First quarter of 2024

Investment Companies | Quarterly roundup | April 2023

Kindly sponsored by abrdn

Equity rally belies difficult quarter for sector

2024 started on strong footing, with global equities (as measured by the MSCI All Countries World Index) rallying 9.2% over the first three months (in sterling terms). However, while there some standouts in the emerging world, global equity returns were overwhelmingly driven by developed market companies.

Inflation and interest rate expectations were once again a major influence on returns. Bond yields rose over the first quarter. There was, until recently, a general consensus that inflation was back under control; at the start of the year, the market was pricing in several interest rates cuts. These dovish expectations wilted over the quarter though, on the back of strong US economic data and inflationary pressures from a strong oil price and increased shipping costs. That encouraged a rally in the gold price.

Europe was a beneficiary of the improvement in rate expectations, as its recent 2.4% annual inflation figure is both lower than that of the US and the UK, as well as approaching the ECB’s target.

The other story which drove markets was the ongoing fervour around AI. While AI seems to have almost limitless potential, the reality is that there relatively few listed equities which are currently viewed as direct beneficiaries. While many of the big tech firms did benefit, it is the ‘picks and shovel’ trade that seems to have performed best, given the rally in semiconductor makers and ancillary services.

Despite the disappointment on US rate cuts, its strong economic growth, coupled with the AI rally, kept its markets well into the black. The UK unfortunately was once again a laggard.

New research

So far in Q1, we have published notes on: Chrysalis Investments, Gulf Investment Fund, GCP Infrastructure, Ecofin Global Utilities and Infrastructure, JPMorgan Japanese Investment Trust, Urban Logistics REIT, Polar Capital Technology, NextEnergy Solar Fund, Aquila European Renewables, Pantheon Infrastructure Trust, Polar Capital Global Healthcare, AVI Japan Opportunity, Tritax EuroBox, abrdn Private Equity Opportunities, Oakley Capital Investments, Temple Bar Investment Trust, BlackRock Throgmorton, and Edinburgh Worldwide.

At a glance

Winners and losers

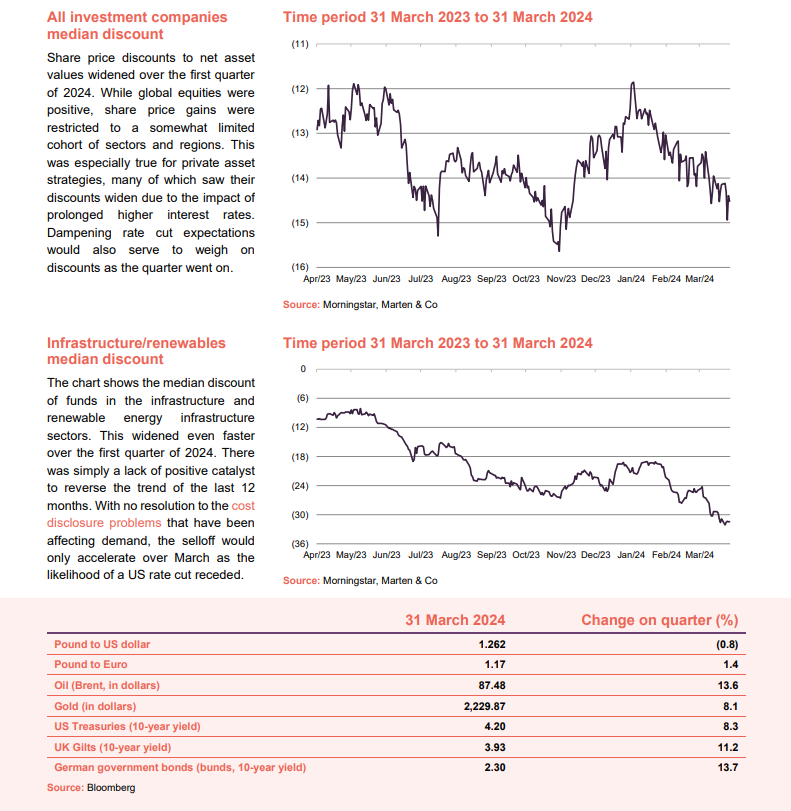

Thanks to the global equity rally that we saw over the start of 2024, NAVs grew by a median of 1.8%. Discounts, however, widened slightly from a median of 12.6% at the end of the fourth quarter of 2023 to 14.5% at the end of the first quarter of 2024.

By sector

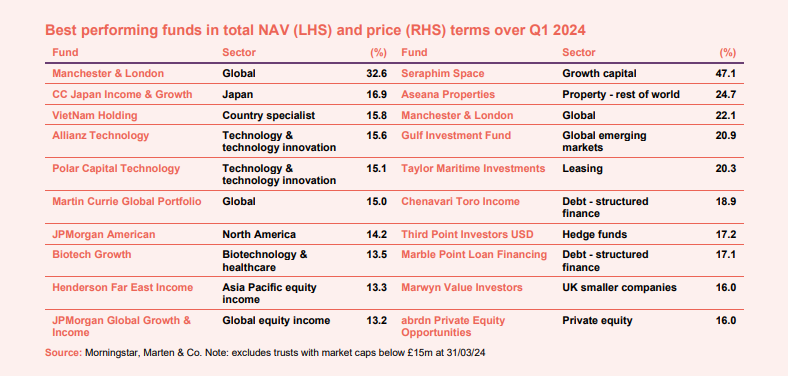

The impact of the AI opportunity can be seen in the performance of the Technology & Technology Innovation sector, which is dominated by Allianz Technology Trust (ATT) and Polar Capital Technology (PCT).

The good run in Japanese equities over 2023 continued into 2024. The MSCI Japan Index rose by 12% in sterling terms. Incredibly, yen returns were even higher at 19% but, once again, the yen was weak. Corporate governance reforms are a big factor in the market’s decent performance. So too are signs of life in the economy.

Large cap stocks drove the US and European markets higher and that fed through into the returns of the global trusts.

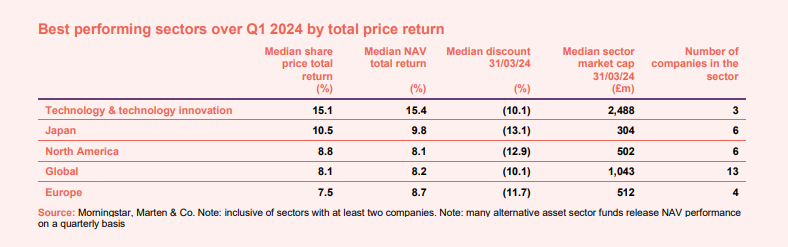

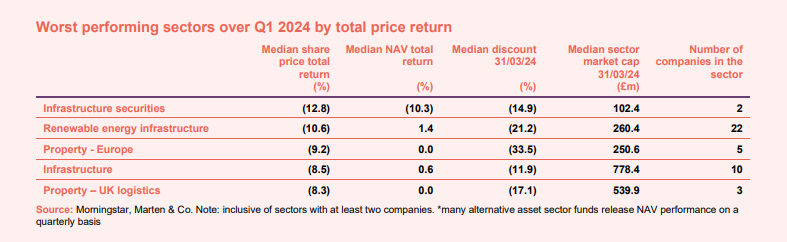

The primary cause of the woes of the worst-performing sectors can be laid squarely at the disappointment on the pace of interest rate cuts/rising bond yields. Each of these sectors is sensitive to moves in interest rates. The scale of the share price moves was far greater than might reasonably have been expected, however (as is evidenced by the much more modest NAV moves). It seems likely that these are also some of the sectors that have been worst affected by the buyers’ strike associated with the cost disclosure issues plaguing the sector.

Top 10 performers by fund

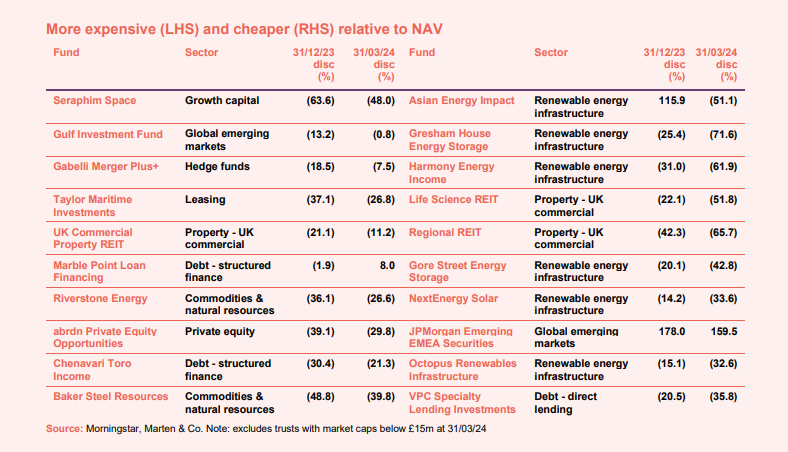

In NAV terms, most of the top performing trusts can be attributed to the tailwinds that we highlighted previously. Manchester & London (MNL), with its highly concentrated portfolio, had the highest exposure to the AI rally of any investment trust, with roughly half of its portfolio being investing into Microsoft and Nvidia, two major winners of the recent rally. Allianz Technology, Polar Capital Technology, and even Martin Currie Global Portfolio (MNP) also benefitted from this phenomenon.

CC Japan Income & Growth (CCJI) was the best-performing of the Japanese funds over the quarter. VietNam Holding (VNH) was the standout performer within the rest of Asia, driven by good stock selection within that market. Henderson Far East Income had a very strong month in February, helped by its exposures to the tech sector in Taiwan and South Korea.

Special mention is due to two JPMorgan funds – JPMorgan American and JPMorgan Global Growth and Income, both of which beat benchmarks over the quarter.

Buoyed by positive stock selection, Biotech Growth Trust (BIOG) rode a recovery in the biotech sector and benefited from several of its holdings being taken over during the period.

Manchester and London is the only trust to feature in both the NAV and share price lists, but its share price did not keep pace with the soaring NAV. Seraphim Space was helped by some positive press comment that highlighted the extreme discount to NAV that the shares entered 2024 with.

Aseana Properties (ASPL) provided an update on both its asset sales and legal action. ASPL announced that it has reached a settlement with Ireka Corporation Berhad, the parent company of its former development manager, for non-payment of previous debts owed to ASPL. ASPL also provided a positive update on its sale of Sandakan Assets.

Gulf Investment Fund (GIF) saw its share price rebound after being sold off in the fourth quarter of 2023 on the back of the outbreak of the increased conflict in the Middle East. GIF continued to generate positive, benchmark beating returns over the quarter, up 4.6% in NAV terms.

Taylor Maritime Investments’ (TMI) share price rose in March as the conflict in the Middle East disrupted traffic through the Red Sea, contributing to a rise in charter rates for TMI’s vessels.

High-yielding structured debt funds Chenavari Toro Income (TORO) and Marble Point Loan Financing (MPLF) saw their discounts narrow over the quarter. It may be that the robust US economy reassured investors that these funds were not about to suffer from higher rates of debt defaults within their portfolios.

Third Point Investors (TPOU)’s discount narrowed on decent NAV returns, up 9.6% over the quarter; ongoing share buybacks; and the prospect (since realised) of a discount triggered tender offer.

There was also no specific new surrounding Marwyn Value Investors (MVI), rather its share price likely reflects the rebound from the historically wide 54% discount the trust traded on at the start of the year.

abrdn Private Equity Opportunities (APEO) benefited from its share buyback scheme, which it implemented in 2023 following a partial realisation of its largest holding.

Worst 10 performers by fund

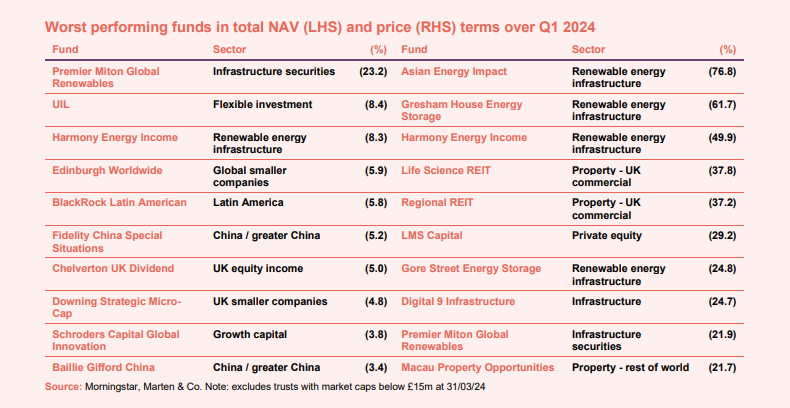

The worst performing funds in NAV terms largely reflected the headwinds we outlined earlier. However, barring this small group of funds, the overall NAV performance of the investment trust universe was strong in the first quarter, with only one trust reporting double digit NAV losses.

Moves in the valuation of Premier Miton Global Renewables’ portfolio are amplified by the gearing provided by its zero dividend preference shares. In the case of UIL, its NAV fall was the result of one of its largest underlying holdings, Resimac, falling by 13% over the month due to investors taking profits in the company after a strong rally in 2023.

Harmony Energy Income reported that weaker than expected revenues from its UK battery storage plants had impacted on its NAV (more on this later).

Edinburgh Worldwide (EDIN), with its focus on high growth small caps, has a heightened sensitivity to market sentiment. The disappointments on rate cuts hit it hard. The same headwinds also impacted Schroders Capital Global Innovation Trust, which also focuses on small, rapidly growing companies.

Investors retained their negative outlook on China, with the MSCI China returning only 1% over the quarter. Fidelity China Special Situations’ (FCSS) performance reflected this, compounded by its bias to smaller companies. Baillie Gifford China was similarly afflicted.

While there have been some bright spots within the UK sectors, the performance of Chelverton UK Dividend (SDV) and Downing Strategic Micro-Cap (DSM) reflect the ongoing pain the overall UK equity market has endured and the particular antipathy towards small cap. The MSCI UK Value and Small cap indices rose by 2.8% and 2.2% over the quarter, respectively, but stock specific issues led to underperformance.

As rate cut hopes dissipated, interest rate sensitive sectors such as infrastructure and property dominated the worst performers.

Asian Energy Impact (AEIT), previously Thomas Lloyd Energy Impact, finally resumed trading this quarter, having been forced to suspend its trading for 12 months following the discovery of problems in an Indian solar plant by its previous manager. As soon as they were able, many investors rushed for the exit. The trust has since announced that it will pursue a managed wind down.

The three battery storage funds were hit hard as they revealed that revenues from their UK activities were much below expectations following issues with getting the National Grid ESO to use batteries in its grid-balancing activities. That spelled dividend cuts for Gresham House Energy Storage and Harmony Energy Income, but Gore Street Energy Storage is cushioned by its exposure to Irish, German and American battery storage.

Life Science REIT cut its dividend, blaming macroeconomic uncertainty. Regional REIT has been forced to shore up its balance sheet with a deeply discounted rights issue.

LMS Capital (LMS) is tiny, with a mere £17m market cap at the end of March and so barely meets our cut-off for inclusion. It has an investment in Brockton Capital Fund I. Receivers were appointed to Brockton’s “Super Prime” residential development in Mayfair.

Digital 9 Infrastructure (DGI9) saw its shares sell off after it announced that regional regulators were reviewing its announced sale of Verne Global, the proceeds of which were earmarked to clear repay its outstanding debt. The deal was eventually approved and completed during the quarter, however its shares have yet to re-rate, despite the trust now being in a managed wind-down.

Significant moves in discounts and premiums

Getting more expensive

We have covered the movements in NAV and share price for most of the above funds previously. However, in the case of Gabelli Merger Plus+, its shares rallied relative to its NAV after repurchasing shares owned by minority investors. Riverstone Energy was likely due to the implementation of its tender offer. While UK Commercial Property REIT was due to the announcement that Tritax Big Box was launching a bid for the trust.

Getting cheaper

We have covered many of these already. We cannot rationalise why NextEnergy Solar is on this list. It reiterated its commitment to its capital recycling programme, saw good progress within its portfolio and continued to pay dividend in line with target.

Money raised and returned New trust launches and wind ups

The first quarter of 2024 saw another period in which wind ups, mergers and takeovers outpaced new launches, further shrinking the universe. Eight trusts disappeared, with the majority of these being merged with others in order to create more viable funds. No new trusts were launched over the quarter.

The full list of trusts that we lost is:

- abrdn China Investment – merged into Fidelity China Special Situations

- Ediston Property – portfolio sold to a US REIT and the company liquidated in January

- Henderson Diversified Income – merged into Henderson High Income

- JPMorgan Mid Cap – merged into JPMorgan UK Smaller Companies to become JPMorgan UK Small Cap Growth and Income

- JPMorgan Multi-Asset Growth & Income – merged into JPMorgan Global Growth and Income,

- LXI REIT – merged into LondonMetric Property

- Pollen Street – rejig of capital structure and reclassification as a trading company

- Troy Income & Growth – merged into STS Global Income and Growth

We should also note that RTW Biotech Opportunities absorbed Arix Biosciences, adding about £184m to its market cap.

Money coming in

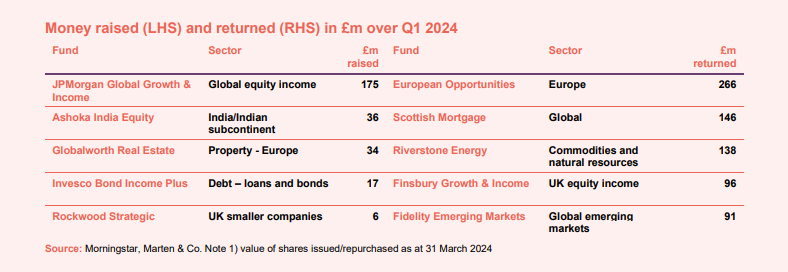

In addition to mopping up JPMorgan Multi Assets Growth and Income, JPMorgan Global Growth and Income continued to expand through regular share issuance. Good performance and a fair wind from a strong economy helped generate demand for Ashoka India Equity. Globalworth Real Estate issued shares to satisfy its stock-based compensation plan despite trading at a significant discount. Persistent higher interest rates helped stimulate demand for Invesco Bond Income Plus. Last year’s good performance helped Rockwood Strategic re-expand.

Money going out

European Opportunities Trust (EOT) returned capital through an oversubscribed tender offer. Scottish Mortgage (SMT) announced an impressive sounding £1bn share buyback programme, although – as we pointed out – this is well short of the maximum that it already has permission from shareholders to execute. Riverstone Energy returned significant capital to shareholders with the help of a tender offer. Finsbury Growth & Income continued its buybacks over the quarter to defend its discount. Fidelity Emerging Markets announced the completion of a tender offer equal to 14.99% of its outstanding shares.

Major news stories over Q1 2024

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled.

Interviews

Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest discussing a particular investment company.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in any of the securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.