Barings Emerging EMEA Opportunities (BEMO) has announced its annual results for the year ended 30 September 2023, during which it provided an NAV total return of 0.5% and a share price total return of -8.8%, which compare to a return on its benchmark of -3.4%. The NAV’s outperformance can largely be attributed to stock selection with holdings in the Financials, Industrials and Real Estate sectors contributing most significantly to relative returns.

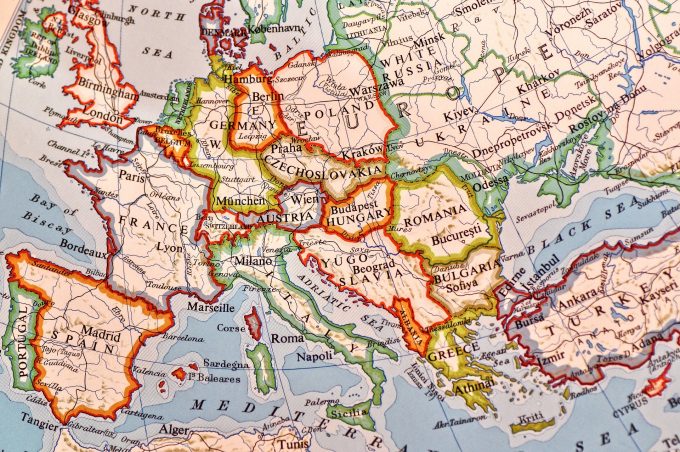

BEMO’s chairman, Frances Daley, comments that, in last year’s chairman’s statement, she wrote about how the tragic events in Ukraine and the various knock-on impacts this had to the global economy and financial markets that resulted in a significant decline of BEMO’s NAV. However, she says that, this year, the performance of equity markets across EMEA has, to a much larger extent, reflected the differing fortunes of each. The performance of the region’s underlying markets was very diverse. Markets in Europe gained between 45-60% on tentative hopes that their economic outlook was improving, whilst more orthodox monetary policy in Turkey helped their equity market gain close to 60%. Meanwhile, in contrast, the larger markets in the Middle East and South Africa posted small declines as some profit taking and a weakening macroeconomic picture both weighed on performance. Overlaying this, EMEA markets also had to contend with the broader global headwinds of inflation, adverse currency movements and higher interest rates across much of the developed world, both of which frequently impacted sentiment as investors digested the latest economic data and reassessed the path for interest rates.

Daley says that the strong relative returns during the most recent financial year are a testament to how performance has continued to recover after last year’s write-down of Russian assets, with the portfolio +3.9% ahead of the benchmark. Whilst the company remains ahead of the benchmark over the ten year period performance, performance over the three to five years continues to be impacted by this write-down, with the company lagging behind the benchmark across both periods.

Investment portfolio performance

BEMO’s holdings in Emerging Europe were some of the strongest performers, helped by some modest improvements in the region’s economic outlook, a strong tourism season in Greece and, in the case of Poland and Hungary, an easing of monetary policy. Similarly, Turkish equities held in the portfolio returned in excess of 80% in the financial year. BEMO says that local equity markets in Turkey have been supported by domestic savers seeking a return in the inflationary environment, whilst the central bank’s move recently to more orthodox monetary policy has been welcomed by the market.

In the Middle East, the portfolio’s holdings in Saudi Arabia and Qatar registered the largest declines on an absolute basis, with a lower average oil price impacting short-term economic sentiment in both countries. Whilst the value of the Company’s holdings in these markets declined over the period, stock selection across these markets was strong and helped improve BEMO’s relative performance versus the benchmark. BEMO’s holdings in South Africa declined in absolute terms as the country continues to face a challenging economic backdrop, worsened by disruptions to the electricity supply.

BEMO’s Russian assets – continue to be held at zero

Russian assets in the portfolio continue to be valued at zero, whilst extensive sanctions and restrictions on the sale of securities remain in place. Dividends from Russian securities are being received into a Russian company bank account but cannot currently be repatriated. BEMO’s board says that it will continue to value these assets at zero until they are capable of being realised. Consequently, there is no exposure to Russia in the company’s NAV and management fees are not being charged on these assets.

Reviewing structures to separate the Russian assets

BEMO’s board says that it is actively reviewing possible structures that would enable BEMO to separate its Russian assets from the main portfolio, whilst ensuring compliance with global sanctions. The Board is mindful of the value these holdings may provide to shareholders in the future and any possible structure will be designed to protect that value. The board says that most of the strategic options available to the company are dependent on finding a resolution to this problem, and it attaches a high priority to this. It says that such a resolution is dependent upon meeting all relevant regulatory requirements and the timescale for any required approvals is not in its control.

Discount management – less effective during volatile markets

BEMO’s board says that it continues to focus on discount management, with the aim of containing discount volatility. However, whilst share buybacks continue to be an option it comments that these are significantly less effective at controlling the discount during periods of elevated market volatility, as has been the case recently. BEMO bought back slightly more shares during this financial year, spending a similar amount to last year, but with the majority of shares acquired during the first half of the year. During the year, 133,299 shares were bought back and cancelled at an average price of £5.20, for a total cost of £694,000. The share buybacks added approximately 1.29 pence to NAV.

The discount at year-end was 21.8% and the average discount during the period was 18.9%. This compares with a discount of 13.3% as at 30 September 2022 and an average discount during the 2021/22 financial year of 15.3%. The average discount has been noticeably wider since the write-down of Russian assets in the first quarter of 2022. In addition, Daley comments that increased levels of broader market volatility across BEMO’s investment universe and equity markets globally have also heightened discount volatility. This has impacted many investment trusts and is not unique to BEMO.

Gearing

There were no borrowings during the period. At 30 September 2023, there was net cash of £3.9m (30 September 2022: £0.2m). BEMO does not currently use a loan facility but keeps its gearing policy under review and says that it may look to make use of borrowing arrangements when markets are less volatile.

Dividends

The income generated by the portfolio continues to be impacted by the absence of Russian dividends. In the financial year under review, the income account generated a return of 14.6p per share, compared with 16.7p last year. The board is proposing to maintain the final dividend at 11p per share. In respect of the six-month period ended 31 March 2023, BEMO paid an interim dividend of 6p (2022: 6p).

Based on dividends for the financial year and the share price as of the end of the financial year, BEMO’s shares yielded 3.5%. The board believes that, given the circumstances, this remains an attractive yield. BEMO retains the flexibility to pay out up to 1% per annum of NAV from capital as income to shareholders. The manager continues to believe the income potential of the portfolio will grow over the medium term and that this growth will be sustainable.

Board succession

The board will be recommending Daley’s reappointment as a director of the company at the 2024 Annual General Meeting. Daley was appointed as a director of the company in April 2014 and appointed as chairman in January 2018. Thus, if re-elected at the forthcoming 2024 AGM, Daley will have served as a director beyond the nine-year recommended period of tenure. However, owing to the strategic issues now facing BEMO, the board have decided that it would be in the best interests of BEMO and its shareholders if Daley remains in post as a director and chairman. It thinks that this would ensure continuity in the ongoing discussions the board is undertaking regarding the future of the company.