Here we go again – Saba published a press release this afternoon.

[Despite its embarrassing failure to seize control of a number of trusts, Saba doesn’t seem to have got the message that shareholders in these trusts quite like what they have and are not looking for change. In the press release below, Saba claims to have held conversations with investors on the need for liquidity at NAV but we would take that with a pinch of salt – how many conversations with how many investors exactly? When he is inevitably knocked back again, will he admit defeat or are we condemned to an endless cycle of pointless attacks?]

Here is the full text:

Saba Capital Management, L.P. (together with certain of its affiliates, “Saba” or “we”) today announced its intention to requisition the Boards of Directors (the “Boards”) of CQS Natural Resources Growth & Income PLC (CYN:LSE), European Smaller Companies Trust PLC (ESCT:LSE), Middlefield Canadian Income PCC (MCT:LSE) and Schroder UK Mid Cap Fund PLC (SCP:LSE) (the “Trusts”) to hold General Meetings for shareholders to vote on a proposal to implement a scheme or process to provide the opportunity to transition to comparable open-ended funds. Saba is convening the General Meetings based on thoughtful feedback received from shareholders over the course of its campaign to deliver value to the U.K. trust sector.

In connection with the announcement, Saba today issued the following open letter to its fellow shareholders of the four Trusts. For more information, visit: www.mindthegap-uktrusts.com.

10 February 2025

Fellow Shareholders,

On behalf of Saba Capital Management, L.P. (together with certain of its affiliates, “Saba” or “we”), I am writing to inform you that today we announced our intention to requisition the Boards of Directors (the “Boards”) of CQS Natural Resources Growth & Income PLC (CYN:LSE), European Smaller Companies Trust PLC (ESCT:LSE), Middlefield Canadian Income PCC (MCT:LSE) and Schroder UK Mid Cap Fund PLC (SCP:LSE) (the “Trusts”) to convene general meetings (the “General Meetings”). We are calling these General Meetings to provide shareholders the opportunity to vote on a proposal to transition each of the Trusts to an open-ended structure and receive long-overdue liquidity at net asset value (“NAV”).

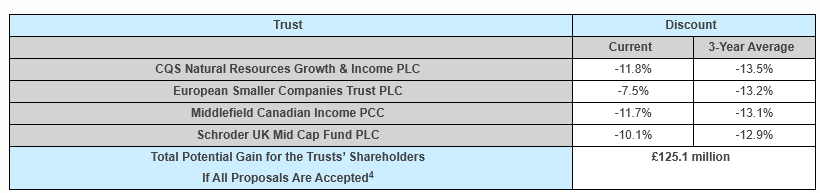

We believe that Saba’s proposal would provide the Trusts’ shareholders with the following benefits:

- Long-Overdue Liquidity at NAV: A transition to an open-ended structure would eliminate the discount in each of these Trusts and would enable shareholders to achieve liquidity at NAV.

- Manager & Strategy Continuity: Shareholders would remain invested in the same strategy with the same manager in an open-ended – rather than closed-ended – structure.

- Tax Efficiency: Expected opportunity for shareholders to roll over their investment into an open-ended fund without triggering capital gains tax.

Responding to Shareholder Feedback: Providing the Option for Liquidity at NAV

During our campaign to deliver value to shareholders of U.K.-listed investment trusts, we received thoughtful feedback from our fellow shareholders that has shaped the request we now plan to put forward at CYN, ESCT, MCT and SCP.2 While we acknowledge that shareholders were not ready to fully replace the boards with new directors, it was clear from our conversations that many investors agree with Saba on one crucial point: the importance of the option for liquidity at NAV.

In our experience, shareholder action is often the impetus that some boards and managers need to take control of discount problems and deliver liquidity options for shareholders. For example, several of the U.K.-listed trusts we called for change at have since announced shareholder-friendly initiatives – which we believe would not have occurred had we not directed the industry’s attention to the performance issues at those trusts. Most recently, Henderson Opportunities Trust PLC (HOT:LSE) announced a scheme to allow shareholders to roll their investment into an open-ended fund or to receive their entitlement upon the winding-up of the trust in cash.3 It is encouraging that our campaign has served as a wake-up call for trusts like HOT, but for others – such as CYN and ESCT – there is clearly more work to be done.

Saba’s Proposal: Give Shareholders the Option to Achieve Liquidity in an Open-Ended Fund

It is apparent that shareholders of CYN, ESCT, MCT and SCP have been trapped in closed-end vehicles trading at deep discounts for years. In our view, the necessary solution is to roll or convert these Trusts into open-ended funds, which by definition trade at NAV and are free of the structural issues that plague closed-end funds. As a result, we intend to requisition General Meetings to give you the chance to vote on a proposal for the Trusts to implement a scheme or process that would provide you the opportunity to roll your investment into a better performing open-ended fund with the same strategy and the same manager.

While MCT and SCP were not part of our initial campaign, we believe they have traded at wide discounts for too long and that their shareholders would greatly benefit from an open-ended fund structure. Of the seven trusts targeted in our initial campaign, we have focused on CYN and ESCT because we believe they are best positioned for an open-ended fund conversion and, unlike HOT and KPC, their boards have not shown an intent to take this action on their own.

Source: Bloomberg. Data is in GBP and as of 6 February 2025.

The Opportunity: Remain Invested in a Fund That Will Never Trade at a Discount to NAV

Our goal is simple: provide you the opportunity to remain invested in the same strategy within an open-ended fund structure that will never trade at a discount to NAV.

The choice is yours to make, and we are excited to offer you the long-overdue liquidity opportunity that you deserve. Saba remains committed to acting as a positive force in the market by putting shareholders’ interests first, delivering enhanced returns for investors and helping rehabilitate the fractured U.K.-listed investment trust sector.

Sincerely,

Boaz Weinstein

Founder & Chief Investment Officer, Saba Capital

***

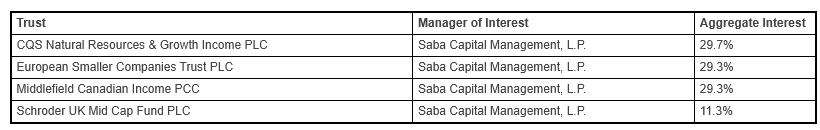

SABA HOLDINGS IN EACH TRUST

As of 6 February 2025, Saba, directly or indirectly, has the following aggregate interest in each of the Trusts (including at least a 5% holding of shares in each Trust):

CYN / ESCT / MCT / SCP : Saba’s back again, now it wants to open-end four trusts