Economic and Political Monthly Roundup

Kindly sponsored by Allianz

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

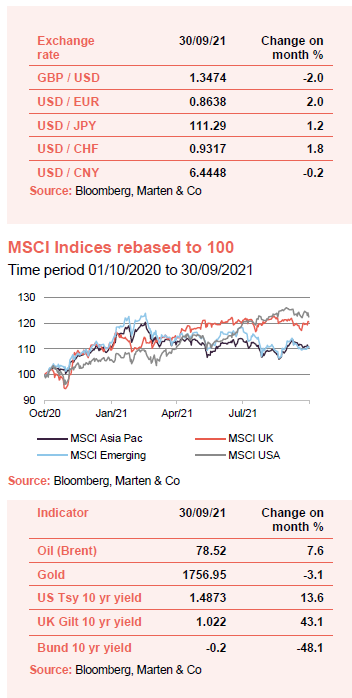

Views appear divided currently, with those who feel the economic bounceback has more to play on one side, and those who think it has peaked and are now feeling nervous again on the other. The market environment appears slightly contradictory too; numbers are down over September, with the MSCI USA down 2.8% and MSCI UK down 0.3% but M&A activity is soaring and business confidence is almost at pre-pandemic levels. In the UK, rising energy prices and political issues (such as raising national insurance and cutting universal credit) are causing worries for consumers, while many fear going into another lockdown as we approach the colder months and cases seem to be rising again. Investors are equally concerned about what these factors – among others – could mean for the economy.

Global

Despite ongoing loose monetary policies, low interest rates and continued significant fiscal support, Zehrid Osmani of Martin Currie Global Portfolio is optimistic on equities. He says they offer an attractive earnings yield compared to bond yields.

Equities good, debt bad

Russel Napier, chair of Mid Wynd International, highlights that the total level of debt in the world is higher than the level at the end of WWII. This is triggering extreme reactions from both central banks and governments – which he believes will last for many years.

UK

Gary Channon, manager of Aurora, expects some companies will need more capital as support packages unwind, this may throw up interesting opportunities.

Dunedin Income Growth chair, David Barron, says there has been a shift in the types of companies outperforming, as we have transitioned from relatively buoyant market conditions at the start of the year to seeing economic growth peak around May.

Adam Wotton and Adam Khanbhai, managers of Strategic Equity Capital, highlight that the UK IPO market has been the most active it has been for over two decades. There are also record amounts of ‘dry power’ in private equity funds which has triggered a ‘takeover frenzy’.

The UK IPO market has been more active in 2021 than it has been for over 20 years

City of London’s chair, Sir Laurie Magnus, says markets have become used to ultra-low interest rates and large-scale central bank buying of government bonds so any change may lead to turbulence.

The manager of Merchants, Simon Gergel, thinks the UK and world economies should see a continuance of economic recovery, though growth remains vulnerable to restrictions and further waves of infections.

Georgina Brittain and Katen Patel, managers of JPMorgan Mid Cap, believe normality is edging closer and that the UK market has a strong platform for growth thanks to a rise in consumer spending and a better-than-expected economic rebound as well as company results.

The managers of the smaller companies portfolio of Acorn Income say the UK finally faces a brighter future than it has done at any point in the past five years.

Jeremy Rigg, chair of Henderson High Income, says confidence has risen among companies and individuals and that there are certainly plenty of reasons to be optimistic.

Confidence has risen among companies and individuals alike

The managers of Aberdeen Smaller Companies Income say it feels like the recovery rally phase has been sharp but short term, and inflation remains a key issue currently.

The chair of Standard Life UK Smaller Companies is hopeful for improved prospects and greater visibility of outlook for companies and the economy.

Debt

Alex Ohlsson, chair of GCP Asset Backed Income, says uncertainty hovers over companies with public-facing elements, such as co-living and multi-use community facility assets, which were directly impacted by lockdown restrictions, as there is speculation that lockdowns will be reintroduced.

Ian Francis, manager of CQS New City High Yield, expects a larger issuance of debt by corporates, spurred on by their investment bank advisers to lock into the low rates while they last.

The managers of M&G Credit Income feel that there are many risks on the horizon from the spread of a more transmissible strain of COVID-19 to geopolitical risks such as cyber security attacks and continued friction between the UK and EU.

Concerns remain over another potential lockdown

Pedro Gonzales de Cosio, of Biopharma Credit, says an active M&A market has helped to drive opportunities for investors, which he finds encouraging and hopes will build up further.

NB Global Monthly Income chair, Rupert Dorey, says non-investment grade credit yields and spreads are more than compensating investors for the current benign default outlook.

Non-investment grade credit yields and spreads are making up for the benign default outlook

The managers of Blackstone Loan Financing highlight momentum in the CLO (collateralised loan obligation) market which has ramped up over the past 12 months.

Robert J Brown, chair of Marble Point Loan Financing, agrees, and adds that the CLO market also recovered faster than expected from the pandemic. The first half of 2021 was the busiest on record for new CLO issuance.

Renewable Energy Infrastructure

The managers of Aquila European Renewables Income expect power prices to remain bullish for the next year or so, driven by rising gas prices and positive conditions for EUAs (European Emission Allowances).

Octopus Renewables Infrastructure chair, Philip Austin, says EUAs have reached record levels due to a growing expectation that carbon pricing will be used by governments and the EU as a tool to drive decarbonisation throughout the economy.

The chair of Gresham House Energy Storage says the board is monitoring a number of negative impacts of the ending of lockdowns from rising costs in shipping to supply chain concerns.

Power prices remain bullish for the next year or two

Liam Thomas of US Solar feels that the US solar market continues to offer attractive opportunities. Patrick O’D Bourke of Ecofin US Renewables Infrastructure says the renewables sector in the US has continued to be active despite the impact of COVID-19.

The chair of Foresight Solar says clean energy generation is expected to remain a key component of climate change policies of most OECD countries, creating further growth opportunities in the renewable generation sector.

Bernard Bulkin, chair of VH Global Sustainable Energy Opportunities, says there are significant technology and storage capacity gaps in the global energy industry today, that are not and cannot be met with battery storage alone and so additional flexible power generation involving less pollutive natural gas and biogas sources will become indispensable in the next few years.

The renewables sector in the US has been active throughout the pandemic

Tom Williams of Downing Renewables & Infrastructure notes that there continues to be a steady flow of opportunities within the subsidised renewables space.

Rónán Murphy, chair of Greencoat Renewables, says there are increasing opportunities in offshore wind, particularly in the Nordics.

Other

We have also included comments on North America from North American Income; Asia Pacific from Schroder Asia Total Return – where Robin Parbrook sets out his views on the Chinese market in the wake of greater political interference; Latin America from BlackRock Latin American; Japan from Nippon Active Value, Baillie Gifford Shin Nippon and AVI Japan Opportunity; India from Ashoka India Equity and India Capital Growth; country specialist from Vietnam Enterprise; flexible investment from New Star and CIP Merchant Capital; growth capital from Schroder UK Public Private and Schiehallion; commodities & natural resources from Baker Steel Resources; private equity from JPEL Private Equity, Dunedin Enterprise and Oakley Capital; hedge funds from Third Point Investors; insurance & reinsurance strategies from Life Settlement Assets; infrastructure from International Public Partnerships and Digital 9 Infrastructure; leasing from Tufton Oceanic Assets; royalties from Round Hill Music Royalty and property from Supermarket Income REIT, Capital & Regional, Secure Income REIT, Standard Life Investments Property Income, UK Commercial Property, BMO Commercial Property, Aberdeen Standard European Logistics Income and Impact Healthcare REIT.

Full version

Click on the link at the bottom of the page to access the full report.

Kindly sponsored by Allianz

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.