Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Roundup

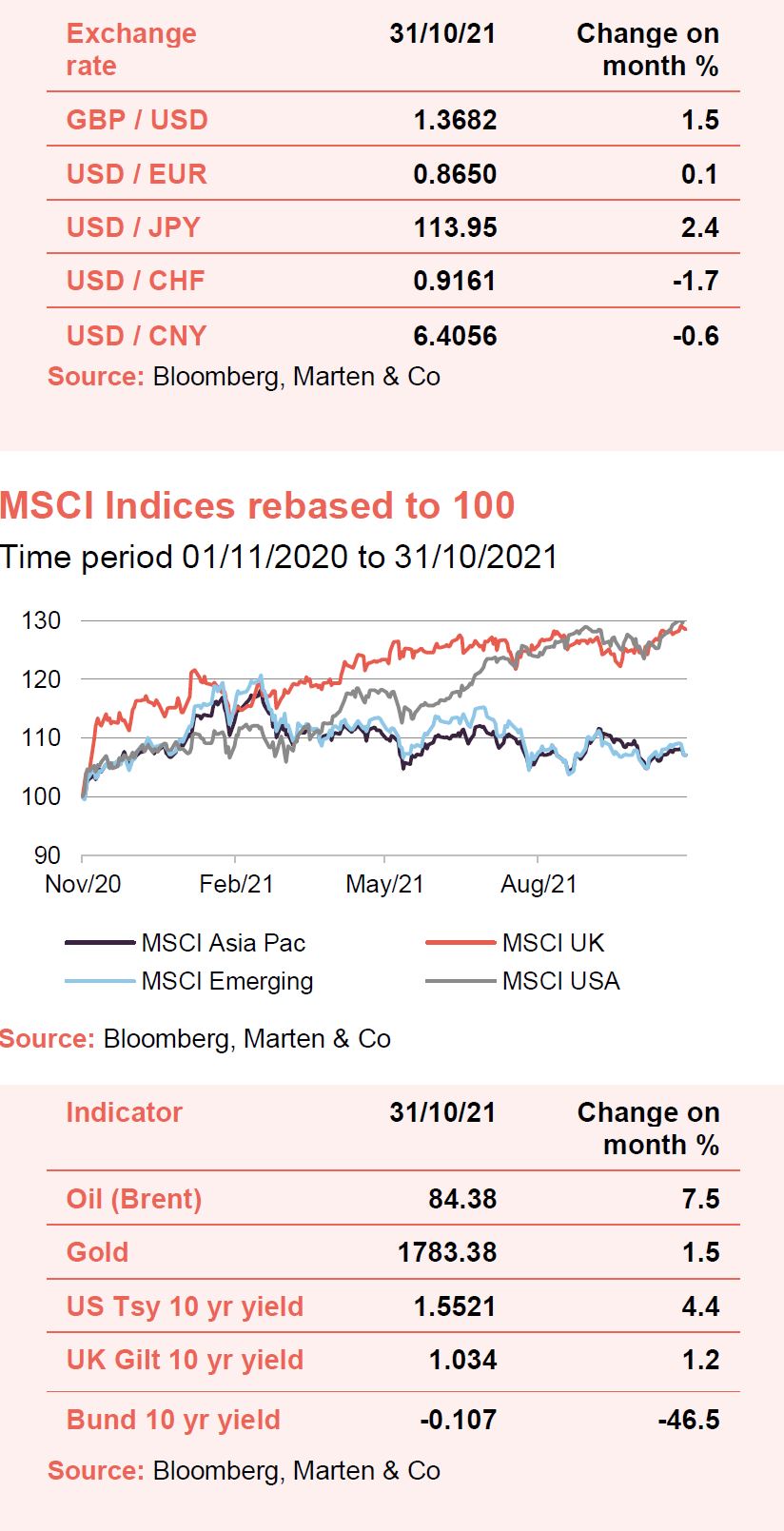

All eyes remain on vaccination levels across the world and the hope that as they reach more people, countries operating below their capacity can finally catch up and recover. Soaring energy prices continue to rock sentiment closer to home but have of course been good news for commodity and natural resources funds which, after months of underperformance, topped returns in October. Meanwhile in the Far East, investors are still concerned about China’s changing regulatory environment, which has had a knock-on effect on the MSCI Asia Pacific and MSCI Emerging Markets indices.

Global

Ben Lofthouse, manager of Henderson International Income, highlights a number of themes that have materialised since COVID, and which could be drivers of ongoing change and investment.

UK

Mercantile managers, Guy Anderson and Anthony Lynch, highlight challenges on the supply-side and a surge in inflation – headwinds which will need to be monitored, as they feel that prolonged disruption could threaten demand and ultimately damage the recovery.

Georgina Brittain and Katen Patel of JPMorgan UK Smaller Companies remain positive on the thesis of a strong UK recovery, heightened by the on-going strength in trading as shown during results season.

Jane Lewis, chair of Invesco Perpetual UK Smaller Companies, says that while uncertainties appear to be lifting and there is greater visibility in how companies are navigating the recovery, changes in operating and economic environments may affect them in ways not yet fully understood.

Asia Pacific

John Russell, chair of Henderson Far East Income, says the post-industrial world in the Far East will be driven by innovation, technology and entrepreneurship, with success depending on entrepreneurial drive, an open-minded population and a strong domestic consumer base.

The managers of Asia Dragon are cautiously optimistic about Asia markets as they think corporate earnings will rebound sharply this year and because government and central bank policies are likely to remain supportive.

Innovation, technology and entrepreneurship will be key in the Far East

The managers of Pacific Assets are less positive, unnerved by the headwinds China currently faces such as a greater government scrutiny and political tensions.

Fidelity Asian Values’ manager, Nitin Bajaj, believes that small cap valuations are playing catch up with those of larger stocks and that there is more to go for.

Europe

TR European’s chair, Christopher Casey, believes a global backdrop of increasing GDP and a pick-up in corporate earnings will be supportive for European smaller companies, but cautions that, as growth inevitably slows post the COVID-19 recovery, it would be reasonable to expect more modest returns in the medium term.

A pick-up in corporate earnings will be supportive for European smaller companies

James Ross highlights the success of cyclical sectors and companies in the face of the pandemic but anticipates a more balanced environment with the recovery ‘adequately priced in’.

Other

We have also included comments on North America from Brown Advisory US Smaller Companies; global emerging markets from Fidelity Emerging Markets; Japan from Baillie Gifford Japan and Schroder Japan Growth; China from Baillie Gifford China Growth; country specialist from VinaCapital Vietnam Opportunity and Vietnam Holding; flexible investment from Schroder BSC Social Impact and JPMorgan Multi-Asset Growth & Income; growth capital from Schroder British Opportunities; commodities & natural resources from CQS Natural Resources Growth and Income; private equity from HarbourVest Global Private Equity and ICG Enterprise; hedge funds from Gabelli Merger Plus+; renewable energy infrastructure from Bluefield Solar Income and property from BMO Real Estate Investments, Target Healthcare REIT, GCP Student Living and PRS REIT.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.