countries are also witnessing higher urbanisation and a rise of the middle class, demand for better “Social Infra” is also required, providing UEM with a number of investment opportunities in the energy, transportation and communication sectors. Further, new and affordable digital technology is driving rapid digital adoption and is increasing demand for digital infrastructure. Digital Infra is becoming increasingly essential in all markets driving economic and social change. UEM is focused on infrastructure investments that are helping to deliver this digital transformation. As EM global GDP increases, EM importance in “Global Trade” increases. This, alongside supply chain disruptions, geopolitical tensions and increasing exports restrictions is changing the global trade environment providing again more compelling investment opportunities.

Government support: Nearly all governments in emerging markets have extensive infrastructure plans. From Brazil, to India, The Philippines, Indonesia and Mexico, the level of ambition is significant. Again providing investment opportunities.

Country attributes: Many emerging economies have additional individual strengths. For example, Mexico with its more affordable and hard working labour force, Brazil with its rich commodities base and Vietnam with its proximity to China. These economies are starting to reach a tipping point. Taking Brazil as an example, its trade surplus in 2022 was USD 62bn and in 2023 it rose to USD 99bn. It is hard to convey just how high we see the levels of energy, drive and momentum underway in the emerging markets.

. . . . . . . . . . .

Oleg I. Biryulyov, investment manager, JPMorgan Emerging Europe, Middle East & Africa Securities, 13 June 2024

The six months ended 30th April 2024 were positive for the EMEA region, and for Turkey particularly. However, the region marginally underperformed the Global Emerging Markets index and lagged further behind the Global Equity Index. This underperformance relative to global markets was due mainly to the EMEA region’s greater focus on value- and income-oriented stocks, which drags on relative performance any time growth stocks, especially those related to technology and artificial intelligence (AI), are in favour with global investors, as they were during the review period. This factor weighted particularly heavily on the UAE market.

Regional markets received support from rising oil prices during the review period. Oil began the period around US$75 pbbl, and ended the half year closer to US$90 pbbl, as the OPEC+ group agreed to limit production by a further 1.5m barrels per day during 2024. This means that daily oil production will be a total of 3.0m bbl lower than in 2023.

Turkey continues to benefit from a resurgence of interest from international investors, who are still very underweight this market. But the major driver is demand from local investors, who use equities as a saving instrument to protect their savings from devaluation. Investors’ enthusiasm was not dampened by the opposition’s victory in municipal elections in Ankara and Istanbul. As we expected, President Erdogan did not make any subsequent policy concessions, or even meet with opposition leaders, so the result will probably have few implications for economic policy. Small, peripheral markets like Slovenia, Georgia, Kazakhstan and Romania all did reasonably well in the review period, with financials and energy names leading the way.

Several major political developments across the region weighed on investor sentiment during the review period:

- The Israeli invasion of Gaza continued, and Yemeni forces sympathetic to the Palestinian cause have had a significant adverse impact on shipping in the Red Sea. We do not expect the conflict to escalate into outright war across the Arab world, as almost all region players including Iran, Iraq, Syria, Egypt, Turkey, Qatar, Saudi Arabia and United Arab Emirates (UAE), along with the US and other Western governments, are engaged in efforts to resolve the crisis. However, the conflict has sparked a significant escalation of global geopolitical tensions and will have long-lasting economic and political implications across the region and beyond.

- In South Africa, the run-up to parliamentary elections in late May created major uncertainty for investors.

- Political instability continues in Kuwait, as the Emir dissolved Parliament due to unresolved disagreements about reform agenda between legislative and executive powers.

The economic outlook for the EMEA region is mixed. The OPEC+ group’s reduction in oil supplies is unprecedented and it will support energy companies and the oil price. (Indeed, we would not be surprised to see oil prices exceed the US$100 pbbl level over the next 18 months.) However, lower oil production will slow growth in the Gulf’s major oil-producing nations, although the non-oil sectors of the Saudi and UAE economies are likely to grow by 3-4% over the year. In case of South Africa, the country risk premium will diminish post-election, and may lift the market accordingly, but as mentioned above, we do not expect the election result to have a significant positive impact on the economy. We expect GDP growth of only 0.5-1.0% this year, although any reforms to the electricity sector, which has suffered constant blackouts and political scandal, or transportation, may add 0.5-1.5 percentage points to annual growth.

Growth in Eastern Europe will be mixed. Greece is likely to see growth of 2-3%, while we expect the Turkish economy to slow in response to a post-election tightening in monetary policy intended to quell inflation pressures and support the currency. The Hungarian economy is likely to accelerate after the authorities’ apparent victory over inflation, but the prospects for the Polish economy are very difficult to call, as tight fiscal policy will constrain activity, although government handouts to individuals may stimulate a consumption-led recovery.

We are positive on the earnings outlook for 2024, but less so than consensus. We expect EPS to be 5-10% higher than the base results for 2023, a respectable rise, but more cautious than the consensus forecast of 18% EPS growth. We expect banks to lead the way, as net interest margins remain elevated. The portfolio’s exposure to financials will continue to benefit accordingly. And with banks comprising almost 40% of the index, this should prove supportive for the entire market.

Stocks with exposure to the AI revolution have been very popular with global investors, but there are limited ways to gain exposure to this theme in the EMEA region. As with advent of the internet in 1990s, we expect a favourable impact on some companies, and on economic activity more broadly. And businesses will need to increase capital expenditure to incorporate AI into their production and administrative processes. But it is too early to say when and how investors will receive a payback from investments in this technology.

Whatever 2024 may hold, we remain optimistic about the longer-term prospects of emerging markets in Europe, the Middle East and Africa. We believe the region already offers equity investors compelling opportunities for growth, value and income, at attractive levels. And these markets will continue to expand and change very rapidly as more companies, offering an increasing range of goods and services, enter the investment universe.

This is a very exciting investment environment in which to seek out high quality, attractively priced investment opportunities.

. . . . . . . . . . .

Chetan Sehgal, lead portfolio manager, Templeton Emerging Markets, 7 June 2024

The first quarter of 2024 has seen a recovery after a period of volatility. We believe that the current investment backdrop is conducive for emerging market equities. Potential interest rate cuts and better earnings growth for 2024 are expected to be tailwinds for emerging markets when they are implemented.

While interest rates are expected to be higher for longer, we believe that they will eventually moderate as goods inflation has started declining in most markets. Our overweight positions in Latin America-especially Brazil, where real rates remain high-reflect our view on interest rates.

AI has seen a boom led by the development of large language models. This has been facilitated by the advancement in semiconductor chips. New applications have emerged. We expect growth in this sector to be structural, driven by the adoption of Al solutions in both enterprise and consumer applications. This should benefit the Al supply chain. Many of the semiconductor and hardware companies catering to the Al industry are based in emerging markets and we remain overweight in that sector. We also remain overweight in South Korea and are well-invested in Taiwan to play these megatrends.

Meanwhile, the EV supply chain is currently experiencing a material slowdown in growth expectations as many consumers and governments have yet to fully embrace the advantages of their deployment. Although we remain aligned with the longer-term growth outlook for EVs, we have lowered our exposure to the EV value chain.

India and Middle Eastern countries have continued to see good economic growth. India is holding General Elections this year, and we expect political stability to continue. Valuations in many of the sectors in India remain elevated and we are currently underweight in that market, with most of our exposure being to the private sector banks. We remain opportunistic in our deployment of capital to the Middle East region, taking advantage of the boom in the IPO market in many of those countries.

The Chinese economy seems to have stabilised with signs of policy support, even though the property sector and government finances are still very feeble. In addition, we continue to see the western countries reduce their dependence on Chinese supply chains. All these factors continue to impinge on valuations in the China equity market and we remain underweight in China. Most of our exposure is to the internet-related names in China where companies continue to generate cash and have elevated shareholder return policies.

It is an interesting time to look at emerging markets. Despite the dynamic nature of emerging markets, we believe that several enduring themes persist. First, we believe their structural growth potential remains superior, driven by an expanding and diverse investment universe with appealing valuations. Second, while navigating challenges such as the COVID-19 pandemic and geopolitical risks, emerging economies have demonstrated remarkable resilience, emphasising the potential for robust growth. Finally, strategic policy decisions, ongoing reforms, and innovation will shape the future of these markets, offering what we believe are significant opportunities for economic progress and investment gains in the years ahead. In summary, emerging markets have evolved, embracing innovation, technology, and diversification. As pivotal players in the global trade map, their adaptability and growth trajectory position them as key drivers of the world economy, making them, in our opinion compelling investment opportunities for investors globally.

. . . . . . . . . . .

Frances Daley, chair, Barings Emerging EMEA Opportunities, 6 June 2024

Looking ahead, global equity markets are likely to continue to be driven by news flows surrounding the potential decline of inflation and a loosening of monetary policy by US and western central banks. Although the oil price rebound in recent months may limit central banks’ scope to reduce interest rates, equity markets should continue to benefit from broadly robust and uninterrupted growth, allaying widespread concern that monetary policy designed to bring down inflation might also lead to stagnation or even recession.

While the global outlook remains uncertain, we are beginning to see an increasingly constructive view within emerging markets, as the monetary policy tightening cycle turns ahead of developed markets. Meanwhile the absolute valuation of EM equities, and the relative valuation versus developed equities, appears attractive, suggesting investor expectations for the asset class remain overly depressed. This creates the potential for increasing interest in the asset class in general and EMEA markets in particular.

In this connection, we already see an improving economic picture across a number of countries in the portfolio. Within Emerging Europe, financials continue to represent a significant portion of the portfolio, and the Investment Manager is positive on the prospects for the sector. In addition, Emerging Europe is also buoyed by strong growth in real household income, which has reached its highest level relative to developed Europe. Against this backdrop, the Investment Manager sees opportunities in residential real estate and broadening discretionary consumption as consumers benefit from this stronger buying power.

Turning to the Middle East, economies continue to benefit from low inflation, healthy consumption growth and high capital investment. A particularly strong performer as regards investment is Saudi Arabia, which is channelling the revenue derived from its oil sector back into other areas of its economy, spurring domestic demand and increasing the relative contribution of non-oil sectors to the economy’s overall performance. On this basis, the Investment Manager continues to identify exciting opportunities for medium term growth across a number of sectors.

South Africa, by contrast, has continued to face more challenging economic conditions with the problems of the country’s electricity supply persisting amid a rising political risk in the run-up to the imminent national elections.

. . . . . . . . . . .

China/Greater China

Mike Balfour, chairman, Fidelity China Special Situations, 10 June 2024

While the Chinese economy remains sluggish, having failed to reap fully the benefits from the post-COVID reopening, there are undoubtedly signs of improvement. The March PMI figure – a measure of the economic health of the manufacturing sector – moved into positive territory (a reading above 50) for the first time in six months, reaching its highest level since March 2023 and potentially signalling a more sustained period of improvement. April trade data was good and showed a rise in imports, indicating a possible rise in domestic demand. At the same time, it is heartening to see that the Chinese authorities have not been panicked into implementing one-off large measures to boost the economy. They are going about things in a gradually stimulating fashion on both the fiscal and the monetary side, which will hopefully lead to a more balanced outcome. Meanwhile, with Chinese equity market valuations at particularly low levels, both relative to their own history and in a global context, there should be many opportunities for investors to participate profitably in the recovery.

Perhaps the major risk to our cautiously positive outlook is the forthcoming US Presidential election. US relations with China have stabilised somewhat, although increasing tariffs and trade restrictions remain a concern. There is a significant risk that relations could worsen and US may implement measures such as raising tariffs on imports from China to 60%, which would significantly harm Chinese exporters and would depress global trade and exacerbate US inflation trends.

. . . . . . . . . . .

India/Indian subcontinent

Kristy Fong and James Thom, managers, abrdn New India, 13 June 2024

India is the world’s fastest-growing major economy, backed by a resilient macro backdrop that includes a real estate boom, strong consumer sentiment in urban areas, and a robust infrastructure capex cycle.

The growth story is underpinned largely by supportive policies from the central government as well as a decade of painful, but necessary economic reforms. The groundwork laid by these sweeping reforms has put India on a positive economic trajectory. We are also seeing early signs of a private capex revival. This can potentially continue to sustain both economic momentum and corporate earnings growth.

India still faces some near-term risks, most of which are external, including potentially higher global energy prices and a slowdown in the world economy. As a net oil importer, recent developments in the Middle East remain a potential source of concern as any escalation will push oil prices higher. Valuation is also a perpetual risk – given its recent outperformance, India has become a consensus trade, with valuations becoming stretched, especially in small and mid-caps.

. . . . . . . . . . .

Amit Mehta and Sandip Patodia, portfolio managers, JPMorgan Indian Investment Trust, 6 June 2024

the investment case for India has become more credible for a multitude of reasons. The catalysts for growth, discussed below, are multiplying in number, and increasing in scale.

Sustained growth

Since Narendra Modi’s government took power in 2014, India’s GDP has grown at a compound annual growth rate of around 7% per year, to $3.6 trillion, and the economy’s global ranking by size has jumped from seventh to fifth. This has been to a large extent driven by several fundamental structural reforms including simplification of the tax regime and reduced tax burdens for those already in the system. In addition, a bankruptcy law has been introduced, the banking system has been cleaned up, and the real estate sector is now subject to regulation. All these reforms, coupled with stricter and more effective inflation targeting, favourable demographic trends, the build-up of digital and physical infrastructure, strong corporate balance sheets and political stability, are allowing the country to realise its potential to deliver a more sustainable growth.

Next year India is expected to become the fourth largest economy and the government has set a target to reach third place by 2028. This ambition stands out in a world where most large economies are expected to see growth rates decline in coming years.

Blue collar job creation

Of the three main components of GDP growth – labour, capital, and productivity – India has historically benefited from the contributions made by white collar labour and productivity increases driven by technology and outsourced services. However, over the past three decades, manufacturing’s contribution to GDP has fallen from near 20% to 15% in FY2023, which is roughly half that of China.

More than 40% of India’s workforce is still employed in agriculture, which compares with much lower levels in China (25%), Indonesia (29%) and the developed world (less than 5%). The poor performance of India’s manufacturing sector has meant tepid blue collar job creation, which has prevented excess labour capacity in agriculture from being absorbed by the industrial sector. However, the government appears to have recognised the need to create an estimated 9-11m jobs in more capital-intensive sectors such as construction and manufacturing, to absorb both: (1) new labour coming into the market; and (2) migration from agriculture to more remunerative employment. Job creation of this scale is essential to ensure that India’s demographic dividend pays off and boosts productivity accordingly.

Fixed capital formation

India is still in the early stages of diversifying its GDP to increase the proportion of fixed capital formation from sectors such as manufacturing and construction in its GDP mix. India’s fixed capital formation as a percentage of GDP has started to trend up and this increase in capital intensity should translate into a further uptick in private capex. As such, we believe rising fixed capital expenditure formation will be a structural theme for India over the medium- to long-term. This will ensure more broad-based growth, as opposed to the current over-reliance on consumption and services.

Premium and discretionary consumption

Historically, India has largely been a bottom-of-the-pyramid consumption economy, with 225 million households earning less than $8,000 per annum. Forty million of these households live below the poverty line. Even as India has delivered strong GDP growth in the last ten years, GDP per capita has lagged. Its GDP per capita, currently at $2,379, has not improved dramatically and stands below countries like Bangladesh and Sri Lanka.

We expect this to change as investment-led growth not only accelerates wealth creation at the top of the pyramid, but also allows more households at the bottom of the pyramid to start consuming beyond subsistence living, thanks to more blue-collar job creation. This should drive consumption by both those at the bottom of the pyramid looking for basic ‘value’ products, and by top-of-the-pyramid households seeking ‘premium’ brands and discretionary goods in categories like clothing, eating out, jewellery and consumer durables. As an illustration of the potential impact of such a transformation, if the ratio of retail spending to total GDP rises from 25%, to match China’s 40%, India’s retail sector could expand from $650-700 billion at present, to $2 trillion over the next five years.

Risks to monitor

Although the macro picture and outlook for India is overwhelmingly positive, we are aware of inherent risks that emanate from several quarters: dependence on imports for oil/energy needs; low agricultural productivity; India’s heavy reliance on global capital inflows to support growth; a dependence on global growth to support foreign demand for Indian goods and services; and complacency among policymakers.

Summary

Despite these risks, India’s long-term macro-economic and political story is on a strong footing, and we believe the market offers one of the best prospects for equity investors globally over the medium to long term. The recent rally in markets, particularly in the small and mid-cap space, has, however, left valuations looking expensive across sectors in general.

. . . . . . . . . . .

Biotechnology & Healthcare

Sven H. Borho and Trevor M. Polischuk, portfolio managers, Worldwide Healthcare Trust, 6 June 2024

Innovation is one of the major value drivers across the healthcare space. One of the most objective measures of said innovation is novel product approvals and 2023 was record setting with 67 approvals across a wide range of therapeutic categories. More impressive has been the nearly 400 new drugs approved over the past 7 years. This marks one of the most productive periods in the bio-pharmaceutical industry. With standards for new product approvals ever increasing, this industry-wide accomplishment stands as one of the most consequential achievements in the modern era of medicine. Additionally, the recent return of FDA inspectors to China and other Asian venues for the first time in two of years is an encouraging sign for the industry (source: Washington Analysis).

There were many notable new drugs among the more than five dozen approvals in 2023. As mentioned previously in this report was the landmark approval of Leqembi (lecanemab), the first monoclonal antibody to show unequivocal disease modifying effects in the treatment of mild to moderate Alzheimer’s disease, ushering in a new paradigm in helping patients and families with this devastating disease. GSK presided over the best (non-COVID) vaccine launch in history after the approval of Arexvy, indicated for seniors for active immunisation for the prevention of lower respiratory tract disease in patients exposed to Respiratory Syncytial Virus (RSV). Another medicine approved for RSV was Beyfortus (nirsevimab), a monoclonal antibody designed to prevent infections in newborns babies. Multiple novel gene therapies were also approved, including Elevidys for Duchenne Muscular Dystrophy (a genetic problem in producing dystrophin, a protein that protects muscle fibers from breaking down, a disease found in young boys which results in the inability to crawl or walk and early death) and Roctavian for Haemophilia A (a genetic disorder resulting from a deficit of factor VIII, a vital blood-clotting protein, that manifests as protracted and excessive bleeding either spontaneously or secondary to trauma).

A significant investment theme in 2023 – a theme we expect to continue into 2024 – is the accelerated pace of mergers and acquisitions in the therapeutics space, fuelled by a variety of factors. First, the industry is facing another “patent cliff” with approximately U.S.$250 billion in branded sales at risk to generic alternatives commencing in 2025. Second, the looming drug price headwinds in the U.S. in 2026 (from the Inflation Reduction Act) is pressuring management teams to bolster top lines via M&A. Third, historically low biotechnology valuations have created bargains with many small and mid-capitalisation biotechnology companies being taken out at or below their all-time high price. Finally, and most importantly, innovation in biotechnology is at all-time highs where 65% of the industry pipeline and 50% of approved drugs originated from small and mid-capitalisation biotechnology companies.

This has created a very positive environment for deal making as high interest rates and a quiet initial public offering market created some barriers to access for capital for these companies. The financial year saw a total of 40-bio-pharmaceutical takeovers valued at U.S.$115 billion. The first 14 weeks of calendar 2024 saw14 deals, accelerating the trend into the new year.

The largest sector development continues to be the incredible era of innovation that the bio-pharmaceutical industry is presiding over. The global phenomenon of obesity drugs that gripped the market in 2023 actually represents a class of drugs that is nearly 20 years old, but the continued innovation by the pioneers – Eli Lilly and Novo Nordisk – pushed the efficacy benefits beyond expectations. And these companies are not stopping here despite the recent launches of Wegovy and Zepound, rather, next-generation incretins are already in late-stage development. Over the next 6-12 months, data for “CagriSema” (from Novo Nordisk) and “retatrutide” (from Eli Lilly) will most likely improve the standard-of-care beyond what we are seeing today, pushing the life cycle of GLP-1 drugs (and the various combinations) well into the next decade and beyond.

Capital expenditure exceeding U.S.$10 billion per company is being spent on expanded global manufacturing capacity in attempt to satisfy the incredible demand for these drugs. Additionally, both companies are in hot pursuit of oral incretins as well, to further increase the size and reach of this market.

Another key tailwind for this class of drugs is also usage outside of “diabesity” with impressive clinical data for cardiovascular disease, heart failure, osteoarthritis, kidney disease, liver, and sleep apnea already published. Over the coming year we should see data in other indications as well, such as peripheral arterial disease and even Alzheimer’s disease. An independent study out of France even showed proof-of-concept for a GLP-1 molecule benefiting patients with Parkinson’s disease. Of course, there are many companies, both small and large, trying to enter this market and we should see plenty of rival data in 2024.

As 2023 came to a close, the latest generation GLP-1’s were annualising at U.S.$40 billion per annum – despite neither company having fully rolled out Wegovy and Zepbound globally by year end. Previously, we speculated if this market could reach U.S.$100 billion in annual sales by 2030. No more. Now we are contemplating a market size of potentially U.S.$200 billion by the decade end.

A therapeutic class that has been a hot bed of innovation over the past decade has been oncology. The launch of the first “immuno-oncology” agent ushered in a revolution in the treatment of cancer never before seen and despite the bar constantly resetting higher, the industry continues to deliver as “IO” agents eclipsed U.S.$45 billion in sales in 2023. This year, data for next generation IO agents (such as TIGIT, LAG3, and newer CTLA-4) may prove critical in the continued growth of this class. Also, novel bi-specific formulations could be game changing.

Not to be outdone, but the largest inflection of interest in the oncology space over the past year has been in the antibody-drug-conjugate (ADC) class of drugs. ADCs are a form of targeted medicines that deliver chemotherapy agents directly to cancer cells, destroying them whilst mostly sparing normal, healthy cells. The pursuit of ADCs was behind the largest business development deals in 2023, specifically the U.S.$43 billion acquisition of Seagen (by Pfizer) and the U.S.$22 billion development deal between Daiichi Sankyo and Merck.

Radiopharmaceuticals – the using of localised radiation in the form of injectable isotopes – was another area of oncology which saw outsized M&A activity with Eli Lilly, AstraZeneca, and Bristol-Myers Squibb all buying their way in to compete with the industry leader, Novartis.

With record new drug approvals and clinical pipelines as full as they have ever been, this impressive wave of innovation will be bountiful in 2024 and for years to come. Whilst our focus here has been on metabolic disease and oncology, by no means are new achievements in innovation limited to these therapeutic classes. 2023 saw the approval of the very first disease modifying agent for Alzheimer’s disease (Eisai’s Leqembi). 2023 saw the approval of the very first vaccine for respiratory syncytial virus (GSK’s Arexvy). 2023 saw the first approval for a gene therapy treatment for Duchenne muscular dystrophy (Sarepta Therapeutic’s Elevidys). Early 2024 saw the approval of the most sophisticated surgical robotic suite ever produced (Intuitive Surgical’s da Vince 5). Early 2024 saw the approval of the most efficacious agent to treat pulmonary arterial hypertension (Merck’s Winrevair). This list goes on and on – across immunology, inflammation, women’s health, haematology, endocrinology, respiratory, dermatology, gastrointestinal, neurology, infectious disease, and vaccines. The next 12-18 months will bring new and novel data sets across numerous disease states, advancing the standard of care in medicine, and driving the value of the sector higher.

The state of the healthcare industry remains strong, supported by significant global demand and new product flow, underpinned by an era of incredible innovation that has not been seen before. Moreover, the challenging investment backdrop for healthcare stocks that has been in place since the easing of the COVID pandemic appears to be in the past as the recent inflection of share prices across the industry is much more indicative of the positive fundamentals of the space. The long-term growth potential of healthcare also remains strong: global demographics, aging populations, and constant, persistent demand. Innovation, however, continues to advance in unparalleled fashion and is the primary driver of value creation. Innovation is not just in the domain of biotechnology, but across therapeutics, medical technology, patient services, analytics, and platform technologies. Together, they are improving patient care, advancing medical knowledge, and creating new medicines, with many that now can offer a cure. The productivity in the therapeutics space continues to be exceptional, with pipelines the fullest they have ever been, and the number of new drug approvals at all-time highs. The inflection in M&A in the space is just one testimony to this productivity, one that has already continued in 2024.

. . . . . . . . . . .

OrbiMed Advisors, portfolio manager, The Biotech Growth Trust, 4 June 2024

We have been encouraged to see the early stages of a recovery in small cap biotech from unprecedented absolute and relative valuations.

One proxy commonly used to track the performance of small and mid cap biotech is the XBI, an exchange traded fund created in 2006 that tracks an equal-weighted index of biotech companies. About 50% of this index consists of small cap names. If one plots the relative performance of the XBI versus the S&P 500 (shown in Figure 3 on page 12 of the Annual Report), one can see that since inception, the XBI has outperformed the S&P 500, indicating that emerging biotech has historically been a sector offering better returns than the broader market. Over the past 18 years, however, there have been short periods when the XBI has underperformed the S&P 500, shown by the red circles. Typically, these drawdown periods result in underperformance versus the S&P 500 of 30-45%. The most recent relative drawdown was 77%, making it the longest and largest drawdown of the XBI on both an absolute and relative basis. Prior drawdowns have been followed by periods of significant outperformance of the XBI versus the S&P 500, denoted by the green arrows on the graph, which usually results in the biotech index reclaiming prior outperformance highs. We believe the relative performance drawdown of the XBI versus the S&P 500 has likely run its course, as shown by some indications of stabilisation in Figure 3 (on page 12 of the Annual Report) over the past few months. We continue to expect small cap biotech to outperform the S&P 500 from current levels, just as it has rebounded historically.

Despite the nascent recovery in small cap biotech, absolute valuations remain at historically depressed levels. A significant number of biotech companies are still trading at negative enterprise values (i.e. market caps below the net cash on their balance sheets). As shown in Figures 4 and 5 (on page 13 of the Annual Report), we estimate close to 15% of the biotech universe, representing approximately 60 companies, is now trading at a negative enterprise value as of 31 March 2024. While there has certainly been an improvement on this metric coincident with the recent recovery in emerging biotech, we expect further valuation increases will restore levels to historical norms.

We believe the first interest rate cut by the Fed could be the trigger that catalyses a more full-fledged valuation recovery from currently depressed levels. At the current time, the Fed is still anticipating that rate cuts will begin in 2024. In the meantime, continued M&A activity and positive clinical developments should help the sector re-rate.

. . . . . . . . . . .

Infrastructure

James Stewart, chair, Sequoia Economic Infrastructure, 25 June 2024

Investment in infrastructure is a priority for governments around the world and therefore demand for infrastructure debt in the sectors and geographies that we lend to will remain high.

[There are] large themes in infrastructure, notably decarbonisation and digitalisation. These transformations will require a staggering amount of capital, estimated at tens of trillions of pounds, over the coming years. This is on top of the capital needed simply to maintain the current stock of traditional infrastructure, such as transport systems and utility companies.