Menhaden Resource Efficiency (MHN) released its annual results today, for the 12 month period ending 31 December 2023.

- Over the 12 months MHN reported a NAV total return of 23.8% and share price total return of 12.6%. Both represented an outperformance versus MHN’s benchmark, RPI +3%, which returned 8.4% over the same period.

- The lower share price return reflected the widening of MHN’s discount, which increased from 31.4% to 37.2%.

- Both the public and private equity investments generated positive returns over the period. Public equity, which represents 77% of MHN, generated a total return of 29.0%, and added 21.6% to the NAV. The largest contributions were from MHN’s digitalisation theme (Alphabet, Microsoft, Amazon) and sustainable transport (VINCI, Safran and Airbus). The weakest contributors were its investments in North American railways.

- Private equity co-investments, which at the end of 2023 comprised 9.7% of MHN’s portfolio, generated a total return of 32.3%, adding 2.9% to the NAV. MHN made a successful exit from its largest co-investment, a £9.1m investment in the clean energy developer X-ELIO, made alongside KKR. MHN made a $25m commitment to the TCI Real Estate Partners Fund IV over the year.

- A notable improvement to HMN’s environmental performance was a 7% uplift in the renewable energy generated by its public equity investments and 36% increase in renewable energy consumed. c.75% of MHN’s listed equities have committed to, or set science-based targets for emissions reductions in line with the goals of the global climate Paris Agreement.

- In 2023 the board saw fit to utilise the buyback policy available to it to help control MHN’s discount. The board repurchased 975,000 shares, 1.2% of total issuance, between February and April 2023. The board is conscious not to overly utilise this facility to avoid shrinking the trust.

- Howard Pearce replaced Ian Cheshire as chair in 2023, though Ian still remains a non-executive director.

- MHN paid a dividend of 0.9p per share over 2023, up from 0.4p paid in the prior year.

MHN’s portfolio managers commented:

“We keep focusing on what we can control. Our preference remains for investments that require us to make as few predictions as possible. We believe our criteria of investing in energy and resource efficiency businesses offering quality and value results in a portfolio well placed to generate superior returns over time relative to the level of risk taken, in most market conditions.

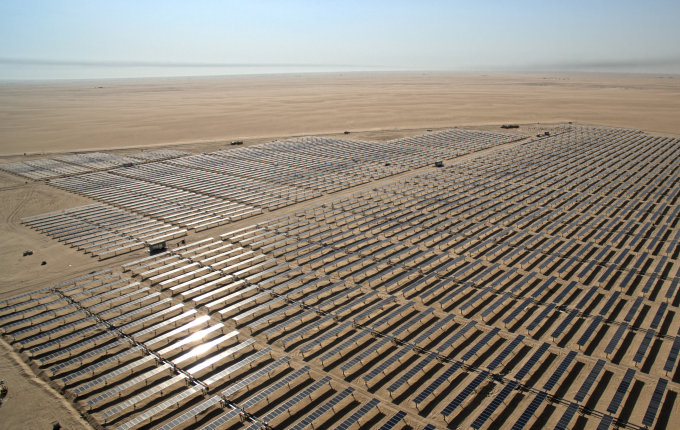

“The completion of the sale of X-ELIO meant we finished the year with a high cash balance. Following the year end, we deployed a portion of the cash, equivalent to 5.8% of NAV, across the portfolio’s existing quoted equity holdings in January. Since then, we were pleased to agree a new co-investment with KKR in a solar developer in the United States, Avantus, in March. This company has one of the largest development pipelines across California and the Southwest. We believe the deal is highly opportunistic and at an attractive valuation. As always, we only make private investments when they offer a more attractive balance between risk and reward compared to public markets. We believe this transaction met this criterion and we expect it to produce returns significantly in excess of public equity markets. Our initial US$17.5 million investment equates to ~10% of the Company’s NAV and was funded from cash on hand and the partial sales of existing quoted equities. We expect this transaction and further drawdowns on our commitment to TCI Real Estate Partners Fund IV to significantly increase the portfolio’s allocation to private investments.

“Following the strong performance in 2023, the Company’s net asset value per share has now compounded at over 12.3%, after fees, for the five years ended 31 December 2023 compared to our benchmark RPI+3% return of 6.7%. Share price performance continues to trail the Company’s net asset value returns, resulting in a widening discount to net asset value. We believe this is primarily due to the size of the Company and a corresponding lack of liquidity in the shares. We intend to keep our relentless focus on investment performance to deliver growth, and a reduction in the discount, as both the performance and growth are recognised by the market. With all members of the Portfolio Manager owning significant equity stakes in the Company, our interests are in full alignment with shareholders”