Firing on all cylinders

- RIT Capital Partners (RCP) has reported annual results for the year ended 31 December 2024 this morning. It posted strong numbers, with all three investment pillars – quoted equities, private investments, and uncorrelated strategies – delivering positive returns.

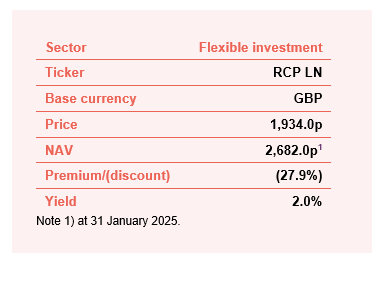

- NAV was up 7.7% over the year to 2,614p per share. Including dividends, the NAV total return was 9.4%. This compares to returns on its reference performance benchmarks – CPI +3% and the MSCI ACWI (50% sterling) – of 5.5% and 20.1% respectively.

- Strong operational performance has led the company to propose a 10.3% dividend uplift for 2025 to 43.0p per share, which would be the twelfth successive year of dividend growth.

- The company’s quoted equities portfolio was up 15.8% over the year, helped by the performance of its small- and mid-cap holdings and the performance of its specialist manager partners in China and Japan. Meanwhile, private investments were up 4.8% and uncorrelated strategies returned 4.5%.

- Share price total return was 7.9%, reflecting the trust’s discount widening by 1.6 percentage points to 24.0%. Having bought back £80m shares in the year, the board has signalled its confidence in the NAV and continues to allocate capital to buybacks in 2025.

- Chair Sir James Leigh-Pemberton will retire at the AGM in May, after six years on the board, due to increased demands from his wider commitments. He will be replaced by senior independent director Philippe Costeletos.

Maggie Fanari, chief executive of RCP’s manager, J Rothschild Capital Management:

“2024 was a year of solid progress for the company, and we enter 2025 with the portfolio well positioned for continued growth. Our quoted equities pillar delivered mid-teen returns, while in private investments we enhanced performance and realisations and our SpaceX investment demonstrates our ability to access exclusive opportunities not typically available to individual investors. While macroeconomic uncertainties remain, we believe our flexible and resilient portfolio is well positioned to take advantage of global opportunities across asset classes while managing risks.

Markets in 2025 offer challenges and opportunities, with the US economy expected to outpace the eurozone, inflation likely to continue to stabilise and the uncertain impact of new import tariffs. Buoyant equity markets face risks from high valuations and concentrated technology performance, underlining the importance of a selective approach. Meanwhile, private investments are set to benefit from improved regulatory conditions, supporting growth in M&A and IPO activity, while certain credit markets and market-neutral strategies remain attractive.

Against this backdrop, we are building on our foundation for sustainable growth. We continue to see significant opportunities in megatrends that are shaping the global economy. These include the diffusion of technology, with AI and digital transformation extending well beyond traditional tech sectors, medical advances increasing longevity and quality of life, and a multi-polar world, with shifting economic power reshaping supply chains and investment flows.

Our specialist partners provide privileged access to opportunities across public and private markets, while our flexible capital structure enables us to deploy capital swiftly where we see compelling returns. We are focused on delivering long-term capital appreciation and attractive risk-adjusted returns for shareholders, building a dynamic and resilient portfolio for the years ahead.“

QuotedData’s view

RIT Capital Partners’ (RCP’s) focus on capital preservation through a flexible and diversified portfolio seems the ideal tonic for the current uncertain macroeconomic and geopolitical backdrop. Equity markets have been driven by a narrow group of mega-cap technology stocks, but risk lurks in the form of high valuations and an AI war with (reportedly cheaper) Chinese counterparts.

The importance of RCP’s selective approach and focus on undervalued small- and mid-cap stocks has come to the fore here and could continue to pay off handsomely going forward, with an expected broadening of technology ‘winners’ and a portfolio aligned with other global megatrends it has identified, such as medical advances.

We have stressed the investment opportunity in the private equity sector for a long period of time, so it was good to see the M&A and IPO markets showing some signs of life at the back end of 2024. We expect this to develop further in 2025 and onwards. RCP’s portfolio of conservatively valued private investments should drive returns as more exit opportunities present themselves.

The unique ability of the manager to access investmentopportunities that others cannot, should not be underestimated. The investment in SpaceX is particularly exciting and these types of investments could be a source of superior returns for the trust for years to come.

Having bounced back in 2024 from a disappointing couple of years, including the trust’s first NAV decline in more than a decade in 2022, it was a surprise to see the company’s discount widen during the year to 24.0%, and march out further still in the first two months of 2025. In our view, this presents an opportunity for investors to buy shares in the company at an extremely attractive entry price.

Watch RCP’s manager discuss the results

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on RIT Capital Partners Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.