It has been another eventful week in the investment company sector. My colleague Richard covered the launch of Achilles Investment Company here and I wrote about it for Citywire, which you can read here. There is an enormous mismatch between NAVs and share prices in the alternatives sectors. We have done our bit to try to close this yawning gap by highlighting opportunities, calling for solutions to issues that are deterring investors from taking advantage of them, and broadening the audience for these companies. However, in the face of a failure by the government, the FCA, and others to act, investors’ patience was never going to be inexhaustible.

Achilles’s constructive approach contrasts with Saba

Achilles seems likely to go about its job the right way, by building consensus amongst investors, and having sensible and open-minded discussions on the way forward. As I said in my Citywire article, I think Achilles may be a force for good, but that does not mean I will always agree with its choice of targets.

By contrast, Saba’s scatter gun, bullying, and ultimately inept attacks deserve to be fought off. Despite suffering the humiliation of losing all seven of the votes that it demanded, Saba is coming back for more. It hopes to convince investors to back its calls for open-ending four investment trusts: CQS City Natural Resources Growth and Income (CYN), Middlefield Canadian Income (MCT), Schroder UK Mid Cap (SCP), and The European Smaller Companies Trust (ESCT). Perhaps unsurprisingly, I am here to tell you why that would not be a good idea.

Saba’s task is much harder this time around as its proposals would need the support of 75% of those voting as they would involve liquidating these companies and this requires passing a special resolution. Given the antipathy towards it that it managed to create last time around, this looks like a lost cause. Unfortunately, though, the trusts will have to incur substantial costs fighting off the attack.

What Saba is after is a chance to cash in some of the enormous stakes that it built up in these vehicles in pursuit of its first plan – of forcing through its plan to grab assets under management (AUM) and boost its fee income. It presumably thinks that it could pass off exits at NAV to its investor base as evidence of the success of its strategy, pretending that this was all part of its original cunning plan. If it loses again, that will be a harder story to spin.

Vote your Herald shares

As an aside, please do make sure it doesn’t get a ‘win’ at Herald via the back door – vote and vote early.

Boards must keep an open mind

Boards will keep an open mind about the way forward, but whatever they come up with will also have to appeal to the rest of the shareholder base. It is interesting that both MCT and ESCT say that they have been in constructive discussions with Saba. Saba has agreed to withdraw ESCT’s requisition for 30 days “to allow both parties to enter into good-faith negotiations aimed at achieving an outcome that benefits all shareholders” and MCT’s requisition for 60 days “to enable the company and its advisers to formulate proposals that are in the best interests of all shareholders.”

One important consideration will be the often-repeated call for larger, more liquid trusts. Shrinking them by buying Saba out would go against this. To be fair, any exit proposal would also have to be available to everyone. However, assuming that discussions break down and these votes go ahead, here are some good reasons why investors would be better off sticking with these funds in closed-ended form.

Small caps do better in closed end structures

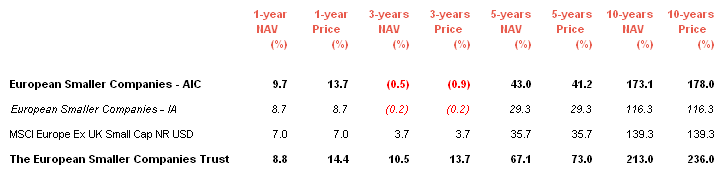

If we focus first on the two trusts that have already suffered from Saba’s attentions – CYN and ESCT. Over 10 years to end January 2025, CYN generated a return of 206% in share price terms and 165% in NAV terms, which compares to 141% for the MSCI All Countries Metals and Mining Index. Over the same period, ESCT generated a return of 236% in share price terms and 213% in NAV terms, which compares to 139% for the MSCI Europe ex UK Small Cap Index.

I am convinced that these returns are so good because these trusts’ small cap exposure is better suited to a closed-end structure.

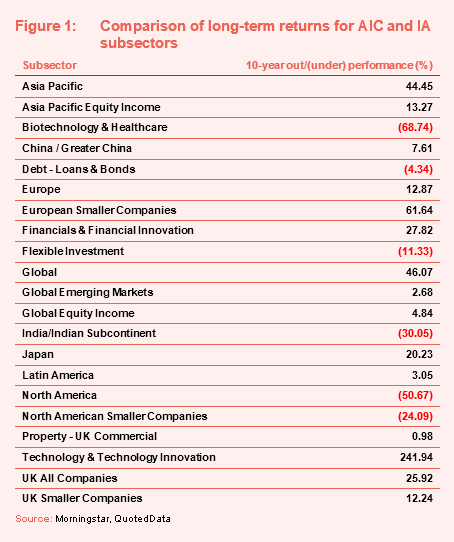

I ran some numbers to end January 2025, looking at average share price and average NAV returns of investment companies by AIC sector over one, three, five, and 10 years, and comparing these to the average returns of the equivalent IA sector. There are quite a few AIC sectors that do not have an IA equivalent, just because there are many assets that naturally sit better in closed-end structures. That still leaves about 21 sectors where you can make a valid comparison. Figure 1 is using share price data for the investment companies.

Over the long term, trusts win hands down. Over 10 years, in 15 of 21 sectors, closed ends have outperformed open ends on average. However, three- and five-year results are more mixed, reflecting the impact of widening discounts and in some cases being geared into falling markets. Encouragingly, both on an NAV and a share price basis, the picture looks brighter over one year. [Why did some AIC sectors fail to beat the IA index? – see the appendix below]

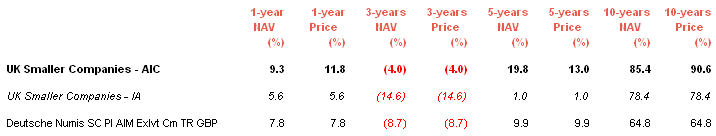

Looking at small cap sectors, in both share price and NAV terms, UK small cap investment trusts beat equivalents open-ended funds and the Deutsche Numis Smaller Companies plus AIM excluding Investment Companies Index over every time period. That speaks volumes about the power of being able to take a long-term view, avoid the drag of keeping cash on hand to fund redemptions, and being able to borrow to enhance returns when valuations look attractive.

For European funds, the three-year period (favoured by Saba) sees some very marginal underperformance by the average investment trust, but every other time period works well. Over 10 years, European small cap trusts returned 178% in share price terms, well ahead of the 116% generated by the average equivalent open-ended fund.

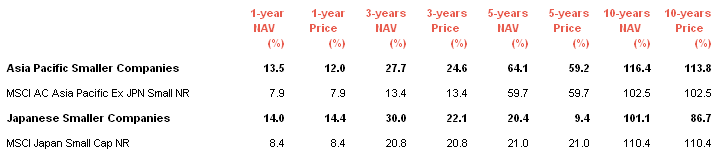

What we do not have is an IA comparator for Japan and Asia ex Japan small cap sectors, but again performance relative to indices looks good over most time periods.

The other two trusts – SCP and MCT – have more of a bias to more liquid stocks. You might argue that they could achieve similar results in open-ended form, but appetite for UK mid cap and Canadian exposure ebbs and flows. It is unlikely that they would have survived the bad times had they been open-ended funds.

I also have to point out that in each and every trust that Saba is targeting, investors chose to own them over equivalent open-ended funds. There are many investors who are not that bothered about relatively stable discounts, such as MCT’s, which tends to trade on a low double-digit discount. For the most part, these investors tend to buy these trusts because they want exposure to the underlying portfolio, not because they think they can make 3% or 4% here and there from short-term discount narrowing.

Shareholders in trusts have the power to change things, to keep managers in check, to lower fees, to engage with directors and managers and make their voices heard. They have access to detailed information on the workings of the company that simply is not available on open-ended funds. I have long been convinced that investment companies are the superior product and Saba is unlikely to change my mind.

Appendix – why did some AIC sectors underperform?

- Biotechnology and healthcare – Here I think the problem may have been that the AIC sector has more of a bias to early stage biotech. At times, this area does amazingly well, but it suffered in the wake of interest rate rises in 2022/23. Now, things are improving.

- Debt – loans and bonds – Here I may be being a bit harsh on the AIC sector. I chose as the comparator the IA high yield index rather than the corporate bond sector. If I had gone for the latter, the AIC sector would have won hands down.

- Flexible investment – the AIC sector encompasses a wide range of styles, but there are a fair few trusts that aim to preserve investors’ capital and their long term returns are lower than those that have a higher risk tolerance.

- India/Indian Subcontinent – no excuses here, but the good news is that the AIC sector is ahead over one, three, and five years.

- North America – after a long period of very poor performance, finally JPMorgan American’s revamp seems to be turning the tide here

- North American Smaller Companies – no excuses