Silent revolution

Silent revolution

Vietnam Holding (VNH) has quietly undergone a major overhaul during the last two years, making it more shareholder-friendly and putting it on a stronger footing (see pages 4 and 5).

However, in a world that is increasingly conscious of corporate responsibilities, it is VNH’s strongly-held ESG principles that might be the key attraction for prospective investors. These are right at the core of its investment process (it is a signatory of the UNPRI – see page 11). The manager believes that investee companies that focus on these will provide superior performance over the longer term. Vietnam benefits from a number of major structural growth drivers (the manager believes that Vietnam can become a top 20 global economy by 2050) and, at present, valuations are undemanding. In a bid to capture the benefits of this growth, VNH’s portfolio is focused on three key themes: industrialisation, the consumer and urbanisation.

Capital growth from a concentrated portfolio of high growth Vietnamese companies

Capital growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | VN All-Share total return (%) | VN 30 total return (%) | MSCI Emerging markets TR. (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Nov 2015 | 11.10 | 9.20 | -2.30 | -2.90 | -13.40 |

| 2 | 30 Nov 2016 | 42.80 | 36.50 | 35.90 | 32.70 | 31.20 |

| 3 | 30 Nov 2017 | 9.10 | 12.20 | 34.80 | 41.30 | 23.30 |

| 4 | 30 Nov 2018 | -2.90 | -1.90 | -0.30 | -0.30 | -3.40 |

| 5 | 30 Nov 2019 | -2.00 | -1.10 | 1.60 | -0.30 | 6.20 |

Fund profile

Fund profile

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also, subject to certain restrictions, invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). Further information on the manager’s ESG-orientated investment process, including investment restrictions, is provided on pages 9 to 12 in the PDF version.

VNH was originally established in April 2006 as a Cayman Islands-domiciled closed-end fund that was listed on AIM. However, as discussed below, the company has undergone a major overhaul during the last two years. In addition to a completely new board, it has a new investment manager, its domicile has been moved to Guernsey, and its AIM listing has been cancelled in favour of premium main market listing on the London Stock Exchange. More information on Dynam Capital, VNH’s investment manager, is provided on pages 24 and 25 in the PDF version.

No formal benchmark index

No formal benchmark index

VNH does not have a formal benchmark. However, for the purposes of performance evaluation, the manager has traditionally included comparisons against the VN Index, the VN All-Share, the VN 30 Index and the MSCI Emerging Markets Index in its literature. We have included these as well as the MSCI Vietnam Index in this report.

Major overhaul during the last two years

Major overhaul during the last two years

Since September 2017, VNH has undergone a number of significant changes designed to address failings on the part of its former board and previous investment manager, VNH Asset Management. The changes were largely corporate governance- and investment management-related, and reform was driven by the concerns of a number of VNH’s largest shareholders.

Background to overhaul

Background to overhaul

Whilst it is reported that there were a number of issues, the two primary red flags were that:

- the previous chairman received bonuses from VNH that had not been disclosed to shareholders. In September 2018, VNH announced that it had agreed a settlement that exceeded the final bonus paid to the former chairman; and

- when Juerg Vontobel, the founder of VNH Asset Management, was convicted of money laundering offences in Switzerland in September 2008, it was agreed with the former board that he would cut his ties with VNH and VNH Asset Management (although his family would retain ownership of the management company). However, over time, Juerg became increasingly involved with the affairs of both again.

Remedial measures

Remedial measures

Following discussions with several of the larger shareholders, the former board agreed to step down in its entirety at the 2017 AGM, with four new independent directors appointed in their stead (see pages 25 to 27 in the PDF version for more information on the current board).

The new board initiated a full review of both the investment management and corporate governance arrangements for VNH. The outcome of this review led to a series of changes that have been implemented during the last two years. Specifically (in a roughly chronological order):

- Daily NAV announcements were introduced with effect from the beginning of January 2018 (previously these estimates were published weekly);

- VNH’s buy-back authority (usually renewed annually at the company’s AGM) was increased from 10% of shares outstanding to 14.99% at an EGM on 9 July 2018;

- A new investment manager, Dynam Capital Limited, was appointed on 16 July 2018 (shareholders also approved the continuation of the fund for a further five years at this time – see page 23 in the PDF version);

- A modest reduction in management fees payable. VNH has a tiered management fee (see page 22 in the PDF version). With effect from 9 October 2018, VNH pays a management fee equivalent to 1.25% per annum for net assets in excess of US$300m up to US$600m, previously this was paid at a rate of 1.3%;

- A 15% tender offer was undertaken in November and December 2018. The tender was fully subscribed and 9.7m shares were purchased at US$2.7215 per share;

- Juerg Vontobel has cut his ties with VNH;

- VNH moved its domicile from the Cayman Islands to Guernsey with effect from 25 February 2019;

- VNH’s listing moved from AIM to the LSE’s main market, with a premium listing, with effect from 8 March 2019; and

- At the time of the move to the main market, the quoted currency for VNH’s ordinary shares changed from US dollars to sterling.

Protecting shareholders’ interests

Protecting shareholders’ interests

VNH has undergone a significant series of changes, which we believe illustrate the new board’s commitment to protecting shareholders’ interests. Many of these measures are specifically designed to make VNH more shareholder-friendly and therefore make it more attractive to potential investors. For example, an LSE main market listing, with the superior corporate governance, regulatory and reporting requirements that this brings, should provide investors with additional comfort. Moving the domicile to Guernsey should make VNH more accessible for UK-based investors, as some will have found the former Cayman Islands domicile an impediment to investment.

It is hoped that these measures, combined with the allocation of additional resources to raising VNH’s profile among investors, should help to improve liquidity in VNH’s shares and narrow its discount.

Market outlook

Market outlook

Recent history and valuations

Recent history and valuations

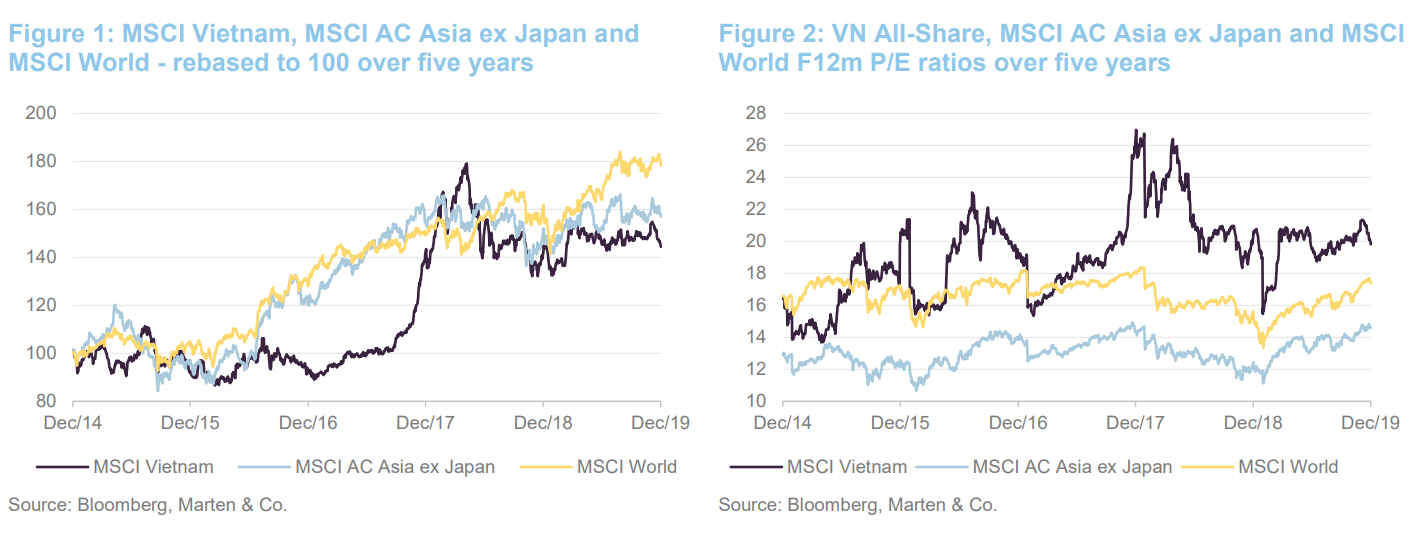

As illustrated in Figure 1, Vietnam (as represented by the MSCI Vietnam Index), emerging Asia (as represented by the MSCI AC Asia ex Japan index) and global equity markets more generally (as represented by the MSCI World Index) have provided strong absolute returns during the last four years. This period has generally been good for equity markets, albeit with some wobbles, as the global economy continued on its path of expansion. Global markets have been very macro-driven during the past few years, with top-down macroeconomic considerations frequently outweighing company fundamentals. This is partially illustrated in Figure 2, which shows marked movements in valuations. Nonetheless, markets have continued to make progress, although, whilst concerns of a global recession appear to have eased for now, the global economic expansion now looks long in the tooth.

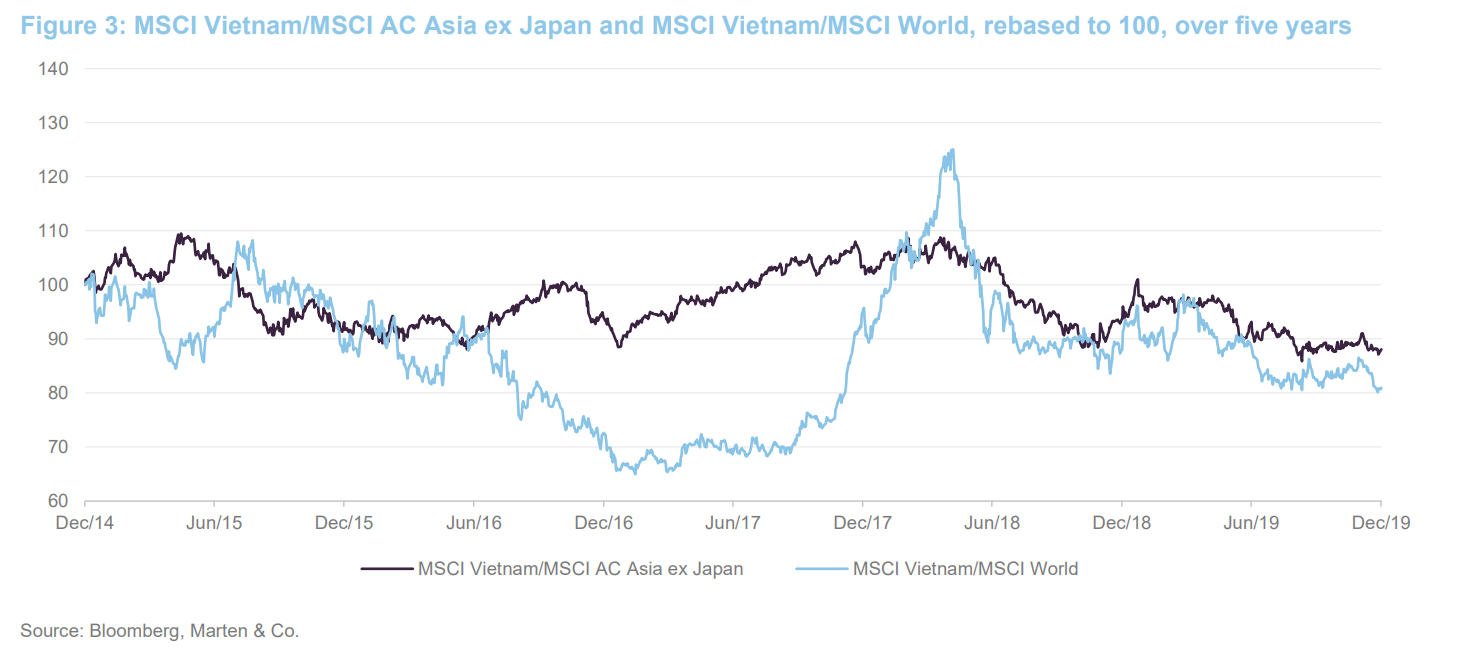

As illustrated in Figure 3, during the last five years Vietnam has underperformed both emerging Asia and global markets. Vietnam broadly held its own against emerging Asia until around the end of the first quarter of 2018, but has steadily underperformed since. Coming off of its previous highs (the Vietnamese market had a very strong 2017), the retrenchment versus global markets is particularly harsh. While investors had been previously favouring growth stocks more generally, a strengthening of the US dollar, a rising oil price and trade tensions with the US started to weigh heavily on emerging markets in particular. Vietnam was not immune to this. Furthermore, there were concerns that, with a considerable trade deficit with the US, it could also face direct action from the US, along with China.

As is illustrated in Figure 2, Vietnamese equities have tended to trade at a premium to both global markets and emerging Asia, arguably reflecting its superior growth opportunities. However, as also illustrated in Figure 2, valuations for Vietnamese equities are now significantly below their five-year high of 27.0x. For example, as at 3 December 2019, the MSCI Vietnam was trading at an F12m p/e 19.8x, which is modestly above its five-year average of 19.2x (the MSCI Vietnam has traded in a relatively wide range – from a F12m p/e of 13.7x to 27.0x). In contrast, the MSCI AC Asia Ex-Japan Index was trading at an F12m p/e ratio of 14.6x. This is close to its five-year high of 14.9x (five-year trading range 10.7x to 14.9x). The MSCI World was trading at an F12m p/e of 17.4x, which places it towards the top of its five-year trading range (13.3x to 18.4x) and above its average of 16.6x.

Vietnam – strong GDP per capita catch up potential

Vietnam – strong GDP per capita catch up potential

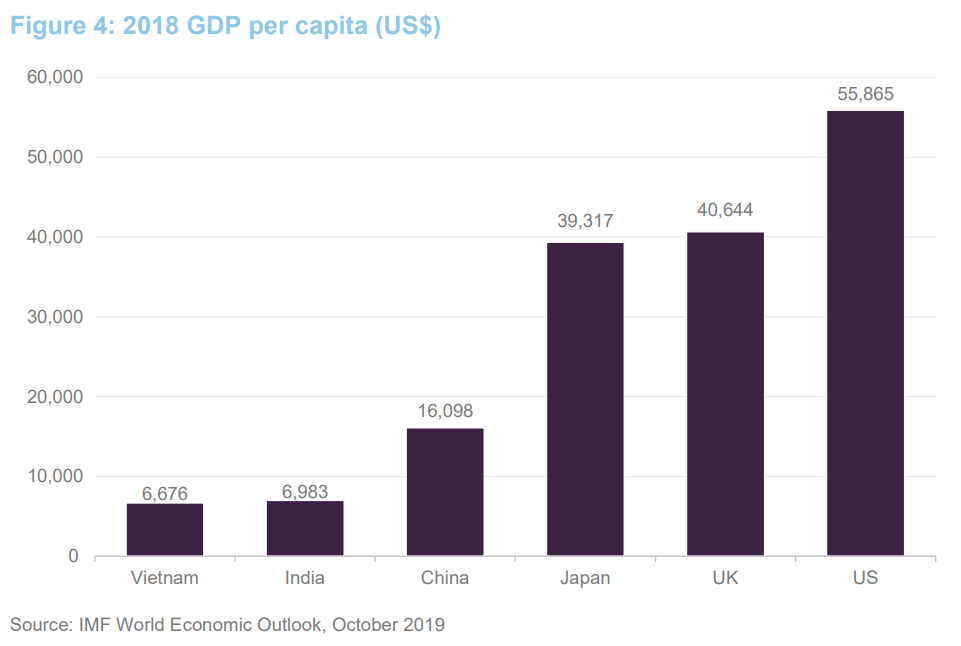

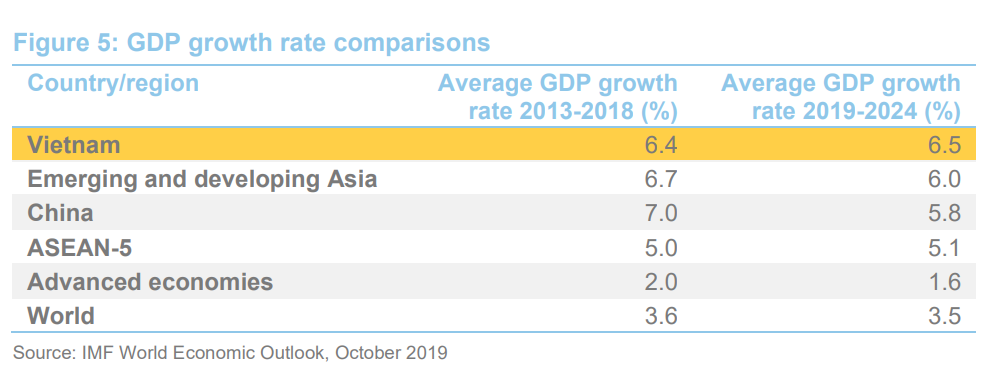

Looking at Vietnam’s longer-term growth drivers, its GDP per capita is a little below India’s, around 40% of China’s (see Figure 4), and significantly below that of more developed nations. This gives it significant catch-up potential. The IMF’s World Economic Outlook for October 2019, forecasts average annual growth for Vietnam for the period 2019-2024 of 6.5%. This is in excess of China’s, above the average of ASEAN peer group and significantly above world and developed market averages. It is also worth noting that whilst the IMF’s estimated growth rate for China is on a declining trend (from 6.1% in 2019 to 5.5% in 2024), Vietnam’s is expected to remain constant at 6.5%. In addition, Vietnam has a favourable demographic profile (a median age of 30.5 years) and it is relatively resource-rich, with substantial coal reserves and commercially-viable reserves in a range of metals and minerals.

Manager’s view – a rising star in ASEAN

Manager’s view – a rising star in ASEAN

Dynam Capital is positive on the long-term outlook for the Vietnamese economy and market. The manager highlights that Vietnam has benefitted from a high and stable growth rate during the last 30 years. With strong structural growth drivers in place, it expects this to continue, with Vietnam becoming a top 20 global economy by 2050. Whilst Vietnam is benefitting from increasing exports, its growth is largely domestically driven, making the economy more resilient in the event of a global slowdown.

A growing middle class is driving consumption

A growing middle class is driving consumption

A growing middle class and an increasingly consumer-driven society is driving GDP growth, which drives incomes, creating a virtuous circle. Dynam believes that by 2035, there could be an additional 35m middle-class consumers, which is expected to be around 50% of the population. It notes that car ownership has doubled over the last five years, while consumer loans have also increased five-fold and now total over US$51bn. To capture the benefits of these developments, the managers are focusing on three major themes within the portfolio:

- Industrialisation;

- The consumer; and

- Urbanisation

Dynam believes that the Vietnamese economy is approaching an inflexion point in economic growth, with increased demand for consumer goods being fulfilled through rapidly growing modern-trade and retail chains. It also believes that rapid levels of urbanisation and industrialisation are creating opportunities in real estate development and industrial services.

Structurally well positioned for ongoing growth

Structurally well positioned for ongoing growth

Vietnam benefits from a number of structural growth drivers that suggest it is well-positioned for further economic expansion for years to come. For example:

- Vietnam benefits from a large and youthful population;

- Vietnam has a relatively well-educated workforce (Vietnam has a 95% literacy rate, placing it second-highest among the top 10 investable frontier-market countries);

- Vietnam is an industrious nation. At 76%, it has one of the highest employment-to-population ratios globally (the global average is 58%, while the average for East Asia and the Pacific is 65%);

- Vietnam is a natural manufacturing hub. It has a low manufacturing labour cost (around half that of China and around two-thirds of that in Mexico). It is also centrally positioned within ASEAN and is well-positioned relative to other major economies in the region (China, Japan and Korea);

- Vietnam benefits from a relatively stable socio-political environment (85% of the population is ethnic Kinh, which reduces the likelihood of internal conflict);

- Vietnam has high internet penetration compared to wider emerging markets (circa 60%) and is benefitting from increasing urbanisation. Dynam comments that Vietnam’s internet economy is forecast to reach US$45bn by 2025;

- The country has also been on a path of increasingly opening its economy, driven by a variety of free trade agreements. It moved from 77th place in 2018 to 67th place in 2019 in the global competitiveness index (this being the largest increase between these two years);

- Vietnam has 13 free trade agreements in place and has concluded negotiations on a further three. The newly-signed CPTPP, Vietnam-EU FTA and RCEP are expected to boost foreign trade;

- Vietnam is well-diversified in terms of its foreign trade partners and is not overly reliant on any particular one. China is the largest partner at around 22% of foreign trade. The next largest is the US at around 15%;

- Vietnam is a strategic alternative to China for global product sourcing. Despite concerns to the contrary, Vietnam has benefitted from a recent surge in exports as trade tensions have escalated between the US and China; and

- Vietnamese capital markets have seen healthy development in recent years. They have grown in size, boosted by new IPOs and privatisations of former SOEs. However, the foreign ownership limits (FOLs) remain a challenge (30% for banks and 49% for other listed companies). The manager says that draft revisions to Vietnam’s securities law may provide clarity.

As a consequence of the above, Vietnam has been attracting high levels of foreign direct investment in recent years.

Investment process

Investment process

In managing VNH’s portfolio, Dynam Capital (www.dynamcapital.com) is looking for high-growth, compounding businesses that it can hold for the long term. This can be summarised as growth at an attractive valuation. Dynam manages its portfolios using a mixture of top-down and bottom-up investment strategies. The top-down element of the investment process guides the manager towards the key sectors and sub-sectors, to focus its attention on, with the aim achieving superior long-term returns. The bottom-up element of the process uses extensive fundamental research to select the best companies in those sectors and sub-sectors.

ESG incorporated into all investment and monitoring procedures

ESG incorporated into all investment and monitoring procedures

ESG criteria are central to Dynam’s approach and have been part of its DNA since the beginning. Vu Quang Thinh, Dynam’s CIO, is very well regarded in this area. He is a founding member and former chairman of the Vietnam Institute of Directors (VIOD). Established in April 2018, VIOD was the first private and independent organisation in Vietnam, aimed at promoting the highest standards and best practices in corporate governance among domestic firms.

Four stage investment process: internal screening, due diligence, investment decision and investment monitoring

Four stage investment process: internal screening, due diligence, investment decision and investment monitoring

Dynam’s investment universe comprises around 1,500 companies split across three exchanges in Vietnam (the two major exchanges are Ho Chi Minh City and Hanoi), with a combined market capitalisation in the region of US$200bn. The overwhelming majority of these are deemed to be not suitable for investment. Many are too small, and others will not fit Dynam’s ESG criteria (for example Dynam tends to avoid former SOEs).

The initial screening process reduces the investable universe to around 150 companies. Further analysis reduces this to around 70, on which Dynam speaks to company management and conducts extensive due diligence. Ultimately, this is narrowed to a portfolio of around 23 that fully reflects Dynam’s philosophy.

Internal screening

Internal screening

Dynam regularly screens the Vietnamese market against its investment screening criteria to identify new potential investments. This includes an assessment against the manager’s critical risk table and its initial ESG checklist. Companies that pass this phase undergo a concept discussion at the weekly team meeting. If they pass, they enter the investment pipeline.

Due diligence

Due diligence

Of the 70 or so companies that make it through the initial screening phase and enter Dynam’s investment pipeline, the manager conducts extensive due diligence to assess a company’s suitability for inclusion in Dynam’s portfolios.

In this phase, a company is assessed in detail against Dynam’s investment criteria (see below). The manager conducts site visits, interviews company management, scores the company against its ESG matrix in greater depth, and builds a detailed valuation model. Broker reports and sector reviews feed into this process. Dynam’s investment criteria can be summarised as follows:

- Compounding long-term EPS growth (approximately 20% per annum);

- Attractive valuation with built in safety margin;

- Strong balance sheet and cashflow management;

- Rigorous adherence to ESG principles;

- Industry leader with strong competitive position; and

- Best management teams amongst peers.

The due diligence process is fully documented and conclusions of all of this analysis are pulled together into a draft investment proposal, which is presented to the investment team. The investment team critically appraises the proposal and it is revised based on their feedback. Assuming that an investment clears this stage, the investment proposal is then finalised.

Investment decision

Investment decision

Once an investment proposal has been finalised, it is reviewed by the investment committee at its weekly meeting and, where appropriate, the client. Assuming that an investment receives approval at this stage, it is passed to the trading team for execution.

Investment monitoring

Investment monitoring

Dynam operates a process of ongoing investment monitoring. This includes attending analyst meetings, regular company visits, reviewing results and periodically rescoring a company against Dynam’s ESG matrix. Following such an event, an internal update on the company is produced and this is reviewed by the investment committee. Where appropriate, this may lead to company engagement, to propose improvements or suggest remedial action. It may also lead to a divestment proposal, which is also reviewed by the investment committee, before being acted thereon.

Investment restrictions

Investment restrictions

VNH’s articles of association impose the following investment restrictions:

- VNH will not invest more than 10% of its NAV (at the time of investment) in the shares of a single investee company;

- VNH will not invest more than 30% of its NAV (at the time of investment) in any one sector;

- VNH will not invest directly in real estate or real estate development projects. However, it may invest in companies that have a large real estate component, if their shares are listed or are traded on the OTC Market;

- VNH will not invest in any closed-ended investment fund unless the price of such investment fund is at a discount of at least 10% to its prevailing net asset value (at the time of investment);

- VNH may invest up to 25% of its NAV (at the time of investment) in companies with shares traded outside of Vietnam, if a majority of their assets and/or operations are based in Vietnam;

- VNH may invest up to a maximum of 20% of its NAV (at the time of investment) in direct private equity investments;

- VNH may invest up to 20% of its NAV (at the time of investment) in other listed investment funds and holding companies which have the majority of their assets in Vietnam;

- VNH may borrow money, and grant security over its assets, provided that such borrowings do not exceed 25% of the latest available NAV (at the time of the borrowing);

- In addition to equities, VNH may invest in securities that have equity features, such as bonds that are convertible into equity;

- VNH may also invest its available cash in domestic bonds or international bonds issued by Vietnamese entities; and

VNH may utilise derivatives contracts for both hedging purposes and efficient portfolio management, but it will not utilise derivatives for investment purposes.

Investment restrictions – based on the United Nations Principles for Responsible Investment

Investment restrictions – based on the United Nations Principles for Responsible Investment

VNH is a signatory of the United Nations Principles for Responsible Investment (UNPRI). This imposes a number of ESG-related restrictions. As a signatory, it will not invest in companies:

- Known to be significantly involved in the manufacturing or trading of distilled alcoholic beverages, tobacco, armaments or in casino operations or other gambling business;

- Known to be subject to material violations of Vietnamese laws on labour and employment, including child labour regulations or racial or gender discriminations; or

- That do not commit to reducing, in a measurable way, pollution and environmental problems caused by their business activities.

Asset allocation

Asset allocation

Concentrated and low turnover portfolio of Vietnamese stocks

Concentrated and low turnover portfolio of Vietnamese stocks

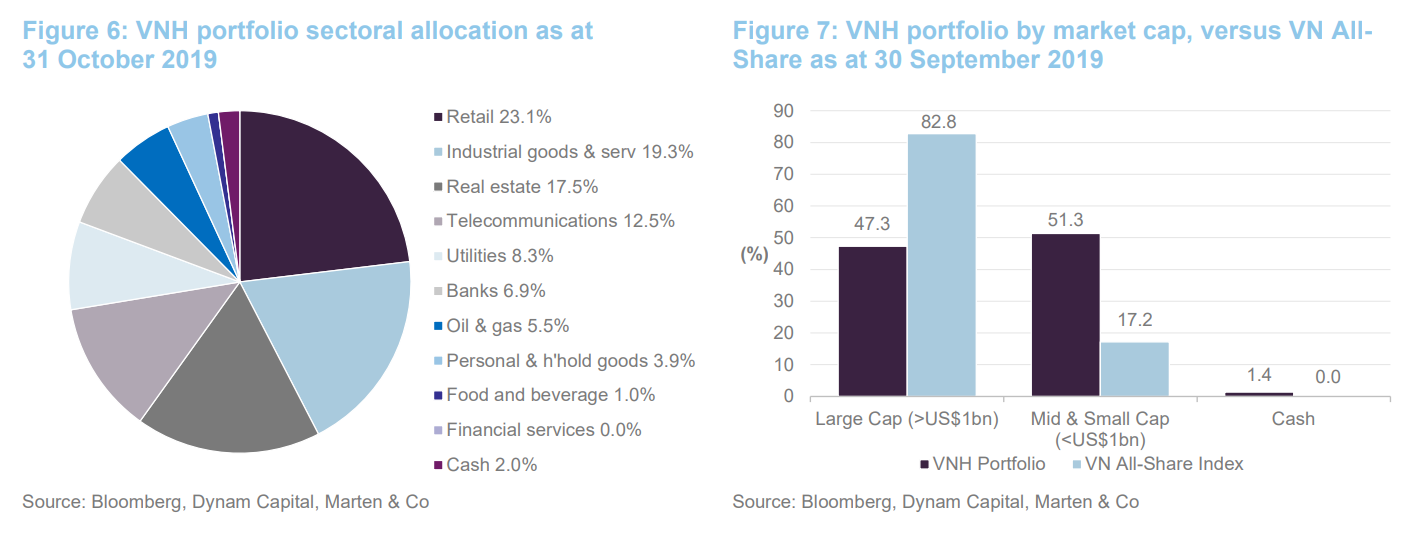

As at 31 October 2019, VNH’s portfolio had exposure to 23 securities (down from 25 securities as at 31 October 2018). VNH’s portfolio is highly concentrated; it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%) but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction).

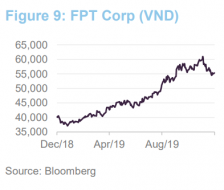

As illustrated in Figure 8, the top 10 holdings accounted for 68.3% of VNH’s portfolio as at 31 October 2019 (2018: 68.5%). Whilst the allocation to the top 10 is essentially unchanged, the concentration within the top five has increased (45.4% as at 31 October 2019, versus 42.4% a year earlier).

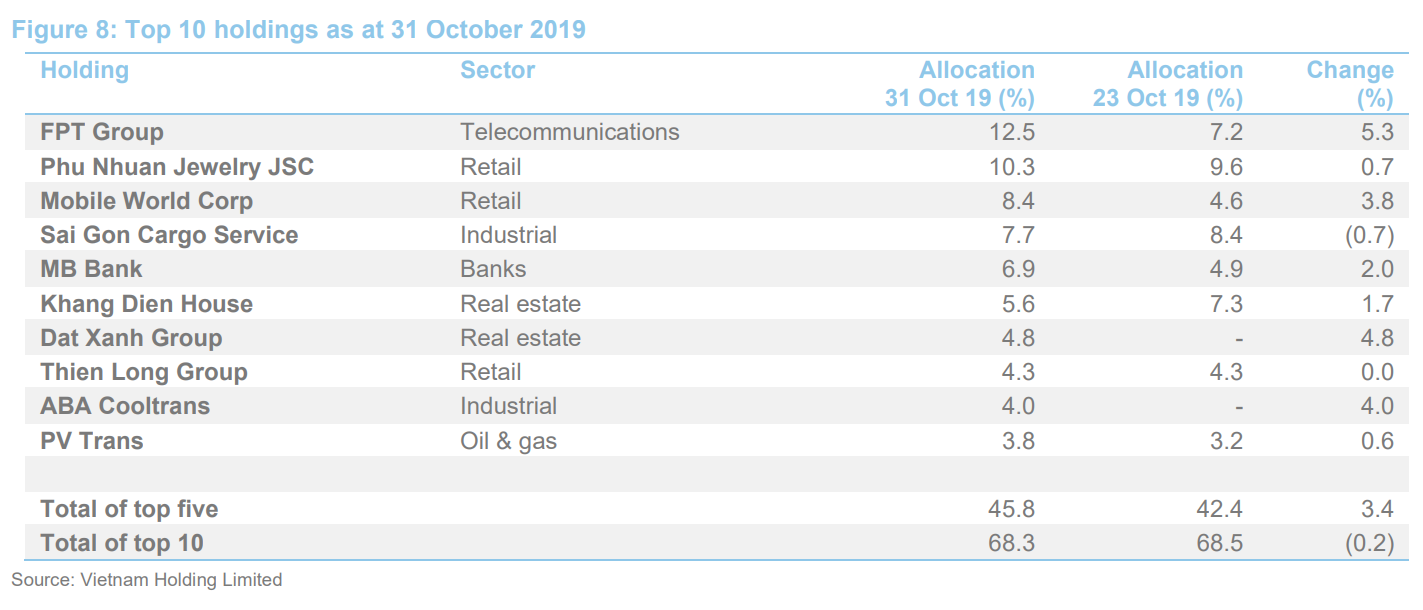

The portfolio is distinctly different from the VN All-Share (it has a high active share – 77.5% as at 30 September 2019) and, as illustrated in Figure 7, VNH’s portfolio has a markedly higher allocation to mid and small cap stocks (the VN All-share, in contrast, is heavily weighted towards stocks with market caps in excess of US$1bn).

Top 10 holdings

Top 10 holdings

Figure 8 shows VNH’s top 10 holdings as at 31 October 2019 and how these have changed over the previous year. The six largest holdings as at 31 October 2019 were all constituents of VNH’s top 10 a year earlier, albeit the relative positions have changed. New entrants to the top 10 are Khang Dien House, Thien Long Group, ABA Cooltrans and PV Trans. Names that have moved out of the top 10 are Hoa Phat Group JSC, Viet Capital Securities JSC, Van Phu – Invest and Yeah1 Group Corp. The six largest positions, as at 31 October 2019, are discussed in more detail below.

FPT Group (12.5%)

FPT Group (12.5%)

FPT Group (fpt.com.vn/en), formerly The Corporation for Financing and Promoting Technology, is the largest IT services company in Vietnam. It develops software, provides IT and telecom services (including broadband internet), and is a distributor/retailer of IT and communication products. VNH’s managers say that the company has been the market leader in Vietnam for IT services since 1996, and benefits from the strong network it has developed over this time. VNH has been invested in FPT since January 2007, shortly after its listing in December 2006. At 49% foreign ownership, the company is at its FOL.

According to VNH, the company employs the largest engineer workforce in Vietnam and offers outsourcing services to more than 650 global customers and partners, including 100 in the Fortune 500. It also owns significant telecoms infrastructure, which includes a main north-south fibre link. Its private telecom network allows it to service all 64 of Vietnam’s provinces. FPT has been working on expanding into overseas markets.

FPT has a sustainability strategy based on three core pillars:

- Profit, achieved by competitive enhancements.

- People, driven by developments of human resources and community activities, and

- Planet, via environmental protection.

VNH says that, together with having strong business development and corporate governance credentials, FPT has made significant contributions to the development of society through an education support program (which has a focus on youth development). In 2018, FPT and its employees combined contributed VND33bn to community activities (VND29.2bn from the company and VND3.8bn from the employees), which was split between education, young people’s development programs, charitable programs to support families living in poor conditions and disaster victims. VNH has been invested in FPT since December 2009, around six months after its listing in March 2009.

Dynam Capital say that they see very strong potential for FPT to grow both its domestic and international sales from here; it has a high degree of technical expertise and its labour costs are very competitive compared to India and China. At home, both the government and the private sector (for example banking and oil & gas) are increasing their spend on IT services. Overseas, FPT has a strong footprint in Japan and, increasingly, in China. At 49% foreign ownership, the company is at its FOL, which the manager considers is depressing its share price. At a p/e of approximately 12x, the manager believes this is cheap, particularly as it expects 25% earnings growth over the next three years.

Phu Nhuan Jewelry JSC (10.3%)

Phu Nhuan Jewelry JSC (10.3%)

Phu Nhuan Jewelry (www.pnj.com.vn) is the leading jewellery manufacturer in Vietnam (PNJ is the only jewellery house in Vietnam that has a production capacity of 4m units per annum, although it currently produces around 2.5m units, whilst its closest competitor has a store network around the quarter of the size of PNJ’s). Its operations cover the full value chain. It employs an experienced team comprising jewellery designers and over 1,000 skilled goldsmiths, which Dynam Capital says is one of the company’s strongest assets.

PNJ has a product range that covers the mid end to luxury jewellery segments. It has a nationwide network of 324 retail stores (2017: 269) along with over 3,000 wholesalers. In the branded jewellery segment, it has a market share in the region of 30% (2018: around 28%).

PNJ’s sustainable development strategy is based on the UN’s 17 sustainable development goals. It has five pillars:

- Economic growth via full concentration on core jewellery business;

- Social development by providing proper annual training to employees;

- Environmental protection through processing of toxic waste in an environmental-friendly manner and promotion of energy-efficient focused practices;

- Labour force development by creating a safe and unprejudiced working atmosphere to not only attract but also nurture talent; and

- Community building via effective investments in community projects.

VNH says that PNJ has firm policies to ensure that its precious stone purchases are from legitimate sources rather than conflict zones. PNJ has also reduced its raw material waste to below the industry standard of 1%. VNH says that the company has been very open with its communications with stakeholders and is responsive to the managers’ enquiries regarding ESG issues. Dynam Capital says that PNJ achieved compound earnings growth of 43% per annum between 2013 and 2018 and it believes that PNJ can double its earnings over the next three to four years.

Dynam Capital believes that PNJ has very strong long-term growth potential. As incomes rise in Vietnam and a middle-class emerges, consumers are looking for better quality and the manager believes that PNJ is well positioned to benefit from this. It believes that revenue growth of 8% per annum is achievable for the foreseeable future, both through expansion and same store growth. Given its spare production capacity, the business benefits from considerable operating leverage.

Mobile World Investment Corporation (8.4%)

Mobile World Investment Corporation (8.4%)

Mobile World Investment Corp (mwg.vn/eng) is a ‘relatively’ new investment for VNH (VNH first invested in September 2017). It is Vietnam’s largest retailer and is focused on three key areas: mobile phone retail (Gioi Di Dong), consumer electronics retail (Dian May Xanh) and grocery retail (Bach Hoa Xznh). According to VNH, at the end of 2018, Mobile World had a 45% share of the domestic mobile phone market and a 35% market share of the consumer electronics market. It is aiming to achieve a 10% market share in grocery retail (its newest venture) by 2022. This market is worth around US$50bn per annum.

In terms of its sustainability strategy, VNH says that consumer retail requires a high degree of customer satisfaction and Mobile World has built a consumer-centric corporate culture. All of its stores are equipped with LED lighting systems and, since 2013, all stores have installed optical sensors that feed into an automatic system that controls the lights and air conditioning. The company has also developed an internal e-learning program to help the induction of thousands of employees into its grocery chain.

In terms of ESG challenges, VNH says that grocery retailers have high levels of food waste (which typically accounts for 2% to 3% of on-shelf goods). However, over the course of 2019, MWG is implementing an advanced automatic SKU management system with the aim of reducing this ratio to between 1% and 1.5%.

Single use packaging is another key issue facing retail chains globally. With over 400 grocery stores, serving nearly half a million customers daily, MWG is not immune to this. VNH says that this remains an ongoing challenge for the company, and for the industry as a whole. However, Dynam Capital says that MWG has proven itself to be very strong at executing, it is operating in structural growth areas, has proven itself to be strong at identifying winning sectors to enter and it believes that innovation will allow the company to keep its growth momentum. It is expecting earnings growth of 30% in 2019, 38% in 2020 and 20% in 2021, through a combination of new store openings and existing store sales growth.

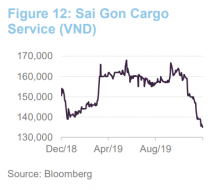

Sai Gon Cargo Service (7.7%)

Sai Gon Cargo Service (7.7%)

Sai Gon Cargo Service (www.scsc.vn) is another relatively new investment for VNH (it first invested in September 2017, ahead of the company’s listing in August 2018). The company is the leading air cargo terminal operator at Ho Chi Minh City’s Tan Son Nhat airport (as at June 2019, the company had 30 airlines in its customer base and handled approximately 36% of the total air cargo throughput volume at Tan Son Nhat airport). Its services include customs paperwork, security screening, packing, storing and airfreight consolidation.

In terms of its sustainability strategy, the company aspires “to be the obvious first choice for air cargo service requirements in Vietnam” and “to establish its air cargo terminal as the regional benchmark by which to measure first class air cargo service quality in South East Asia”. It faces limited competition in its home market (there is just one other significant player) and is well-positioned as the country develops (exports have been growing around 18% per year). It has spare capacity within its existing warehouse infrastructure and also has development land (enough for the next five years, in the manager’s opinion), which gives it room to grow.

It operates in a sector that has significant energy requirements. However, its main sustainability development strategy focuses on applying different solutions to save and reuse energy efficiently, improving production and business processes and protecting the environment. Its achievements include the implementation of:

- An information management system to control and check cold store systems;

- Inverter technology, to air conditioning systems, to increase energy efficiency;

- A building management system (to control lighting and ventilation) to increase energy efficiency; and

- LED lighting system to reduce electricity consumption.

VNH says that, in 2018, the company’s total energy consumption showed an improvement over previous years. Other ESG achievements include:

- Plastic bag consumption growth of 4%, which is much lower than revenue growth;

- A decrease in diesel consumption of 23% year-on-year, due to increased operational efficiency in its forklift fleet; and

- Printing and copying paper volume grew by 9% year-on-year, which is lower than the cargo throughput volume growth of 10%.

In terms of ESG challenges, VNH says that, given the company’s financial strength, it is now looking for M&A opportunities that will allow it to expand into other airports in the northern and central regions of Vietnam. However, VNH says that most M&A targets have weak corporate governance, a lack of transparency and a web of cross share-holdings to deal with. VNH sees the challenge of managing this inorganic growth, while maintaining a culture of good corporate governance as a key issue for the company. However, the manager believes that the company can grow its earnings by 15% per annum over the next three years. With a gross margin greater than 60%, an ROE in excess of 30% and low levels of debt, the company is well-positioned to pay a high dividend yield.

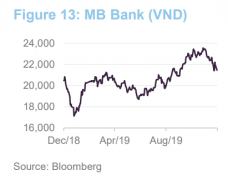

MB Bank (6.9%)

MB Bank (6.9%)

Despite its name, MB Bank, or the Military Commercial Joint Stock Bank, (www.mbbank.com.vn) is a traditional banking operation focused on Vietnam. Established in 1994, it has transaction points in most of major cities and provinces in Northern, Midland and Southern Vietnam. It offers a full range of retail and commercial banking services, including insurance products, and has increased its sales revenue every year for the last five years (115% compound over the five years to the end of 2018).

Dynam Capital says that MB Bank has a strong customer base, a high market share in Vietnamese retail banking and its wholesale banking operations are doing well. Despite its strong growth rate, the manager says that it can continue to grow due to the increased commercialisation of Vietnam, where it is well positioned to benefit. The manager considers that MB bank is well-managed, has a strong balance sheet, low NPLs (reflecting its conservative approach to making loans), and bad debts are well provisioned for.

The manager says that MB bank is well organised internally and has been ahead of the State Bank of Vietnam’s (the central bank’s) schedule for implementing Basel 2. However, in terms of ESG challenges, it lacks a proactive culture for investor relations (it has largely been held by SOE’s including Viettel, which is controlled by the military). This is an area where VNH’s manager wants to see improvement. It believes that if MB Bank is able to complete its proposed placing to foreign investors, this should lead to increased pressure for the bank to improve its IR efforts.

MB Bank is at its foreign ownership limit, which the manager says is depressing its valuation. The manager says that it is trading at a p/b ratio of circa 1.2x, which makes it look cheap versus larger banks that are trading at around 4x.

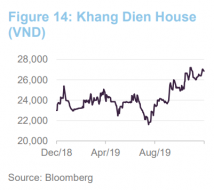

Khang Dien House (5.6%)

Khang Dien House (5.6%)

Khang Dien House (www.khangdien.com.vn/en) was established in 2001 as a developer of residential properties for emerging middle-income buyers. It focused on small ready-built villas and townhouses at relatively-affordable prices. Khang Dien House (KDH) attracted private equity investment between 2007 and 2009, before listing towards the end of 2009. VNH made its first investment in March 2015.

KDH is now one of the largest private property developers in Vietnam. It has a landbank of some 400 hectares in the South West of Ho Chi Minh City, where it intends to develop an urban ‘city.’ As at 31 December 2018, KDH had 23 subsidiaries and employed a total of 292 people.

VNH says that Khang Dien House was, compared to its peers, an early adopter of sustainable practices and has been publishing a sustainability report since 2016. It cites these reports as illustrating the attention to detail that the company pays to environmental and social factors when it is planning, designing and building projects; as well as when it is managing and operating properties.

Its achievements include the implementation of solutions to save power and fuel. Specifically:

- An increased use of unbaked bricks. In 2018, KDH used 50% unbaked bricks in its high-rise developments, but plans to use 75% unbaked bricks for future developments. (Note: unbaked bricks are eco-friendly and highly insulative. They are also less energy intensive in their production when compared to baked bricks.)

- The company uses exterior paints with high thermal insulation.

- Landscaping that combines open spaces in high-rise buildings and planting trees at height to reduce heat absorption.

VNH says that the company appears to be well aware of its responsibilities in regard to occupational health and safety. The company updates and maintains occupational health and safety policies. It also monitors its contractors’ compliance with these. The company strictly adheres to construction standards, laws on occupational safety and laws on fire protection. VNH highlights that, during 2018, all of KDH’s entities including member companies and project management units ensured labour safety and fire protection (there were no labour accidents or fires during this year).

In terms of ESG challenges, VNH says that, historically, Vietnam’s real estate sector has suffered from a lack of transparency, in both land-clearance and approval activities. The sector has challenges in terms of ensuring build quality and safety, as well as ensuring that projects are quality-assured during the construction phase.

Performance

Performance

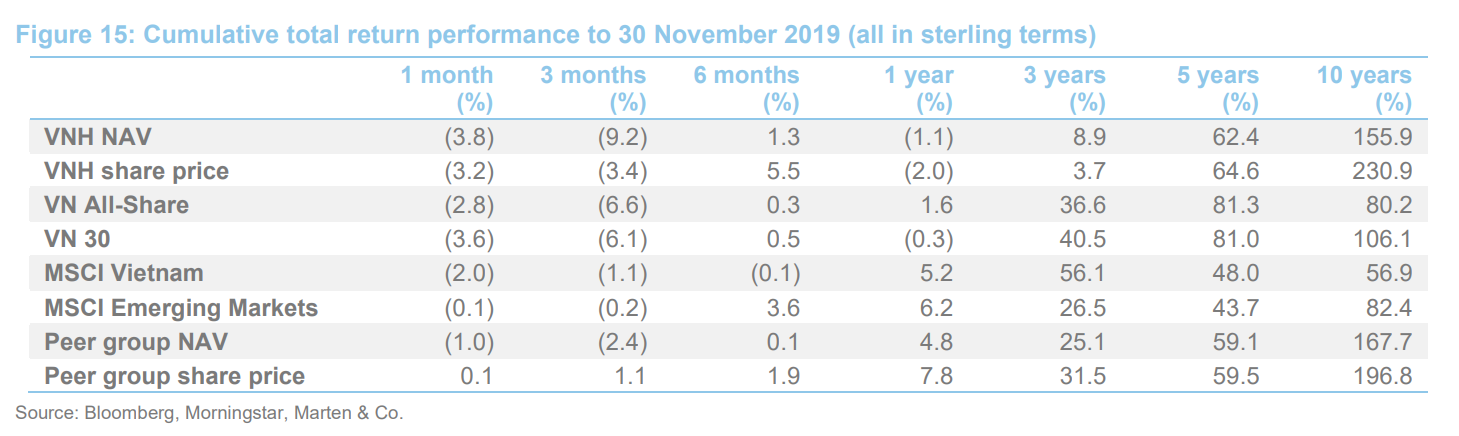

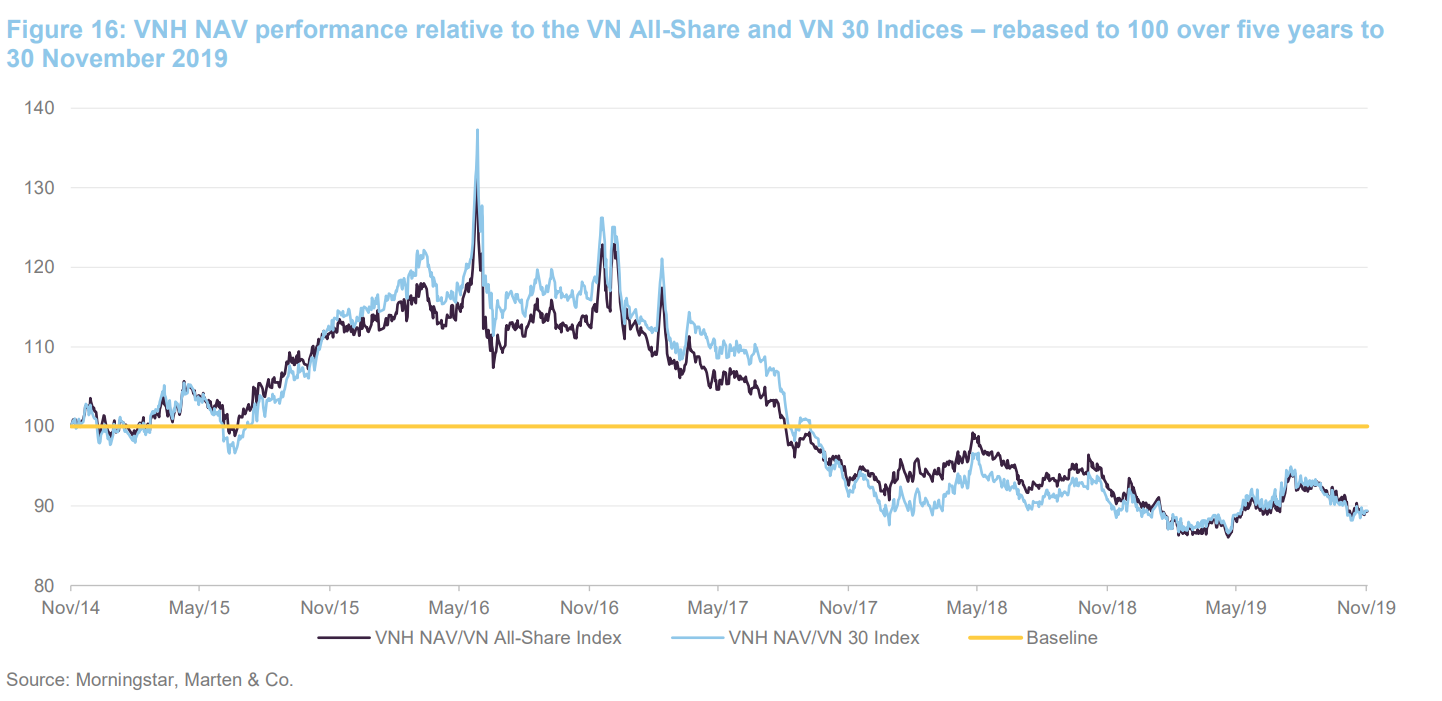

Figure 15 illustrates VNH’s share price and NAV total return performances in comparison with those of its country specialists: Asia Pacific ex Japan peer group, the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices. Absolute returns over the five- and 10-year periods are very strong. Over 10 years, VNH outperforms all of the indices although it falls behind the average of the peer group. Over five years, it outperforms the peer group, although it falls behind the VN All-Share and VN 30 Indices.

Absolute and relative performance during the last three years has clearly been more challenging. As illustrated in Figure 16, much of this occurred between mid-2016 and January 2018 (a period during which VNH began its overhaul). Relative performance subsequently improved, although VNH has underperformed more recently. Nonetheless, VNH’s long-term performance record remains very strong and, in our view, it is over longer-term horizons that a strategy such as VNH’s is best assessed. We would also note that VNH is focused on the mid cap space, where performance is inherently more volatile due to reduced liquidity. VNH also operates with a concentrated portfolio which tends to exacerbate this problem. However, VNH has undergone fundamental changes that mean that it is better placed to add value to shareholders going forward, and whilst its portfolio is concentrated and mid caps are volatile, VNH will be well-positioned to benefit if the manager is able to look through the short-term noise and make good investment decisions.

Latent value in VNH’s portfolio due to FOLs

Latent value in VNH’s portfolio due to FOLs

Dynam Capital says that VNH’s NAV is not entirely representative of what could be achieved in the absence of Vietnam’s foreign ownership limits. Where companies are at their FOL, large foreign institutions tend to sit on their hands and the only stock that tends to trade freely is between domestic players. In the absence of these restrictions, demand would be higher, pushing up prices. Furthermore, where foreign-owned stock does change hands (typically to another foreign investor), this will be at a premium that reflects the fact that this stock allows another foreign investor to gain access to the stock. Dynam Capital says that many of VNH’s positions are at their FOLs and are tightly held as a result. It believes that significant premiums could be achieved, over and above the NAV, in the event that the portfolio was liquidated. The manager says that roughly 40% of the portfolio could achieve a premium of 10–30% (anecdotally, the manager says that a large line of Mobile World Group recently changed hands at a 35% premium).

Peer group

Peer group

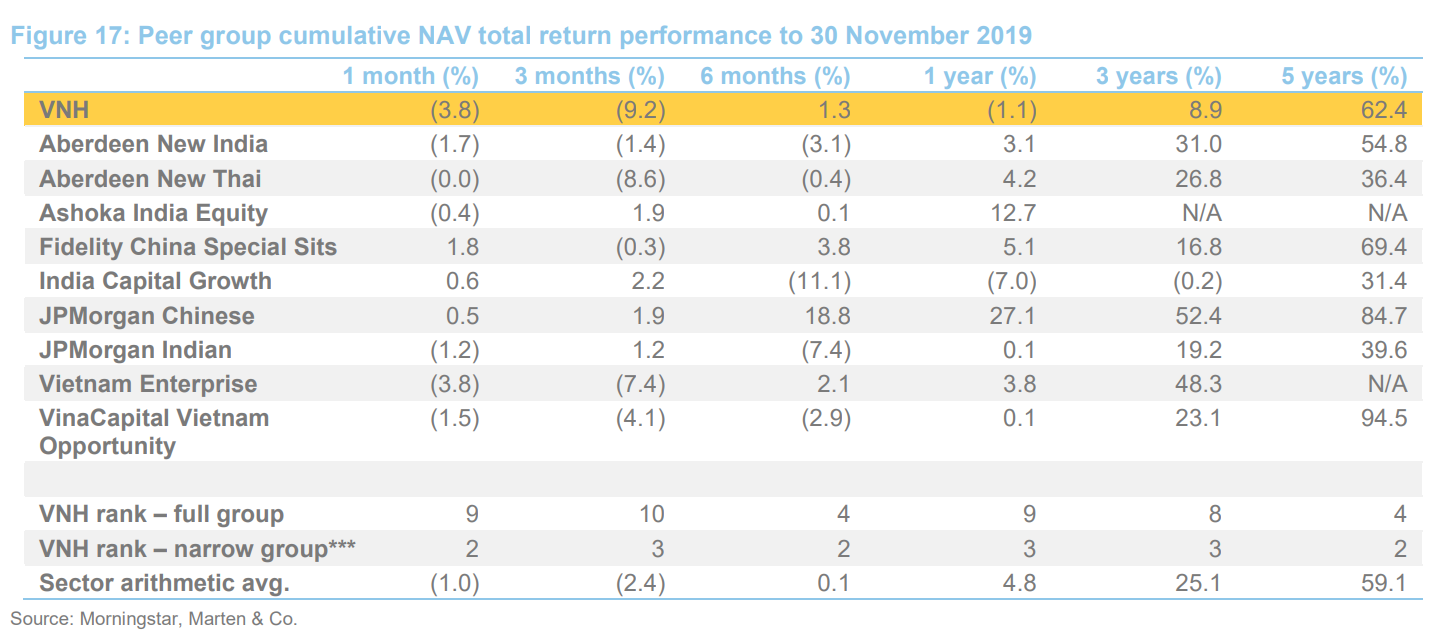

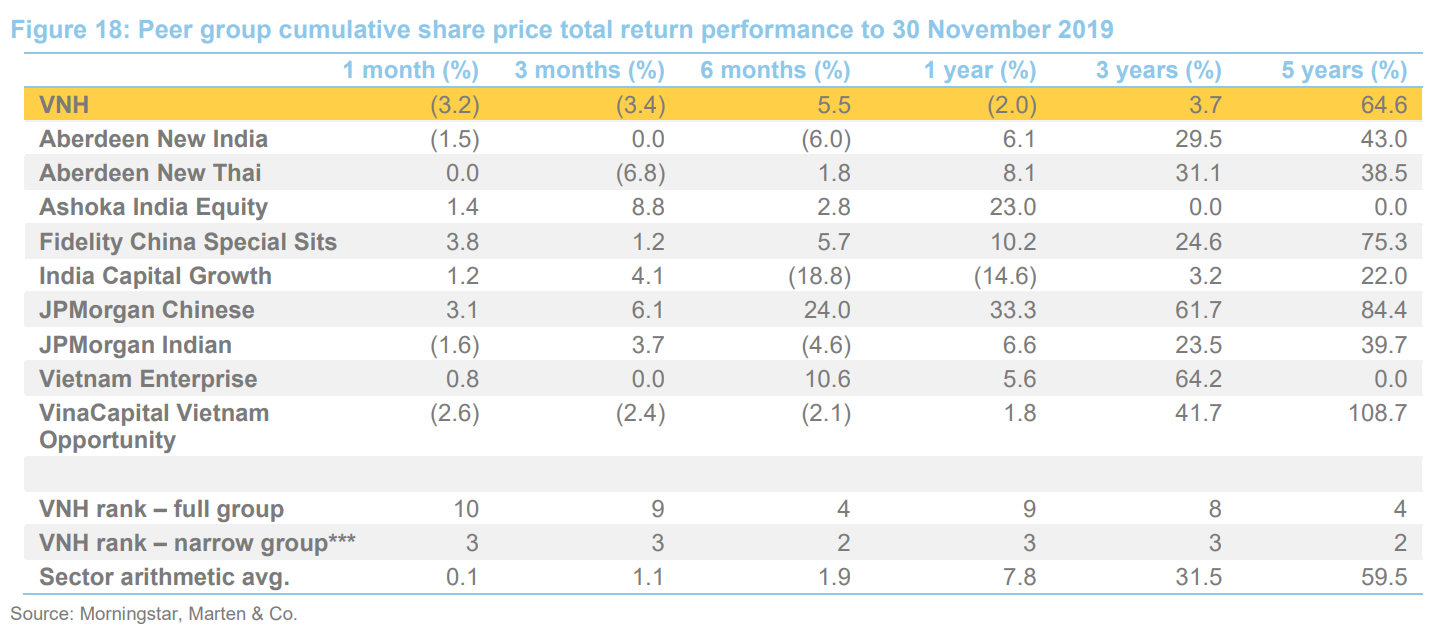

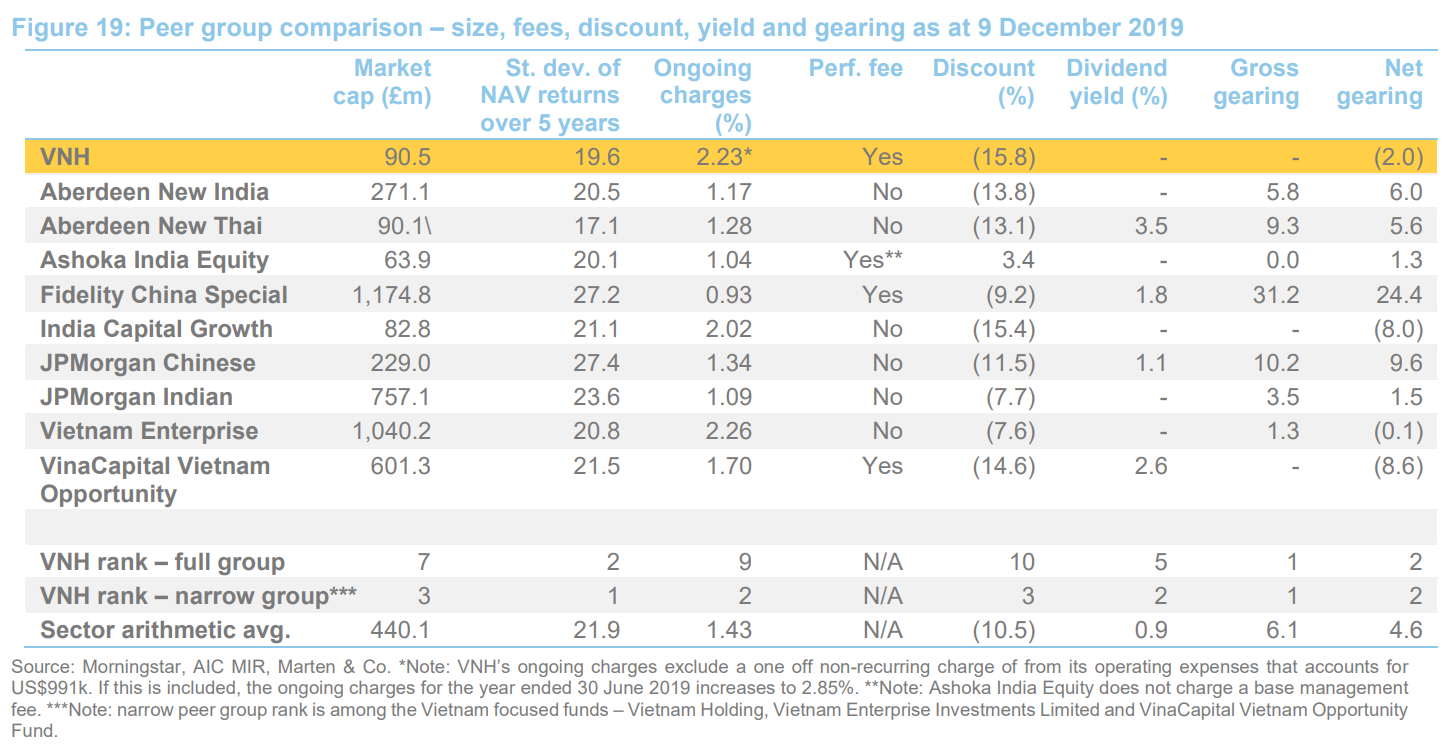

VNH is a member of the Association of Investment Companies (AIC)’s country specialist: Asia-Pacific ex-Japan sector, which comprises 10 members. All of these are illustrated in Figures 17 through 19. However, whilst they are all members of the same peer group, the funds included in this peer group comparison are quite diverse and are imperfect comparators for VNH.

For example, four of the funds are focused on India, two are focused on China and one is focused on Thailand. Including VNH, there are three funds in the peer group that are focused on Vietnam; the others are Vietnam Enterprise Investments (VEIL) and VinaCapital Vietnam Opportunity (VOF). Of these two, VEIL is the closest peer; it is also primarily focused on listed investments with a modest allocation to unquoteds, but it is a significantly larger fund. VOF also invests in listed Vietnamese equities, although this allocation is lower than VNH’s or VEIL’s (63.0% as at 30 October 2019). To reflect these differences, the peer group comparisons in Figures 17 to 19 include rankings for VNH against the wider peer group as well as against these three Vietnam-focused funds.

As illustrated in Figure 17, VNH’s recent NAV total return performance has eaten into its longer-term performance record. However, despite this, it continues to be ahead of the wider peer group over five years. A similar pattern is seen in VNH’s share price total return performance against the peer group.

The volatility of VNH’s NAV returns is the lowest of its Vietnam’s focused peers and, of the wider peer group, it is the second-lowest (only Aberdeen New Thai has lower volatility).

At 2.23%, VNH has the second-highest ongoing charges ratio within its wider peer group, although this places it middle of the pack for the three Vietnamese-focused funds. However, readers may wish to note that this excludes a one-off operating expense that would have otherwise pushed the ongoing charges ratio to 2.85% for the year ended 30 June 2019. The higher than average ongoing charges ratio, does in part reflect its relatively small size. However, it is notable that VNH’s is modestly smaller than VEIL’s, yet VEIL is a significantly larger fund.

As discussed on page 22 in the PDF version, the management contract does allow VNH’s manager to potentially earn a performance fee and, like many funds in the sector, VNH does not pay a yield. In terms of gearing, while VNH is permitted to borrow, the managers have chosen not to and, instead, to maintain a modest cash balance that is sufficient to meet its ongoing cash needs. All of the Vietnam-focused funds are running net cash to some degree, although VinaCapital Vietnam Opportunity is potentially exposed to the largest cash drag.

No dividend – capital growth focused

No dividend – capital growth focused

VNH’s investment objective is to achieve long-term capital growth by focusing on high-growth companies in Vietnam that demonstrate strong ESG principle awareness. VNH does not have a formal dividend policy and has not paid a dividend since its launch. As a Guernsey-domiciled investment company, there is no requirement to pay out a minimum of 85% of its net revenue income that would apply if it was a UK-domiciled investment trust.

VNH’s dividend policy is arguably a reflection of its investment objective and underlying investments. High-growth companies of the type that VNH focuses on frequently retain a high proportion of earnings for reinvestment in the business, rather than returning cash to shareholders. This will tend to mean that dividend income will be a relatively small proportion of the returns that its portfolio generates. During the year ended 30 June 2019, VNH earned dividend income of US$4.6m (2018: US$3.7m), which is equivalent to USc8.04 per share (2018: USc5.26).

Premium/(discount)

Premium/(discount)

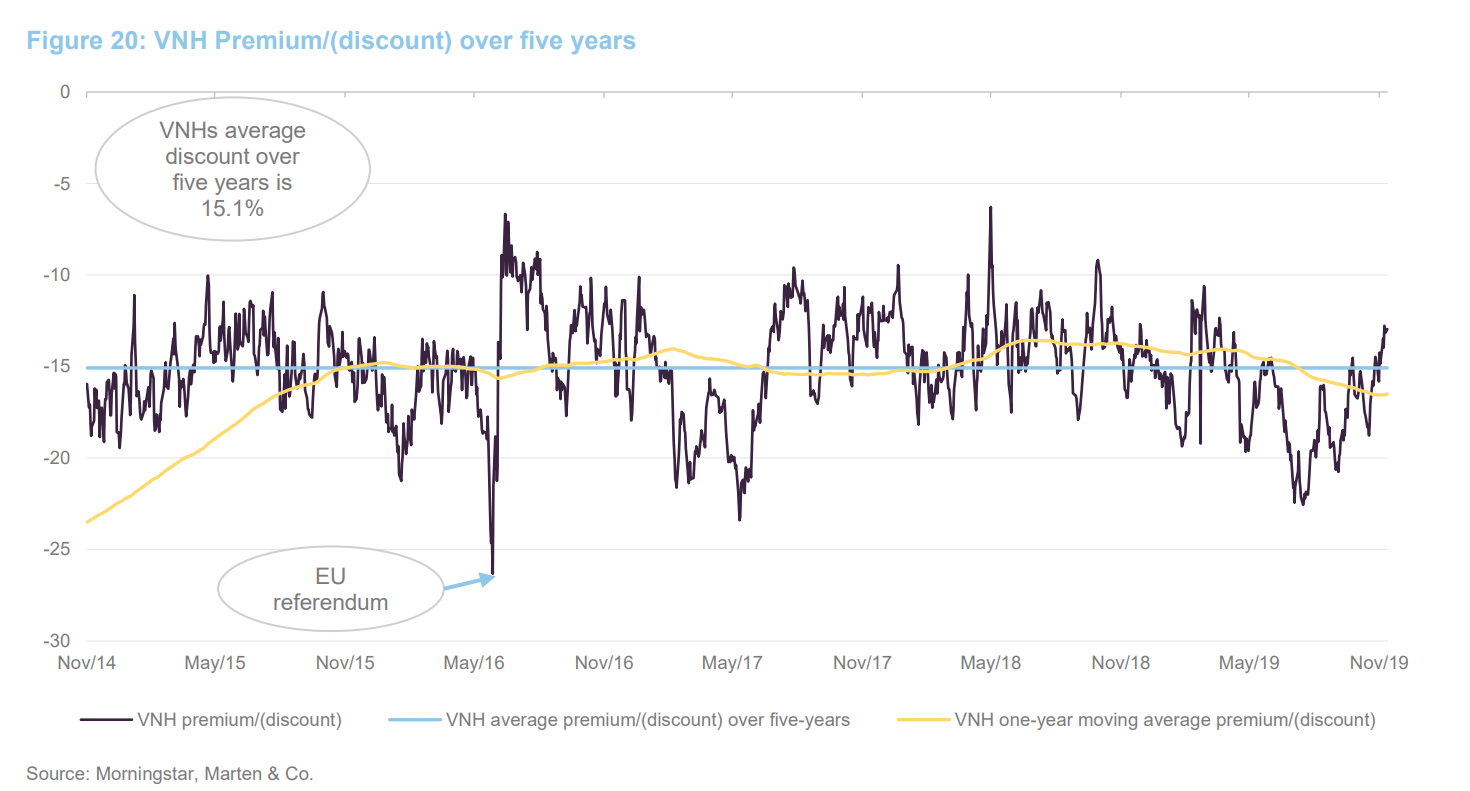

As illustrated in Figure 20, VNH’s discount has exhibited strong mean-reversion tendencies during the last five years. The discount reached its five-year high in the immediate aftermath of the EU referendum, although this quickly reversed and, during the last 12 months, VNH has traded between a discount of 10.6% and a premium of 22.6%, with an average discount of 16.5%.

VNH is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital (these authorities are renewed annually at VNH’s AGM). It also has an active discount control policy that seeks to address the imbalance between the supply of and demand for its ordinary shares. This process is overseen by VNH’s broker, finnCap Ltd, and is monitored by the board. VNH has repurchased 2.92m shares during the last 12 months (equivalent to 5.4% of its issued share capital 12 months ago).

Historically, VNH’s discount has tended to narrow with improving performance and improving sentiment for Vietnam and emerging markets generally. VNH has seen significant changes during the last two years and, whilst they have put the fund on a much stronger footing for the future, this process has likely created periods of short-term uncertainty that have weighed on the discount. With the overhaul now behind it and with greater resources being deployed to raise VNH’s profile amongst investors, it seems reasonable that VNH could move to a structurally tighter discount, particularly if the managers can provide a performance that is attractive to investors.

Fees and costs

Fees and costs

Tiered base management fee starting at 1.5% of net assets per annum and reducing

Tiered base management fee starting at 1.5% of net assets per annum and reducing

Under the terms of the investment management agreement, Dynam Capital is entitled to receive a basic management fee of:

- 5% per annum of net assets up to US$300m;

- 25% per annum for net asset in excess of US$300m up to US$600m; and

- 1% of net assets in excess US$600m.

The management fee is paid monthly in arrears and there is also a performance fee element. The management agreement can be terminated on six months’ notice by either side. The ongoing charges ratio for the year ended 30 June 2019 was 2.23%.

Performance fee

Performance fee

Dynam Capital is also entitled to a performance fee of 12% of any of the outperformance of VNH’s NAV per share above an 8% compound hurdle rate, starting with a high watermark of 30 June 2018.

Where payable, the performance fee is paid 50% in cash and 50% in shares issued at the higher of NAV or closing mid-market price at the financial year end. Half of any such shares are subject to a lock up for a 12-month period, with the remainder subject to a lock-up period of 24 months.

Fund administration and company secretarial services

Fund administration and company secretarial services

Sanne Group (Guernsey) Limited was appointed as VNH’s administrator and company secretary with effect from 7 October 2019 (replacing Carey Commercial Limited, who were appointed when VNH redomiciled to Guernsey). The administrator receives a fee of 0.07% per annum for of net assets up to US$100m and 0.06% per annum for net assets in excess of this. The fee is subject to a monthly minimum of US$5,500. The administration and accounting fees were US$211.7k for the year ended 30 June 2019 (2018: US$140.2k).

Capital structure and life

Capital structure and life

VNH has a simple capital structure with one class of ordinary share in issue. It is also permitted to borrow up to 25% of its net assets, although, in practice, VNH does not have any debt facilities in place and, instead, maintains a small cash balance that is sufficient to meet its operating requirements.

VNH’s ordinary shares have a premium main market listing on the LSE and, as at 9 December 2019, there were 50,968,601 ordinary shares in issue with none held in treasury. VNH also listed on the Official List of The International Stock Exchange on 8 March 2019.

Unlimited life; continuation vote in 2023

Unlimited life; continuation vote in 2023

VNH does not have a fixed winding-up date, but previously, it offered shareholders a continuation vote at every third AGM. However, following the major overhaul that began in September/October 2017, shareholders were asked at the 2018 AGM to approve a resolution for VNH to continue for a further five years, if the company migrated from the Cayman Islands to Guernsey. Shareholders approved the resolution and the migration of the domicile was completed in February 2019. VNH’s next continuation vote is therefore scheduled for the 2023 AGM.

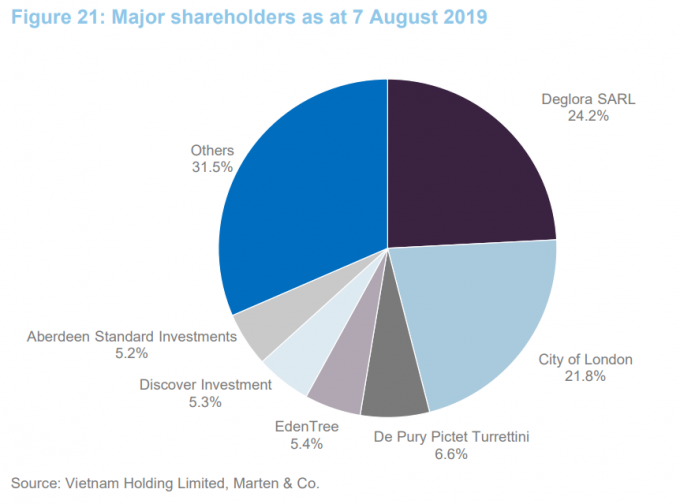

Major shareholders

Major shareholders

Financial calendar

Financial calendar

VNH’s year-end is 30 June. The annual results are usually released in September/October (interims in March) and its AGMs are usually held in October/November of each year.

Management team

Management team

Dynam Capital

Dynam Capital

VNH is managed by Vietnam specialist Dynam Capital. Dynam is a partner-owned business whose sole focus is asset management in Vietnam. Its investment strategy is based on fundamental research, with a strong focus on companies that have a strong commitment to Environmental, Social and Governance (ESG) principles.

Vu Quang Thinh and Craig Martin (see biographies below) are both executive directors and founding partners of Dynam. The manager says that, as a small and collegiate team, it is nimble and focused in its decision making, allowing VNH to be right-sized across the market cap spectrum in Vietnam.

The lead portfolio manager is Nguyen Hoang Thanh (see biography overleaf). He is supported by a portfolio analyst, a data analyst and a trader. Dynam was appointed as VNH’s manager on 16 July 2018. Further information on Dynam Capital Investment process can be found on pages 9 to 12 in the PDF version.

Vu Quang Thinh (chief investment officer and managing director of Dynam Capital)

Vu Quang Thinh (chief investment officer and managing director of Dynam Capital)

Vu Quang Thinh has over 30 years’ business experience. This includes 14 years in asset management, 12 years in corporate restructuring and seven years in an information technology business. He joined Vietnam Holding Asset Management (VNHAM) in 2011 as CEO and, he was appointed to the board of VNHAM in 2014.

Before joining VNHAM, he served as chief executive officer of a local asset management company. Previously, he was managing partner of MCG Management Consulting, which he founded. Prior to this, he was head of the management consulting practice of KMPG Vietnam where he did extensive restructuring work with several state owned enterprises.

Thinh holds an MBA from Washington State University and a BS degree in Mathematical Economics from Hanoi National Economic University. He is a Certified Asset Management Practitioner in Vietnam. As noted on page 9 in the PDF version, he is a founding member and former chairman of the Vietnam Institute of Directors (VIOD).

Craig Martin (chairman of Dynam Capital)

Craig Martin (chairman of Dynam Capital)

Craig Martin has over 25 years investment and fund management experience in emerging markets. He has lived and worked in Southeast Asia since 1993. This includes seven years in Cambodia, five years in Vietnam and 13 years in Singapore.

Until early 2018, Craig was co-CEO of CapAsia, a Singapore headquartered private equity fund manager, focusing on investments in Asia’s emerging markets. He joined CapAsia in 2010, and served on the boards of companies in Thailand, Malaysia, Philippines, Vietnam, Singapore, Indonesia and Pakistan. Prior to CapAsia, Craig was head of private equity for Prudential Vietnam (now Eastspring), and he was previously part of the founding management team at Standard Chartered Private Equity.

Craig has a Masters degree in Engineering from the University of York and a MBA with Distinction from INSEAD. He is also a member of the Singapore Institute of Directors. Craig is also a non-executive director of several private companies.

Nguyen Hoang Thanh (portfolio manager)

Nguyen Hoang Thanh (portfolio manager)

Nguyen Hoang Thanh has nearly 10 years of experience in the banking and finance industry in Vietnam, including seven years in asset management and more than two years in the banking industry. He started his career at LienVietPostBank, as a corporate banking officer, before joining Vietnam Holding Asset Management in 2011 as an analyst (he was then promoted to manager in 2014). Thanh then spent one year at Dragon Capital as a senior banking analyst and, in late 2017, he worked at Pavo Capital as a Senior Investment Manager covering IPOs and pre-listing investment opportunities. He holds a Masters degree from Clark University, Massachusetts, and a BA in Finance from Can Tho University, Vietnam. He is also a CFA charterholder.

Board

Board

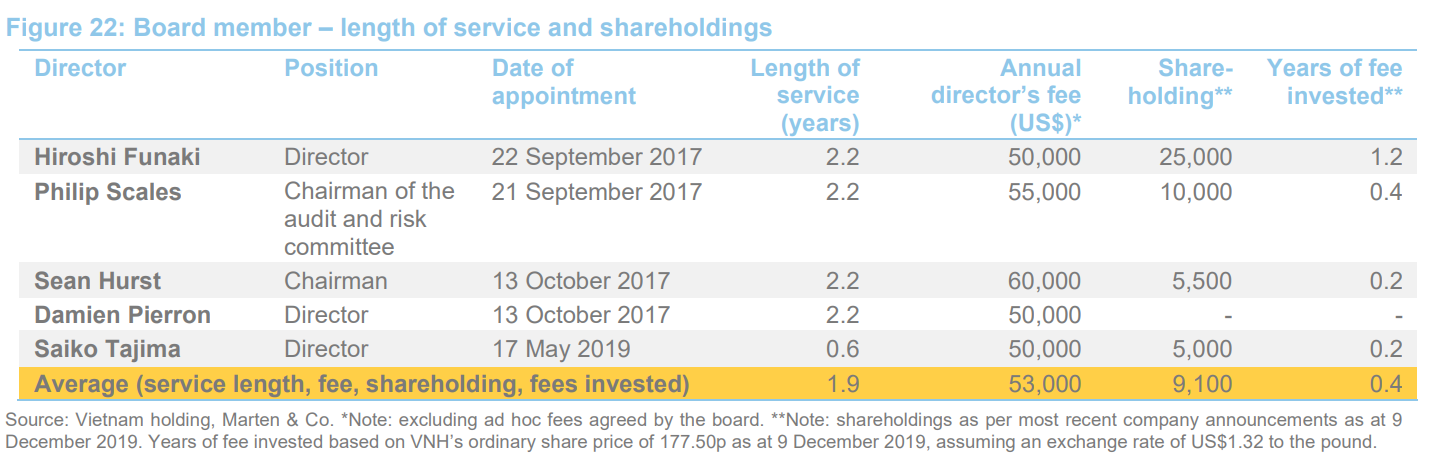

VNH’s board is comprised of five directors, all of whom are non-executive and considered to be independent of the investment manager. Other than VNH’s board, its directors do not have any other shared directorships.

As part of the major changes that were made in September/October 2017, VNH’s board underwent a complete refresh. This saw four of the current board appointed within a two-month period. A fifth director, Milton Lawson, was also appointed at this time. However, Milton resigned from VNH’s board with effect from 31 October 2018 and Saiko Tajima was appointed in May 2019 in his stead, thereby keeping the number of directors at five. As a consequence of these developments, VNH has a relatively young board with an average length of service of just 1.9 years.

Board policy is that all of VNH’s board members retire and offer themselves for re-election annually. VNH has adopted a formal policy that neither the Chairman nor any other director shall serve for more than nine years. VNH’s articles of incorporation limit the aggregate directors’ fees to a maximum of US$350k per annum. VNH has no bonus schemes, pension schemes, share option or other long-term incentive schemes in place for its directors.

Hiroshi Funaki (chairman)

Hiroshi Funaki (chairman)

Hiroshi Funaki has been actively involved in raising, researching and trading Vietnam funds for 23 years. Previously, he worked at Edmond de Rothschild Securities (between 2000 and 2015) where he led the Investment Companies team, focusing on Emerging Markets and Alternative Assets. Prior to that, he was head of research at Robert Fleming Securities, also specialising in closed-end funds. Hiroshi currently acts as a consultant to a number of emerging market investors. He has a BA in Mathematics and Philosophy from Oxford University, and is a UK resident.

Hiroshi became chairman at the conclusion of this year’s AGM on 8 November 2019. Hiroshi has taken over the position from Sean Hurst, who remains a director.

Philip Scales (chairman of the audit and risk committee)

Philip Scales (chairman of the audit and risk committee)

Philip Scales has over 40 years’ experience working in offshore corporate, trust, and third-party administration. For 18 years, he was managing director of Barings Isle of Man (subsequently to become Northern Trust), where he specialised in establishing offshore fund structures, latterly in the closed-ended arena (both listed and unlisted entities).

He subsequently co-founded IOMA Fund and Investment Management Limited (now named FIM Capital Limited), where he is deputy chairman. Philip is a Fellow of the Institute of Chartered Secretaries and Administrators, and holds a number of directorships of listed companies and collective investment schemes. He is an Isle of Man resident.

Sean Hurst (director)

Sean Hurst (director)

Sean Hurst was co-founder, director and chief investment officer of Albion Asset Management, a French regulated asset management company, from 2005–2009. He is an experienced multi-jurisdictional director, including roles at Main Market and AIM traded funds and numerous offshore and UCITS funds. In addition to advising companies on launching both offshore and onshore investment funds, he is currently non-executive chairman of JPEL Private Equity Ltd and a non-executive director at CIAM Opportunities Fund and Satellite Event Driven UCITS Fund. Sean was formerly a non-executive director of AIM listed ARC Capital Holdings Ltd. He holds an MBA in Finance from CASS Business School in London and is a resident of France.

Damien Pierron (director)

Damien Pierron (director)

Damien Pierron is currently managing director at Société Générale in Dubai, where he heads the coverage for Family Offices and Wealthy Families in Middle East and Russia. He has 15 years’ experience in M&A, private equity, equity derivatives, wealth management and investment banking gained at, among others, Lafarge Holcim, OC&C Strategy Consultants and Natixis. Damien is a CFA charterholder and holds a Degree in Mathematics, Physics and Economy from Ecole Polytechnique in Paris. He also holds a Masters Degree in Quantitative Innovation from Ecole Nationale Superieure des Mines de Paris. He is a Dubai resident.

Saiko Tajima (director)

Saiko Tajima (director)

Saiko Tajima has over 20 years’ experience in finance, of which eight years have been spent in Asian real estate asset management and structured finance. She has worked for Aozora Bank and group companies of both Lehman Brothers and Capmark, where she focused on financial analysis, monitoring and reporting to lenders, borrowers, auditors, regulators and rating agencies. Over the last five years, she has invested in and helped develop tech start-ups in Tokyo, Seoul and Sydney.

The legal bit

The legal bit

This marketing communication has been prepared for VietNam Holding Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.