For those that joined our annual investment trust forum yesterday, either via the online live-stream or in person, the discounts to net asset value (NAV) that are currently prevailing within the sector, most notably in the alternative income subsectors although very few areas have been left unscathed, were a big part of the discussion.

David Stevenson, the Financial Times’ ‘Adventurous Investor’ and our key note speaker, kicked off the day by pointing out that current market sentiment and the discounts that are prevailing have shut the fundraising window for now and, in the process, has halted the sector from displaying what is perhaps one of its greatest strengths – its ability to innovate (think of all of the renewable energy projects that have been funded by the investment companies sector during the last decade – ten years ago there were just three renewable energy infrastructure funds, today there are 22 with total assets of £18.3bn).

Discounts were mentioned at some point in most, if not all, of the panel discussions but such is the problem that there was also a dedicated panel looking at ‘Solutions to the discount problem facing the trust sector’ and, while we weren’t able to fully resolve it in the 45 minutes we had, the subject attracted a lot of debate (if you weren’t able to join on the day, you’ll be able to view the videos for this and all of the presentations on our website next week).

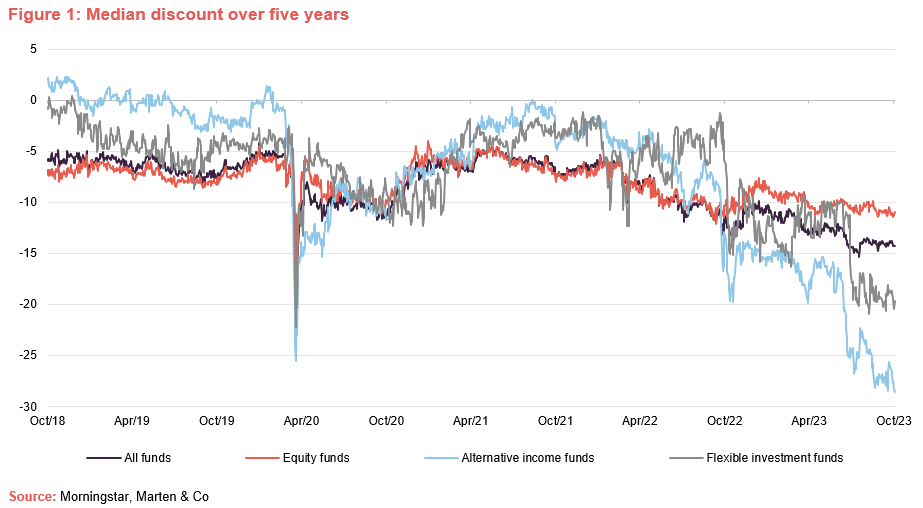

Figure 1 below shows how the median investment trust discount has moved over the last five years. Across the entire sector, this has widened from a discount of 5.7% at the beginning of October 2018 to 14.3% today – a move of 860 basis points. However, traditional equity funds have been far less impacted, with their median discount moving out 390 basis points, from 7.4% to 11.3%. Not surprisingly, it is the alternative income funds, of which there is a vast array (think renewable energy infrastructure, infrastructure, debt, leasing and the various property subsectors) that have suffered heavily against a backdrop of rising interest rates.

These asset classes attracted a lot of attention in the years following the GFC when interest rates where low and investors piled in, searching for income. However, as interest rates started to rise, investors were once again offered an alternative and they have pulled money out of these sectors in favour of fixed income. The median discount across all of the alternative income sectors (renewable energy infrastructure, infrastructure, leasing, royalties, reinsurance and the various debt and property sectors) has moved from a median premium of 2.0% to a 28.6% discount – a savage derating. Private equity and flexible investments are sectors that have also been hit hard.

It should be noted that while rising interest rates are a significant factor, they are not the only issue that has led to widening discounts and various causes were cited during our discussion. Consolidation within the wealth management space – traditional buyers of investment trusts – has seen an increase in the minimum size of fund needed to make it onto the centralised buy lists of the large houses. Regulation and cost of capital has seen the prop books of the market makers operating in the space decrease. Consumer duty requirements have placed additional burdens on intermediaries looking to use investment trusts. Fee levels are in some instances a problem as well and this is by no means an exhaustive list.

Depending on the underlying causes, there are areas where boards and managers can make improvements (for example, reviewing strategies that are underperforming or making adjustments to make trusts more shareholder friendly) and there are areas where better regulation can help (fee disclosures that put investment trusts at a disadvantage are a commonly cited problem).

Valuations are another area of concern, and it is noteworthy that it is funds with private assets – which includes all of the funds in the alternative income sector – that have suffered heavily. However, it is in these areas that, if valuations are correct, the greatest opportunities can be found, and it is perplexing that more investors are not buying.

Investors are, in some cases, rightly concerned about debt levels in an environment of rising interest rates, although many funds have either secured good terms or are selling assets to pay down expensive debt – either way, it should be largely factored into the NAV calculation. Another concern is the methodologies used to value the assets that are incorporated into the NAV calculation and whether these are truly reflective – either because these are revalued periodically and so values might be out of date or because discount rates are not high enough.

One route for these funds to validate their NAVs is if they’re able to achieve asset sales close to or even at a premium to the carrying values. Recognising this, some funds are actively looking to divest assets to prove their valuation discipline and raise cash, which can be returned to shareholders, perhaps through buybacks: to pay down debt, preferable where a fund’s debt is relatively expensive; or to reinvest in new projects where there are greater growth prospects.

There have been exceptions but, by and large, these funds are selling assets at valuations that not only underpin their NAV methodologies but have been achieved at sensible premiums, suggesting the assumptions used in the NAV calculations are quite conservative. We saw another example this morning, from the renewable energy infrastructure sector, with Octopus Renewables Infrastructure Trust (ORIT) announcing that it has agreed terms to sell two onshore Polish windfarms at attractive premiums of between 14-19% over their holding values (click here to read more).

This transaction is expected to complete in the next 2-6 months and ORIT says that it expects to realise an IRR of 25% to 30% over the lifetime of its investment in these assets. It purchased the assets when they were in their construction phase in October 2021, successfully bringing them into operation in 2022. Lots of these funds now invest in ‘shovel-ready’ assets as, by this stage, projects are significantly de-risked (leases or free holds have been obtained, planning consent given, EPC contractors in place, etc) and as they move the construction phase to operation and become further de-risked, their value increases (this is reflected in a falling discount rate used to value the projects). Given that there is now less capital flowing into the sector, it seems possible that for ORIT and its peers that can invest in new projects, particularly development projects, the potential for attractive returns remains.

HICL Infrastructure (HICL) also achieved a premium to asset value with its disposal of five assets to John Laing (click here to read more). The portfolio, which is made up of HICL’s entire equity interest in four UK PPP projects: Queens (Romford) Hospital, Oxford John Radcliffe Hospital, Priority Schools North East Batch and South Ayrshire Schools, in addition to half of its investment in the Hornsea II OFTO2, sold for a total consideration of £204m and the proceeds are to be used to reduce the drawings on HICL’s Revolving Credit Facility (to about £130m).

It has been clear for some time that private markets, which are able to take a longer-term view, are placing higher valuations on these assets and so we could see further disposals like these or, as happened with John Laing Infrastructure, entire companies being snapped up and their assets taken private. However, with clear transactional evidence that supports the prevailing NAVs, many of the extreme discounts we are seeing look irrational and could close quickly if investor sentiment changes – quite possibly by a shift down in interest rates, particularly a sustained one. If market sentiment shifts, pricing for these funds could move quickly. In the meantime, investors are able to achieve particularly high yields from income streams that frequently have a high degree of inflation linkage with sensible debt levels secured against highly predictable cash flows. The time to buy could be now.