This week, following recent results announcements from trusts such as Ruffer (RICA) (click here to read) and Golden Prospects Precious Metals (GPM) (click here to read), along with commentary in our August investment companies monthly (click here to read) that highlighted a number of funds that have been benefiting recently from their exposure to the gold, I thought I would take a look at the asset class and the funds that offer exposure to the precious metal.

In particular, I was keen to know whether, after such a strong run of performance, there could be more to come – as suggested by GPM’s chair, Toby Birch, who in interim results said we’re not at the end of the bull but at the end of the beginning with the next phase involving broader investor participation – or whether investors should be following Ruffer’s lead and trimming their exposure to the commodity?

A glittering run recently

After a couple of more modest years of performance, the last two years have seen a strong rally in the price of gold, particularly during the last year, leaving the precious metal trading at or close to all-time highs. Year-to-date, at the time of writing, gold is up 29% in sterling terms – from £2,083.20 to £2,686.44 per oz – just ahead of the 28.4% return it provided in 2024.

In comparison, global equities have returned 6.8% year-to-date in sterling terms (as represented by the MSCI World Index), following on from 21.5% in 2024 and, as has been well-documented in the pages of our website and others, much of this has come from a relatively narrow-group of AI-focused tech stocks, with returns from broader equities much more subdued.

What’s driving gold higher?

A combination of factors has pushed gold sharply upwards in 2025. First, it is little secret that Trump’s ‘Liberation day’ tariffs have been inflationary, particularly for US consumers but for the global economy as a whole as supply chains adjust.

To give some context, in the US, CPI-all items increased by 2.9% year-on-year in August, up from 2.7% in July and the highest level since January. Core CPI (excluding food and energy) rose 3.1% year-on-year in August – unchanged from July – and, while this is lower than the 3.5–4% seen during 2024, it continues to remain above the US Federal Reserve’s 2% target and its persistence suggests that inflation is firming, not easing.

At the same time, it is also little secret that Trump wants the Fed to cut interest rates – something that its chair Jerome Powell has held firm against reflecting the ongoing concerns over persistent core inflation noted above. However, Trump’s recent attacks on the Fed – in particular his attempts to fire Governor Lisa Cook – have raised concerns about the Fed’s ability to remain independent when setting interest rates over the longer-term, should Trump be successful in his power grab.

A significant cut in interest rates against a backdrop of already rising prices could prove to be very inflationary and gold tends to be a natural inflation hedge – its intrinsic value and scarcity often tends to lead to increases in its price during inflationary periods, helping to protect the real value of an investor’s assets.

Another factor is that a weakening US dollar has made gold more affordable for overseas buyers – a clear objective of the Trump administration – while heightened geopolitical tensions have reinforced its safe-haven appeal.

Furthermore, against an increasingly uncertain global economic outlook, and one in which the value of the US dollar as the global reserve currency is being increasingly questioned, Central banks continue to both add to and diversify their reserves. Gold’s prominence has increased, having recently overtaken the Euro to become central banks’ second most widely held asset. Gold now accounts for around 20% of Central banks’ reserves globally, double the amount it was a decade ago.

For similar reasons, inflows into gold-backed exchange-traded funds (ETFs) have accelerated as investors look for diversification in an uncertain macro environment.

Is gold a good long-term investment?

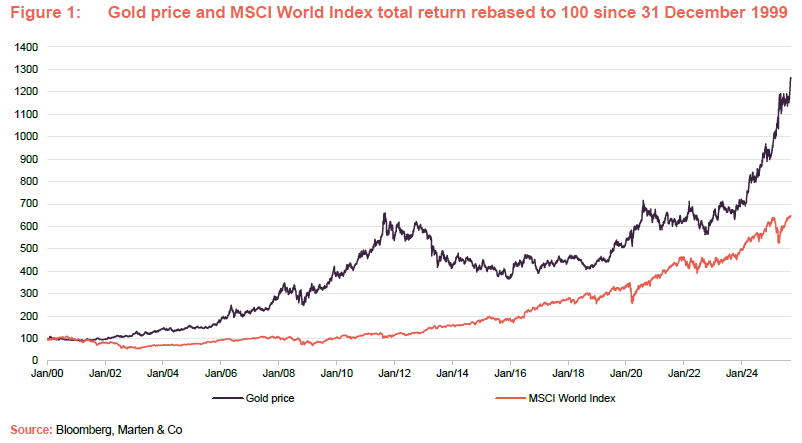

To put it in the simplest of terms, the answer is yes, but some caution is required. The chart below charts the gold price versus the MSCI World in total return terms since the turn of the century, in sterling terms and it is clear that, if you had put your money into gold rather than equities on 31 December 1999, you would be significantly ahead of global equities, even after the recent AI surge. This highlights the long-term attractions of the asset class and why it regularly features in the portfolios of investment trusts focused on providing capital preservation.

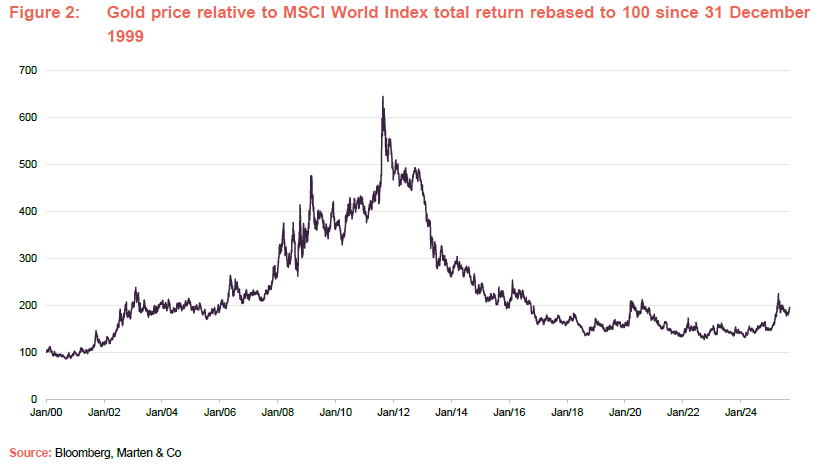

However, as Figure 2 shows, there have been distinct periods of out- and underperformance by gold of global equities. From the turn of the millennium up until late 2011, the broad trend was one of a strong performance of gold over global equities. However, the last 14 years have been one of a relative bear market for gold. This period was one that was characterised by low inflation expectations and low interest rates, and it is clear that, in relative terms, there is considerable catch-up potential for gold.

The trusts that gold has been putting a shine on

The resurgence in the gold price has breathed fresh life into a number of investment trusts with gold exposure. The trusts with exposure to gold tend to fall into two camps – specialist commodities focused funds such as Golden Prospect Precious Metals (discussed above) and CQS Natural Resources Growth & Income (CYN), and diversified wealth preservers like Ruffer (discussed above) and Personal Assets Trust (PNL).

Taking a look first at CYN, this is an actively managed investment trust offering a broad exposure across the natural resources sector, with a particular tilt toward undervalued, cash-generative mining equities. In its most recently published factsheet, which had data as at 31 July 2025, precious metals accounted for 43.9% of CYN’s portfolio, which encompasses gold and related mining companies.

Although this level varies over time reflecting where its managers see the best opportunities, CYN has tended to have a substantial allocation to gold and precious metals due to its managers’ long-held conviction in gold’s role as both an inflation hedge and a diversifier, as well as the potential for much higher inflation than we have seen in much of the post-GFC period.

This hefty exposure has served the trust well during the last year – its NAV is up 48.4% over 12 months, at the time of writing, placing it second in its peer group only to its stablemate GPM, which has returned 95.7% in NAV total return terms. Reflecting discount narrowing, the 12-month share price returns of both CYN and GPM are even higher at 70.7% and 114.4% respectively.

These returns illustrate how mining companies and the funds that invest in them tend to be leveraged plays on the price of the underlying commodities in which they invest. Resource extraction tends to be an expensive business and one that involves high fixed costs. For example, building roads, sinking shafts and constructing processing facilities all tend to be costly and need to be done before mining can commence in earnest and any profits from the mine come in. However, the flip side is that, when commodity prices are high, much of the price rise tends to drop straight through to the bottom line with the profitability of these companies increasing dramatically in a higher pricing environment.

Not surprisingly, the strength of this performance has lifted both trust’s performance over the longer term as well. CYN, with its broader exposure, has returned 8.6%, 22.6% and 15.0% per annum in NAV total return terms during the last three, five and 10 years, respectively. GPM has provided annualised returns of 26.2%, 2.9%, and 14.6% over the same time periods.

Of course, the gold price rally has benefitted other funds in the commodities and natural resources peer group, with the median return for the group coming at 21.2% over the last 12-months – still less than half of that of CYN (CYN has now outperformed the median fund in its peer group over the one-, three, five and 10-year periods). Given that CYN has returned 26% in the last month alone, we think that shareholders who sold into the tender offer at the end of June, following agitation from the US hedge fund Saba Capital, may now wish they had held on, given the prospect of more to come, particularly as there could be additional upside in other more depressed commodity stocks that it owns.

Taking a look at Personal Assets, this sits with most of the other wealth preservation focused trusts in the flexible investment sector, which offers quite a diverse range of strategies. Data from its most recent factsheet – as at the end of August 2025, shows an allocation to ‘gold-related investments’ of 11%. Its managers comment that “it is little surprise gold continues to shine amid the uncertainty” but reflecting its much lower allocation to gold, its returns are noticeably more muted – an NAV total return of 8.1% during the last 12 months – in line with the sector median for funds focused on wealth preservation of 8.1% and just ahead of the broader flexible sector median NAV total return of 7.9%.

Compared to a fund such as CYN, PNL’s return is much less volatile by design – it has provided annualised NAV total returns of 4.3%, 4.6% and 6.1% over the last three, five and 10 years, respectively. However, it has not exceeded the median return for either the broader flexible investment sector or for its more wealth preservation focused peers during any of these periods. We still think PNL is a strong option for wealth preservation but believe that for investors who are interested in having exposure to gold, the higher volatility of the resource focused funds such as GPM and CYN is more than compensated for by their superior returns.