Calling the direction of global markets is not an easy task. Be it the whims of central bankers, the next hottest thing in tech up-ending the market, or the seemingly constant stream of geopolitical crises – what we once thought was the calm after the COVID-19 storm may have only been the eye, as today it seems just as difficult to call the trajectory of where markets will lead us. Do we end up with a ‘hard landing’, with central banks sending markets and economics into bear territory as they attempt to control heightened inflation; or a ‘soft landing’, whereby economies and markets slowly tick upward in the face of rising rates? Your guess may end up being just as good as mine.

Calling which region or style of investing will come out on top is a monumental task. Conventional wisdom would suggest that declining inflation would have been a sign to invest into long-duration bonds. However, inflation has not declined fast enough, which has led the Fed (the US central bank) to announce that it is taking a tougher tone in the face of what it believes to be structural inflation, impacting the value of bonds almost instantly – a sore lesson for some, but a sad reflection of the uncertainties of today’s markets for others.

What can one do? Well, we believe that one solution may be to try not to look for the right type of ‘beta’ – that is trying to predict which market or asset type will outperform – but rather back the ‘alpha’ generation potential of good managers. Put another way, rather than trying to time a difficult market, bet on the skills of good stock pickers.

Experience tells us that some of the best opportunities to generate alpha can be found in the more under researched areas of the market, where you are more likely to find mispriced securities. This suggests that the emerging markets should be amongst the more fertile hunting grounds for high alpha managers, given their relative lack of sophistication and greater absence of professional investors. This is particularly true in the small and mid-cap segments of these markets.

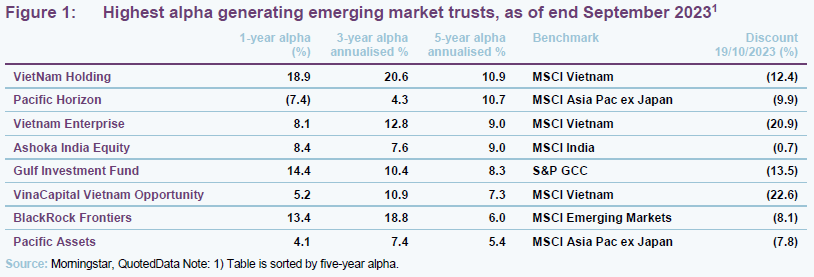

Figure 1 is a table of some of the highest alpha generating emerging market equity managers in recent years, sorted according to their five-year alpha figures.

The Gulf states and southeast Asian countries stand out as regions where professional managers have been able to generate considerable alpha, with strategies such as Gulf Investment Fund (GIF) and Vietnam Holding (VNH) epitomising these. Vietnam is classified as a frontier market and the Gulf nations make up a sliver of the MSCI Emerging Markets Index.

When it comes to generating alpha, a well-resourced team that benefits from strong local knowledge is clearly beneficial. These help managers to navigate the structural issues that their particular regions face. Using Ashoka Indian Equity (AIE) as an example, its management team highlights that the strength of corporate governance within a firm is a key driver of whether a company can outperform, and whether shareholders can also reap the benefits. Poor governance often goes hand in hand with government ownership or state intervention within emerging markets, limiting a manager’s ability to add alpha.

The management team behind AIE is sufficiently confident in its process that its fees are entirely dependent on the alpha it generates – AIE does not pay a base management fee, with the manager only earning a performance fee. The manager has also taken the essence of its approach to investing in India and applied it to a global emerging markets strategy, with the successful launch of the Ashoka WhiteOak Emerging Markets Trust, which has a similar ‘performance fee only’ structure.

Dynam Capital, the management team behind Vietnam Holding (VNH), attributes its success to its strong focus on ESG considerations. These have been built into the manager’s approach since VNH’s beginning and VNH is a long-time signatory of the UNPRI. Vu Quang Thinh, Dynam’s CIO, is a founding member and former chairman of the Vietnam Institute of Directors (VIOD). This was established in April 2018 and was the first private and independent organisation in Vietnam, aimed at promoting the highest standards and best practices in corporate governance among domestic firms.

Ensuring adherence to good standards of corporate governance, and the wider tenants of ESG, can be challenging for emerging market managers, be it due to the looser disclosure requirements or the simple fact that these issues are not particularly high on the agendas of corporate management teams in these jurisdictions. That hasn’t stopped Pacific Assets (PAC) from successfully integrating it into its process, having even been designated as an Article 9 fund (a fund that has fully committed to sustainable investing), a key attraction of the trust beyond its historic alpha.

We believe it is worth looking more closely at the returns of Pacific Horizon (PHI), as it has led it to having the unique characteristic of having both the highest five-year alpha but lowest one year. PHI’s returns reflect not only the team’s long term stock picking but also a strong growth-stock bias. Sentiment towards global growth investing began to turn in the face of rising global interest rates. However, the numbers suggest that when PHI’s style is in vogue the manager is able to capitalise on the opportunities available to such an extent that it can carry the trust over the long term.

Despite the praise we have given to the trusts mentioned in this article, investing in the emerging market region still carries some risk. Because of the idiosyncratic nature of these markets, and the comparative lack of available information about these companies, it can be relatively easy to lose value. Unsuccessful managers can easily languish in underperformance for some time.

Ultimately, emerging market funds should be seen as long-term investments. If you select managers that have a proven ability to generate alpha across the cycle, you should be better positioned to capture the superior growth that these regions offer. Of course, diversification will always be key, so think about spreading your risk across a number of strong alpha generators.