QuotedData visits Bluefield Solar’s Elms farm – Earlier this week, QuotedData attended an analyst and investor site visit arranged by Bluefield Solar Income Fund (BSIF). BSIF is a client of our sponsored research service – we published an initiation note earlier this year, which you can access here.

We figured it would be interesting to share some of our findings from the visit. Before visiting BSIF’s 29 megawatt (MW) Elms solar farm (all photos included were taken on site) in Oxfordshire, we went to Bluefield’s technical asset management offices in Bristol (effectively the ‘control room’ for all sites), where portfolio supervision, monitoring and performance optimisation activities are carried out for BSIF. We spent about an hour at Elms farm, where temperatures were sweltering at above 30c, which interestingly is beyond the ideal temperatures for efficiently converting sunlight into power.

Renewable energy infrastructure funds have been attracting a lot of interest with a number of existing funds successfully raising new money over recent months, while the sector has been at the forefront of new issue activity too (Aquila European Renewables Income and US Solar Fund launched). A significant increase in UK power prices over the past 18 months (we’ll touch on this), attractive yields (typically above 5.5%) and the fairly predictable cash flows the funds have locked-in are some of the reasons behind why premiums in the sector have widened in 2019. BSIF began the year with its shares trading at a premium to NAV of about 10%; this has widened to over 20%.

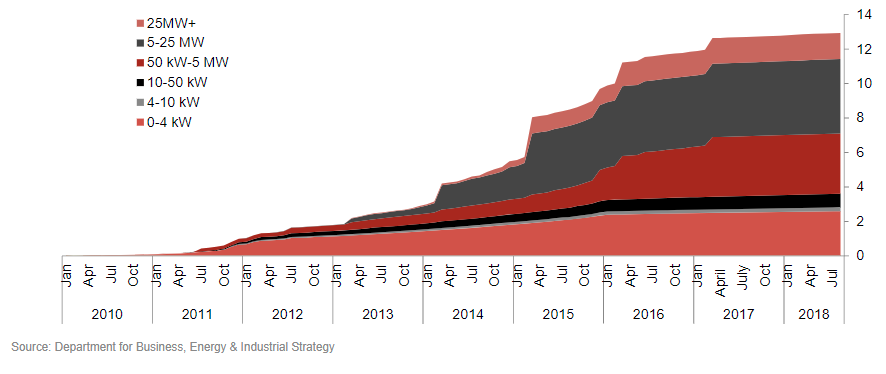

Figure 1: UK Solar development: by capacity (gigawatts)

Figure 2: Renewables infrastructure assets discount/premiums versus global

Bristol control room drives it all

Before we begin, it probably makes sense to briefly run through BSIF’s corporate structure, as specialist renewable funds typically are setup differently to many of the more conventional equity or bond funds. BSIF is setup as a parent company with investments carried out by a holding company, which in turn are held in special purpose vehicles (SPVs). BSIF has an asset manager (Bluefield Services) and an investment advisor (Bluefield Partners); Bluefield Services runs the ‘control room’ in Bristol and is responsible for all monitoring activity.

Howard Johns, CEO of Bluefield Services, was the main speaker in Bristol. Bluefield Services provides asset management (including monitoring and performance optimisation) and engineering services. Key takeaways include:

- Howard described the process by which all sites (45 large-scale sites at the time our initiation note was published) are monitored. All strings on the solar panels are monitored for 12 hours a day from Bristol by teams of asset engineers. Whenever an issue arises (typically around a hundred mostly small ones in a given week), this immediately shows up on the monitoring software. We were shown the area where this is carried out with multiple screens monitoring all sites. One analyst asked what happens in the event of a power failure, Howard said that the monitoring system’s servers are not housed at the Bristol site and the software can be and is regularly accessed remotely. The team also uses drones and thermal imaging to monitor sites;

- Where issues are found at sites, Howard refers to an authorised engineer whose safety clearance is needed before maintenance engineers are dispatched to a site. This is potentially very dangerous work so safety is paramount. Site personnel are hired so that they are within 40 minutes of a farm to minimise lag time when issues arise;

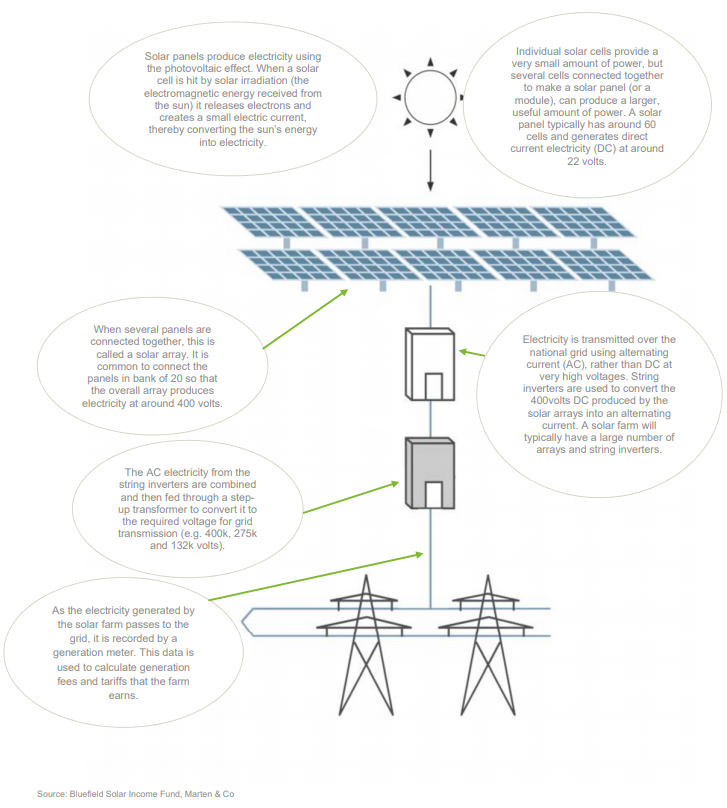

- Properly maintaining the ‘kit,’ including the inverters and transformers on the farms (they convert the energy produced by the solar arrays to the required voltage for use on the power grid), allows the useful life of the equipment to be maximised and ensures that ‘kit’ warranties are not voided;

- Theft on the farms has been an issue in the past. Thieves would typically go for the copper wires around the panels – these have mostly been replaced by aluminium, which has little theft value. CCTV cameras are installed across all the sites and interestingly, the farms are typically designed to not be visible to nearby traffic;

- Howard also made a comparison between the output improvements of the solar cells and the advancement in computer processing power; the technology behind solar is getting better all the time. BSIF’s cost structure (and its solar peers) is mainly fixed so any increases in power prices and efficiency improvements from the solar assets can flow through to the company’s bottom line;

- Finally, Howard discussed the importance of keeping the landowners onside. There have been instances of landowners being difficult to work with, which will likely be an ongoing issue for the sector as nearly everyone is aware of its success. Vegetation at the solar farms is typically grazed; it is quite common to see sheep at solar farms and this was the case at Elms.

Figure 3: An inverter at Elms

Figure 4: Sheep grazing at Elms

Elms farm can power 5 acres per megawatt

We reached the 29MW Elms site at 4pm. Everyone had to put on wellies and wear safety jackets. We were taken around the farm by one of the on-site technicians and were also accompanied by Howard and some of the team from Bluefield Partners (the manager). It is a sprawling site that looked particularly striking under the hot sun and blue skies. BSIF acquired the site in 2015 for a commitment of £32.8m.

For context, we were told that a 50MW site would have the capacity to power a small town over a year. We walked around one area of the site over the hour we spent; it would take several hours to cover the whole space. There were sheep everywhere, happily co-existing with the solar panels, with many taking shelter under the panels.

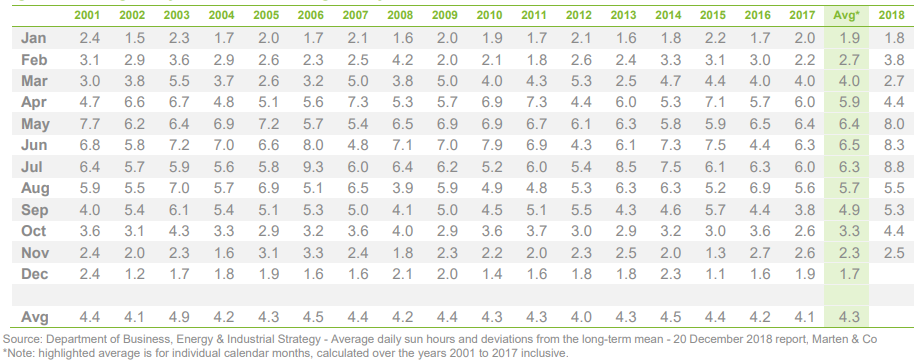

Figure 5: Average daily UK sun hours: weighted by location of UK solar PV resource

Subsidy-free expansion

The past 18 or so months have been very conducive to solar power in the UK. An exceptionally hot and dry summer in 2018 provided ample solar irradiation (the power source of solar assets); that said, even without the blistering summer, the average daily sun hours seen in the UK is remarkably consistent (shown in figure 5). Power prices also increased meaningully in 2018, coming close to 10-year highs. The main driving forces behind the power prices are though to include higher commodity prices (coal and natural gas) and a reform of the EU’s emission trading system, which is expected to lead to scarcity of carbon credits.

Expanding has been harder though. The cost of buying secondary assets has increased considerably with competition for these high yielding projects growing and less new supply coming following the reduction of government subsidies (for those interested in the finer detail behind the sector, including the subsidy environment, we suggest reading our BSIF initiation note). BSIF told us they were focusing on operational improvements at their existing sites and in terms of expansion, the improving economics of solar mean they see the greatest opportunity coming from subsidy-free expansion. The cost of producing solar energy is coming down and China toning down its solar subsidies is bringing the cost of equipment down due to oversupply. We were also told at Bristol that BSIF prefers being the ‘owner’ of projects for legal reasons; when you buy secondary assets you often inherit contracts with suppliers/contractors which might not be ideal to your needs.

Figure 6: Solar farm explained in brief

BSIF: QuotedData visits Bluefield Solar’s Elms farm