It is that time of year again – Black Friday. The US export has quickly become one of the biggest shopping days in the UK. But with shops closed due to lockdown, it will almost entirely take place online this year.

It is estimated that £6bn will be spent on Black Friday this year versus £5.6bn last year. With the vast majority of this being bought online, it will be a logistical nightmare for retailers and third-party logistics operators, such as DHL and DPD, that run contracts for them.

A dream for logistics property owners though.

The warehouses of online retailers and parcel delivery companies are already at capacity having seen a surge in online shopping during the pandemic – with 28.1% of all retail sales occurring online in October (compared to 19% in February and 18.1% in October 2019).

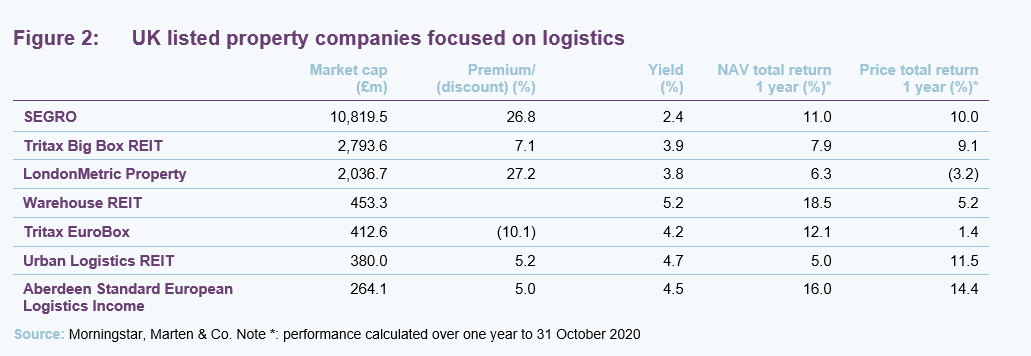

Take-up of logistics space has rocketed in response. Take-up in the first three quarters of this year exceeded that of the record full-year take-up in 2018. The share prices of listed property companies focused on the sector have taken off too.

And it is easy to see why. A property sector that is very much in demand, with favourable structural tailwinds and a decent dividend yield to boot.

With demand for space rapidly increasing, supply has conversely dwindled. This supply-demand imbalance is the holy grail for property companies. Rental growth is rampant in hotspot areas as retailers scramble for more space.

Although online retailing has been the main source of demand, it is by no means the only. The pandemic has thrown up all kinds of quandaries for businesses occupying warehouse space.

Supply chains from China and the Far East were shut off almost overnight in March, leading to a significant supply chain shock for companies in Europe that rely on manufacturing in the Far East. Businesses are now re-shoring manufacturing back to Europe in order to avoid this scenario, and requiring a significant amount of space to do so.

Inventory levels have also increased because of the pandemic. Retailers and manufacturers had been increasingly moving to a “just in time” logistics model where stock levels were at the optimum level, thereby reducing space. The supply chain shock and a rush of panic buying at the start of lockdown caught many out.

The online grocery market is a good example of this. Ocado uses highly-sophisticated technology to optimise its warehouse space but came unstuck when capacity couldn’t meet the surge in demand. Other supermarkets were able to ramp up their home delivery service by effectively using stores as warehouses.

Europe

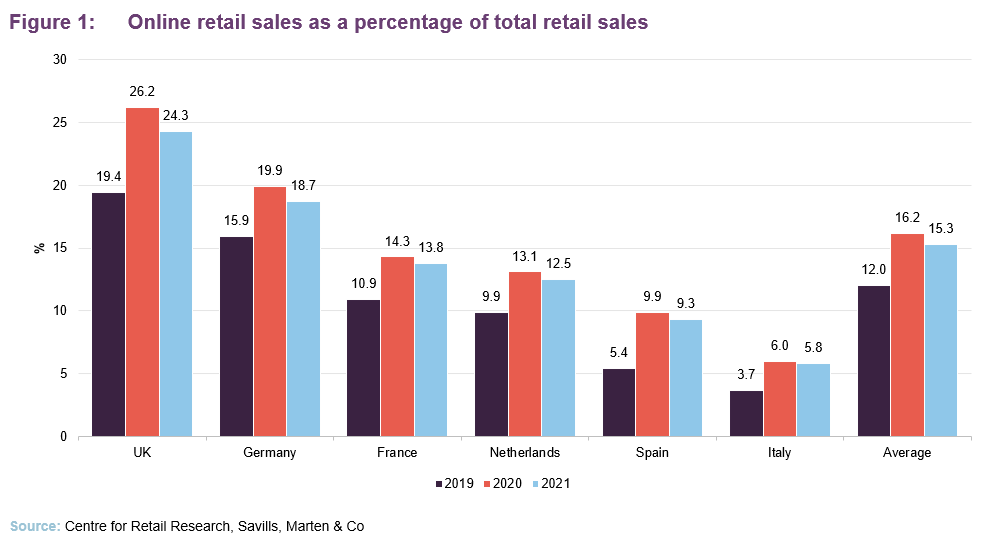

Most European logistics markets are on a similar growth trajectory to that witnessed in the UK. Less mature markets like Spain and Italy are predicted to see the highest growth in e-commerce penetration leading to increased demand in logistics property to support these businesses.

Average online retail sales penetration in Western Europe has been sped up by a year due to the pandemic. Aberdeen Standard European Logistics Income (ASLI) and Tritax EuroBox (EBOX) are both well placed to benefit from this growth, with large established portfolios of logistics assets in these countries.

Logistics is hot property right now and events like Black Friday and the effects of the pandemic only serve to make it hotter.