A milestone was passed very recently without much fanfare. 15 September 2023 marked the 15th anniversary of the collapse of Lehman Brothers, a vanquished titan of American finance, an event which precipitated the 2008 global financial crisis, the most significant downturn since the great depression of the 1930s. While the societal consequence of the crisis has (largely) worked its way through the system, the economic impact is still being felt, as only in the last year have central banks finally begun to unwind the ultra-accommodative monetary policy that has characterised the last decade and a half. Given the conflux of policy and milestone, it seems an opportune time to reflect on the long-term performance of the investment trust sector, since this seismic event.

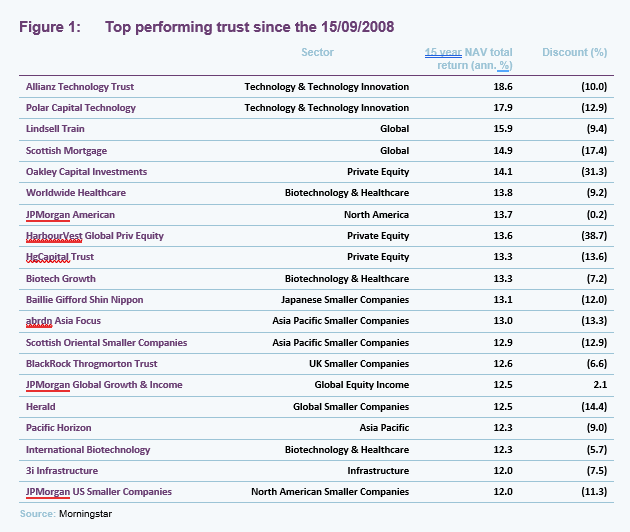

Figure 1 shows the top 20 trusts ranked by NAV total return performance over the last 15 years, i.e., from the date of Lehman’s collapse. The top ranked trusts should not come as much of a surprise. The last decade and a half has been partially characterised by the stellar performance of technology, with global equity markets being increasingly composed of mega-cap US technology stocks – the birth of acronyms like FAANG and the magnificent seven reflecting the frequency in which they appeared in pundits’ conversations.

While the developments in technology have been highly impressive, and a clear boon to the likes of Polar Capital Technology, Allianz Global Technology and Herald, the sector was also given huge leeway to take risks thanks to the rock-bottom discount rates investors used when assessing an investment’s validity, a consequence of ultra-low interest rates. This also explains why the broader ‘growth’ sector, such as Scottish Mortgage, did well, as well as the more highly valued ‘quality’ sector, like Lindsell Train or Mid Wynd, which could justify their valuations due to the low cost of capital. These tailwinds and accommodative monetary policy go some way to explaining why two US investment trusts also make our list – both were able to tap directly tap into the technology rally as well as benefit from the wider expansion in both US equity valuations and earnings growth (on the back of a robust US economy and a cost of capital close to zero).

The success of these above-mentioned styles of investing is well documented, and their presence in the top performers is probably of little surprise to our regular readers, so we would rather draw your attention to some of the more surprising constituents in this list. First is the cohort of private equity trusts that have done surprisingly well, yet trade on enormously wide discounts as investors worry about debt levels, the rising cost of debt and valuations against a backdrop of a slowing economy (probably unfairly as private equity has reformed itself dramatically since the GFC).

Of these, Oakley Capital (OCI) takes the top spot, with its focus on entrepreneurial management and enduring business models beating out both HgCapital, whose exclusive focus on technology placed it in prime position to capture on the associated tailwinds, and HarbourVest, which is one of the global giants within private equity. The NAV returns of private equity strategies are, as is inferred by their name, largely shielded from the wider market sentiment. This long-term outperformance gives some credibility to the commonly espoused notion that holding onto good businesses for a long period of time is key to generating capital growth. We note that the share price returns of both OCI and HGT are marginally higher than their NAV return, which reflects the fact that private equites saw their discounts widen over during the GFC and have narrowed slightly today. Yet given that today’s economy is nowhere near the state it was in during 2008, one does wonder if the share price returns of private equity trusts should have been higher, as it is difficult the fathom how today’s market sentiment could be comparable to that in the aftermath of the GFC’s.

Another interesting result is the prevalence of Biotechnology and healthcare trusts. Following the sequencing of the human genome in the 1990s, there was much fanfare about the potential for biotechnology, but it wasn’t until supporting technologies, such as the necessary diagnostic tools, became more readily available that this sector started to shine. However, helped by structural growth trends, such as ageing populations placing greater demands on global healthcare, the sector exploded and provided ample opportunities for managers to generate attractive returns, as has been the case with Worldwide Healthcare, Biotech Growth, and International Biotechnology. What is particularly interesting is that there is little difference in the returns of these three trusts, individually, whether we use 16 or 15 years of returns, whereas most other trusts will see a noticeable fall in their returns when their returns are sampled prior to the GFC.

The last noteworthy detail is the presence of Asian equities within the top 10. While the recent issues surrounding China’s economy have dogged the region recently, the long-term returns of these trusts serve as a reminder of the potential of emerging Asia, which is generally associated with advantageous demographics, attractive labour costs and the benefits of an emerging middle class.

While not as strong a trend as the others listed here, we feel that an honourable mention should go to one UK investment trust that made the top 20 – Throgmorton (THRG), which has done much to illustrate the merits of the UK small and mid-cap sector investing. Throgmorton is ostensibly a quality-growth strategy, but with the ability to also short stocks. It seems that through a combination of effective stock picking, a flexible investment mandate, and supportive tailwinds, THRG has proven that despite all the headwinds the UK has faced over the last 15 years, quality investment management can still produce genuinely attractive returns from investing in the UK economy.