Focused on dividend cover

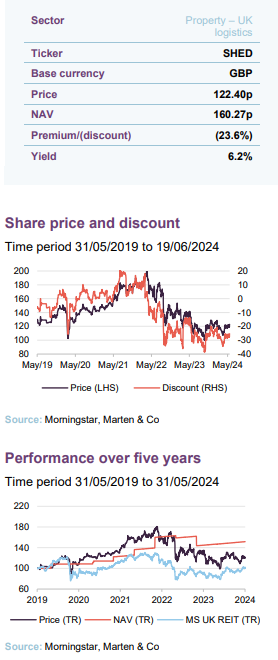

Urban Logistics REIT (SHED) has reported its full year results for the year end 31 March 2024 this morning. It has been another year of strong operational performance, with net rental income up 8.4% to £57.4m. Valuations have stabilised, with EPRA net tangible assets (NTA) was down just 1.3% to 160.27p.

The value of the company’s portfolio of mid-box urban logistics assets was stable over the 12 months falling just 0.3% on a like-for-like basis to £1.1bn.

Although net rental income was up 8.4% to £57.4m, adjusted earnings per share was down slightly to 6.89p (2023: 6.93p), due to higher interest costs on its debt. That means its dividend of 7.6p was just 90.6% covered by earnings. The management team said that dividend cover was a priority for the company and is confident it can be achieved through the leasing up of vacant space.

The company has total debt of £354m (equating to a conservative LTV of 29.3%), with a weighted average cost of debt in the period of 4.02% (2023: £351m, 3.21%). The debt is 97% hedged and a weighted average maturity of 5.4 years. The first debt refinancing is due in August 2025, and the manager said that negotiations with the lender were well advanced.

The fundamental mismatch in supply and demand in the occupational market continued to push rents higher, with 35 lease events during the year generating an additional £3.0m in rental income, at an average 19% like-for-like rental uplift.

Chair’s comments

“2023 was characterised by geopolitical conflicts, high inflation and interest rates at higher relative levels. These factors led to UK property shares across the sector trading at substantial discounts. This made it almost impossible to raise money in the market. The presumption was that income could be affected by tenant failures and rising costs, in particular rising interest rates, resulting in potentially uncovered dividends. The industrial sector, and in particular a company like Urban Logistics associated with logistics providers as tenants, was largely unaffected by these issues. Vacancy has remained low, and asset management initiatives, including improving the environmental ratings of our properties, have led to improved lease terms. The valuation of the portfolio is only marginally down on last year. Through hedging and fixing our interest, costs have remained at a manageable level. This means we have been able to maintain our dividend, albeit it is marginally uncovered.

“With inflation falling and interest rates very likely to reduce through the current year, opportunities for Urban Logistics should emerge once again, and we are well placed to take advantage of them. We are considering increasing our LTV towards the lower end of our stated range in order to acquire properties with suitable asset management opportunities. At the same time, we will proactively recycle those assets where we have maximised returns.

“The portfolio has performed well through the property cycle, and we are well set to grow earnings, allowing us to maintain and ultimately grow the dividend. We continue to believe that our shares trade at a value which does not reflect either the demand for the underlying real estate or the operational performance of the Company, and believe there is significant upside to be captured in the years ahead.”

Nigel Rich, SHED chair

QuotedData’s view

Urban Logistics REIT’s (SHED’s) manager’s expertise in asset management has come to the fore again in these annual results, with 35 lease events signed at an average 19% like-for-like rental uplift. This contributed to a net rental income uplift of 8.4% to £57.4m.

The asset management also had the effect of offsetting the impact of yield expansion in its portfolio, with valuation remaining remarkably stable, with a slight reduction of just 0.3% on a like-for-like basis.

The dividend was not covered by earnings, mainly due to an uplift in finance costs. The manager is in advanced discussions with lenders to refinance debt facilities that are due to mature in August 2025, at a reduced margin, while future lettings should help plug the gap.

Letting up vacant space, which stood at 5.8%, will be a top priority for the manager. The majority of this is on assets that were acquired by the company with asset management plans in mind. It is close to announcing a deal that would add £1.0m to the rent roll and future lettings are in the works.

Promisingly, occupational markets appear to be rebounding – demonstrated in SHED’s results, where deals signed in the first half of the financial year were conducted at an average 10% uplift compared to 27% in the second half of the year. The last-mile, urban end of the logistics sector has far more favourable supply and demand dynamics than the rest of the market due to their location close to major towns and cities. Although the headline vacancy rate across UK logistics rose to 7.8%, the vacancy rate for the ‘mid-box’ sub-sector (in which SHED operates) is far more encouraging at just 4.5% (according to CoStar).

Click here to read SHED’s full year results

Click here for an updated SHED factsheet

Click here for SHED’s peer group analysis

Previous publications

| Title | Note type | Date |

| Shed load of growth to come | Initiation | 10 August 2021 |

| In the sweet spot | Update | 22 December 2021 |

| Long-term dynamics remain strong | Annual overview | 4 October 2022 |

| Fundamentals strong as market stabilises | Update | 17 May 2023 |

| A re-rating candidate | Annual overview | 10 January 2024 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| This marketing communication has been prepared for Urban Logistics REIT Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from | receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the | period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.