July 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in June 2024

There were a handful of major catalysts driving global markets in June. We saw the AI phenomenon reach a new peak, with Nvidia briefly becoming the largest company in the world by market cap on June 19th, hitting a valuation of $3.3trn, before subsequently declining by 13%. The US Federal Reserve held rates steady in June, indicating only one potential cut within 2024. This led to markets tempering their previously bullish expectations around future US interest rate trajectories. The impact was felt across the developed world.

Three major political events had ramifications for the performance of certain sectors. Firstly, Modi secured a third term as India’s prime minister after his party entered into a coalition to back his appointment. A UK election was announced at the end of May, reducing market expectations of a near-term rate cut. In Europe, Macron announced a snap French election, which shocked European equity markets, especially France’s.

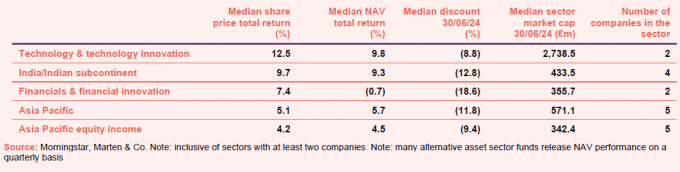

These catalysts are clearly visible in the best and worst-performing sectors and trusts. With respect to the best performing sectors, the technology & technology innovation sector led the way, capitalising on the ongoing rally of global technology companies. Despite the selloff in Nvidia, it and the wider US technology sector remained up over the month, with their performance reflected by the two global trusts in the sector, Polar Capital Technology and Allianz Technology Trust, both generating comparable returns over the month.

Indian equities saw a powerful rebound after Modi took power, resolving the political uncertainty that had dogged the region’s equity markets. Indian equities reported one of their best months for inflows, reflected in both the NAV and share price returns of the India/Indian subcontinent sector, reversing their previous month’s negative performance. This performance also led to a rally in the Asia Pacific and Asia Pacific equity income sectors, both capturing the region’s growth.

The financials & financial innovation sector reflected two announcements by Augmentum Fintech, one of the sector’s two constituents. It announced a share repurchase programme at the end of May and its share price was up 15.5% for the month, with the discount narrowing by 7%.

Best performing sectors in June 2024 by total price return

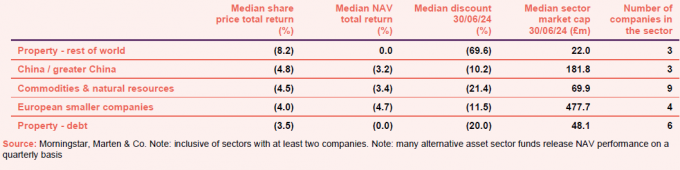

In terms of the worst performers, the property – rest of world sector was once again the laggard this month. The sector, made up of three diverse strategies, was again driven by the negative performance of two trusts: Aseana Properties fell by 25.6%, and Macau Properties fell by 8.2%. Both of these are small, thinly traded strategies, and these losses reflect their unique issues as much as the demand for East Asian property.

The poor performance of the China / greater China sector reflected the market’s reaction to the region’s increasing slowdown, with official PMI data showing Chinese manufacturing activity fell for a second month in June, and services activity slid to a five-month low. This slowdown comes alongside weakening domestic demand and long-standing issues impacting the property sector, all of which have weighed on investor demand for the region.

The share prices of trusts in the commodities & natural resources sector fell across the board, reflecting weakening demand from China and the impact of dampening US interest rate expectations, which increase borrowing costs for the often debt-funded miners and also reduces expected economic activity and thus commodity demand. Most types of commodities were down over the last month, with only oil and select agricultural commodities up due to unique supply issues. Notable figures within the peer group included Geiger Counter’s NAV falling 13.3% and Riverstone Energy’s share price falling 10.7%.

European smaller companies fell due to the uncertainty brought about by the snap French election. Smaller companies are generally more sensitive to shifts in domestic political and economic trends as they have less international revenue, amplifying their exposure to increased risk factors in June. In contrast, the European large cap sector fell only 1.9% in share price terms.

The property – debt sector fell as a direct result of the decline in global interest rate expectations, with the value of bonds being inversely related to interest rates. The majority of the sector reported a negative share price return as a result, with the market likely anticipating future write-downs in NAV due to potentially higher discount rates.

Worst performing sectors in June 2024 by total price return

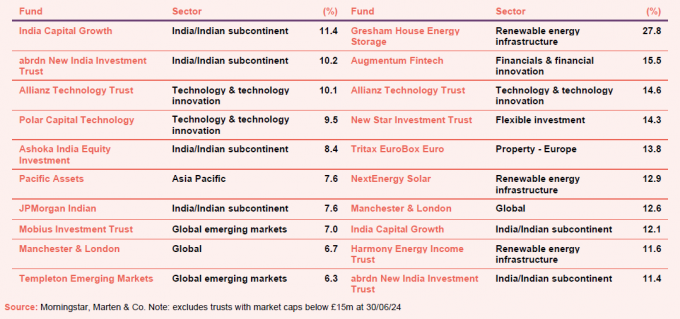

Best performing

Looking at the best-performing companies in terms of NAV growth, Indian and technology trusts led the way for the reasons outlined earlier. Pacific Assets’ approximately 40% allocation to India also propelled it to be one of the best performers over the period. Manchester & London, being entirely invested in technology, capitalised on the tailwinds of the wider sector.

In the case of Mobius Investment Trust, its highly concentrated portfolio meant its performance was driven by stock-specific factors more than the wider rally in Indian equities. Its heavy (approximately 55%) exposure to technology stocks likely benefited from the sector’s rise over the period despite having no direct exposure to the US market.

Templeton Emerging Markets was an example of a strategy bucking the wider trend. Its largest allocation was to China, while also having an underweight position in India. Stock selection likely carried the day for Templeton, where, like Mobius, it has an overweight position in technology companies.

In share price terms, the top performer was Gresham House Energy Storage, which saw its shares rally after announcing it reached a tolling agreement with Octopus Energy. The contract provided what its managers believe are “attractively priced,” two-year fixed-price contracts for approximately half of its portfolio.

New Star Investment Trust announced a proposed return of capital on June 21, returning £17m to shareholders via a share repurchase scheme (swapping ordinary shares for redeemable B shares). Its shares rallied on the back of this announcement.

Tritax EuroBox announced a possible cash offer for the trust by Brookfield Asset Management on 3 June, with its shares rallying in response. As of the time of writing, interest in Tritax has increased, with multiple bidders indicating their interest.

NextEnergy Solar announced a £20m share buyback programme in June. The trust also outlined the second phase of its capital recycling programme on the same day, selling a solar asset for £27m and using the proceeds to pay down debt.

Harmony Energy Income Trust saw its discount narrow at the start of the month after PrimeStone Capital increased its holding to 10%. There was also a flurry of trading activity at the end of the month upon the release of its interim results. The results outlined an amended dividend policy, whereby it will aim to distribute a minimum of 85% of its operational free cash flow as a semi-annual dividend. This new dividend profile was positively received by the market, with its shares jumping on the back of the announcement.

We covered the remaining trusts elsewhere in this note.

Best performing funds in total NAV (LHS) and share price (RHS) terms over June 2024

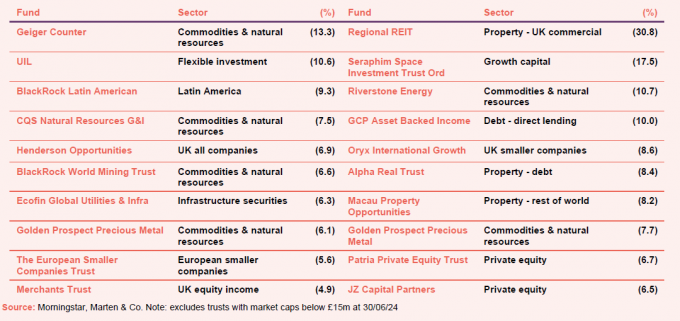

Worst performing

The worst performing trusts, in NAV terms, were dominated by the commodities sector, reflecting some of the headwinds we mentioned earlier. Geiger Counter led the pack, however, with some of its largest holdings down more than 15% over the month. This decline was a direct reflection of the fall in the spot price of uranium, which fell 6.8% over the month. The other natural resources trusts reflected the falling prices of their respective commodities.

UIL’s performance would have likely reflected the underlying holdings of its largest investment, Somers Limited, which makes up more than 45% of its portfolio, and Zero Resources limited, which makes up 15% of its portfolio. These are financial services and natural resources holding companies, respectively, with both sectors having reported negative performance over the month of June.

BlackRock Latin America’s performance reflected the wider pain felt by the Latin American region over June. The region has long had a strong exposure to the commodity sector, as well as an inverse relationship to US interest rates, as it can have a knock-on effect on the repayment of the dollar denominated debt that is issues within Latin America. The trust represented some of the worst performers in the region, however, as the wider Latin American market was down 5.3% in sterling terms over the month.

Henderson Opportunities and Merchants Trust reflect the UK’s negative performance over the month. The combination of geared UK exposure with likely poor stock picking amplified the losses of the two mostly large-cap strategies.

Ecofin Global Utilities & Infrastructure portfolio has been hit by further disappointments on the timing of interest rate cuts.

The European Smaller Companies Trust was the worst casualty of the selloff in European equities, which we discussed earlier.

Worst performing funds in total NAV (LHS) and share price (RHS) terms over June 2024

In terms of share price performance, it was a mixed bag; however, a general theme across many of them was the impact of dampening rate expectations on asset prices.

Regional REIT’s share price dropped immediately following the announcement of a £110.5m capital raise. The trust intends to issue 15 new shares for every 7 existing shares at an issue price of 10 per share. The fall in its share price effectively represents the impact of dilution, as the issue price is below the prevailing share price.

There was no negative news surrounding Seraphim Space Investment Trust, other than its Q3 results, which reported a 1.4% increase in its portfolio valuation. The decline in its share price likely reflects the impact of shifting rate expectations and investors taking profits, as Seraphim had previously enjoyed a substantial re-rating of its shares from the approximately 64% discount it traded at the start of 2024.

Riverstone Energy and Golden Prospect Precious Metals reflect the general woes the commodity market faced over the period.

GCP Asset Backed Income fell after the conclusion of its first capital distribution.

There was no specific news surrounding Oryx International Growth; however, with its concentrated portfolio of both listed and unlisted UK and US small-cap companies, it likely fell afoul of rising interest rates in the same way other comparable strategies did.

Macau Property Opportunities is undergoing a realisation of its portfolio. Its discount widened over the month, reflecting the possible impact of rising rates or the generally slow process of returning capital to shareholders. Its board announced a change to its fees at the end of June to ensure its managers remained incentivised, earmarking a further $100,000 per month to the manager. The sell-off accelerated following the announcement.

Patria Private Equity and JZ Capital Partners’ share price moves run counter to improved NAVs announced by both trusts during the month. The disappointment on rates could be a factor.

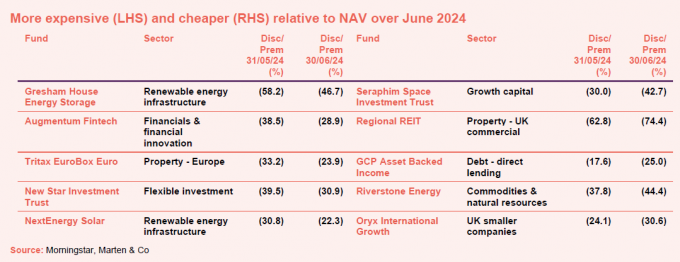

Moves in discounts and premiums

More expensive (LHS) and cheaper (RHS) relative to NAV over June 2024

Most of the companies featured in this list have already been discussed. On the plus side there is Gresham’s new price agreement, Tritax’s possible takeover, Augment’s new investment, and New Star and Next Energy’s capital returns.

On the negative, it was disappointing to see Seraphim Space’s discount widen.

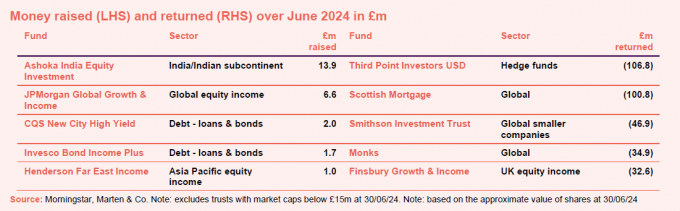

Money raised and returned

Money raised (LHS) and returned (RHS) over June 2024 in £m

In terms of money raised, it is once again the usual suspects making an appearance, with the top four trusts having consistently issued shares on the back of their premium rating. Henderson Far East Income is a new entrant, having begun to trade on a premium since the start of May.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Hipgnosis Songs Fund General meeting – 08/07/2024

- Personal Assets General meeting – 09/07/2024

- Pacific Assets AGM – 09/07/2024

- Worldwide Healthcare Trust AGM – 10/07/2024

- Templeton Emerging Markets AGM – 11/07/2024

- Value and Indexed Property Income AGM – 11/07/2024

- TwentyFour Income Shareholder presentation – 11/07/2024

- Ashoka WhiteOak Emerging Markets AGM – 16/07/2024

- Edinburgh Investment Trust AGM – 17/07/2024

- Biotech Growth Trust AGM – 18/07/2024

- Fidelity China Special Situations AGM – 23/07/2024

- Cordiant Digital Infrastructure AGM – 24/07/2024

- JPMorgan European Discovery AGM – 24/07/2024

- Montanaro UK Smaller Companies AGM – 25/07/2024

- JPMorgan Japan Small Cap Growth & Income AGM – 25/07/2024

- CT UK High Income AGM – 26/07/2024

- Menhaden Resource Efficiency AGM – 27/07/2024

- Rockwood Strategic AGM – 31/07/2024

Major news stories and QuotedData views over June 2024

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Portfolio developments

- Widening discount wipes out gains for Oryx shareholders

- Seraphim Space Investment Trust maintains momentum as portfolio continues to develop

- Optimism growing as Monks delivers strong gains

- Gresham House Energy Storage secures revenues for half its portfolio

- Chrysalis warns on wefox valuation but ‘likely disposal’ still on track

- Challenges continue for Lindsell Train

- OCI ups tech exposure with investment in cybersecurity

- AshokaWhiteOak Emerging gets off to good start

- Bankers slimming down portfolio to focus on best ideas

- Montanaro UK Smaller Companies discount offsets its NAV growth

- Positive return for Augmentum Fintech despite macro challenges

- Triple Point Energy Transition’s first results after approving wind-down

- Templeton Emerging Markets outperforms and accelerates buybacks

- Growth company headwinds weighed on Montanaro European Smaller Companies

- Cordiant Digital reasonably good results at odds with discount

- Syncona backs two new cancer companies

- NextEnergy Solar shows resilience in face of sectoral challenges

Corporate news

- Merck Mercuriadis to leave Hipgnosis Song Management after Blackstone deal

- Alliance and Witan to combine

- Schroder Japan adopts new dividend and discount policy

- New name and lower fees for JLEN Environmental

- Downing Strategic Micro-Cap requisitioned by Milkwood Capital

- NextEnergy Solar sells Whitecross and launches £20m buyback programme

- JLEN Environmental Assets refinances its sustainability linked RCF

- Asian Energy Impact updates ahead of wind-up resolution later today

- Aurora tweaks investment objective and performance fee methodology

- Pantheon International appoints Charlotte Morris as co-lead manager

- Andy Ho, CIO of VinaCapital, passes away

- Pershing Square’s manager pulls in $1bn of external money

- Octopus Renewables Infrastructure Trust launches £10m buyback, rethinks debt

- Incremental increase in Blackstone offer for Hipgnosis Songs Fund

Property News

Portfolio developments

- Ground Rents Income Fund values slashed by leasehold reform

- NewRiver REIT boosts capital partnerships business with acquisition

- AEW UK REIT makes solid progress on dividend cover

- SEGRO goes Dutch with €222m triple buy

- Target Healthcare REIT sells four care home at book value

- Harworth sells development land to Microsoft for hyperscale data centre

- Warehouse REIT buys retail park and reports resilient results

- Urban Logistics REIT focused on dividend cover after posting solid results

Corporate news

- More suitors in for Tritax EuroBox

- Regional REIT in last chance saloon with proposed equity raise

- Home REIT fails to refinance loan

- Brookfield mulls bid for Tritax EuroBox

- New REIT targets £500m IPO

- Tritax EuroBox continues strategic revival in challenging market

- Triple Point Social Housing REIT to make portfolio sales and cuts ties with troubled tenant

QD views

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

Research

Polar Capital Technology’s (PCT’s) manager remains all in on the artificial intelligence (AI) investment theme, having fine-tuned the portfolio towards the ‘AI enablers’ and ‘AI beneficiaries’ that it considers will outperform the wider sector over the long-term. 2024 is set to be a profound moment for AI and a showcase for the rapid rise in its use and capability – with several new large language model launches expected, including OpenAI’s GPT-5. These launches will not only act as progress waypoints, but could also turbo-charge already-impressive adoption rates and help embed AI into everyday life. With one of the largest technology investment teams in Europe and a private fund that has been dedicated to AI for almost seven years, PCT’s manager’s expertise ought to be reflected in the trust’s rating, a discount to NAV of 6.7% seems attractive.

In a world where the share prices of AI-related companies have determined the fortunes of global equity markets, Herald Investment Trust (HRI) offers a way to capitalise on these potent tailwinds while still offering an arguably seldom-found discount opportunity within a universe known for its high valuations, coupled with the trust’s shares currently trading on an attractive 11.5% discount to net asset value (NAV).HRI’s war chest of liquid capital means that it is well primed to capitalise on opportunities as they arise, as well as to profit from the inefficiencies of the UK equity market. Thanks to structural tailwinds supporting technology and successful stock-picking by the HRI team, HRI has been able to sustain its track record of outperformance.

CQS New City High Yield Fund (NCYF) is consistently one of the highest-dividend-yielding funds in its debt – loans and bonds peer group and, over the longer term, is also one of its best-performing. NCYF has benefitted from an uplift in capital values as the headwind of higher interest rates that weighed on bond valuations in 2022 and 2023 has turned tailwind – a trend which its manager, Ian “Franco” Francis, thinks has further to go. NCYF looks the best-positioned of its peers to benefit from this, helped by Franco’s locking in of decent yields in advance of interest rate falls. NCYF is conservatively managed with a strong emphasis on capital preservation. The portfolio retains its high exposure to the UK.

Urban Logistics REIT (SHED) has reported its full year results for the year end 31 March 2024 this morning. It has been another year of strong operational performance, with net rental income up 8.4% to £57.4m. Valuations have stabilised, with EPRA net tangible assets (NTA) was down just 1.3% to 160.27p.Urban Logistics REIT’s (SHED’s) manager’s expertise in asset management has come to the fore again in these annual results, with 35 lease events signed at an average 19% like-for-like rental uplift. This contributed to a net rental income uplift of 8.4% to £57.4m.The asset management also had the effect of offsetting the impact of yield expansion in its portfolio, with valuation remaining remarkably stable, with a slight reduction of just 0.3% on a like-for-like basis.

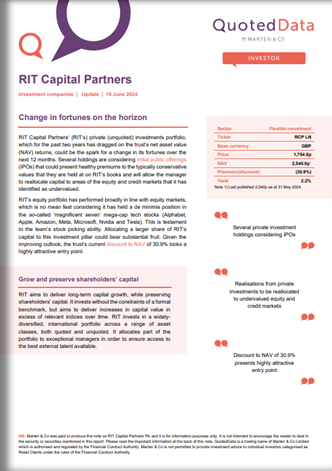

RIT Capital Partners’ (RIT’s) private (unquoted) investments portfolio, which for the past two years has dragged on the trust’s net asset value (NAV) returns, could be the spark for a change in its fortunes over the next 12 months. Several holdings are considering initial public offerings (IPOs) that could present healthy premiums to the typically conservative values that they are held at on RIT’s books and will allow the manager to reallocate capital to areas of the equity and credit markets that it has identified as undervalued. RIT’s equity portfolio has performed broadly in line with equity markets, which is no mean feat considering it has held a de minimis position in the so-called ‘magnificent seven’ mega-cap tech stocks. This is testament to the team’s stock picking ability. Allocating a larger share of RIT’s capital to this investment pillar could bear substantial fruit.