September 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in August 2023

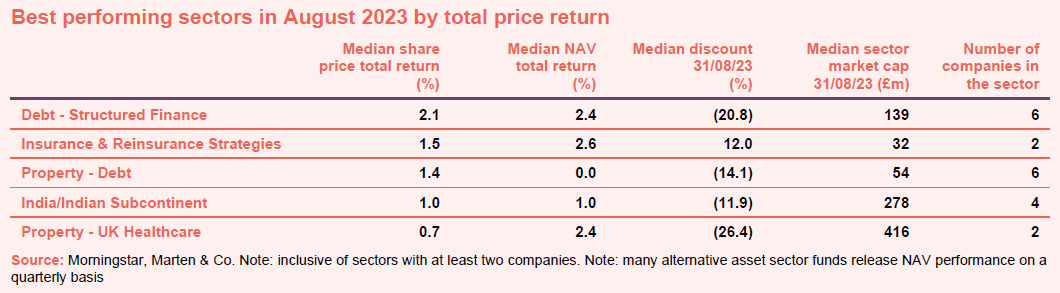

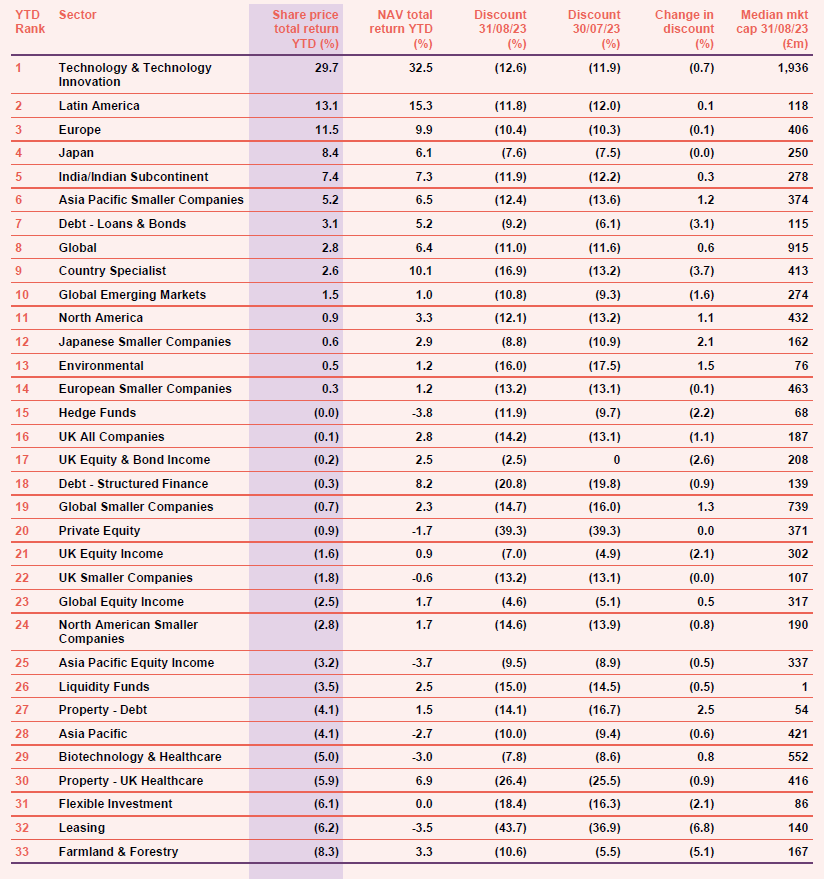

Share price total returns for investment companies were generally poor over August, with the best performing sector, Debt – Structured Finance, returning just 2.1%, with only a few sectors managing to eke out a positive total return. Funds in the Debt – Structured Finance sector tend to focus on the more complex end of the bond market, utilising financial engineering to provide more bespoke debt solutions, like collateralised loans. While the US yield curve has steepened over August (implying bonds have lost value over the month) it has been coupled with stronger expectations for the US economy. There is also greater talk that the US and some other developed markets have either reached or are approaching peak inflation, leading to greater expectations of a rate cut at some point in the future. However, structured finance products can vary quite markedly and there was a wide range of returns within the peer group over the month.

Insurance & Reinsurance Strategies continued to benefit from a climate of hardening rates and, as a more economically sensitive sector, may have benefited from a modestly improving outlook in the US at the margin.

Property – both debt and equity – has suffered against a backdrop of rising interest rates designed to choke off inflation, however, with further signs that inflation is cooling there appears to be some demand for Property debt strategies. The India sector’s performance has been a reflection of a comparatively strong month for India. The UK Property – Healthcare sector has seen a reversal of its July selloff, aided by signs that inflation is cooling. It may also have benefited as investors, worried about the heightened prospects of a recession, look to sectors that are able to generate reliable income streams.

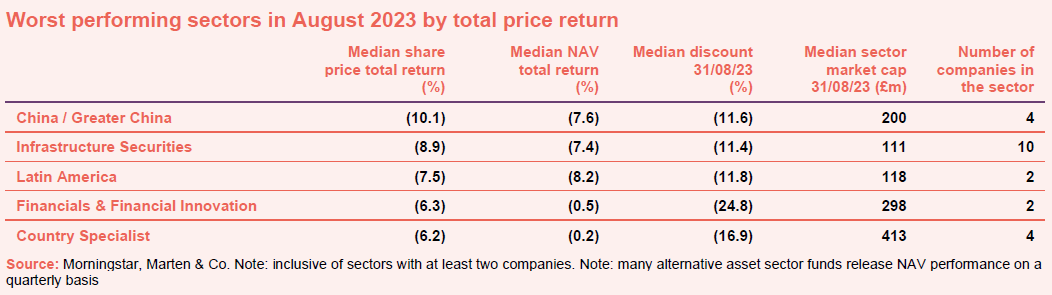

Increased pessimism about China’s economic outlook impacted the China/Greater China sector specifically, but this has been a factor in the performance of other areas, given the implications for industrial output and export demand including Latin America (think demand for commodities) and Country Specialist (its constituents are all Asia ex Japan and predominantly Vietnamese equity strategies – and China is Vietnam’s largest export market). Financials have likely suffered from growing recessionary concerns. Infrastructure Securities suffered partly in response to a deteriorating China but also because more capital-intensive businesses have suffered against the current interest rate backdrop and investors also switched their attention from the opportunities to the challenges of the energy transition.

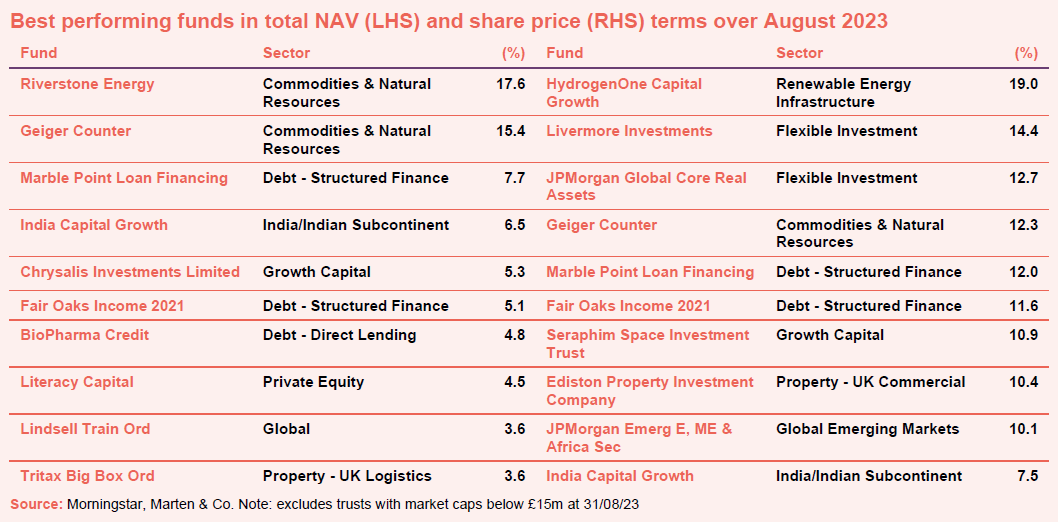

Riverstone Energy benefited from a rising oil price over the month, while Geiger Counter has benefited from a positive price outlook in the uranium market. As noted before, the Debt – Structured Finance funds have benefited from an improving outlook, at the margin, in the US. The US dollar appreciated over the period, so dollar exposed assets, such as those in BioPharam Credit, would have seen a NAV uplift as a result.

India Capital Growth benefited from the strong performance of India, while Chrysalis’s NAV movement reflects the publication of its quarterly NAV as at 30 June, which moved primarily due to fair value adjustments largely reflecting progress in its underlying holdings. In its quarterly NAV update, Literacy Capital benefited from an asset sale at a 53.8% premium to carrying value. Lindsell Train, known for its ultra long-term approach and focus on enduring business models, may have benefited from investors shifting their focus to higher quality companies as worries around recession increase. Tritax Big Box announced the sale of an asset let to Howdens in Raunds for £84.3m, which equated to a net initial yield of 4.0%, and was the major factor behind its NAV increase.

HydrogenOne’s share price benefited from a positive trading update – while its NAV only grew 0.7% in the second quarter, revenue was up 170% versus the prior year. Livermore Investments has a substantial portfolio of CLOs and has benefited from higher interest rates. JPMorgan Global Real Assets implemented a share repurchase programme at the start of the month and has been active, buying back 0.6% of its share capital over August. It has a lot more cash it can deploy towards buybacks. Seraphim Space provided a very positive portfolio update in August and, like HydrogenOne, has benefited from improved sentiment towards growth investments. Ediston Property released an update on its strategic review in August, in which it announced that it was in advanced discussions with a third-party buyer regarding a possible sale of the trust’s property portfolio. JPMorgan Emerging Europe, Middle East & Africa’s (JEMA’s) share price benefited from news that two of its Russian holdings have made tender offers of their shares during 2022/2023. However, as Russian sanctions prohibit transfers to foreign investors, these assets are valued at zero and there has been no change in the trust’s NAV.

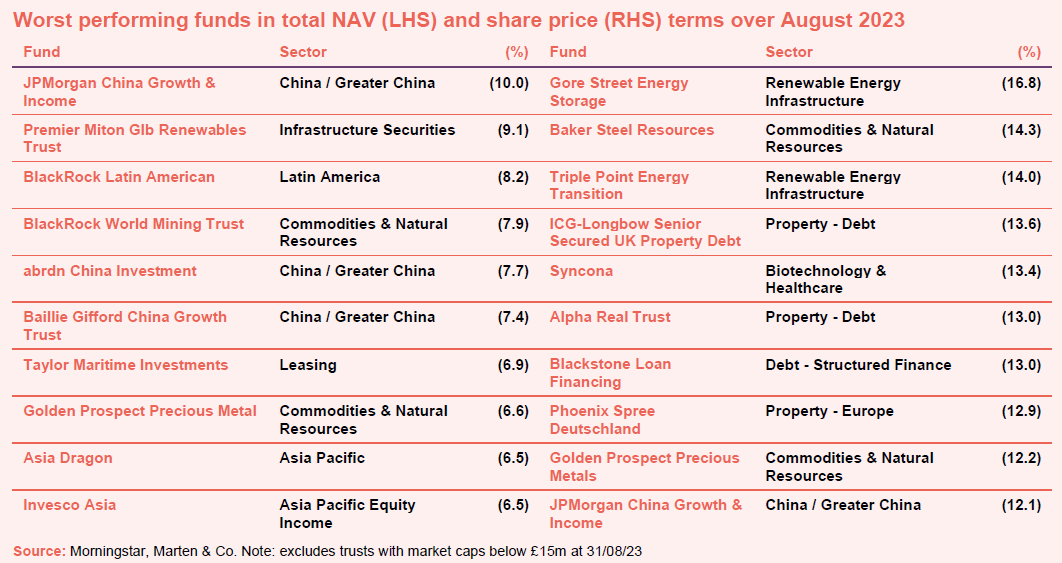

Worst-performing

The worst performing trusts in NAV terms are largely unified by their exposure to China, be it direct or indirect. Reflecting the region’s deteriorating economic outlook, the MSCI China was down c.10% over the month (in US dollar terms), which clearly explains why the Chinese equity sector has fallen. The effect of this can also be seen in the deteriorating NAVs and share prices of Asia Pacific funds with large China allocations. China’s weakness has also had a knock-on effect on the resources sectors, as well as Latin America, which supplies much of the resources China consumes. Even Taylor Maritime, a trust focused on the shipping industry, has taken a hit as Chinese exports make up a significant portion of global commercial maritime traffic. Premier Miton Global Renewables (PMGR) has low exposure to China (2.1% as at the end of July 2023) and appears to have suffered as investors’ focus has shifted away from the benefits of the energy transition towards the costs.

In terms of the largest share price fallers, the themes of negative sentiment towards China and commodities are apparent, with some of the same names appearing in both the NAV and share price fallers lists. Gore Street Energy Storage and Triple Point Energy Transition appear to have suffered for similar reasons to PMGR. Syncona’s share price has slid markedly since the announcement of its first quarter update (currency moves offset much of the gains made by the portfolio), which coincided with an announcement regarding its holding, Freeline Therapeutics. Blackstone Loan Financing saw its share price retrench significantly in August following the release of inflation figures that saw the market expecting the Bank of England to raise interest rates to 6%. Both Alpha Real Trust and ICG-Longbow Senior Secured UK Property Debt suffered similar share price trajectories following the announcement of the same inflation numbers. The increasing risk of a recession and defaults have weighed on all three. Phoenix Spree Deutschland saw its discount widen following the announcement of its portfolio valuation update for the six months ended 30 June – a decline of 6.9%.

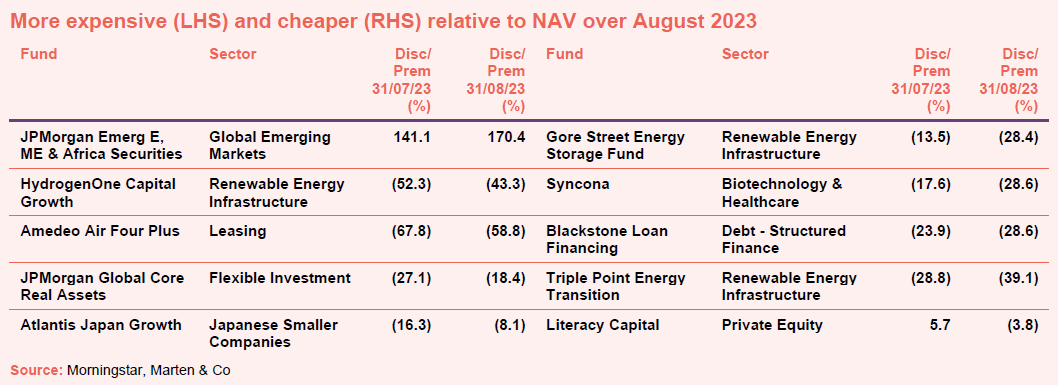

Moves in discounts and premiums

As noted above, JEMA’s premium widened following some positive news with a couple of its Russian holdings that won’t be reflected in its NAV. HydrogenOne’s discount narrowed following a positive trading update as did that of Amedeo Air Four Plus. JPMorgan Core Real Asset initiated a share buyback programme and has been active in repurchasing its shares. Atlantis Japan Growth’s discount narrowed significantly following the announcement of proposals for it to merge with Nippon Active Value.

As noted above, Gore Street Energy Storage and Triple Point Energy Transition appear to have suffered as investors’ focus has shifted away from the benefits of the energy transition towards the costs, while Syncona’s share price slid following the announcement of its first quarter update. Blackstone Loan Financing’s discount widened following the release of inflation figures that raised the market’s expectation of an interest rate rise. Literacy Capital’s NAV benefited from an asset sale at a 53.8% premium to carrying value and its share price failed to keep pace.

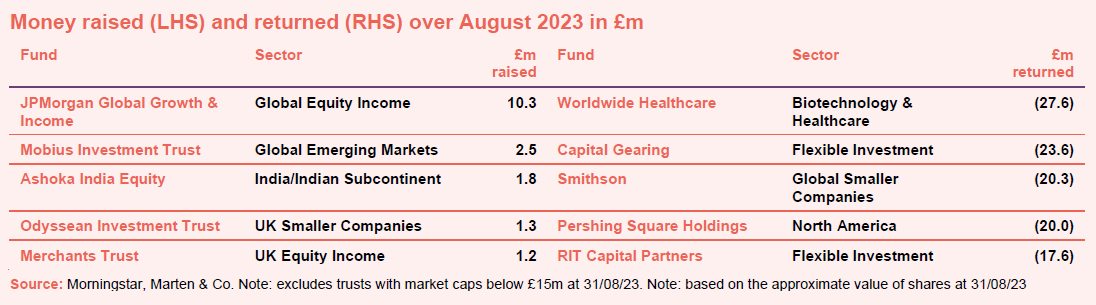

Money raised and returned

August was again another month of subdued capital raises. JPMorgan Global Growth & Income regularly features in this list, while Mobius, Ashoka India Equity, Odyssean and Merchants regularly issue stock reflecting their premium ratings and strong demand for their strategies.

All of the companies returning cash regularly feature in this list.

Major news stories and QuotedData views over August 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

|

Research

Ecofin Global Utilities and Infrastructure Trust – Utilities and infrastructure at low tide

In recent months, macroeconomic conditions have weighed on the utilities and infrastructure sectors and on the returns generated by Ecofin Global Utilities and Infrastructure (EGL). Now, as the peak of interest rates draws nearer and economic growth stutters, the tide may be about to turn in the trust’s favour. EGL’s manager, Jean-Hugues de Lamaze highlights the strong earnings of the companies in its portfolio (see pages 5 and 6), which have made some of these look even more undervalued.

GCP Infrastructure Investments (GCP) has announced a potential three-way merger between it, GCP Asset Backed Income (GABI), and RM Infrastructure Income (RMII). As we explore in this note, this has the potential to address some of the issues that may have given rise to GCP’s exceptionally wide share price discount to its NAV. The outlook for investors remains as promising as ever thanks to a broad range of supportive conditions.7

The Negative investor sentiment towards the commercial real estate sector has seen the share price discount to net asset values (NAVs) among REITs and listed property companies remain excessively wide, including abrdn Property Income Trust (API). This is despite a large valuation correction at the end of 2022 and transactional evidence of value stabilisation. A re-rating of the sector and API’s shares should be triggered by market indications that interest rates have peaked (due to their close correlation with property yields), so promising inflation data for June was encouraging.

Despite the headwinds it has faced – chief among them higher interest rates – Montanaro European Smaller Companies (MTE) remains committed to investing in high-quality, high-growth companies. MTE’s manager, George Cooke, has been unflinching in his approach, making little change to MTE’s portfolio other than increasing its concentration by trimming lower-conviction holdings.

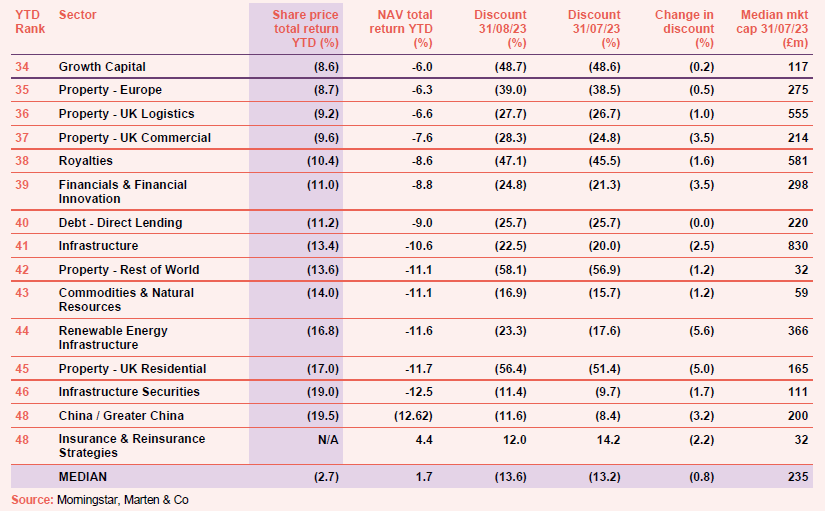

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.