At the outset of 2024, we challenged our analysts to come up with some ideas for investment companies that they liked, and thought could do well over the course of this year (click here to read the original article which set out our analysts’ thinking and why they liked the stocks). We also promised to pop back later in the year to see how our choices are doing – for better or worse – and, having just passed the halfway point, now seems like the perfect time to check on their progress.

To recap, each analyst was asked to select two ideas – one that was a relatively mainstream core investment (although this could, for example have a strong growth flavour bias to it and so is not without risk) and a spicy idea that is a bit more adventurous.

As a reminder, the yardstick against which we are judging our ideas is their performance in share price total returns (sterling adjusted). Please note, nothing in this article is intended to encourage the reader to deal in any of the securities mentioned in this article. However, if you have any thoughts, we’d love to read about it in the comments below.

So, how have our core ideas done so far?

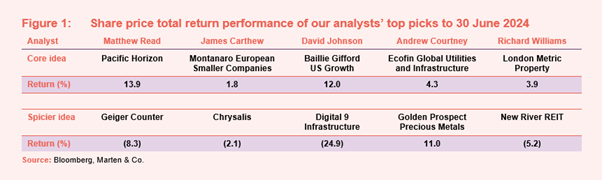

Figure 1 details all of our analysts’ top picks – broken down by core idea and spicier idea – with the performance of each stock during the first six months of 2024. Within our core ideas there is an interesting mix of strategies – a fund focused on Asia, one focused on Europe, another focused on the US, a global fund focused on utilities and infrastructure as well as one focused on UK commercial property – all of these have made their shareholders money during the first half of 2024.

Looking at our stock picks afresh, it is clear that, for our core ideas, we all chose strategies that we believed would benefit from falling interest rates on the expectation that inflation would continue to trend down. Broadly speaking, this has worked but, with the benefit of hindsight, while inflation has continued to edge down, it has not fallen as fast in the west as was expected at the beginning of the year. We have not had the number of interest rate cuts that were predicted and I think it is fair to say that all of our core ideas are stocks that should benefit from interest rate cuts: Pacific Horizon (PHI), Montanaro European Smaller Companies (MTE) and Baillie Gifford US Growth are all ostensibly growth strategies, while Ecofin Global Utilities and Infrastructure (EGL) and LondonMetric Property (LMP) own long lived income producing assets that are inherently sensitive to interest rates (although this is more nuanced in many cases due to inflation linkages in their revenue streams – particularly for utilities and infrastructure). Our race is far from over and, given that inflation looks set to continue to edge down, there is room for these stocks to benefit in the second half of the year and into next assuming interest rates continue on their path of retrenchment.

The best performing core idea so far has been my suggestion: Pacific Horizon (PHI). I felt that, following a couple of years in which Asia and growth strategies had suffered significant headwinds, it could be well positioned to benefit with signs that inflation was easing in the west (the expectation being that lower interest rates would follow and this would support capital flows into Asia) and the view that China, traditionally the big motor for growth in the region, would continue on its path of gradual recovery (Chinese growth of 5.3% in Q1 was higher than consensus and the economy appears to be on track to beat the 5% target the government set for 2024 at the start of the year). In the case of PHI, I think this has further to run as inflation and interest rates trend down (the same can be said for all of the other core ideas) and China’s recovery continues to gather pace.

The second-best performer was David Johnson’s choice – Baillie Gifford US Growth (USA). The US market was driven by the performance of the magnificent seven on the back of the frenzy around AI in 2023. David felt that we should see the US lead global markets for at least another year (it is more advanced than most in tackling inflation and the government will want financial market stability in the run up to the election) and felt that a growth strategy was the best positioned to benefit (he too expected interest rate cuts to favour growth stocks). As noted above, inflation has been higher than expected, but the US market has continued to outperform. David says “Although I am currently placed in second, I have mixed feelings about USA’s performance – it hasn’t capitalised on the AI trend in the way I had hoped for and has underperformed the wider US market. This likely explains why it remains on a double-digit discount. However, I think higher rates could bite, weighing on economic indicators and leading to interest rate cuts to USA’s benefit. Rumours that SpaceX (c.9% of USA’s portfolio) may hold a tender offer this year could be a major tailwind.”

In third place was Andrew Courtney’s choice – Ecofin Global Utilities and Income (EGL). Andrew observed that EGL had been heavily impacted by rising interest rates and saw strong rerating potential with the market pricing multiple rate cuts through 2024, particularly given the strong fundamentals of its underlying holdings. EGL has previously traded at a decent premium rating and Andrew expected to see some reversion in its low double digit discount as interest rates edged down. He also noted that with its heavily contracted earnings and exposure to more juicy storage, nuclear, and hydrogen assets, EGL has a foot in both reflationary and deflationary camps, making it well equipped to ride out the increasingly uncertain macro-outlook. A climate of greater political uncertainty and higher than anticipated inflation has weighed on the trust during the year, but it has benefited indirectly from the excitement around AI as the big providers have signed deals with some of its holdings to provide power for their data centres. Andrew says “Shares in EGL are down almost 6% over the past month, wiping away most of its YTD gains, but I’m still hard pressed to think of a better company to ride out the current macro uncertainty. I think fundamentally, utilities are a different beast to what they were a decade ago, providing a wealth of growth drivers but still excellent defensive characteristics. The trust still trades on a chunky discount of 13% and I’d be very surprised if this remained the case throughout the rest of the year.”

In fourth place was Richard William’s choice – LondonMetric Property (LMP). Real estate has had a difficult couple of years due to rising interest rates continually chipping away at valuations but with signs of inflation easing and a series of interest rate cuts predicted to come through, Richard saw the potential for the heavily discounted sector to rebound as asset values recover and discounts narrow in response. While acknowledging that its NAV took a hit due to the costs of the deal, Richard also liked the angle of LMP picking up LXI REIT at an attractive price in December. He envisaged it being able to dispose of non-core assets into an improving market at premiums to their acquisition cost – something that it is now making progress on. Richard says “LMP has recently been elevated to the FTSE 100 Index, which should boost liquidity in its shares. With further non-core sales to be worked out, and the redeployment of proceeds into its core logistics focus (where rental growth prospects are good), earnings and dividend growth are on the cards. Add in interest rate cuts later in the year, and we remain confident in LMP’s outlook.”

In fifth place was James’s choice – Montanaro European Smaller Companies (MTE), which has had a difficult couple of years of performance that has also driven a widening of its discount. James cited three major headwinds – growth has been out of favour as interest rates have risen, a derating of stocks perceived as high quality and the general underperformance of smaller companies. Like his colleagues, James envisaged interest rate cuts coming through with inflation in retreat. He saw the focus of the market shifting towards the likelihood of recession and felt that investors should favour companies with strong franchises and balance sheets, which would benefit MTE. James also felt that the valuation between small and large caps could close as well, bolstering MTE’s recovery even further. James says “While this is uncomfortable right now, it still feels to me as though MTE could come good by the end of the year. In the short-term, the snap French election is unhelpful as it will make markets nervous. However, as we go through the year nerves could steady and the ECB, which is already one of the first out of the blocks on interest rate cuts, could do more.”

What about our spicier ideas?

Figure 1 above shows that, at the halfway point, we cannot give ourselves the same pat on the back as for our core ideas as only one pick – Andrew’s choice of Golden Prospect Precious Metals (GPM) – has made its shareholders money. At this point it’s worth saying that Andrew deserves an honourable mention as he is the only analyst that has generated a positive return for both his core and spicier idea. However, his choice of stocks provides a useful illustration of the extent to which macro factors – inflation expectations primarily – have driven equity markets. GPM has proved to be a defensive allocation – it is the one stock idea within the group that arguably benefits from higher-than-expected inflation.

At the beginning of the year, Andrew highlighted how, despite wide predictions of recession in 2023, global markets put in a stellar performance. He felt that, with uncertainty around the direction of rates, geopolitics, elections, China’s recovery, US valuations, and inflation, 2024 would prove to be even more confusing and so decided to opt for GPM, which effectively offers a levered exposure to the gold price through the small cap gold explorers and developers it owns. With inflation surprising mildly on the upside, Andrew’s decision to make an indirect allocation to gold has proven to be quite defensive. Andrew says “Well first of all I’d like to congratulate myself for leading at the halfway mark … but more seriously, I would have to admit to being a little lucky with the GPM pick. While the general theme of ongoing uncertainty around interest rates and inflation has played out, the extent of the rally in gold has surprised most people. The market appears to be increasingly concerned around fiscal deficits, and that has only increased with Trump’s election odds. It will be fascinating to see how the bond market reacts, but it’s hard to see to see a resolution on the horizon, which should bode well for gold prices.”

In second place was James’s choice – Chrysalis (CHRY). James observed that Chrysalis had been hit by rising interest rates and felt that, with these having peaked, a major obstacle to its recovery had been removed. However, he saw the real kicker coming from CHRY making disposals – giving credibility to and potentially enhancing the NAV, which should help narrow the trust’s c 40% discount. CHRY highlighted a potential NAV enhancing disposal earlier in the year but this is yet to come to pass but, regardless, the investment case looks intact. James says “I haven’t been helped here by the disappointment on the writedown of CHRY’s take in wefox. However, the team has dropped heavy hints that the disposal that has been in the works for some time (widely believed to be Graphcore) will soon reach fruition, a new borrowing facility will give the team more flexibility, and it is possible that Klarna will IPO, which could give a boost to the NAV as well as transforming CHRY’s balance sheet.”

In third place was Richard’s choice – NewRiver REIT (NRR). Richard observed that property, and retail property in particular, has been in the doldrums for years and felt that 2024 could be the year for a comeback. He felt that NewRiver REIT was well positioned, noting that it had sorted out its balance sheet and has a portfolio weighted towards retail parks which have robust rental growth characteristics. He saw a kicker from the group’s growing capital partnerships arm (with the likes of pension funds and councils), with asset management fee income boosting earnings along with the potential for discount narrowing. Its recent results show that its turnaround strategy is paying off and the recent acquisition of Ellandi Management Limited is a boost the capital partnerships business and earnings. Richard says “I had seen NRR as a possible M&A target, but the company is on the front foot in this regard – lining up a possible bid for shopping centre peer Capital & Regional. The greater scale and cost synergies should be recognised by the market.”

In fourth place was my choice – Geiger Counter (GCL). This benefits from a number of long-term structural growth drivers – nuclear is essential to the energy mix if we are to decarbonise power generation, but a 10-year bear market has restricted investment in new supply in what is already a highly-concentrated market that is in supply deficit. I observed how, reflecting these, the uranium price had increased significantly during the last nine months (from around US$50 to around US$91 per pound) and could see room for further increases in light of an improving economic outlook against a challenging environment for fulfilment (uranium demand price is inherently price inelastic and production for the major suppliers is already contracted out) with demand also expected to grow from life extensions as well as new reactors coming on line.

In fifth place was David’s choice – Digital 9 Infrastructure (DGI9), which David saw as a great way to capitalise on expected interest rate cuts – he argued that its portfolio is effectively invested in unlisted growth stocks, which meant the c.70% discount it was trading on offered strong rebound potential. He also liked the exposure it offered to mega trends in a world of the growing importance of AI and felt it could be a prime candidate for a takeover if its discount persisted.

Of all of the spicier ideas offered, DGI9 is the only one that could be considered as a special situation. The company had well documented problems – its previous managers had made significant commitments, presumably on the basis that the trust could continue to raise fresh equity, but higher interest rates brought an end to this, leaving DGI9 with a funding crisis that forced it to axe its dividend. The share price fell 64% in 2023. The sale of Verne Global – widely viewed as the crown jewel of its portfolio – was meant to shore up the balance sheet (its ability to repay a £375m RCF falling due in March 2025 had become a major concern) but this was not sufficient to turn its fortunes around and a strategic review initiated by the board concluded that a wind up was the best option. However, it continues to be dogged by problems – February saw an announcement that the Icelandic regulator opened an investigation into the deal that could delay the sale by up to 135 working days.

David says “I still hold out hope for DGI9. I think a lot is baked into the share price and the Verne Global sale has allowed the vast majority of the debt to be repaid. Shareholders were not happy with the board, particularly regarding the pace of progress, but this has now been replaced. Investors have fretted about the sale of Verne Global – widely seen as DGI9’s crown jewel – but are ignoring the fact that the assets that remain are still high quality, being key pieces of digital infrastructure that are neatly split between wireless and cabled infrastructure companies whose operations are chugging along nicely. Rather than a play on falling interest rates, DGI9 is a wind up play and if the first capital return is encouraging and occurs before the end of the year I expect there to see a major bounce in its share price.”