Hipgnosis Songs acquires catalogue from The Chainsmokers – Hipgnosis Songs (SONG) has announced that it has has acquired a music catalogue from The Chainsmokers, the 14th most streamed artist globally on Spotify with 41m monthly listeners.

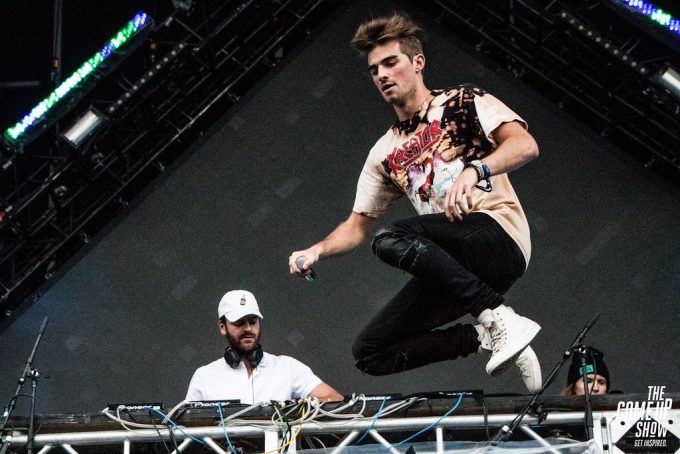

The Chainsmokers, an artist and producer duo made up of Alex Pall and Andrew Taggart, which SONG describe as having been the most consistently successful pop artists of the last five years with 55 number 1 and 245 top 10 chart positions globally. They have won ‘best dance recording’ at the 2017 grammy awards, two american music awards, seven billboard music awards, and nine iHeart radio music awards.

Catalogue includes hit songs, ‘Dont Let Me Down’ and ‘Closer’

- Their 2016 Grammy award winning ‘Don’t Let Me Down‘ featuring Daya, which reached number 1 on the US hot dance/electronic songs, is certified 6x platinum in the US and has been streamed over 1.2bn times.

-

Their hit single ‘Closer‘ featuring Halsey, reached number 1 on the US billboard hot 100, where it stayed for 12 weeks, and went to number 1 on over 30 charts worldwide. As well as winning the ‘top 100 hot song’, ‘top collaboration’ and ‘top dance/electronic song’ at the 2017 billboard music awards; ‘dance song of the year’ at the 2017 iHeart radio music awards; and being nominated for the best pop duo/group performance at the 2017 Grammy awards, ‘Closer’ has been streamed 1.6bn times as well as being certified diamond in the US. .

Merck Mercuriadis, founder of SONG, said: “The Chainsmokers are the highest paid duo in the world not only because they know how to spin records better than anyone else but because they have created amongst the very biggest hits in the world for the dance and pop community over the last 7 years. This is a set of songs that people can’t stop playing and that will define the lives of so many people that have grown up in the 2010’s.”

SONG: Hipgnosis Songs acquires catalogue from The Chainsmokers

Click here to subscribe for free equity research on investment trusts, funds and listed companies.