BB Biotech (SWX:BION) showed a resilient investment performance in an extremely difficult period for biotech in the first quarter this year, although its NAV, share price and long standing premium have all clearly come under pressure. The Swiss investment company closed the first quarter of 2022 with its shares trading at CHF65.4, down by 10.3%, on the start of the year, while its NAV was down by 4.9% at CHF 52.35/share.

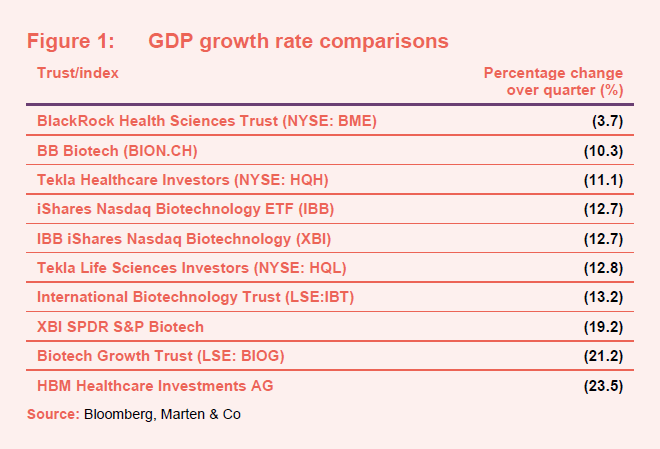

However, this compares with a 12.7% fall for the broad-based IBB Nasdaq biotechnology index/ETF (known as the IBB), and a 19.2% fall for SPDR S&P Biotech ETF (known as the XBI, which tracks small-to mid-size companies), the two most closely followed benchmarks in the sector (all price comparisons in this article are for simplicity for the three months to market close on 1 April). BB Biotech’s share price performance in the quarter ranks it in second position among closed end collective vehicles that specialise in biotech (see table below).

The small/mid-cap biotech space has seen a massive sell-off since peaking in early February last year. The XBI is down by 43% since its peak (and the IBB is down by 23.5%, from a peak reached in September). The 2021-22 drawdown represents one of the most severe and certainly the longest period of stock price decline on record for biotech. A contributory factor has been the high proportion – perhaps 80% – of negative clinical trial readouts in the last year and this seems be a significant deviation from what has probably been closer to 50% for a long time. Furthermore, the FDA is clearly becoming more cautious on approving new drugs (exemplified by the number of complete response letters) and a preponderance of development projects that have been put on clinical hold for safety reasons. Another factor that is weighing on investor sentiment is the relative lack of acquisitions by big pharma, which might have been expected to increase given the current lower valuations.

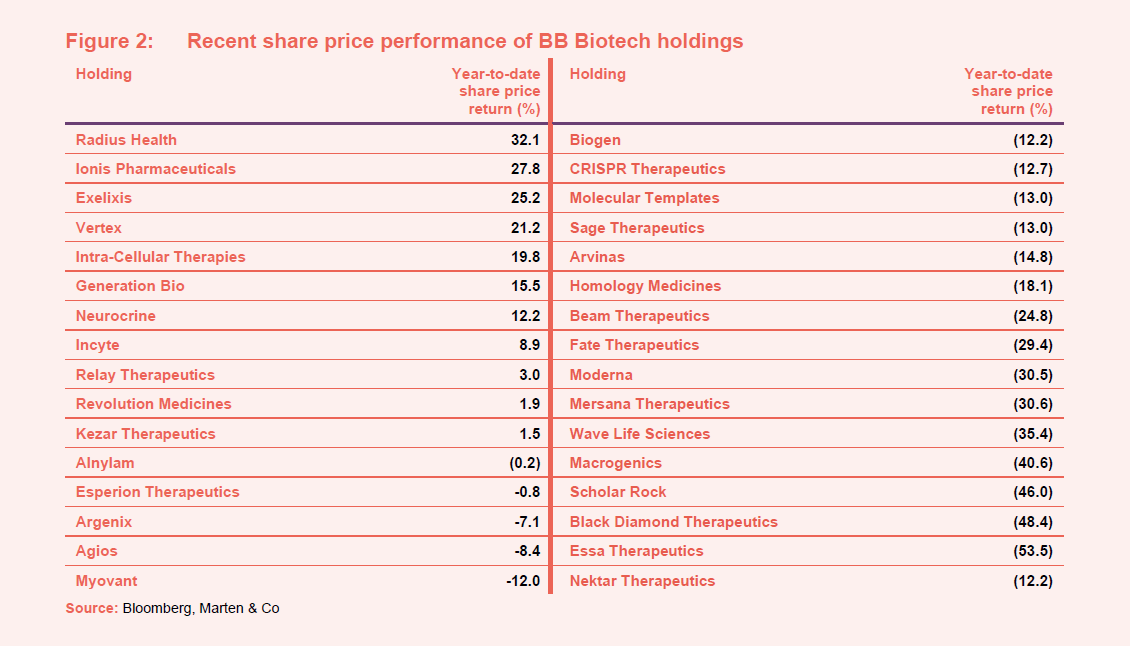

Within BB Biotech’s portfolio, only 11 of its 32 positions have seen a positive share price performance so far this year, with 21 showing a decline and some by quite a large margin. The top performers were Radius Health (+32%) and Ionis Pharmaceuticals (+28%) – the latter being one of its larger and longest standing holdings. Radius’ stock gains are, however, only a partial recovery after a massive sell off in December, when a late-stage study on its abaloparatide patch for osteoporosis failed and the stock is still down by 56% on a one year basis.

The worst performer this quarter was Nektar Therapeutics, which saw the failure of Phase 3 trial testing of bempegaldesleukin in metastatic melanoma. This trial readout had been one of the most closely watched in biotech: expectations were thought to be low (and thus the potential return for a positive result was correspondingly high), but the outcome led to a near 60% fall in the quarter.

Undoubtedly, the most significant detractor to performance – on account of the size of the position -at 10.6% of NAV (the largest individual holding) was Moderna, which saw a 30.6% fall in its share price in the quarter. Moderna did not suffer any particular setback – indeed operationally it has performed extremely well – but investors are growing more cautious about its exposure to what is seen as a waning Covid pandemic.

Individual year-to-date stock price performance of BB Biotech’s holdings is shown in the table below.

Most observers continue to predict a recovery for biotech in 2022 and this has been called several times in recent week when the whole sector seems to have climbed on positive news.

BB Biotech will issue its Q1 report on 22nd April.

[QuotedData comment: Notwithstanding the difficult period for biotech and the disappointing short-term performance for investors, BB Biotech has managed to achieve a commendable performance relative to its peers. The company is well-managed and its long-term orientation and strategy has historically delivered out-performance. Its premium to NAV is unusual in the sector but has been maintained throughout the bear market, which is a testament to the high regard in which its managers are held. We consider the stock offers investors an attractive vehicle to gain exposure to a focussed group of biotech drug developers.]