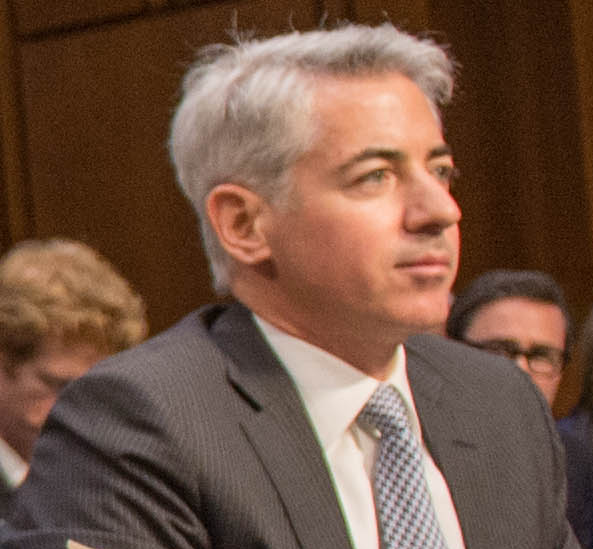

Pershing Square Holdings’s (PSH) manager Bill Ackman has released the following statement in reaction to volatility in markets:

“During the past ten days, we have taken steps to protect the portfolio from downward market volatility. We have done so because we believe that efforts to contain the coronavirus are likely to have a substantial negative impact on the U.S. and global economies, and on equity and credit markets. Our approach to address this concern has been to acquire large notional hedges which have asymmetric payoff characteristics; that is, the risk of loss from these hedges is limited, while their potential upside is many multiples of our capital at risk. These hedges will likely mitigate portfolio losses in severe market declines, while also somewhat reduce the portfolio’s upside potential if there is minimal economic or market impact from the virus. We believe this approach to hedging is preferable to that of selling our portfolio of high quality, conservatively financed companies whose long‐term intrinsic value is not likely to be materially affected by coronavirus developments.

Our approach to disclosure is to provide you with the information we would want if our positions were reversed, that is, if you were the investment manager and we the shareholder. We do not share information, however, which we believe could create a competitive disadvantage for PSH. For this reason, we do not intend to update you as to the specific details of our hedges, nor the timing of increases or decreases in the size of the program.”

PSH: Pershing Square’s Bill Ackman discusses trust’s approach to managing current volatility