Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairmen and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Roundup

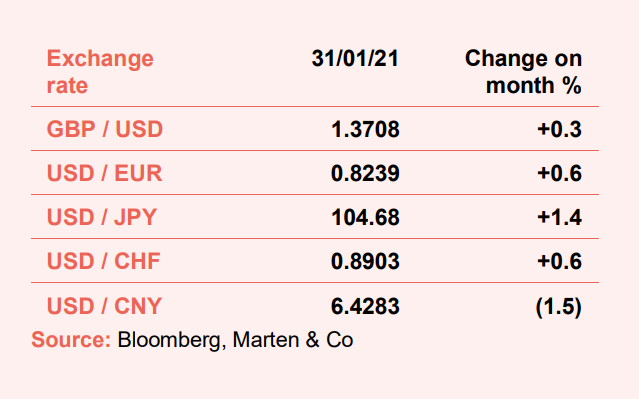

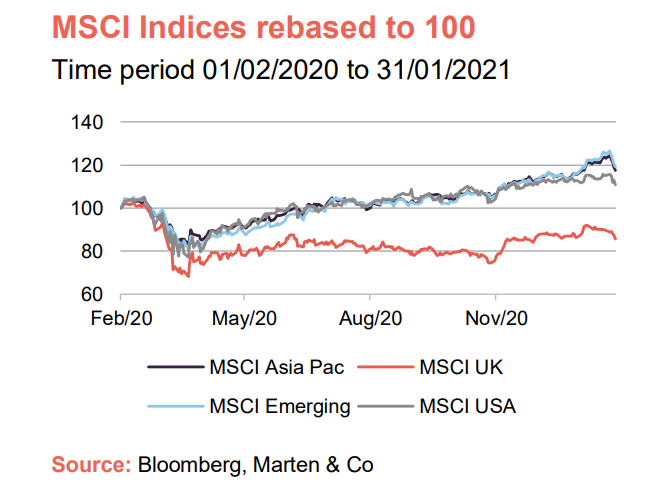

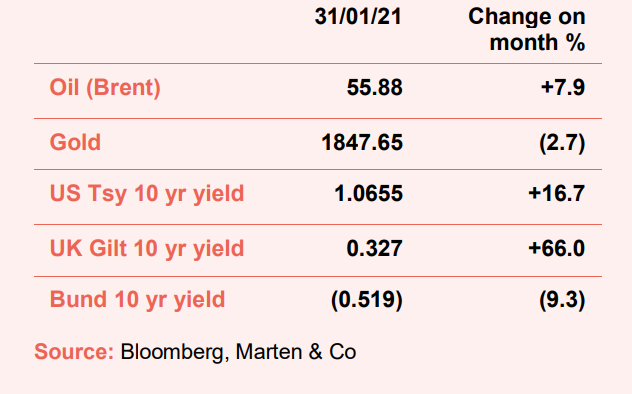

Emerging markets were quickest out of the gates in January, building on a strong 2020. The oil price was stronger too. 10-year bond yields in the US and UK rose were up, after hitting record lows last year, pushed on by improving sentiment tied to vaccines, and the prospect of more stimulus in the US especially. Elsewhere, the growing power of organised retail investors in the US, was one of January’s main themes.

Global

Biden presidency should ease trade tensions

Sue Inglis, chair of Bankers, looks at what to expect as Joe Biden begins his presidency. She notes that with the likely exception of China, trade tensions should ease, resulting in lower market volatility.

UK

Severe tests remain for corporates

The manager of Aberforth Smaller Companies makes the point that the consensus view is that yesterday’s winners will be tomorrow’s winners and there is little questioning of taut valuation stretches between and within markets.

Neil Hermon, manager of Henderson Smaller Companies, says that in the corporate sector, conditions are intrinsically stronger than they were during the financial crisis of 2008-2009. Balance sheets are, in particular, more robust. However, he adds that the scale of economic shock means that this ‘strength’ will be severely tested and key questions for investors today revolve around a company’s available liquidity, leverage, bank covenants and ability to see the economic downturn through.

North America

Are we nearing the end of the almost 40-year bull market in US bonds?

Baillie Gifford US Growth’s manager recaps on an excellent year for the fund, with a review of the areas of the healthcare and technology sectors it invests in.

The manager of Gabelli Value Plus+ says that we are probably in the final innings of an almost 40-year bull market in US bonds.

Baillie Gifford US Growth’s manager recaps on an excellent year for the fund, with a review of the areas of the healthcare and technology sectors it invests in.

The manager of Gabelli Value Plus+ says that we are probably in the final innings of an almost 40-year bull market in US bonds.

Capital markets reform has accelerated in China

Dave Nicholls, manager of Fidelity China Special Situations, notes that while there are variances between regions and sectors, overall, the economy continues to recover. The manager also discusses how we continue to see an acceleration in capital market reforms in China; from the loosening of short-selling restrictions, the lowering of foreign investment restrictions and the implementation of a registration-based IPO mechanism.

Asia Pacific

China has been opening up selected areas of its economy to foreign investors

Invesco Asia’s chairman, Neil Rogan, recaps an excellent 2020 for Asian markets. He also explains how a political risk discount is one of the reasons why Asian markets have typically traded at lower valuations than, say, America.

Ayaz Ebrahim, Robert Lloyd, and Richard Titherington, managers of JPMorgan Asia Growth & Income, explain that although trade wrangles between the US and China remain a source of uncertainty, the Chinese government continues to open up selected areas of its economy to foreign investors. Areas such as insurance, banking, asset management and automotive production are gradually being liberalised and becoming more accessible, with strong interest from foreign investors.

Other

We have also included comments on the flexible investment sector from BMO Managed Portfolio Growth and BMO Managed Portfolio Income; country specialist: Europe – ex UK funds from JPMorgan Russian; private equity from Standard Life Private Equity; growth capital from Chrysalis Investments; leasing from KKV Secured Loan; and UK property from BMO Real Estate Investments, U and I Group, and Safestore.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.