In QuotedData’s morning briefing 4 March 2022:

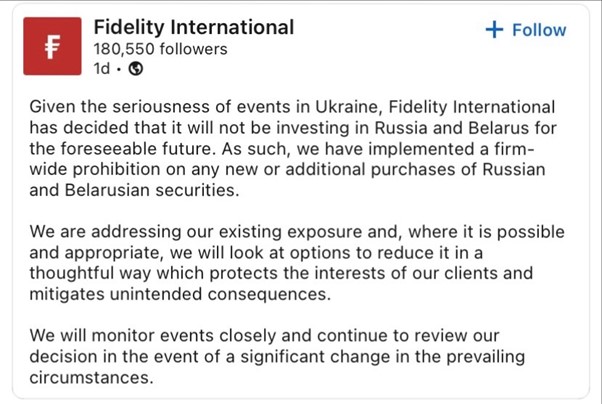

- Fidelity International has announced that it is pulling the plug on investment in Russia and Belarus. Its statement reads as follows:

Given the seriousness of events in Ukraine, Fidelity International has decided that it will not be investing in Russia and Belarus for the forseeable future. As such, we have implemented a firm-wide prohibition on any new or additional purchases of Russian and Belarusian securities.

We are addressing our existing exposures and, where it is possible and appropriate, we will look at options to reduce it in a thoughtful way which protects the interests of our clients and mitigates unintended consequences.

We will monitor events closely and continue to review our decision in the event of a significant change in the prevailing circumstances.

- Pacific Horizon (PHI) has published its interim results for the six months ended 31 January 2022. During the period, PHI’s NAV and share price decreased by 3.7% and 7.5% respectively, in total return terms, compared to the comparative index which declined 2.7% (all in sterling terms). PHI’s manager says that this reporting period was noticeable for the dramatic shift in investor sentiment, catalysed in part by renewed inflation fears and the Federal Reserve indicating a more aggressive rate tightening cycle. This led to a sharp global correction in ‘growth’ assets, as investors rotated dramatically into ‘value’. The result was previously unloved sectors, such as energy, being the best performing over the period (+24.3% in absolute terms), followed by Utilities (+12.5%) and Financials (+8.9%). Conversely ‘growth’ sectors faced substantial headwinds with Healthcare, Communication Services and Information Technology the worst performers (falling -28.7%, -23.1% and -12.8% in absolute terms respectively). Given PHI’s growth bias, the result was a partial reversal of the portfolio’s strong performance led by weakness in its holdings in Information Technology and Communication Services.

- JPMorgan Global Core Real Assets (JARA) has announced that $11.1m of its committed capital has been called and funded into the US Real Estate Mezzanine Debt strategy. This investment will take JARA to being effectively 100% invested and was funded from its cash balance and by reducing the liquid real asset allocation portion of JARA’s portfolio. JARA says that the investment will provide it with exposure to a portfolio of 15 existing loans with a bias towards multifamily and office loans. The weighted average duration of the portfolio of loans is 2.7 years. At full investment and with the addition of the Mezzanine Debt strategy, the Company will have positively increased its sensitivity to rising interest rates, given the Mezzanine strategy’s 64% exposure to floating rate loans. This allocation will also help to increase JARA’s portfolio income as the underlying Mezzanine strategy has provided an income of 7.4% over one year and an annualised return of 6.9% since inception. Target total returns for the Mezzanine strategy are 7-9% gross and 6-8% net, this return will be primarily income orientated.

- Ashoka India Equity (AIE) has published its interim results for the six months ended 31 December 2021. During the period, AIE provided NAV and share price total returns of 25.2% and 26.2% respectively, compared to the benchmark index, the MSCI India IMI, of 15.4% (all in sterling terms). The chairman, Andrew Watkins, comments that the outperformance demonstrates the abilities of the investment management team to identify those companies most likely to benefit from a return of confidence as India eased itself out of the crisis. He also says that part of this outperformance will be down to new investments in cutting-edge businesses but also by remaining invested in longer-term holdings that have since witnessed recovery in their share prices.

- Jupiter Emerging & Frontier Income (JEFI) has provided an update on its exposure to Russia. It says that Russian-listed securities represented 0.4% of net asset value as at 1st March 2022 and the portfolio has no exposure to Ukrainian securities. JEFI also says that, as at 23rd February, prior to Russia’s invasion of Ukraine, the portfolio had direct and indirect exposure to Russian securities representing 6.3% of net asset value and no exposure to Ukrainian securities. Since that time, JEFI’s exposure to the region has been reduced, partly as a result of selling down Russian securities and also due to price declines in those securities. The portfolio no longer holds shares in Sberbank, as the position was exited on 24th February.

- Urban Logistics REIT (SHED) will be added as a constituent of the FTSE 250 and FTSE All Share Indices, on Monday, 21 March 2022. Furthermore, the company has also satisfied the required eligibility criteria to be added to the FTSE EPRA/NAREIT Global Real Estate Index Series.

- Scotgems’ (SGEM’s) board has said that it wishes to provide an update to its shareholders following SGEM’s announcement on 1 March regarding the decision from First Sentier Investors group (FSI) to announce its intention to resign from managing SGEM’s portfolio. SGEM’s board says that it has had further discussions with FSI who have not yet submitted their notice to the Board. SGEM’s board says that it has been reassured by FSI that there will be a continuity of management whilst the Board considers its options in respect of its management arrangements going forward. It says that, in considering these options, it intends to consult with its larger shareholders in due course.

We also have annual results from Murray International and Hammerson and an update from Baring Emerging EMEA Opportunities on its Exposure to Russia (it had 17.6% of its portfolio in Russian, prior to the Invasion of Ukraine).