International Public Partnerships (INPP) has agreed binding terms to acquire five infrastructure investments in New Zealand for around NZD 200m from Morrison & Co managed Public Infrastructure Partners. The Acquisition marks INPP’s first investment in New Zealand and will provide further diversification of INPP’s investment portfolio as well as a platform which should generate further investment opportunities into the country. The portfolio comprises the following five projects, where the Company will have 100% ownership. These are:

- three schools projects, representing an investment in 11 schools across the breadth of New Zealand, all of which were procured via public-private-partnership (‘PPP’) concessions with the NZ Ministry of Education;

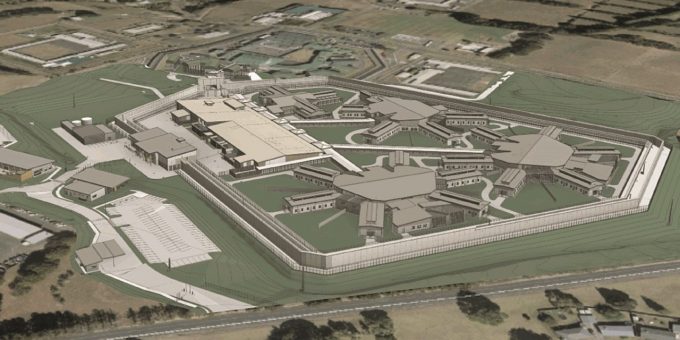

- the Auckland Prison, where the project company only has responsibility for the provision and maintenance of physical assets with the custodial services provided independently by the New Zealand Department of Corrections. This was procured under a PPP and

- a purpose-built student accommodation facility at the Auckland University of Technology (‘AUT’) underpinned by a service agreement with AUT guaranteeing 96% of rental occupancy and benefitting from high historic occupancy levels (even during Covid-19).

All of these infrastructure investments are already operational, delivering long-term stable cash flows linked to inflation. INPP says that the return profile is significantly based upon government backed revenue streams generated through standard PPP contracts in a highly rated, stable OECD geography. The average remaining investment life of the five projects is over 24 years. In growing the Company’s contribution to essential infrastructure, the investments meet the Company’s environmental and social commitments, under Article 8 of the EU Sustainable Finance Disclosure Regulation (‘SFDR’) designation.

The portfolio acquisition is subject to regulatory approval, including New Zealand’s Overseas Investment Office (‘OIO’), financier and counterparty consents after which time financial close is expected to occur in Q2 2023. As at 8 December 2022, the Company’s £250m revolving credit facility was £29.3m drawn, with approximately £17m committed via letters of credit for near-term pipeline investments.

Comments from Mike Gerrard, chair of INPP

“We have entered the New Zealand market with a portfolio of high-quality assets primarily within the education sector. This investment builds on our education sector expertise and includes six large secondary schools and five primary schools located across the country. We’ll also be providing housing for around 200 students at AUT’s North Shore Auckland campus.

“The five new investments further enhance INPP’s growing Australasian presence, which will represent approximately 11[1]% by investment fair value, of our international portfolio and provides us with a strong platform for growth. New Zealand is a mature infrastructure market, complementing our proven track record over the past decade in Australia.”