Retail has been a dirty word for property investors for so long now that it’s hard to remember the time when it was the darling of the real estate sector. When shopping centres were popping up all over the UK and high streets were buzzing.

The bubble burst with online retailing in the 2010s and demand for bricks-and-mortar slowed to a trickle. Towns and cities the country over were left with half empty malls and boarded up shops. Rents have halved over the last decade and values have taken a battering. It does seem like the bottom is near, but a lot of people have cut their hands trying to catch that falling knife, so I won’t be calling the bottom anytime soon.

Whilst retail in the UK (and much of Europe) has suffered, a little-known Spanish retail-focused REIT is defying all the doom and gloom.

Viva España

Lar España Real Estate, which is listed on the Madrid Stock Exchange and owns a €1.5bn portfolio of shopping centres and retail parks across the country, has been posting extraordinary numbers of late.

Gross rental income was up 16.4% to €48.9m for the six months to 30 June 2023, thanks to strong lettings success. Across 100 lease agreements in the first half of the year (eight new lettings, 22 re-lettings and 70 renewals), rents increased on average 7.7% versus their previous rents – excluding the inflation-linked uplift built into the lease contract.

The value of the group’s portfolio fell slightly by just 0.5% over the six months, having risen 3.5% in 2022 – impressive given the impact that higher interest rates is having on the property yields across the world.

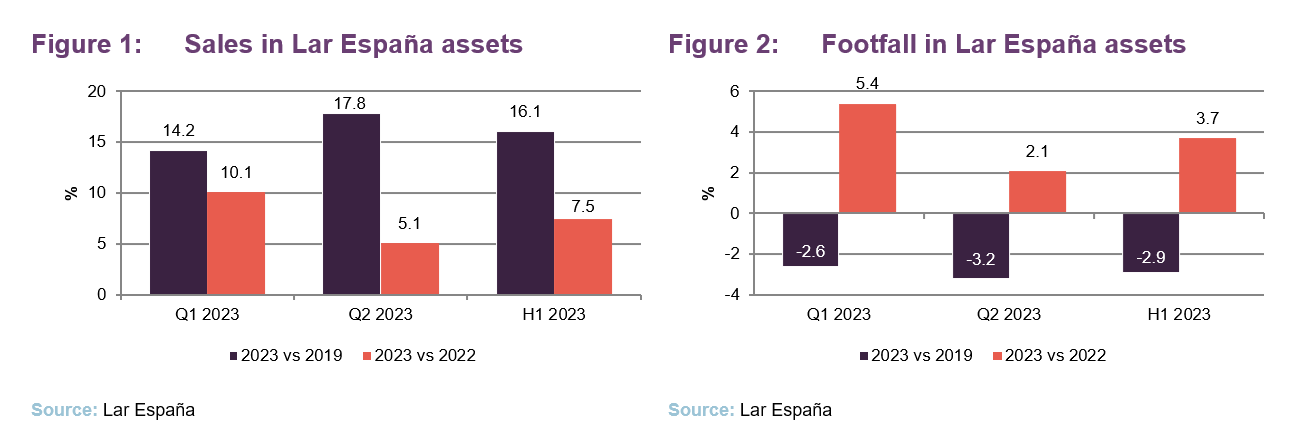

Sales in its shopping centres and retail parks reached €505.1m in the first six months of 2023, up 7.5% compared to the same period in 2022 and up a whopping 16.1% on the same period in 2019 (pre-COVID), as shown in Figure 1. Footfall is yet to recover to pre-pandemic levels, but has been steadily increasing year-on-year, with its assets visited 39.5 million times during the first six months of the year.

The effort rate – a key retail performance metric that measures the ratio between the total cost to the retailer (including rent and charges) and the turnover generated at the property (also known as the occupancy cost ratio) – was also very low at 9.5%. This increases the appeal of the assets to retailers.

What’s behind the numbers?

When it seems that all other retail focused companies are continuing to suffer, how is Lar España posting these numbers?

The company says that it is reflective of the quality of the properties, which are mostly categorised as ‘dominant’ – large centres, in large catchment areas with little competition. The Spanish retail sector is unlike that of the UK and US and has, therefore, been less impacted by structural events that have plagued the retail sectors in these countries.

What has been borne out in both the UK and US retail markets is the oversupply of retail space, which has had the effect of pushing vacancy rates up and rents down. There are no such oversupply issues in Spain. The country’s density of shopping centre space per inhabitant is 0.34 sqm, according to the Caixabank 2021 Retail sector report, which is well below the figure in the US of 2.35 sqm per inhabitant. The total floorspace classified as shopping centre in Spain amounts to 11.5 million sqm across 410 assets (centres over 5,000 sqm), according to Cushman & Wakefield. In comparison, there is around 17.5 million sqm in the UK across 726 shopping centres. This led to a vacancy rate of 18.2% across shopping centres in the UK at the end of 2022 (according to the British Retail Consortium). In Spain, the shopping centre vacancy rate is much lower and just 4.1% at Lar España’s shopping centres.

Spanish malls have less exposure to department stores, which has been one of the root causes of spiralling vacancy rates in the UK and US and which is still being worked out. For instance, 46% of US mall space was let to department stores or hypermarkets, according to the Caixabank 2021 Retail sector report, compared to 24% in Spain.

The boom in online retailing that has been prevalent in the US and UK over the past decade has yet to be seen in Spain. The company believes that for many reasons online retailing as a percentage of total retail sales will not hit the levels of 20% to 30% seen in the UK and US.

Online retail sales are expected to rise to 8% of total sales in 2024 (from 5% in 2019). Outside of the big two Spanish cities of Madrid and Barcelona, online retailing penetration rates will remain at very low rates, the company believes, due to a number of factors including poor infrastructure and the geographical landscape obstructing the effective operation of online retail.

Next phase of asset recycling

Lar España’s valuations were backed up by the sale of two retail park assets in July 2023 – Rivas Futura and Vistahermosa – for a combined €129.1m, at an exit yield of 6.3%. These were mature and established assets, with high occupancy and where asset management initiatives had taken place and value-add opportunities exhausted. The sales were made at a slight premium to their book value at 31 December 2022 and 24% above the price they paid for them in 2018 and 2016 respectively.

With the sales proceeds and existing cash reserves (it now has around €230m in the bank), it will look to acquire new assets that fit its investment criteria (large, dominant centres in their catchment area that have significant capital and rental growth potential through intensive asset management opportunities). It is analysing dozens of assets across Spain in the shopping centre sub-sector, where it says yields are more attractive and hidden value exists.

Re-rating likely?

When you consider that the company also has an enviable debt profile, with a loan to value (LTV) of 38.1%, a very low average cost of debt of 1.8% and an average debt maturity of 4.3 years, it’s baffling to see it trading on a discount to NAV of 48%.

Perhaps tarred with the same brush as its European retail peers, investor recognition for its achievements has so far eluded it. A re-rating is surely on the cards, however.