Private equity, technology, biotech and emerging markets trusts rallied in July, but several funds in wind-down wobbled. Our monthly roundup of the biggest investment company risers and fallers highlights one UK real estate trust offering a cash-covered 9% dividend yield on an attractive discount.

Private equity, tech and EM funds rally

Welcome to our new-look monthly roundup of the biggest investment company movers. Glance at the right hand side of our first two tables for the biggest rising and falling share prices, and check out the left hand side for the largest movements in underlying net asset value (NAV).

Private equity, technology, biotech and emerging markets (EM) trusts dominated July’s biggest risers as they benefited from the continued market rebound from April’s tariff lows and corporate activity in the investment company sector.

Starting at the top on the right hand side of our first table, Apax Global Alpha (APAX) soared 31% on the back of a £794m cash bid from its fund manager Apax, which wants to take the underperforming private equity fund of funds private at a 17% discount to net asset value (NAV). There isn’t an immediate readacross to other London-listed private equity funds trading on wide discounts other than to say big valuation gaps eventually reduce one way or another.

There may have been an element of M&A speculation in the 18% leap in Symphony International (SIHL), a £153m Asia private equity fund, which remains on a forbidding 53% discount even after this rise. However, a weak dollar and easing concerns over US tariffs propelled other emerging markets funds higher. The £86m Barings Emerging EMEA Opportunities (BEMO) rallied 15.5% and trades 11% below NAV while £1.2bn Vietnam Enterprise (VEIL) gained 13.9% to stand on a 15.6% discount and Fidelity China Special Situations (FCSS) put on 13.1% taking the £1.4bn single country fund 31% higher this year, which has narrowed its gap to NAV to 6.7% from a one-year average discount of 10.6%.

Elsewhere, technology was the broad theme behind the other big gainers. Manchester and London (MNL), the £350m global investment trust that fund manager Mark Sheppard has dedicated to cutting-edge tech companies, saw its share price rise just over 16% to rank it fifth in our right-hand column of fastest-moving shares. That reflected a 15.9% gain in the value of its investments that also ranks it second in our left hand column of biggest-moving NAVs. The shares have soared around 40% in the past three months, the best return in its sector, though the listed fund stands on a 14% discount, suggesting investors are wary. With 39% net exposure to Nvidia at 30 June, MNL isn’t for the faint hearted.

Its more conventional rivals, the £4.6bn Polar Capital Technology (PCT) and £1.7bn Allianz Technology (ATT) didn’t make it into our top 10 share price risers, but their 9.7% and 8.2% advances in NAV suggest they were close, placing them seventh and tenth in the left-hand column. They’ve also had a strong run, with share price gains of 30% and 24% respectively over three months. That maintains their 10-year total returns among the very best in the UK, generating 571% for PCT shareholders and 644% for ATT holders ahead of 419% from MNL. However, with investors cautious about an AI bubble the shares trade 10% and 9% below asset value.

The tech theme is also at play in the 8.2% NAV rise in Edinburgh Worldwide (EWI), a £655m Baillie Gifford managed global portfolio with around 60% invested in aerospace, software and biotechnology. Its top holding is a 13.8% allocation to the unquoted shares of Elon Musk’s SpaceX, which is reported to be raising funds at a $400bn valuation. That stake has caught the eye of activist Saba Capital, which still holds 24.5% of EWI having failed in its challenge to take control of the company in January.

Biotech Growth (BIOG) will hope it is escaping the bear market that has gripped smaller drug developers in the past five years and left shareholders nursing a 35% loss. It extended a 13% rise in June with a 16.2% gain in July as investors crossed their fingers that US drugs companies would escape tariffs. A 23% vote against the £201m company’s continuation last month may increase the chance of a merger approach for the Orbimed fund trailing on a wide 12% discount in a sector where Bellevue (BBH) is looking for a suitor. A possible candidate could be the stronger performing £218m International Biotechnology Trust (IBT) boosted by an 11.5% NAV gain last month, although its shares stand on an even slightly wider discount of nearly 13% that might make a combination difficult.

Crystal Amber (CRS), the £99m UK small-company activist in the midst of a lengthy winding-down, leaped 16% after announcing a £2.5m share buyback or return of capital. Livermore Investments (LIV), a £91m AIM-listed debt fund based in the British Virgin Islands, gained 12.5%.

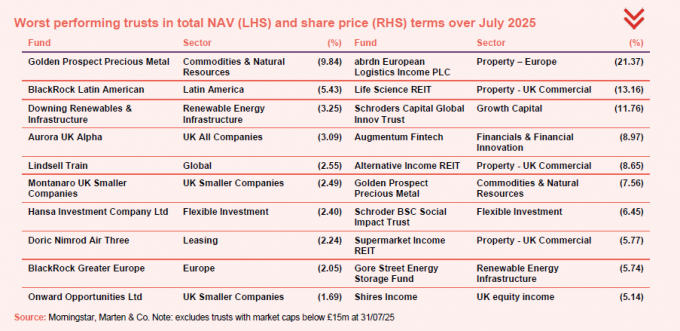

Wind-downs wobble

Speaking of wind-ups, three companies looking to shuffle off the stock market and return shareholders’ money provided our biggest share price fallers (see right hand column in our second table). Abrdn European Logistics Income (ASLI) fell 21.4% after selling properties in Madrid at a discount, Life Science REIT (LABS) retreated 13.2% in a month that saw it publish interims showing an 11% first half fall in assets, and Schroders Capital Global Innovation (INOV), the one-time Woodford Patient Capital, declined 11.8% as it completed a tender offer to return £37m to shareholders.

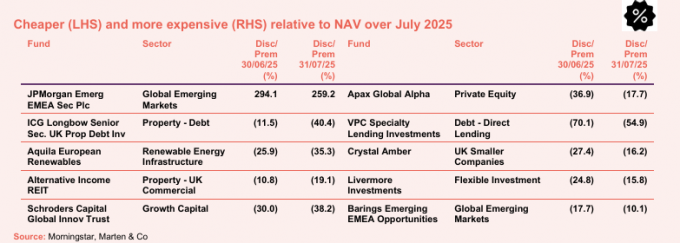

Trusts looking cheaper

Turning to perhaps the most interesting of our three tables: investment companies that are left looking cheap (left) or expensive (right) after moves in their share prices against their underlying net asset values.

Starting with the right hand side, the rally in Apax Global Alpha after the bid from its fund manager narrowed its discount, or gap, to NAV from nearly 37% to over 17%, in line with the cash offer. Crystal Amber, Livermore and Barings Emerging EMEA Opportunities also narrowed their discounts following the rises in their share prices we saw earlier.

Closed-end funds looking cheaper are led by an unusual anomaly. JPMorgan Emerging EMEA Securities (JEMA) is hardly “cheap” with the shares standing at 259% above NAV at 31 July, even if that exorbitant premium fell from 294% in July. Speculation that its frozen Russian assets, which have been written down to zero, will be realisable at some point has caused the shares to trade well above asset value for some time but will be vulnerable if those hopes are dashed.

Three of the other companies in our “cheaper” list are in wind-down, hopefully selling their holdings at or close to asset value, which makes debt fund ICG Longbow (LBOW), Aquila European Renewables (AERS) and Schroders Capital Global Innovation potentially interesting on discounts of up to 40%. However, wind-downs are not always simple and both LBOW and Aquila have had setbacks, the latter last week pausing a sale of most of its assets ahead of a big reduction in NAV this week.

A small but cheap income alternative

That means bargain hunters might want to look at the remaining company on the cheap list. Alternative Income REIT (AIRE) featured in our monthly real estate roundup yesterday because its shares fell 8.6% in July. That left them trailing 19.1% below NAV compared to their 10.8% discount at the end of June and the 14.5% average discount of the past year.

With a market value of just £55m, the long lease UK commercial property portfolio is off the radar of many investors, but the shares stand around a 12-month low so could perhaps attract a bid as the REIT sector consolidates. Because of its small size it only has 20 holdings, which is not as diversified as many of its rivals, but a 9% covered yield is the highest in its sector.

The fund is managed by Martley Capital Real Estate, which is the company set up last year by the team at M7 who have run the portfolio since 2020. The REIT was previously managed by AEW and called AEW UK Long Lease. This week it declared a fourth interim dividend of 1.55p to hit its annual 6.2p target, up 5.1% from 5.9p the previous year, and said the portfolio had returned 2.5% in the second quarter.

At 67.8p, the shares are below their five-year peak of 84.6p in 2022, reflecting the challenges faced by all property funds as interest rates and inflation rose. Nevertheless, including the quarterly dividends, the company has generated a total 83% return for shareholders in the past five years.

So can I ask why did AIRE slump in July?

There doesn’t appear to have been any news or events behind the share price move. The shares of AIRE are very illiquid and it appears there were several large trades at the end of July that drove the share price down. With stocks like this, one large seller in the market can have an oversized impact on the share price. Prior to this, the share price had climb to a two-and-a-half year high of 75.5p.