Looking way beyond the now

It is now just over three years since Baillie Gifford, a house famed for its growth investment strategies, took over the management of Baillie Gifford UK Growth Trust (BGUK). This move has paid off with absolute and relative performance versus peers improving dramatically, while a marked discount was, until recently, eliminated. BGUK offers investors the best ideas from Baillie Gifford’s UK equities team. Its managers are stock pickers, with a long-term (five-to-10-year) view, whose portfolios are managed with a consistent philosophy, allowing them to look through short-term market noise. While markets fret about the risk of new COVID variants, BGUK’s managers are excited about the innovation and prospects they see for their portfolio companies. Today’s discount opportunity could prove short-lived.

Focused portfolio of UK growth equities

BGUK aims to achieve capital growth by investing in a concentrated portfolio (35–65 holdings) of UK equities, with the aim of providing a total return in excess of the FTSE All-Share Index. The portfolio will predominantly comprise constituents of the FTSE 350 Index, but where appropriate, it may also include convertible securities, and equity-related derivatives for efficient portfolio management purposes. BGUK may also invest up to 10% of its total assets in unlisted investment opportunities.

Fund profile

Focused UK growth equities portfolio

BGUK aims to achieve capital growth by investing in a concentrated portfolio of UK equities, with the aim of providing a total return in excess of the FTSE All-Share Index. The company invests in a relatively concentrated portfolio of between 35 and 65 stocks, the majority of which are constituents of the FTSE 350 Index.

The managers take a stock-picking approach and the size of individual stock holdings depends on the managers’ degree of conviction, not the stock’s weight in any index. BGUK may, if appropriate, use convertible securities, and equity-related derivatives for efficient portfolio management purposes.

Baillie Gifford took over the management of BGUK’s portfolio at the end of June 2018 and has been managing this for just over three years now. While BGUK has been an investment trust since its launch in 1994, its name was changed in May 2021 to explicitly include the word trust. This was done to clarify that BGUK is an investment trust and therefore has all the advantages of a closed-end structure over an open-ended fund.

About the managers

Baillie Gifford has 130 investors/analysts, spread across 21 teams, most of whom are based in its Edinburgh office. It is structured as a partnership and encourages a collegiate approach to managing money, although it allows its portfolio managers the freedom to have the final say about their portfolios. It managed or advised on about £352bn at the end of June 2021, of which £20bn was invested in UK equities. BGUK is co-managed by Iain McCombie and Milena Mileva (brief biographies of the managers can be found below).

Constructed without reference to a benchmark

BGUK’s benchmark is the FTSE All-Share Index, although the portfolio is not constructed with reference to this or any other benchmark index. We have substituted MSCI UK Index for the All-Share in this report and have also included comparisons against the MSCI UK Growth Index and the MSCI World Index.

Managers’ view

BGUK’s portfolio is managed bottom-up with a long-term view. Long-term macro-economic considerations are explicitly taken into account, as part of the managers’ stock analysis, but the investment process seeks to deliberately set aside short-term noise from a shifting macro-economic sentiment. As a result, the near-term macro tends to be less important to BGUK’s strategy and its presentations and results do not tend to dwell on these. However, the managers are looking for companies that have a number of key attributes and so, whilst they are not thematic investors per se, there are a number of themes that can be seen within the portfolio. Specifically, they like tech generators or tech enabled companies, as well as companies that are R&D driven, as they believe that significant value can be created with innovation. Growth financials are a significant part of the portfolio, reflecting the strong secular growth opportunities available here (for example, with an ageing population, the move away from defined-benefit pensions schemes and the trend towards self-investment).

Key portfolio areas are as follows (figures as at 30 April 2021):

- Growth financials (24.4%) – Hargreaves Lansdown, Legal & General, AJ Bell, Hiscox, St James’s Place, Helical, Prudential, IG Group, Lancashire Holdings, Just Group and Integra Fin.

- Market share gainers (18.3%) – Ashtead, Bunzl, 4imprint, HomeServe, Inchcape, Volution Group and Howden Joinery.

- R&D innovators (12.7%) – Genus, Abcam, Creo Medical and Renishaw.

- The digital consumer (12.6%) – Rightmove, Boohoo.com, Farfetch, Auto Trade, Just Eat and takeaway.com.

- The digital enterprise (6.7%) – Draper Esprit, FDM and First Derivatives.

- Niche industrials (9.5%) – James Fisher and Sons, Bodycote, Ultra Electronics, Halma, Victrex and PageGroup.

- Powerful brands (8.0%) – Diageo, Burberry and Games Workshop.

- Data, data everywhere (4.9%) – RELX, Experian and Euromoney II.

- Commodities (2.5%) – Rio Tinto.

The allocation to Rio Tinto warrants a brief mention. The managers say that the company has a diversified portfolio of high-quality assets with key strengths in iron ore, copper and aluminium. They believe that the growing demand for these materials – both to build renewable infrastructure required for the transition into a low carbon economy and from a further boost from fiscal stimulus-led infrastructure spending – combined with constrained supply growth, will result in improved pricing. This should allow Rio Tinto to generate very attractive returns for shareholders in the future.

Unlisted opportunities

At its AGM on 5 August 2021, shareholders approved proposals to allow the trust to invest up to 10% of BGUK’s total assets (at the time of investment) in private companies. Any private investment needs to have a market valuation in the region of £500m or more, whilst offering something that cannot be accessed in the listed space at the time of investment. BGUK’s managers say that they are generally interesting opportunities in the late-stage private market and that the trust’s closed-end structure is well suited to investing in these.

The managers highlight that there has been a trend of companies staying private for longer (they cite the recent IPO of Wise as a company that previously might have come to market sooner, in their view) and believe that the new authorisation will allow them to get exposure to such opportunities earlier and at potentially more competitive prices. Consequently, while they are not in a rush to deploy cash into private investments, they expect the new authorisation to be value-accretive over time. Private investments will be subject to the same bottom-up analysis and debate that is applied to the trust’s listed investments (see below). It is noteworthy that over the past couple of years, Baillie Gifford has assessed over a thousand private companies, approximately 180 of which were UK businesses. Of these 180, clients of Baillie Gifford invested in eight names across a number of different sectors; two of these have subsequently listed and one has been subject to a takeover. Whilst BGUK is able to purchase secondary positions, it is expected that most investments will be acquired as part of funding rounds.

Investment philosophy and process

The underlying approach

Baillie Gifford believes that markets are inefficient at pricing long-term growth, especially over a time horizon of at least three years, and that this creates an opportunity to generate alpha. For this reason, it aims to encourage a culture of long-term thinking within the firm. Baillie Gifford believes that there is persistence of good company management, business models and stock prices. This translates into a culture of ‘sticking with the winners’.

Three-stage team-based approach

As an investment house, Baillie Gifford has a strong emphasis on using a team-based approach, as it believes that teams make better decisions than individuals. Integral to this is a culture of debate, with a challenge-driven mentality across the firm. Baillie Gifford could be considered as effectively being made up of a small number of investment teams with different strategies. The UK equities team uses a consistent three-stage approach that comprises:

- discovery;

- debate; and

- decision.

There are three lead managers on the team: Gerard Callahan (the head of the team), as well as Iain McCombie and Milena Mileva (BGUK’s co-managers). The team also has a senior analyst, as well as a number of graduates from the company’s graduate programme (these rotate every 12 months). The team also has a senior sustainability analyst, Anne Stewart, who works across the firm, but is embedded within the UK team’s investment framework.

Stage 1 – Discovery

This is the idea-generation part of the process. Every six weeks the team has their prospects meeting, which sets the research agenda for the following six weeks (the UK stock universe is 500+ stocks and the team has a priority list of around 200 companies). Baillie Gifford holds the view that is important for both portfolio managers and analysts to carve out time to do their own research. This is part of their objectives and helps to keep them accountable for their investment decisions (as discussed below, while there is considerable debate around stocks, the lead portfolio manager makes the final decision).

For the prospect meeting, team members bring along ‘half-formed’ ideas to discuss (an analyst or PM may have seen something that has caught their eye and open it up to the wider group). The discussion is open-minded and constructive. Baillie Gifford does not believe in coverage for the sake of having coverage. For example, even if a stock is large, the team will not cover it if there is no expectation of ever wanting to invest in it. That’s not to say that team does not keep an eye on the broader market; they will look at such stocks when looking at the competitive landscape, for example.

In the discovery stage, the team can draw on external research providers and other in-house teams, but Baillie Gifford tries to encourage analysts to hunt for new ideas. They are encouraged to follow their enthusiasms and look at things they are drawn to and are excited about. This frees the analysts, who are all generalists, allowing them to get a broader perspective. It is noteworthy that the analysts are not divided along sector lines and there is no concept of ‘maintenance research’ at Baillie Gifford. When the team is talking to companies, the conversations with their management teams focus on the long-term prospects of the business.

Iain and Milena are able to draw on the resources of the whole investment team when analysing companies, and can sit in on meetings with companies outside their geographic remit. This is especially beneficial when Iain is trying to identify how his companies compare with competitors domiciled in other markets.

Stage 2 – Debate

The debate stage is the most important stage of the investment process. It is structured around a concise investment note which, for the UK equities team, is limited to a maximum of three pages, to keep the arguments focused with a clear recommendation at the end (there is, however, no limit on the number of supporting pages that can be attached to the back of the note). Notes are structured around Baillie Gifford’s five-question framework:

- Edge – why is a stock interesting? This focuses on the industry background, company-specific factors, competitive position and key issues pertinent to the investment case.

- Growth – what will it look like in five years? This focuses on sales, profit margins and the capital allocation.

- Sustainability – what are the governance and sustainability considerations not considered elsewhere in the report? This focuses on management alignment, board structures and sustainable business practices.

- Valuation – should we own it? This focuses on the company’s valuation, the reasons why a company should trade well, and the likely valuation in five years and beyond.

- Discipline – What would make us sell? This focuses on the key risks and any non-negotiables of the investment case.

In addition, another member of the team will be appointed to play the role of devil’s advocate ahead of the discussion. The purpose of this is to uncover assumptions and challenge these so that ultimately a superior recommendation can be reached. The head of the UK equities team, Gerard Callahan, takes detailed minutes of these discussions, which provide an anchor for the team for future discussions. Specifically, Gerard’s notes record the risks identified around a stock as well as the reasons for selling. This is important, as it acts as a barrier to analysts and portfolio managers from shifting the goal posts on stocks over time, forcing them to retain their objectivity.

Stage 3 – Decision

In terms of portfolio construction, while the team actively discusses all of the stocks, the final decision as to what enters the portfolio is down to the lead manager, or managers of the respective portfolios. This is designed to give individual accountability on top of the team discussion.

Self discipline

In terms of sales, loss of faith in a company’s management is an instant trigger for a sale. The managers also sell if they feel that a business model is not working, or if the market has caught up with their expectations for a company.

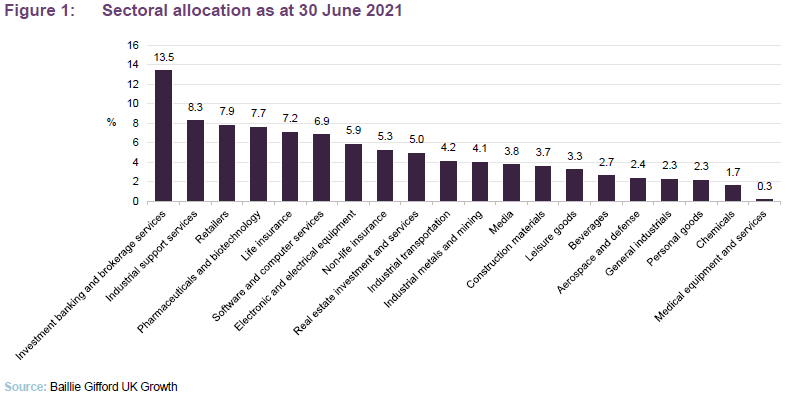

Asset allocation

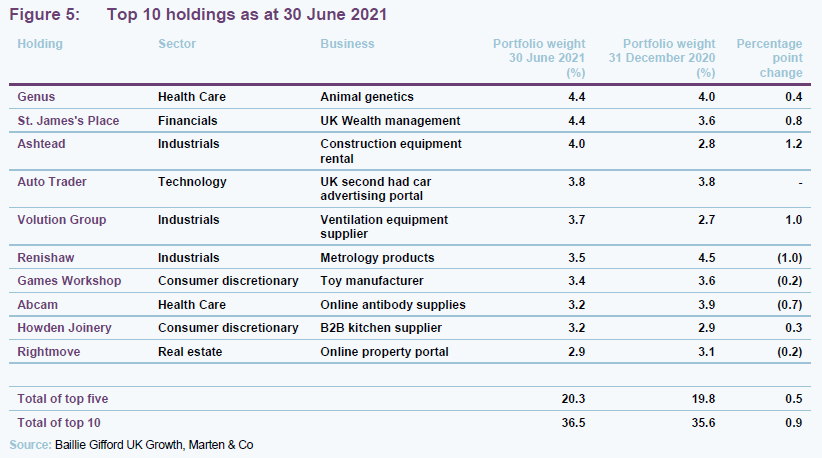

As at 30 June 2021, BGUK’s portfolio had 44 holdings, an increase of one over the previous six months. As illustrated in Figure 5, the portfolio is reasonably concentrated with the top 10 issues accounting for 36.5% of BGUK’s total assets as at 30 June 2021; an increase of 0.9 percentage points over the previous six months.

Figure 1 provides a breakdown of the portfolio by sector as at the end of June 2021 and illustrates the diverse nature of the investment ideas within the portfolio. It should be remembered that whilst this provides a useful illustration, the allocations are a result of the managers’ stock selection decisions and will change based on these, rather than big macro views. As should be expected of a concentrated growth portfolio such as this, which is not managed with respect to a benchmark, there are large chunks of the market to which BGUK offers no exposure.

Reflecting the long-term approach that the managers follow, portfolio turnover tends to be very low (around 3% for the last financial year) and so the evolution of the portfolio’s sector allocation will also likely be slow-paced. Unsurprisingly, given the managers’ focus on maintaining a focused portfolio of individual growth ideas, the active share will tend to be high (currently around 85%).

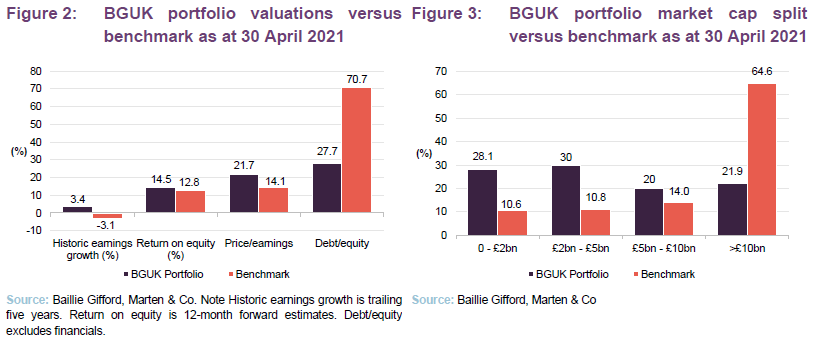

Portfolio characteristics

As illustrated in Figure 2, BGUK has a markedly different portfolio to the benchmark. Specifically, while BGUK’s portfolio clearly trades at a significant premium to the benchmark, it has far superior historic earnings growth, offers a superior return on equity and has much lower debt levels. As illustrated in Figure 3, BGUK’s portfolio has a strong bias to mid-cap and small-cap stocks when compared to the benchmark. Once again, this is not something that the managers set out to achieve, but is a result of their stock selections and, specifically, reflects where they are able to find the best opportunities.

New additions and exits

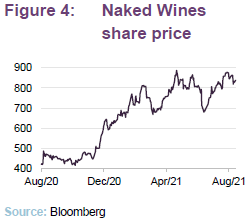

Reflecting the managers’ low-turnover approach, the number of stocks entering and exiting the portfolio in a given year are likely to be limited. For example, during the year ended 30 April 2021, two new positions were added: Experian, and Lancashire Holdings, while two positions were exited in their entirety: Rolls-Royce, and Mitchells and Butler. Naked Wines is a recent addition to the portfolio, which is discussed further below.

Naked wines – benefitting from a very engaged customer base

Naked Wines (www.nakedwines.com) is a new small position in BGUK’s portfolio. The company has a quirky model whereby it effectively crowdfunds independent wine makers, for a subscription of around £20 a month in the UK, and then sells these wines to its supporters at preferential prices. Reflecting this approach, it has a very engaged community around it, with very loyal customers. Recently, the company has been loss-making, as it has been investing heavily in new customer acquisition, which is expensive, but the economics of its existing customers are in BGUK’s managers’ view very good.

BGUK’s managers think that there is a big opportunity for the company in the US, which they describe as a very mature wine-buying market, with very sticky customers. They acknowledge that the company is still a niche offering, in a very competitive market, but highlight that the size of the addressable market is huge. They observe that Naked Wine’s customers tend to be repeat buyers and also tend to increase their size of their orders over time. They think that the company could double its revenues over the next five years and is able to earn very good margins on these.

Darryl Rawlings has been appointed to the company’s board and is chairman designate (he is expected to takeover following the company’s AGM this year). Darryl is the founder and chief executive of Trupanion, a D2C monthly subscription business that provides medical insurance for cats and dogs in the US and Canada. BGUK’’s managers believe that his extensive experience of developing online subscription-based businesses will be very valuable to Naked Wines in driving its next leg of growth, while keeping a rein on customer acquisition costs.

Top 10 holdings

Figure 5 shows BGUK’s top 10 holdings as at 30 June 2021 and how these have changed over the six months from 31 December 2020. Reflecting the managers’ long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular followers of BGUK’s portfolio announcements.

New entrants to the top 10 are Ashtead and Volution Group. Names that have slipped out of the top 10 are Boohoo.com and Prudential. We discuss some of the more interesting developments in the next few pages.

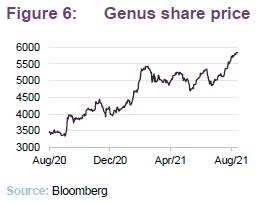

Genus (4.4%) – improving the sustainability of farming

Genus (www.genusplc.com) describes itself as is a world-leading animal genetics company that partners with farmers to transform how the world is nourished – a mission that it sees as important to building a sustainable future. More specifically, the company analyses animal DNA to look for markers associated with desirable characteristics (such as feed efficiency, disease resistance, growth rate, protein and fat content, and fertility), so that these can be accurately selected and used to breed subsequent generations. The aim is to help farmers to raise healthier and more productive animals (for example, allowing farmers to produce high-quality meat and milk more efficiently and sustainably).

Milena says that Genus is a company that Baillie Gifford’s UK equities team has held for a long time. It is an example of following your winners as the business has been consistently reinvesting in itself, driving a lot of innovation which continues to pay off and has allowed the business to get stronger over time. Genus has two main markets: pork; and beef and dairy. Its R&D investment provides it with a large defensible moat in a market where its primary competitors are primarily unprofitable co-operatives. In Milena’s view, Genus has a massive competitive edge that makes it very difficult to catch. However, while Genus is helping farmers to improve their sustainability, Milena highlights that these forms of agriculture are inherently ‘dirty businesses’ from an environmental perspective and the long-term challenge for the company will be the extent to which people curtail their consumption of meat and dairy products in the face of these sustainability issues. Despite this, the BGUK team thinks that the company has a very strong growth runway for now. It is experiencing significant growth in China, having invested heavily in its local presence there over the last few years. The country saw its pork herds decimated by swine flu and Genus has benefitted from strong demand for its services since. Genus has approximately a 25% market share in the US and if it were able to achieve something similar in China, the opportunity would be transformative.

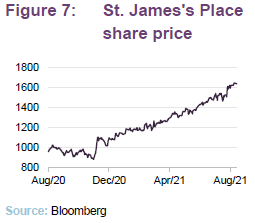

St James’s Place (4.4%) – long-term growth from move towards self-managed investments

St. James’s Place (www.sjp.co.uk) is a leading wealth management operation in the UK. Baillie Gifford’s UK equities team cites it as an example of them being prepared to invest where they see the growth opportunity, irrespective of size (St. James’s Place is a FTSE 100 company, with £143.8 billion of client funds under management, making it one of the larger companies in BGUK’s portfolio).

Milena says that while St. James’s Place is seen as charging a premium price for its services, it has a very high retention rate amongst its existing customers, suggesting that despite the higher fees, its clientele derives considerable value from its advice. She comments that, despite its size, the company has a very strong growth runway driven by the growing complexity of requirements and regulations around pensions and investments, an ageing population, the decline of defined benefit schemes, and the trend towards self-managed investments. It also benefits from significant net income derived from having such a large base of assets under administration.

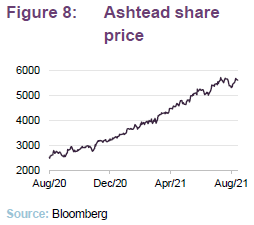

Ashtead Group (4.0%) – benefitting from move towards renting, rather than owning, plant and equipment

Ashtead Group (www.ashtead-group.com) describes itself as an international equipment rental company with national networks in the US, UK and Canada. It trades under the name of Sunbelt Rentals, renting a full range of construction and industrial equipment to an extensive customer base. BGUK’s managers say that Ashtead was previously perceived as a grubby cyclical stock but has undergone a structural re-rating due to its financial performance. They say that the company has been a great performer since the global financial crisis, compounding in the high teens per annum, benefitting from a structural shift away from owning large plant and construction equipment to renting it (BGUK’s managers say that Ashtead has been instrumental in revolutionising this change of approach).

Although Ashtead is listed in the UK, over 80% of its business is in the US, where it is the market leader and has been growing strongly, aided by a nationwide network of depots that have great product availability. The company has been diversifying its offering beyond the traditional diggers and aerial platforms, increasing its focus on ‘speciality’ end markets where it can achieve higher margins. Ashtead surprised the market by being far more resilient during the pandemic than expected. In part, properties still require maintenance during downturns and whilst there may be less new build activity, there tends to be a greater propensity to improve existing buildings. In addition, it has benefited from providing maintenance services for Amazon warehouses.

BGUK’s managers expect to see Ashtead continuing to gain market share in a growing market. They comment that Ashtead makes its customers’ lives easier. For example, they do not need to worry about equipment maintenance, under-utilisation of plant and being compliant with the latest health and safety regulations.

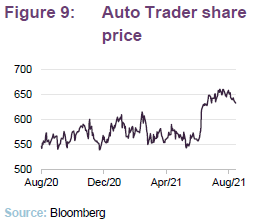

Auto Trader (3.8%) – exited the pandemic stronger

Auto Trader (www.autotrader.co.uk) is the UK’s largest automotive marketplace for buying and selling new and used cars. BGUK’s managers observe that, in addition to dominating the UK vehicle market, it delivers considerable value for its customers, yet takes a relatively small proportion of the sale price (they see parallels here with another key BGUK holding – Rightmove).

The managers consider that Auto Trader was very successful in its handling of the pandemic, with the necessary balance sheet strength to allow it to make long-term strategic decisions. For example, the company gave its larger customers a fee break, helping them to stay afloat at a time when their own revenue base was challenged. This bolstered the company’s standing with its customers at a time when smaller competitors were struggling, allowing the company to emerge from the pandemic stronger.

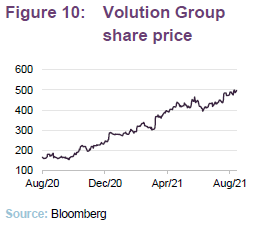

Volution Group (3.7%) – a niche B2B champion

Volution Group (www.volutiongroupplc.com) is characterised by BGUK’s managers as falling into its bucket of Niche B2B champions. These are under-the-radar businesses, with high brand awareness among professionals that frequently have a significant after-market/servicing element to their operations and have the ability to add value through in-market M&A opportunities. The company is a manufacturer and supplier of ventilation products with primary markets in the UK, Continental Europe and Australasia. It operates through 17 different brands split across these different regions (for example, Vent-Axia, Voltair and Ventair), supplying its products to the residential and commercial construction markets.

BGUK’s managers say that Volution is another holding that has consistently reinvested in the business to drive innovation and it is benefitting from this. They see a long-term structural trend of striving to improve air quality, with companies such as Volution at the frontier of this. The pandemic has helped raise awareness of this and Volution has emerged stronger.

Performance

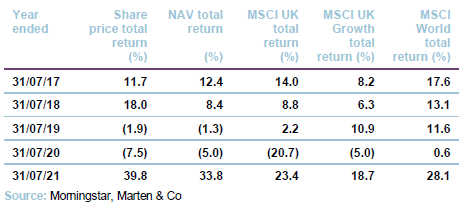

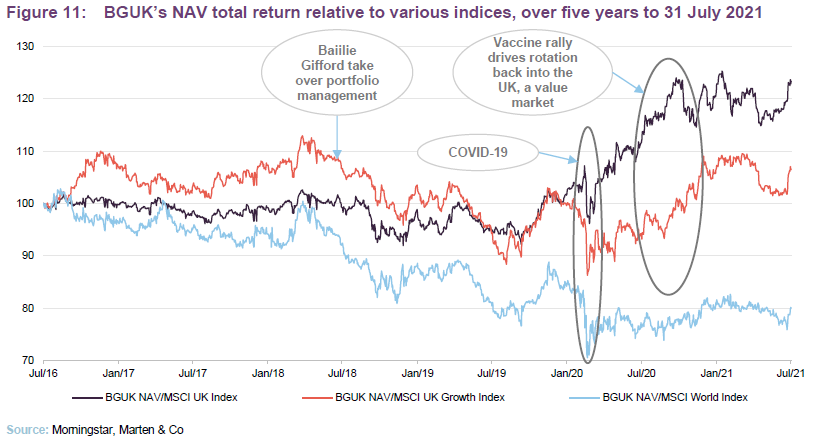

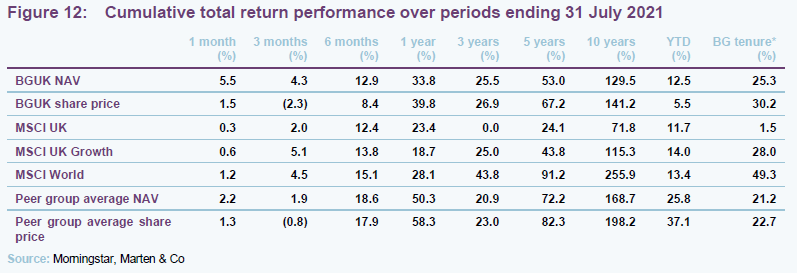

Just over three years have passed since the team at Baillie Gifford assumed responsibility for the management of BGUK’s portfolio. As is illustrated in Figures 11 and 12, since this time, BGUK has provided significant outperformance of the broader UK market (as measured by the MSCI UK Index), performance that is broadly in line with the MSCI UK Growth Index and, reflecting the negative sentiment towards the UK during this period, has underperformed global equities more generally (as represented by the MSCI World Index). The underperformance of global equities during this period is in common with its peers – although, as illustrated in Figure 12, since Baillie Gifford’s appointment, BGUK’s NAV share and share price total returns have both markedly outperformed their peer group averages (this is explored in greater detail in the peer group section below).

An inspection of Figure 11 shows that, against the various index comparators provided, the period in which COVID-19 has impacted financial markets has been one in which BGUK has been able to differentiate itself. Specifically, in the run-up to the market collapse of March 2020, and in the period following this, BGUK has strongly outperformed the broader UK market, reflecting investors preference for its growth strategy in a low-growth, low-interest-rate world. In the immediate run-up to the market collapse, BGUK was underperforming the MSCI UK Growth Index, but reflecting its strong growth focus, it has been on a marked trend of outperformance since. This was punctuated by the vaccine rally in November 2020, but the trend of outperformance continued flattening off from February 2021 as growth investors started to fret about a steepening yield curve. More recently, as investors have started to worry about the threat from the emergence of new COVID variants, BGUK’s growth style has very much been back in vogue, with it outperforming all of the indices over the very short term. However, while we caution that assessments made regarding performance periods within the last 16 months are particularly problematic because of COVID-related market volatility, we would nonetheless argue that a long-term strategy such as that used by BGUK’s managers is best assessed using longer-term time frames.

Results for the year ended 30 April 2021

For the year ended 30 April 2021, BGUK provided NAV and share price total returns of 37.7% and 53.7% respectively, both significantly ahead of the returns on the broader MSCI UK index (20.8%) and the MSCI UK Growth Index (18.6%). It was also markedly ahead of its All-Share benchmark, which BGUK’s annual report says returned 25.9%. The outperformance for the year came solely in the first half, when investors favoured the trust’s growth focus. BGUK’s portfolio rose markedly in absolute terms in the second half of the year as the market surged in the second half on the back of positive news on vaccines, a rotation into value meant that it lagged the market.

BGUK’s managers say that its strong relative performance came from a diverse number of businesses. They highlight online fashion business Farfetch, which generated strong growth and also partnered up with some important businesses in Asia as well as Ashtead, which they say surprised the market by being far less impacted by the pandemic. Another strong contributor was Just Group, whose new management team are starting to deliver on their refreshed strategy.

The managers say that notable detractors were few and far between during the year as a whole, although they highlight that worries about competitive pressures and acquiring a business in the US led to a sluggish Just Eat Takeaway share price (a position that was reduced during the year) and that marine services provider James Fisher was heavily impacted by poor trading in some of its businesses.

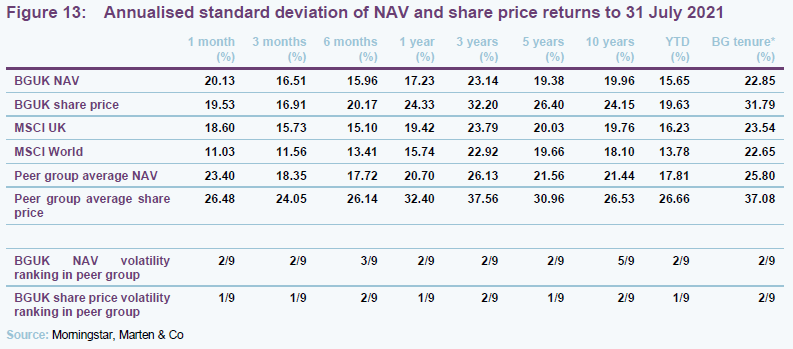

Low volatility strategy

A comparison of Figure 12 and 13 shows that, despite the improvement in its performance, relative to its peer group, since Baillie Gifford became the manager, this has not come at the expense of higher volatility in either share price or NAV. Specifically, both BGUK’s share NAV price and share price volatilities (as measured by the annualised standard deviations of their returns) have been consistently among the lowest of the peers, for both NAV and share price. Furthermore, since Baillie Gifford took over, the volatility of BGUK’s NAV returns have been below those of the MSCI UK index, fractionally above those of the MSCI World Index.

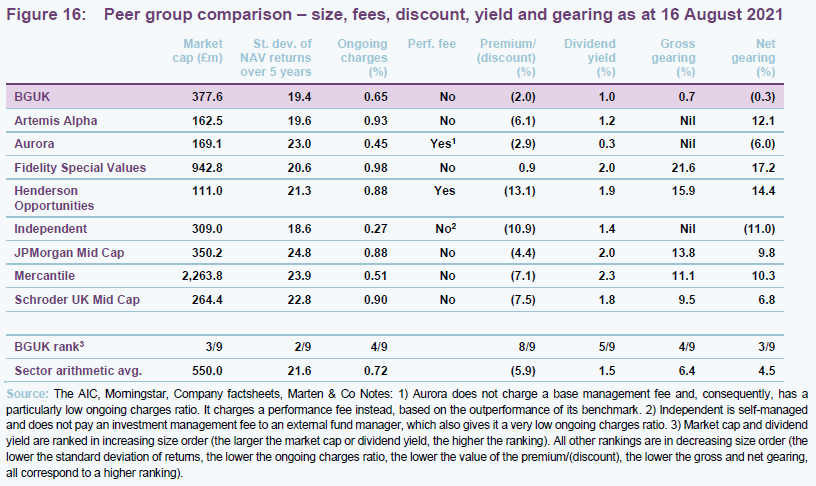

Peer group

BGUK is a member of the UK All Companies sector, which comprises nine members. All of these are illustrated in Figures 14 through 16. Members of UK All Companies will typically have:

- over 80% invested in in quoted UK shares;

- an investment objective/policy to generate majority of returns from capital growth.

- a majority of investments in medium- to giant-cap companies;

- a majority of expenses allocated to capital; and

- a UK benchmark.

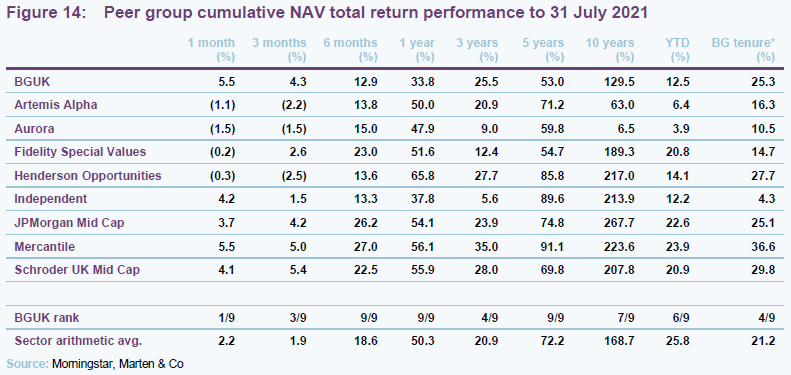

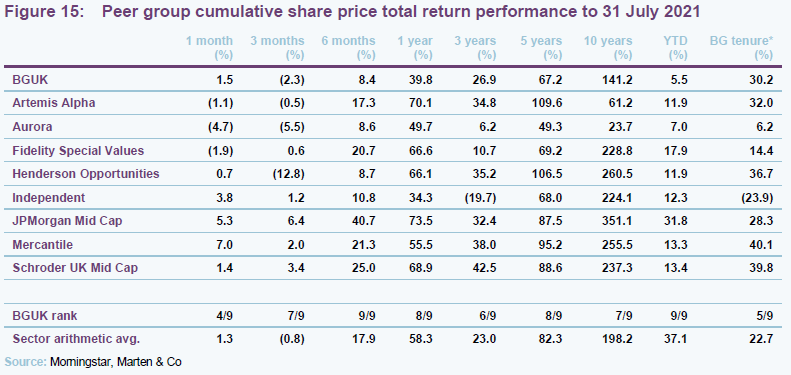

As highlighted in the performance section above, Baillie Gifford took over the management for BGUK at the end of June 2018, and so has managed the portfolio for a little over three years now. When BGUK’s board announced its decision to move the management contract to Baillie Gifford in April 2018, it said: “It is disappointing to note that the company’s long-term investment performance is considerably below the board’s expectation and has lagged the benchmark since inception”. There was no specific reference to the peer group in the announcement, but the trust was tending to underperform its peers and, looking at Figures 14 and 15, the board’s decision to move the management contract has been vindicated by the improvement in its peer group ranking since Baillie Gifford’s appointment. It is worth noting that, while the peer group is fundamentally capital-growth-focused, the Baillie Gifford approach is characterised by a particularly strong emphasis on growth, which is a differentiating factor when comparing BGUK to its peers.

Looking at Figure 14, it can be seen that, over the five- and 10-year periods, BGUK has ranked bottom (ninth out of nine) and seventh out of nine, respectively. However, over the three-year period, and since the managers’ appointment, BGUK has ranked fourth out of nine for both. For the shorter-term time frames, of up to a year, there is considerable volatility in the rankings which reflects shifting views towards the UK more generally. Investor sentiment has shifted quickly towards and against the UK in response to both positive developments on vaccines and then emerging concerns about new variants, which has muddied the waters considerably. Recent nervousness about new COVID variants since the end of June has triggered a switch back into growth stocks, which is particularly apparent in BGUK’s NAV performance over the one-month period. BGUK’s managers have a long-term investment style and so we consider that long-term horizons will be superior for assessing the strategy, but recent market moves mean that particular care should be taken when making assessment about the shorter-term periods.

Looking at Figure 15, which provides a peer group comparison of share price total return performance, it can be seen that there is a similar pattern to the NAV performance displayed in Figure 14, with BGUK’s moving up the peer group rankings since Baillie Gifford was appointed. However, discount moves, also in part a function of market sentiment, mean that the NAV performance does not appear to have been properly reflected in the trust’s share price. Once again, we would reiterate the particular importance of focusing on the longer-term horizons.

As is illustrated in Figure 16, BGUK is the third largest fund in the peer group although its market capitalisation still falls below the sector average as the peer group is distorted by the colossus that is Mercantile. Nonetheless, BGUK’s market cap is above the peer group median of £306.3m (not shown).

BGUK’s higher-than-average rating (third only to Aurora and Fidelity Special Values) is in part a reflection of the strength of the Baillie Gifford Growth offering in the current climate.

BGUK’s ongoing charges are below the sector average for the peer group, despite the peer group average of 0.72% being pulled down by both Aurora and Independent for reasons explained below. BGUK’s ongoing charges ratio is also below the sector median (0.65% versus 0.77%).

Aurora (one of the smaller funds in the sector with a market cap less than half the size of BGUK’s) has a particularly low ongoing charges ratio because it does not charge a base management fee. Instead, it charges a performance fee (unlike the overwhelming majority of its peers) to compensate. However, Aurora’s is not the lowest, as this spot is occupied by Independent, a self-managed trust that does not pay an investment management fee to external fund managers. Instead, it pays a salary to its manager, who is also a shareholder in the trust.

Gearing is another consideration, and this can be more of a concern for investors when markets are at more elevated levels. BGUK’s gearing levels (data as at the end of June) are minimal and well below the sector averages. Aurora and Independent are running significant net cash balances (particularly independent), and these will therefore be less exposed in the event that markets fall back but will suffer more heavily from cash drag if markets continue to progress.

BGUK is currently trading at a small discount but when its premium is in excess of 3–4%, it has tended to issue stock. We expect that if it is able to get back to a premium rating, it will continue to expand and this should, all things being equal, continue to exert downward pressure on BGUK’s ongoing charges ratio (the reverse is also true).

As noted above, BGUK, like most of the funds in this peer group, does not pay a performance fee. In common with its peers, within what is a capital-growth-focused sector, BGUK’s yield is low and modestly below the sector average. However, as discussed in the performance section above, the volatility of BGUK’s NAV has tended to be one of the lowest in its peer group over the longer term, a feature that has been retained since the management contract moved to Baillie Gifford.

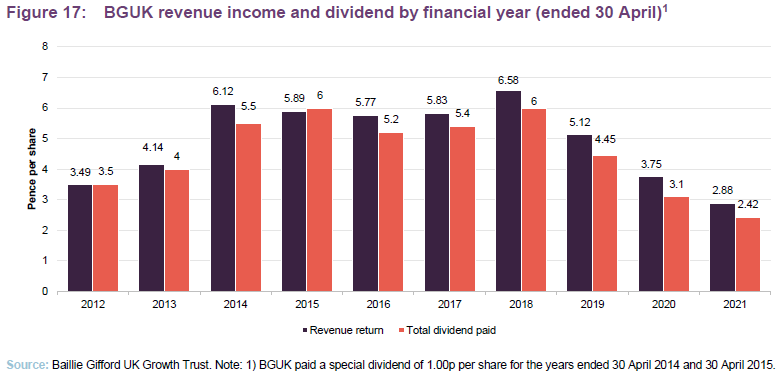

Dividend

BGUK’s investment strategy focuses on generating capital growth for shareholders and dividends are paid to the extent that they are required to maintain BGUK’s investment trust status. As such, while the UK has traditionally been one of the higher yielding markets, dividends are likely to form a small component of shareholders overall returns and BGUK pays one dividend in August each year. This is paid as a final dividend, following shareholders’ approval at the AGM (also usually in November). For example, for the year ended 30 April 2021, BGUK paid a final dividend of 2.42p per share. This is equivalent to a yield of 1.0% on the trust’s share price of 249.0p per share as at 16 August 2021.

As BGUK’s dividend policy is to pay the minimum permissible, and the portfolio is not focused on generating income, it follows that the dividend level may vary from year to year. As is illustrated in Figure 17, which shows BGUK’s revenue income and total dividend for the last 10 financial years (ending 30 April), the dividend has been on a declining trend in recent years. However, the trend has overwhelmingly been one of paying a covered dividend, particularly during the last five years were the dividend paid has been well covered by revenue earnings. There have only been two years in the last decade where the trust has used very small contributions from its revenue reserve to fund the dividend payment (2012 and 2015), both of which occurred under the previous investment manager. For the years ended 30 April 2014 and 2015, the total dividend includes a 1.00p special dividend, reflecting strong distributions received by the trust during these years (these also occurred under the previous investment manager).

As Figure 17 shows, BGUKs revenue income has exceeded its dividend in recent years allowing the trust to build on its revenue reserve. As at 30 April 2021, BGUK had a revenue reserve of 7.99p per share (30 April 2020: 7.19p). BGUK is also permitted to pay dividends out of its capital profits.

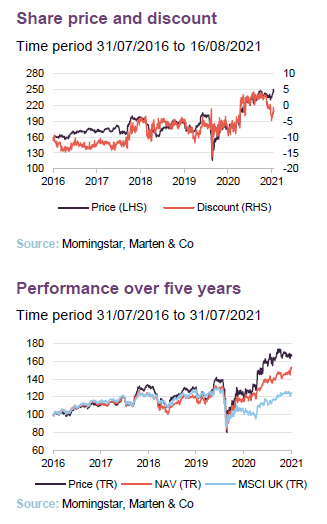

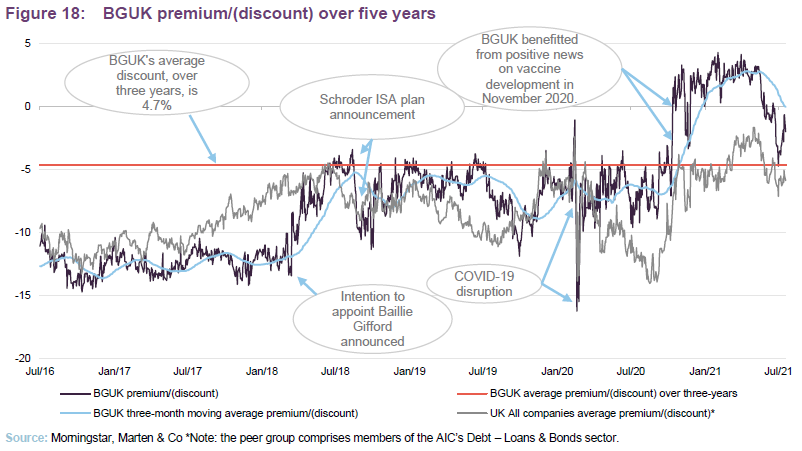

Premium/(discount)

Recent nervousness about new COVID variants has triggered a switch back into growth-focused strategies and BGUK has seen its discount narrow so that it is now trading around par. This has reversed its previous trend of widening, which is discussed in more detail below. Whilst BGUK has benefitted as growth stocks have rallied, this has in part been counter-balanced by the fact that the UK has been treated as a value market by investors. This is a function of both an overhang from Brexit and, at times, our difficult handling of the pandemic. As at 16 August 2021, BGUK was trading at a discount of 2.0%, which is narrower than its three-year average of a discount of 4.7% (one-year range: a premium of 4.3% to a discount of 9.2%).

Significantly discount narrowing under Baillie Gifford’s management

As is illustrated in Figure 18, BGUK had been trading at a wider discount than the sector average prior to the announcement, on 13 April 2018, that the board intended to terminate the investment management arrangements with Schroders and appoint Baillie Gifford in their stead. Following this announcement, BGUK’s discount started to narrow relative to that of the wider UK All companies peer group, so that around the time that Baillie Gifford took over the management of the portfolio on 30 June 2018, BGUK’s discount was comparable to the peer group average (6.4% for BGUK versus 5.3% for the peer group).

This gradual narrowing trend continued until September 2018 when BGUK announced that it had been notified that Schroder Unit Trusts Limited had written to BGUK shareholders that held their shares through ISAs provided by Schroders, who then represented 23% of the issued share capital, saying that they would either have to transfer their holdings in BGUK to a new ISA plan manager, switch their shareholding to another Schroders fund within their ISA, or sell their holding in the company. Failure to respond would see their BGUK shareholding sold and switched to an ISA holding in the Schroder UK Equity Fund (an open-ended fund managed by Schroders). Initially, BGUK’s discount widened by around six percentage points, but this narrowed again over the following couple of months so that it was once again trading at a premium to the sector average, a trend that has continued since.

As markets collapsed in the face of an accelerating COVID-19 infection rate in March 2020, BGUK’s discount widened, reaching a five-year high of 16.2% on

18 March 2020, before quickly reversing. In comparison, the UK All Companies sector average widened to 11.4% on the same day, but whilst the initial move was wider for BGUK, it showed a sharper reversion, arguably reflecting the strength of the managers’ investment proposition as investors sought growth in an economy restricted by lockdowns. Interestingly, despite its growth bias, the trust benefitted very strongly from positive news on vaccine development in November 2020; more so than the UK All Companies sector as a whole, as investors rotated back into value stocks on the expectation of a recovery (the UK had been out of favour with international investors for some time, reflecting both Brexit uncertainty and the government’s poor handling of the pandemic up until that point). However, this abated as a steepening yield curve dampened enthusiasm for growth.

As noted above, more recently, the discount has been on a narrowing trend again, as investors have rotated back towards growth, reflecting concerns about the threat from potential new COVID variants.

Share issuance and repurchases

BGUK has the authority to issue up to 10% of its issued share capital and repurchase up to 14.99% of its issued share capital, which gives it mechanisms through which it can moderate its premium or discount. The board says that it monitors the level of the company’s discount or premium to NAV and will authorise share buy backs when it considers it to be in shareholders’ best interests. Whilst there is no formal discount target, the board takes into consideration the trust’s discount relative to its peers, the absolute level of discount, discount volatility and the long-term impact on liquidity from share repurchases. BGUK’s board appears to be happy to see the trust grow in a measured way, and it also appears to be prepared to provide liquidity at premiums of around 4-5%.

Fees and costs

Low base management fee of 0.5% per annum; no performance fee

Under the terms of the investment management agreement, Baillie Gifford is entitled to receive a basic management fee of 0.5% per annum of the trust’s net total assets. The management fee is calculated and paid quarterly in arrears and there is no performance fee element. The management agreement can be terminated on six months’ notice by either side.

Secretarial and administrative services

In addition to being BGUK’s AIFM and investment manager, Baillie Gifford & Co also provides company secretarial and administrative services to the trust. The fees for all of these services are covered by the investment management fee discussed above.

The Bank of New York Mellon (International) Limited acts as both the depositary and custodian to the company. The fee arrangements for these are not disclosed, but are included within the trust’s other administrative expenses.

Allocation of fees and costs

In BGUK’s accounts, the investment management fees are allocated 30% to revenue and 70% to capital, reflecting the board’s expectation of the long-term split of revenue and capital returns. The ongoing charges ratio for the year ended 30 April 2021 was 0.65% (2020: 0.66%), and, with ongoing share issuance it seems reasonable that it could fall further over the year ending 30 April 2022.

Capital structure and life

Simple capital structure

BGUK has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 16 August 2021, there were 160,917,814 in issue with 7,421,700 of these held in treasury and 153,495,484 otherwise in general circulation.

BGUK is permitted to borrow, although net gearing is not permitted to exceed 20% of total net assets. Within this, the board sets borrowing limits, which it reviews from time to time, to ensure gearing levels are appropriate to market conditions. BGUK has a £20m one-year revolving credit facility with The Royal Bank of Scotland International that expires on 7 July 2022 As at 30 June 2021, BGUK had gross gearing of 0.6% and net gearing of -0.3%.

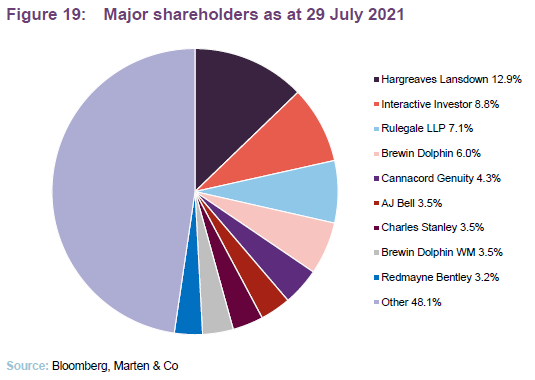

Major shareholders

BGUK’s share register has a strong retail element and, reflecting this, there are a significant number of trading platforms and private client wealth managers that are prominently visible within BGUK’s share register.

Unlimited life with a five-yearly continuation vote

BGUK does not have a fixed winding-up date, but every five years, shareholders are given the opportunity to vote on the continuation of the company as an investment company at the annual general meeting (AGM). This is a special resolution. If this resolution were not passed, the board would put forward proposals to liquidate or otherwise reconstruct or reorganise the company. BGUK shareholders approved the last continuation vote at the August 2019 AGM. The next continuation vote is scheduled for the company’s AGM in 2024.

Financial calendar

The trust’s year-end is 30 April. The annual results are usually released in July (interims in December) and its AGMs are usually held in August of each year. As discussed earlier, BGUK pays one final dividend a year in August that is the minimum required to maintain its investment trust status.

Corporate history

BGUK is a UK investment trust that was originally incorporated on

28 January 1994 as the Schroder UK Growth Fund Plc. The trust, which listed on the London Stock Exchange following its IPO on 10 March 1994, has a premium main market listing. On 13 April 2018, the trust’s board announced that it had decided to terminate the management arrangements with Schroder Unit Trusts Limited and appoint Baillie Gifford & Co Limited in their stead. Baillie Gifford was appointed with effect from 30 June 2018, with the trust changing its name to Baillie Gifford UK Growth Fund Plc at the same time. On 25 May 2021, the trust changed its name to Baillie Gifford UK Growth Trust Plc. Baillie Gifford has now been managing BGUK for just over three years.

Management team

Iain McCombie

Iain graduated with an MA in Accountancy from the University of Aberdeen and subsequently trained as a Chartered Accountant. He then joined Baillie Gifford in 1994 and spent five years training as an investment manager in the US equities team before joining the UK equities team in 1999. Iain served as chief of investment staff from 2013 to 2018 and became a partner of the firm in 2005. Iain is the lead manager of Baillie Gifford’s UK Core strategy. He is also a member of the Global Stewardship Portfolio Construction Group (PCG).

Milena Mileva

Milena graduated with a BA in Social & Political Science from the University of Cambridge in 2007 and gained her MPhil in Politics from the University of Oxford in 2009, before joining Baillie Gifford that year. She is one of three investment managers in the UK equities team (alongside her co-manager Ian McCombie – see above – and Gerard Callahan) and is the lead manager on the UK focus strategy. She has also been a member of Baillie Gifford’s Pan-European Portfolio Construction Group since 2014.

Board

BGUK’s board comprises four directors, all of whom are non-executive and considered to be independent of the investment manager. There have recently been some changes to the composition of the board, with the retirement of Scott Cochrane with effect from 30 June 2021. Scott, who was BGUK’s senior independent director up until his retirement, had served a little over two-and-a-half years, having been appointed to the board in November 2018.

With the appointment of Cathy Pitt (see a short biography below), with effect from 5 August 2021, the board numbers four again. However, her appointment was not sufficiently progressed to allow it to be ratified to take place at this year’s AGM. Instead, this will take place at BGUK’s AGM in 2022 (see below for requirements for new directors).

Other than BGUK’s board, its directors do not have any other shared directorships. The company’s articles of association limit the aggregate fees payable to the directors to a total of £200,000 per annum, with any increase requiring shareholder approval.

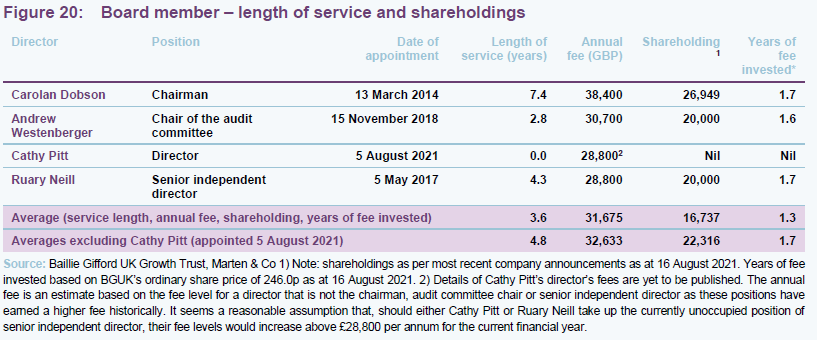

BGUK’s articles of association require that newly-appointed directors offer themselves for re-election at the next AGM. It is board policy that all directors retire and offer themselves for re-election at each AGM. The average length of service is 3.6 years, with Carolan Dobson, the chairman, being the longest-serving director, with 7.4 years of service under her belt.

As is illustrated in Figure 20, with the exception of Cathy Pitt, who has only just joined the board, all of BGUK’s directors have personal investments in the fund, which we consider to be favourable as it helps align directors’ interests with those of shareholders. The levels of these three directors’ shareholdings were unchanged over the year ended 30 April 2021 and have remained at the same levels so far for the current financial year. The average interest is equivalent to 1.7 years or more of their fees, which may also provide some additional comfort for shareholders.

Carolan Dobson (chairman)

Carolan has had a long career in fund management. She was previously head of UK equities at Abbey Asset Managers, and held a number of positions at Murray Johnstone, rising to be head of investment trusts, where she managed Murray Income Trust Plc.

Carolan was appointed to BGUK’s board in March 2014 and subsequently became Chairman at the conclusion of the company’s AGM on 4 August 2016. She is also chairman of the nomination committee and of the management engagement committee. Carolan is also the chairman of Brunner Investment Trust Plc and Blackrock Latin American Investment Trust Plc. She was previously a director of Woodford Patient Capital Trust Plc (now Schroder UK Public Private Trust Plc), Aberdeen Smaller Companies Income Trust Plc and JPMorgan European Discovery Trust Plc.

Andrew Westenberger (chairman of the audit committee)

Andrew is a Chartered Accountant and is currently chief financial officer of Integro Insurance Brokers and Tysers, an independent specialist broker and risk management firm. He is also a non-executive director and trustee of the Chartered Institute of Securities and Investments. Previously, he was group finance director of Brewin Dolphin Holdings Plc and Evolution Group Plc. He has also held senior finance roles at Barclays Capital and Deutsche Bank.

Cathy Pitt (director)

Cathy is a consultant partner at CMS specialising in investment funds, with particular responsibility for investment companies. She has over 20 years’ experience as a senior corporate legal adviser in the investment management and investment trust sectors, with expertise in investment management regulation, investment company corporate affairs, capital markets and corporate governance. Cathy is also a non-exec director of Gresham House Energy Storage Fund Plc.

Ruary Neill (senior independent director)

Ruary has had a career in investment banking. He has worked for UBS Investment Bank in the UK, prior to which he spent several years in the financial sector working in Asian Equity Markets for UBS Investment Bank and Schroder Securities. Ruary is currently a director of JP Morgan Emerging Markets Investment Trust Plc and is a member of the Advisory Board, SOAS China Institute, London University.

The legal bit

This marketing communication has been prepared for Baillie Gifford UK Growth Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.