Pantheon International has published details of its capital allocation policy (CAP).

This is the second step of the company’s three-step programme of shareholder-focused corporate strategy, following the £200m buyback that kicked off last sumer and is now almost complete. As at 15 May 2024, £189.6m had been invested in share repurchases, adding about 4.5% to NAV. Any unused balance of the allocated £200m that remains at the end of the current financial year will be rolled over into the CAP.

PIP’s CAP is designed to capture for shareholders the exceptional benefit available by investing in its own portfolio through buybacks whenever its shares are trading at a significant discount. The CAP will be implemented without compromising the investment strategy, portfolio composition or balance sheet.

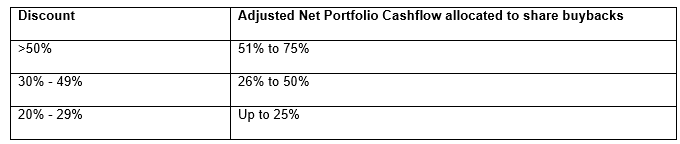

Depending on the prevailing level of discount on the shares, the board intends to buy back shares using a portion of its adjusted net portfolio cashflow (distributions from the underlying portfolio less cash calls and ongoing charges, less expected near term cash outflows, including debt principal repayments due in the next six months).

The amount available will be assessed at the end of each financial quarter and will be based on actual distributions, calls and ongoing charges on a rolling 12-month look-back basis. The reference discount will be calculated using the spot share price as at the financial quarter end relative to the corresponding, published quarter-end NAV. The first calculation will be made for the quarter ending 31 May 2024.

With effect from 1 June 2024, the tiered CAP will be applied as follows:

The share repurchases will be conducted within the limits approved by shareholders at the AGM. At the most recent AGM on 19 October 2023, shareholders authorised Pantheon International to repurchase up to 14.99% of its issued share capital (as is usual for investment companies). As at today’s date, the company still has authority to purchase a further 69,186,434 shares prior to the next AGM which will be held in October.

The board remains committed to putting shareholders’ interests first and therefore intends to be flexible in executing this, perhaps buying back shares at narrower than a 20% discount or investing more than 75% of the adjusted net portfolio cash flow if the discount is above 50%, for example. The CAP will be reviewed on a regular basis by the board to ensure that it remains appropriate for the company and with consideration of the prevailing market conditions.

The CAP is deisned to take into account Pantheon International’s overall financial position, which continues to be prudently managed. The board currently does not expect net leverage to exceed 10% of NAV under normal market conditions.

The statement says that indications are that optimism is starting to return to the private equity market and that M&A activity is gradually recommencing. This should provide a boost to the muted exit environment that has been experienced over the recent period and result in a renewed flow of private equity transactions.

[QD comment: This next step will be welcomed by shareholders we think. It underscores the benefits to NAV of buying back shares on substantial discounts, while leaving freedom for the trust to keep refreshing its portfolio. Pantheon’s NAV returns have averaged 13.8% per year over the last 10 years, that alone should justify a narrower discount. One investor in Pantheon International that we know will welcome this is AVI Global Trust. It has been encouraging listed private equity funds to be more proactive in tackling their discounts.]

PIN : Pantheon International outlines capital allocation policy