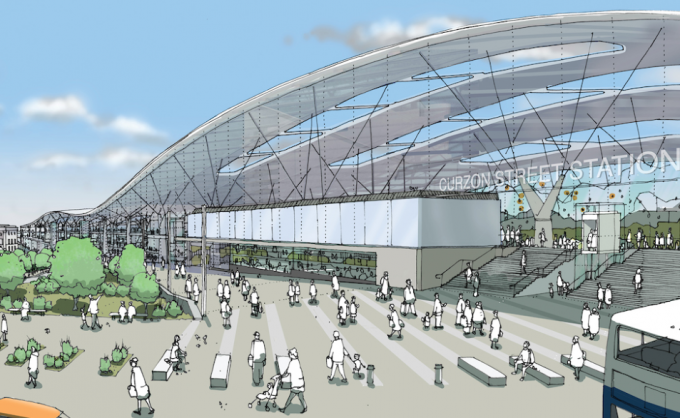

Real Estate Investors continues to see HS2 related demand – Real Estate Investors (RLE), which focuses almost exclusively on commercial properties in the Midlands, had a solid year to December 31, 2018, as it continued to see the demand impact from the High Speed 2 rail project-related population migration from London, driving increased value in asset classes around Birmingham and the wider Midlands

The trust has a 1.55m square foot portfolio, valued at £224.8m (2018 year-end compared to £213.1m in 2017), an increase of 5.5%. Contracted rental income has grown to £17.0m p.a. (2017: £16.2m p.a.), up 4.9%

Key highlights

The company has provided the following key highlights:

- Achieved occupancy of 96.1% (2017: 92.8%) up 3.3%

- Increased revenue by 5.1% to £15.6m (2017: £14.9m)

- Increase in underlying profit before tax* to £7.2m, up 16.1% (2017: £6.2m)

- EPRA** EPS 3.9p (2017: 3.3p), up 16.3%

- Record contracted rental income of £17.0m p.a. (2017: £16.2m p.a.) up 4.9%

- Total dividend per share for 2018 of 3.562p (2017: 3.125p), up 14.0%, final quarterly dividend 0.937p per share

Paul Bassi, CEO of RLE, commented: “Despite the economic and political uncertainty during 2018, we added value to our portfolio through our intensive asset management activities generating underlying profits of £7.2m, up 16.1%, whilst growing the portfolio to £224.8m, up 5.5%, and achieving record occupancy levels of 96.1% up from 92.8%. A pleasing performance.

Our portfolio is stable, secure and diversified across many sectors, with no material reliance on any single asset or occupier. The office element of our portfolio represents 37.9% and, due to the lack of new build over the last decade and some existing office stock being converted to residential under permitted development rights, we are noting a significant undersupply of office space and experiencing rental growth across our office ownership, in particular in our non-city centre stock across the Midlands. Our retail exposure remains focused on convenience, value and neighbourhood outlets.

We have continued to grow the portfolio, completing £15.4m of investment property acquisitions (net of acquisition costs) and £5.7m of strategic sales. Overall, the Midlands property market is positive with pockets where it is buoyant.”

Discussing the fund’s outlook, he added: “Many see the present environment as challenging and troublesome. We do not. As a management team we have operated in uncertain times before, the 1990’s recession, the 2008 financial crisis, the Scottish and European Referendums, and each time we have capitalised on opportunities that have become available during those periods. We are alert to the uncertain political and economic backdrop. However, given our strong financial position, combined with our unparalleled Midlands property network and first mover market intelligence, we are optimistic about uncovering significant further value amongst our chosen markets in 2019.”

RLE: Real Estate Investors continues to see HS2 related demand