Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairmen and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Roundup

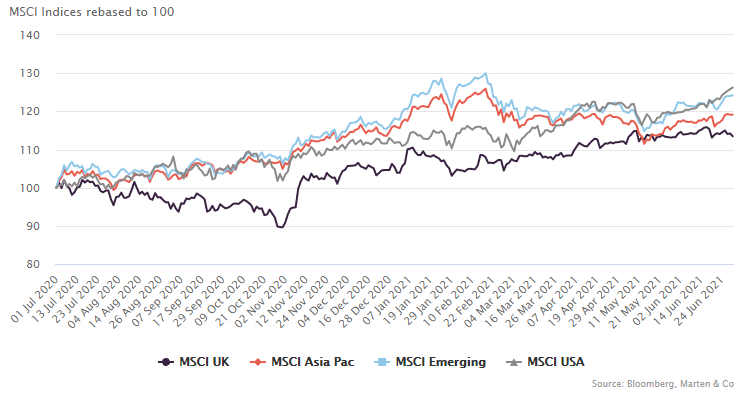

The US was the best performing region for the month, with the MSCI USA index up by 5.6%, more than twice the return for Asia and Emerging Markets and well ahead of the UK, which remained flat. Markets are feeling optimistic as vaccination programmes seem to be in full swing, particularly in developed markets, but a dark cloud threatening higher inflation is looming ever closer.

Global

Inflation on its way whether we like it or not?

Alasdair McKinnon, manager of Scottish Investment Trust thinks a significant rise in inflation is on the cards, even though central banks are playing the prospect down.

BMO Global Smaller Companies chair, Anja Balfour, is pleased to see confidence returning to smaller stocks, which have been the best performers in most markets. US small cap equities bounced back quicker than Europe, the UK and Japan thanks to a less stringent approach to lockdowns and the much larger extent of stimulus.

Spencer Adair and Malcolm MacColl, co-managers of Monks think the post-pandemic phase will accelerate trends and areas not yet touched by technology such as healthcare, education, real estate and energy.

Global funds, including Edinburgh Worldwide, are becoming increasingly concerned about rising inflation

Nick Train, manager of Lindsell Train reflects on the strengthening of global equity markets, driven by the bull market in technology and the big post-pandemic recovery in cyclical and economically sensitive industry sectors.

Edinburgh Worldwide chair, Henry Strutt, notes inflationary pressures are already evident in some ‘dislocated supply chains’ and there are more to come as the world continues to recover from the pandemic.

UK

Despite optimism around the UK’s successful vaccination programme, uncertainty remains surrounding the new Covid-19 variantsx

James Henderson and Laura Foll, co-managers of Henderson Opportunities, also highlight concerns regarding inflation, but also economic contraction and deflation. They say parts of the UK economy will remain subdued, while in other areas there will be strong growth.

Chelverton UK Dividend manager, David Horner, believes optimism is now ‘the order of the day’ as the vaccine programmes continue. However he notes companies have been very cautious in their return to guidance, largely keeping enough powder dry to weather any re-opening delays.

Chair of BlackRock Income and Growth, Graeme Proudfoot, says there is still uncertainty afoot as several new variants of the COVID-19 virus have been detected in the UK whilst recent months have also witnessed an upturn in inflation as prices of fuel, energy and commodities have all risen. Against this backdrop however, and with a successful vaccination programme he believes the outlook for the UK appears to be bright.

Schroder UK Mid Cap managers, Andrew Bough and Jean Roche, are increasingly optimistic on the outlook for the UK economy and many of the domestically-focused mid cap companies exposed to it.

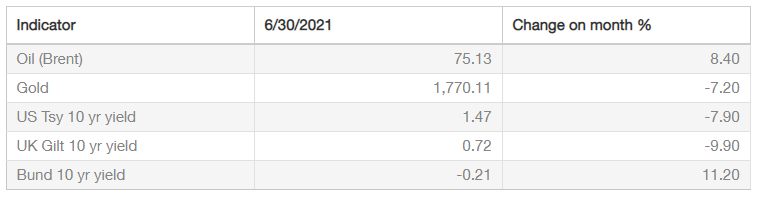

River and Mercantile’s manager, George Ensor, says the steepening of the US yield curve, low short-term rates – which are punishing savers – and accelerating global growth, which has pushed the US ten-year yield higher, has clear consequences for equity investors with shorter-duration assets.

Technology enabled businesses continue to boom

Helen Sinclair, chair of Gresham House Strategic, notes that it is clear that in the future “tech-enabled” businesses whether in consumer, financial services, fulfilment or media will be positioned for success. In the booming markets that these companies are enjoying, she says their share prices have become elevated at the expense of less technologically glamourous firms.

Charles Montanaro, manager of Montanaro UK Smaller, reflects on this time last year, when many thought we would be back in the office by the end of the summer. He says now, with the arrival of the vaccines, a resumption of more “normal life” looks eminently possible – a return to the office and hopefully a summer holiday too.

Baillie Gifford UK Growth’s chair, Carolan Dobson, says Brexit appears to have had little discernible economic impact, albeit the matter is clouded by the impact of the pandemic. However, companies face the ongoing challenge of adapting to what is a very difficult and different trading landscape compared to that faced in early 2020.

Inflation and uncertainty over the long-term outlook for the UK remain a concern

Gary Channon, CIO of Phoenix Asset Management, which manages Aurora, highlights the complexity and unfamiliarity of the past year. There were plenty of cheap looking stocks around in the second quarter of 2020 but it takes a detailed level of knowledge and expertise to be able to model what will happen to a business if the pandemic drags on and vaccines don’t work.

Robert Talbut, chair of Shires Income, says that while there may be increasing excitement currently regarding the UK’s shorter-term economic prospects, there remains uncertainty regarding the longer-term growth and inflation outlook.

Global emerging markets

Dr Myma Belo-Osagie, chair of Africa Opportunity, says African countries have suffered more compared to other emerging market countries, as a result of the pandemic. The actual number of African victims of COVID-19 will never be known but what is certain is that, unlike other economies, a majority of Sub-Saharan Africa’s economies grew anaemically in 2020.

Jupiter Emerging & Frontier Income chair, John Scott, says the election of President Biden also signals a more nuanced approach to international diplomacy which is likely to simplify life for many countries.

Biden’s election is expected to make relationships between the US and other countries more favourable

The managers of Aberdeen Emerging Markets say that the defining feature of the past six months was the return differential between Chinese equities and the rest of emerging markets, with the former underperforming the latter.

John Rennocks, chair of Utilico Emerging Markets, says the world is largely over-leveraged and under-employed. Numerous and substantial social issues are still evident, including nationalism, climate change and wealth inequality. However, communities have pulled together, and the human spirit has risen above this upheaval.

Templeton Emerging Markets manager, Chetan Sehgal, says although inflation has picked up from low levels last year amid recovering economic activity, firmer commodity prices and near-term supply chain bottlenecks, he believes that considerable slack remains in many economies, especially on the labour front.

The pandemic recovery across emerging markets will not be uniform

Sam Vecht and Emily Fletcher, managers of BlackRock Frontiers, think emerging markets will overcome COVID-19 in the second half of 2021. However, as new variants sweep through the emerging world at different paces, the recovery will not be uniform and tracking single country progress is paramount.

Renewable energy infrastructure

The investment team at SDCL Energy Efficiency Income say the costs, inefficiencies and risks of energy systems reliant on centralised generation and the grid continue to be exposed, with the 2021 outages in Texas, USA caused by severe winter storms highlighting the need for greater resilience in the energy system.

Kevin Lyon, chair of NextEnergy Solar, says that the near-term power price recovery during the second half of the financial year and beyond has underlined the resilience of the renewable energy sector in the current uncertain environment.

JLEN Environmental Assets chair, Richard Morse, notes that the outlook is favourable for companies involved in environmental infrastructure, as governments look to ‘build back better’ following pandemic-induced uncertainty.

Government plans for a more environmentally friendly and energy efficient economy are welcome

Jonathan Parr, partner and head of energy at Triple Point Energy Efficiency Infrastructure, says the UK’s target of reducing emissions by 78% by 2035 continues to build on the country’s commitment to net zero, is ambitious but is necessary and achievable.

Other

We have also included comments on North America from BlackRock North American Income and Gabelli Value Plus+; Japan from CC Japan Income & Growth, JPMorgan Japan Small Cap Growth & Income and Aberdeen Japan; Europe from Montanaro European Smaller, JPMorgan European Discovery and JPMorgan European; India from Aberdeen New India and JPMorgan Indian; Russia from JPMorgan Russian; flexible investment from Seneca Global Income & Growth, Aberdeen Diversified Income and Growth and Personal Assets; growth capital from Chrysalis Investments; private equity from Standard Life Private Equity; infrastructure from GCP Infrastructure; biotech and healthcare from Syncona and property from Civitas Social Housing, AEW UK REIT, Custodian RET, Schroder REIT, Urban Logistics REIT, NewRiver REIT and Stenprop.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.